|

市场调查报告书

商品编码

1637879

亚太绿色资料中心:市场占有率分析、产业趋势与成长预测(2025-2030 年)APAC Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

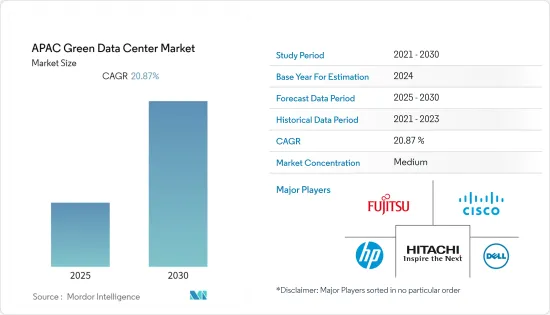

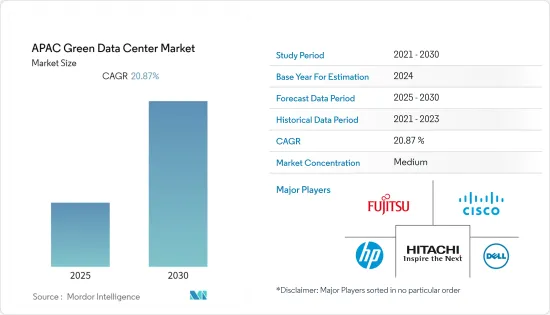

预计预测期内亚太绿色资料中心市场复合年增长率将达到 20.87%。

主要亮点

- 新加坡占东南亚资料中心总供应量的60%。这是一个严重的环境问题,促使世界各地的公司采取措施实现永续性。

- 为了满足不断增长的需求,亚太地区资料中心的能源使用量正在增加。亚太地区消耗了全球资料中心总能源的很大一部分,需求没有放缓的迹象。缺乏能源管理加上前所未有的需求是亚太地区资料中心电力市场面临的主要问题。

- 电力和公共事业价格上涨阻碍了这个市场的发展。过去几年里,电力消耗的急剧上升迫使国营电力供应商将电价提高至少 10%。随着新进入者进入市场,竞争加剧导致成本降低,也侵蚀了资料中心供应商的利润。

- 在新冠疫情的推动下,物联网和人工智慧的采用增加了对更密集处理器的需求,而这些处理器会产生更多热量,因此需要更多电力来冷却。此外,COVID-19 疫情带来的远程办公和其他虚拟活动的增加也增加了资料中心的能源使用量。因此,使用永续技术进行开发的趋势日益增长。

亚太绿色资料中心市场趋势

电价上涨对市场产生负面影响

- 能源价格上涨导致企业经营成本增加、利润率下降。由于需求增加,而自新冠疫情引发的经济放缓以来,供应仍然紧张,石油、天然气和煤炭等能源商品的价格近几週上涨。这是造成亚洲电力短缺的主要原因。

- 中国最近大幅提高燃煤电价,希望透过市场力量解决威胁其经济成长、并在全球产生连锁反应的电力短缺问题。

- 在亚太地区,有限的土地面积、热带气候、缺乏具有成本效益的可再生能源供应以及资料中心发展政策的转变阻碍了该地区资料中心的发展,导致租金上涨。例如,今年 7 月,ST Telemedia 宣布其子公司 ST Telemedia Global 资料 Centres India 已开始在印度位置建造待开发区资料中心设施。他补充说,ST Telemedia 也注重永续性。新的资料中心将是一座绿色建筑,一半以上的电力来自可再生能源。

- 然而,为了增加可再生能源供应并扩大对具有清洁能源来源的世界级资料中心设施的需求,正在考虑绿色选择,包括使用可行的清洁替代燃料(如氢)的措施。此外,今年 2 月,Sify Technologies 宣布将在未来四年内向亚太资料中心市场投资超过 330 亿美元用于资料中心 IT 容量,增加 20 万千瓦的容量,以响应全球可再生能源趋势。该公司宣布已与Vibrant Energy Holdings 签署了231 兆瓦(MW) 太阳能和风力发电容量的购电协议 (PPA)。

- 政府当局有责任提供监管确定性并制定考虑气候影响的资料中心发展蓝图。政府对氢能等技术创新的支持可能有助于资料中心开发商和营运商将这些永续功能纳入其资料中心设计和布局中。

高效液体冷却技术的兴起将推动市场成长

- 随着工作负载的增加,资料中心正在增加机架密度,以提供更强大的客户服务。从小型模组化设施到大型超大规模资料中心,效率和效能并进。随着机架空间的增加,空气冷却不再可行。

- 萨默表示,中型资料中心的伺服器机架每个机架或节点的耗电量为 3 至 6 千瓦。类似地,Uptime Institute 最近对 422 名受访者进行的一项调查发现,许多资料中心的机架密度正在成为 20kW 或更高的现实。

- 机架空间和容量的增加产生了对浸入式冷却技术的需求,其中电介质液体吸收热量的效率远高于空气。从出货量来看,42U至48U机架正被Google、微软、Facebook等主要科技公司采用。随着云端处理的发展,对 42U、45U 和 48U 机架的需求可能会增加。

几家台湾公司正在浸入式冷却领域进行重要的开发活动。例如,2020 年 6 月,台湾冷却解决方案开发商 Kaori Heat Treatment 预计将开始向中国的资料中心运送浸入式冷却系统。

亚太绿色资料中心产业概况

由于许多参与者正在投资绿色技术创新的研发,预计亚太地区的绿色资料中心市场将适度集中。该市场的主要企业包括富士通有限公司、Cisco公司、惠普公司、戴尔公司和日立有限公司。

亚太地区:Green Data 正在澳洲东海岸开发一个资料中心园区,利用与土地收购、可再生能源供应和其他基础设施和公共事业。在亚太地区,Green Data 设计和建造计划以实现可持续的、长期的竞争成本优势,提供低成本、「全天候」的再生能源供应和计划,帮助中心营运商和客户实现加速碳减排以及净零目标。

2022年5月,中金资料与华为数位能源在北京签署战略合作协议,共同发展资料中心基础设施、资料中心业务、智慧光伏发电、绿色能源储存、综合智慧型能源管理,并同意在“其他领域”开展合作「」。 资料将与华为数位能源在顾问设计、工程建设、维运管理等方面合作。

2022 年 9 月,Equinix 将与新加坡国立大学能源研究与技术中心合作,推动资料中心氢技术的发展。此次合作将促进新加坡热带气候中的绿色资料中心转向一系列无污染燃料,包括氢气、沼气和可再生液体燃料,并帮助资料中心排放碳足迹。和互连服务,同时降低开销。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 市场限制

- 绿色资料中心市场机会

- 产业价值链分析与COVID-19影响分析

第 5 章 技术概述

- 技术简介

- 冷却技术

- 液体冷却

- 蒸发冷却

- 免费冷却

- 降低功耗技术

- 低功耗伺服器

- 太阳能和风力发电

- 资料中心基础设施管理

- 整合与虚拟技术

- 持续发展

第六章 市场细分

- 按服务

- 系统整合

- 监控服务

- 专业服务

- 其他服务

- 按解决方案

- 力量

- 伺服器

- 管理软体

- 网路科技

- 冷却

- 其他解决方案

- 按用户

- 主机託管提供者

- 云端服务供应商

- 企业

- 按最终用户产业

- 卫生保健

- 金融服务

- 政府

- 通讯和 IT

- 其他行业

- 按国家

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Fujitsu Ltd.

- Cisco Technology, Inc.

- HP Inc.

- Dell Inc.

- Hitachi Ltd.

- Schneider Electric SE

- EMC Corporation

- IBM Corporation

- Eaton Corporation

- Emerson Network Powers

- GoGrid, LLC

第八章 市场机会与未来趋势

The APAC Green Data Center Market is expected to register a CAGR of 20.87% during the forecast period.

Key Highlights

- Singapore also accounts for 60% of Southeast Asia's total data center supply. Over the life of a data center, the cost of power increases unpredictably, increasing operating expenses.This is an issue of serious environmental concern and a cause for firms worldwide to take steps toward sustainability.

- Energy use in data centers throughout APAC is rising to match skyrocketing demand. The APAC region consumes a significant amount of the total energy used by data centers worldwide, and there is no sign of slowing demand. The lack of energy management methods coupled with the unprecedented rise in demand is the major concern for the data center power market in the APAC region.

- This market is being hampered by rising power and utility prices.The rapid rise in power consumption has driven state providers to increase their prices by at least 10% over the last couple of years. The decreasing cost due to increased competition with the increasing number of new entrants into the market is also cutting into the profits of data center providers.

- The use of the Internet of Things and artificial intelligence spurred by the COVID-19 situation increased the need for higher-density processors, which produced more heat and thus required more cooling power. Moreover, data center energy usage increased due to increased teleworking and other virtual activities brought on by the COVID-19 pandemic. Developments in the form of using sustainable technologies were, thus, on the rise.

APAC Green Data Center Market Trends

Rise in Electricity Prices Affecting the Market Negatively

- Rising energy prices lead to increased business costs and narrow profit margins for companies. Prices of energy commodities - including oil, natural gas, and coal - soared in recent weeks as supply remains tight and demand has increased since a Covid-induced slowdown. This has contributed mainly to power shortages in Asia.

- China has recently allowed the price of coal-fired power to rise sharply in the hope that market forces can address a power crunch that has threatened growth and caused ripple effects worldwide.

- In the Asia Pacific, limited land size, tropical climate, lack of cost-effective renewable energy supply, and shifting policies for data center development are vital challenges impeding the growth of data centers in the region and causing an increase in rental rates. For instance, in July this year, ST Telemedia announced its subsidiary, ST Telemedia Global Data Centres India, has started construction on its greenfield sited data center facility in Noida, India. It added that consistent with their focus on sustainability. The new data center will be a green building and source more than half of its power from renewable energy resources.

- But there are green options, including measures to increase renewable energy supply and use viable cleaner fuel alternatives such as hydrogen for expanding the need for world-class data center facilities in clean energy sources. Furthermore, in February this year, Sify Technologies announced that it has entered into power purchase agreements (PPAs) with Vibrant Energy Holdings for 231 megawatts (MW) of solar and wind energy capacity to invest in over $33 billion for 200 MW of green energy for IT capacity of data centers in Asia Pacific data center market, in the next four years to power data centers with an intense global push towards renewable energy.

- It is incumbent on the government authorities to provide regulatory certainty and set a roadmap for data center development that considers its climate impact. Government support for technological innovations such as hydrogen will help data center developers and operators integrate these sustainable features into the design and siting of their data centers.

Rise in Efficient Liquid Cooling Techniques Aid the Market Growth

- Data centers are increasing rack density to provide more robust client services as workloads grow. From smaller, modular facilities to large, hyperscale data centers, efficiency and performance go hand in hand. With the increased rack space, air cooling will no longer be viable.

- According to Summer, a medium data center server rack uses 3-6 kilowatts per rack or node. However, HPCs with 60 kilowatts per rack or node are now available.Similarly, according to a recent Uptime Institute survey of 422 respondents, racks with densities of 20 kW and higher are becoming a reality for many data centers.

- Such an increase in rack space and capacity creates a need for immersion-based cooling technology that absorbs heat far more efficiently than air due to the dielectric liquid. Regarding shipments, the adoption of racks ranging from 42U to 48U is high amongst some major technology companies such as Google, Microsoft, and Facebook. With cloud computing growth, the need for 42U, 45U, and 48U racks will increase.

Several companies based out of Taiwan are engaging in significant developmental activities in the immersion cooling landscape. For instance, in June 2020, Taiwan-based cooling solution developer Kaori Heat Treatment will kick off a shipment of a liquid immersion cooling system to a Chinese data center.

APAC Green Data Center Industry Overview

.The Asia-Pacific Green Datacenter market is expected to be of moderate concentration, as many players are investing in research and development to innovate green technologies. Some major players in the market are Fujitsu Limited, Cisco Systems, Inc., Hewlett-Packard Company, Dell, and Hitachi Ltd.

APAC Green Data is a developer of data center campuses on Australia's East Coast designed to capture fundamental cost advantages related to land acquisition, renewable power supply, and other infrastructure and utilities. APAC Green Data plans to create and configure its projects to deliver sustained and long-term competitive cost advantages, providing low-cost "around the clock' renewable power supply, and assisting data center operators and customers in meeting their accelerating carbon reduction and Net Zero targets.

In May 2022, Centrin Data and Huawei Digital Power signed a strategic cooperation agreement in Beijing, agreeing to cooperate on data center infrastructure, data center business, smart photovoltaics, green energy storage, comprehensive smart energy management, and "other fields." Centrin Data will cooperate with Huawei Digital Energy in areas such as consulting design, engineering construction, operation and maintenance management, etc.

In September 2022, Equinix and the NUS Center for Energy Research and Technology will partner to advance hydrogen technologies for data centers. This collaboration will explore and develop hydrogen fuel technologies for green data centers in the tropical climate of Singapore by enabling operators to easily switch between various clean fuel options, including hydrogen, biogas, and different renewable liquid fuels, and by also allowing data centers to reduce carbon emissions while meeting the rising demand for data, colocation, and interconnection services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Opportunities in the Green Data Center Market

- 4.6 Industry Value Chain Analysis and COVID-19 Impact

5 TECHNOLOGY OVERVIEW

- 5.1 Technology Snapshot

- 5.2 Cooling Technologies

- 5.2.1 Liquid Cooling

- 5.2.2 Evaporative Cooling

- 5.2.3 Free Cooling

- 5.3 Power Usage lowering technologies

- 5.3.1 Low-power Servers

- 5.3.2 Solar and Wind Energy

- 5.4 Data Center Infrastructure Management

- 5.5 Consolidation and Virtualization Technologies

- 5.6 Ongoing Developments

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 System Integration

- 6.1.2 Monitoring Services

- 6.1.3 Professional Services

- 6.1.4 Other Services

- 6.2 By Solutions

- 6.2.1 Power

- 6.2.2 Servers

- 6.2.3 Management Software

- 6.2.4 Networking Technologies

- 6.2.5 Cooling

- 6.2.6 Other Solutions

- 6.3 By Users

- 6.3.1 Colocation Providers

- 6.3.2 Cloud Service Providers

- 6.3.3 Enterprises

- 6.4 By End-user Industries

- 6.4.1 Healthcare

- 6.4.2 Financial Services

- 6.4.3 Government

- 6.4.4 Telecom and IT

- 6.4.5 Other Industries

- 6.5 By Country

- 6.5.1 China

- 6.5.2 India

- 6.5.3 Japan

- 6.5.4 South Korea

- 6.5.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd.

- 7.1.2 Cisco Technology, Inc.

- 7.1.3 HP Inc.

- 7.1.4 Dell Inc.

- 7.1.5 Hitachi Ltd.

- 7.1.6 Schneider Electric SE

- 7.1.7 EMC Corporation

- 7.1.8 IBM Corporation

- 7.1.9 Eaton Corporation

- 7.1.10 Emerson Network Powers

- 7.1.11 GoGrid, LLC