|

市场调查报告书

商品编码

1637887

旋转泵:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Rotary Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

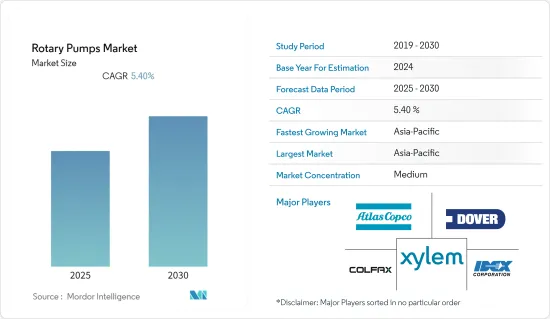

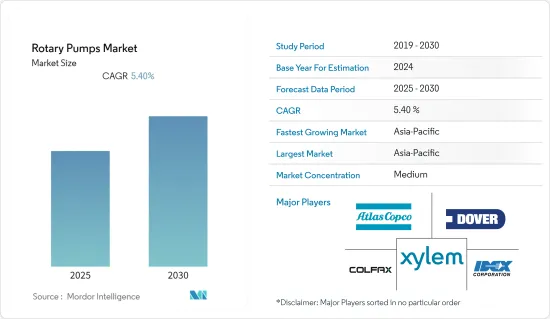

预计预测期内旋转帮浦市场复合年增长率为 5.4%。

主要亮点

- 旋转泵由于其能够无水头损失地泵送气体和液体而一直备受追捧。这使得它们成为寻求以最低成本获得长寿命泵的行业的首选。随着工业流程的进步,对于能够在高压差下有效运作并以紧凑设计泵送高黏度流体的泵浦的需求日益增加。

- 新冠肺炎疫情几乎影响了国际上所有产业,其中泵浦产业受到的打击尤为严重。世界各国政府已实施封锁措施。封锁导致泵浦业关闭。疫情过后情况正在恶化,疫情对废弃物管理、造纸和纸浆等多个终端用户产业的影响越来越大。

- 物联网 (IoT) 和工业 4.0 是迅速主导工业自动化领域的两种最尖端科技的例子。泵浦製造商正在寻找方法,透过推出更有效率、更便宜的泵浦来利用工业领域最尖端科技日益增长的主导地位。

- 我们期望看到越来越多的智慧製造设施,其中的泵浦能够连网到云端,从而提供机器健康状况等重要资讯。因此,推出设计新颖的智慧旋转泵并加强其作为旋转泵市场一站式解决方案提供商的地位,预计将成为未来几年突出的市场趋势。

- 例如,Sensata Technologies 宣布将于 2022 年 5 月发布新的资产监控解决方案。该解决方案可以实现旋转资产的预测性维护,并为工厂经理提供有用的资料。此感测器的设计使其能够轻鬆改装到已在使用的各种旋转泵上。使用 Nanoprecise 强大的 AI 驱动旋转资产演算法检查感测器资料边缘是否存在异常,并将其发送到 Sensata IQ云端基础平台进行进一步分析。

- 此外,旋转泵市场预计将受到现代技术在农业中的应用的推动,以提高全要素生产率,满足日益增长的农产品需求。此外,预计旋转泵市场将受到可支配收入增加和标准提高导致的製程製造需求增加的推动。

- 然而,原材料成本的上涨预计将推高旋转泵的价格,这可能会阻碍市场扩张。随着石油和天然气业务的持续下滑,旋转帮浦市场的製造商可能会将注意力转向抓住其他应用领域的销售机会。

旋转帮浦市场趋势

用水和污水管理占很大份额

- 根据联合国估计,2050年全球水问题预计将恶化50%。这导致世界各国政府和组织增加了对水源产业的投资和活动。预计这些支出将推动用水和污水管理领域的旋转泵市场的发展。

- 在大多数新兴国家中,卫生设施和供水的重要性日益增加,这为旋转泵市场的参与者带来了大量机会。旋转泵浦为一级、二级和三级污水处理方案提供了经济实惠的选择。

- 凸轮转子帮浦是处理污泥含量超过 3% 的水和污水最受欢迎且最经济的帮浦。疫情也导致许多计划被推迟,污水处理行业陷入全面停滞。由于 COVID-19 疫情爆发,Buzzards Bay污水处理设施的启用被推迟至 2020 年 11 月。这些延误已经影响了各个计划对泵浦的需求。

- 工业化、製造业和电子产品需求的不断增长推动了特种化学品行业的发展。此外,过去六年,全球气雾推进剂市场大幅扩张,气雾推进剂常用于喷漆、空气清新剂和除臭剂等产品。

- 例如,2022 年 9 月,NETZSCH Pumps USA 宣布推出一系列适用于要求严格的污水应用的尖端、经过现场验证的设备。对于需要在低压至中压下实现高流速的污水处理应用,TORNADO T1旋转叶片帮浦采用小型紧凑型封装,适合任何方向和安装,是一种用途极为广泛的选择。 TORNADO T1 帮浦可在各种黏度、固态、温度、磨损、腐蚀性/酸性製程流体和环境条件下运作。

预测期内,亚太地区将以最快的复合年增长率成长。

- 由于污水、采矿、电力和化学领域对产品的需求不断增加,预计亚太地区将主导全球旋转泵市场。为了利用旋转泵的成本效益特性并增加在印度、中国等利润丰厚的市场和其他高潜力市场的销量,市场参与者正在将生产基地转移到人事费用低的亚洲国家。

- 此外,到 2040 年,亚太地区的电力消耗量预计将比 2017 年的水准成长 66.6%。根据国际能源总署预测,预计电力成长率将达到 98%。在发电行业中,渐进式泵浦是最常见的类型,由于其效率高,预计会越来越受欢迎。东亚拥有许多发电公司,对旋转泵浦的需求预计会增加。

- 中国是亚太地区领先的旋转叶片帮浦製造商之一,其产品的应用范围十分广泛。另一个重要的商业用途是医药。中国正致力于国内药品生产。因此,製药业对旋转叶片帮浦的安装需求日益增加。

- 在印度和中国等新兴市场,近期的基础设施扩张和持续的工业化进一步补充了旋转泵的使用。因此,新兴国家旋转泵市场的竞争预计将加剧,领先的旋转泵製造商预计将继续主导市场。

- 市场参与企业正在采用旋转泵的最佳定价策略,以在上述经济成长国家的激烈市场竞争中获得竞争优势。因此,中国和印度已成为旋转泵最盈利的市场,并预计未来将继续主导该地区。

- 中国于2022年6月公布了「十四五」规划。国际能源总署表示,该国制定了一个雄心勃勃的目标,即到 2025 年 33% 的电力来自可再生能源,其中 18% 的目标来自风能和太阳能光电技术。为实现这一目标,中国已实施33多项政策,推动可再生能源发电,特别是在太阳能和风力发电等领域。预计这些变数将在整个预测期内对该领域的市场成长产生重大影响。

旋转泵行业概况

旋转泵浦市场适度分散,产品差异化为企业提供了创新潜力。市场的主要企业包括 Dover Corporation、Xylem Inc. 和 Colfax Corporation。最近的市场发展趋势包括:

- 2022 年 9 月 - 在 WEFTEC 2022 上,NETZSCH 推出了最新产品系列:PERIPRO 蠕动帮浦。这些 NETZSCH 软管帮浦具有坚固的设计,可用于要求严苛的应用,并配有大型滚轮,以提高耐用性并降低能耗。 TORNADO T1旋转叶片帮浦是这个新产品系列的一部分。对于需要在低压至中压下实现高流速的污水处理应用,这种小型、紧凑的设备是一种适应性极强的选择,可适应任何方向和安装。

- 2022 年 5 月-ITT Inc. 推出其 i-ALERT 整机健康监测生态系统的新一代技术。 i-ALERT3 感测器可更快、更准确且更低成本地监测和记录纺纱机的温度和振动。透过使用更宽的振动频率范围,它可以主动检测和诊断旋转泵、马达和其他工业机械中的机械和电气故障。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 关注大多数新兴国家的污水管理系统

- 重点改造现有的节能泵

- 产业价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 北美洲

- 按类型

- 叶片

- 拧紧

- 渐进腔(PC)

- 长袍

- 齿轮

- 按最终用户产业

- 石油和天然气

- 发电

- 化工和石化

- 饮食

- 用水和污水

- 药品

- 其他最终用户产业

- 按国家

- 美国

- 加拿大

- 按类型

- 欧洲

- 按类型

- 叶片

- 拧紧

- 渐进腔(PC)

- 长袍

- 齿轮

- 按最终用户产业

- 石油和天然气

- 发电

- 化工和石化

- 饮食

- 用水和污水

- 药品

- 其他最终用户产业

- 按国家

- 德国

- 英国

- 法国

- 其他欧洲国家

- 按类型

- 亚太地区

- 按类型

- 叶片

- 拧紧

- 渐进腔(PC)

- 长袍

- 齿轮

- 按最终用户产业

- 石油和天然气

- 发电

- 化工和石化

- 饮食

- 用水和污水

- 药品

- 其他最终用户产业

- 按国家

- 中国

- 日本

- 印度

- 其他亚太地区

- 按类型

- 拉丁美洲

- 按类型

- 叶片

- 拧紧

- 渐进腔(PC)

- 长袍

- 齿轮

- 按最终用户产业

- 石油和天然气

- 发电

- 化工和石化

- 饮食

- 用水和污水

- 药品

- 其他最终用户产业

- 按国家

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲国家

- 按类型

- 中东和非洲

- 按类型

- 叶片

- 拧紧

- 渐进腔(PC)

- 长袍

- 齿轮

- 按最终用户产业

- 石油和天然气

- 发电

- 化工和石化

- 饮食

- 用水和污水

- 药品

- 其他最终用户产业

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 按类型

第六章 竞争格局

- 公司简介

- Dover Corporation

- Colfax Corporation

- SPX Flow Inc.

- Xylem Inc.

- IDEX Corporation

- Atlas Copco AB

- Pfeiffer Vacuum Technology AG.

- ULVAC Inc.

- Busch Systems

- Gardner Denver Holdings Inc.

第七章投资分析

第八章 市场机会与未来趋势

简介目录

Product Code: 48206

The Rotary Pumps Market is expected to register a CAGR of 5.4% during the forecast period.

Key Highlights

- Due to their capacity to pump gases and liquids without experiencing head loss, rotary pumps have long been in great demand. This makes them the preferred option for industries searching for long-lasting pumps with minimal costs. The need for a pump that can operate effectively under high differential pressure and pump high-viscosity fluids through compact designs has been growing as industrial processes progress.

- The COVID-19 pandemic affected nearly every international industry, and the pump industry was particularly hit hard. The government implemented lockdowns in numerous nations around the world. Lockdown prompted the pump industry to cease operations. In the post-pandemic period, the situation is deteriorating, and the pandemic's effects are being felt increasingly in several end-user industries, including waste management, paper and pulp, and others.

- The Internet of Things (IoT) and Industry 4.0 are two examples of cutting-edge technologies that are quickly taking over the field of industrial automation. Pump producers are looking for ways to profit from the growing dominance of cutting-edge technologies in industrial sectors by introducing highly efficient and affordable pumps.

- Increased smart manufacturing facilities with pumps networked to the cloud are anticipated to supply vital information like the machine status. Thus, introducing novel designs of smart rotary pumps and strengthening one's position as a one-stop solution provider in the rotary pumps market is projected to emerge as a prominent market trend in the following years.

- For instance, Sensata Technologies announced the release of a new asset monitoring solution in May 2022. This solution enables predictive maintenance for rotating assets and provides plant managers with useful data. The sensors are made to be simple to retrofit into a variety of rotary pumps that are already in use. Data from the sensor is examined at the edge for anomalies using powerful AI-driven algorithms for rotary assets by Nanoprecise and then sent to the Sensata IQ cloud-based platform for additional analysis.

- Additionally, the market for rotary pumps is expected to be driven by the use of modern technologies in agriculture to increase total factor productivity in order to meet the growing demand for agricultural products. Furthermore, the market for rotary pumps is anticipated to be driven by rising disposable incomes and an increase in the demand for process manufacturing due to rising standards.

- However, the market expansion may be hampered by the growing cost of raw materials, which is anticipated to raise the price of rotary pumps. As the oil and gas business continues to decline, manufacturers in the rotary pump market will likely shift their attention to seizing sales opportunities in other application areas.

Rotary Pumps Market Trends

Water and Wastewater Management to Account for a Significant Share

- According to United Nations estimates, the global water problem is expected to worsen by 50% by 2050. This is driving up investments and activities by governments and organizations in water utilities worldwide. The market for rotary pumps in the water and wastewater management sector is expected to be driven by these expenditures.

- Numerous chances are opening up for rotary pump market players due to the importance of sanitation and the expanding access to water supply in most developing countries. The rotary pumps offer affordable options for wastewater treatment programs for primary, secondary, and tertiary water treatment programs.

- The lobe rotary pump is the most popular and economical pump for treating water and wastewater with sludge levels of 3% and above. The pandemic also caused numerous projects to be postponed and the wastewater treatment sector to stand at a complete standstill. The COVID-19 outbreak pushed back the opening of the Buzzards Bay wastewater treatment facility to November 2020. The delays influenced the demand for these pumps in various projects.

- The specialty chemical industry is being driven by rising industrialization, manufacturing, and electronics demand. Additionally, during the past six years, the global market for aerosol propellants-commonly used in goods like spray paints, air fresheners, and deodorants-has significantly increased.

- For example, NETZSCH Pumps USA introduced its wide portfolio of cutting-edge, field-proven equipment for demanding wastewater applications in September 2022. For wastewater treatment applications requiring high flow at low to medium pressures in a tiny, compact package in just about any orientation and installation, the TORNADO T1 Rotary Lobe Pump is an incredibly versatile option. The TORNADO T1 pump can operate in various viscosities, solids, temperatures, abrasion, corrosive/acidic process fluids, and environmental conditions.

Asia Pacific to Execute the Fastest CAGR During the Forecast Period

- Due to rising product demand in wastewater, mining, power, and chemicals sectors, Asia-Pacific is anticipated to dominate the global rotary pump market. To capitalize on the cost-effective qualities of rotary pumps and increase lucrative sales in India, China, and other high-potential markets, market players are moving their production operations to Asian nations where labor costs are cheaper.

- Furthermore, compared to 2017 levels, the Asia-Pacific region's electricity consumption is expected to increase by 66.6% by 2040. According to the IEA, the growth of electricity is anticipated to soar by 98%. The popularity of progressive capacity pumps, the most common in the power production industry because of their efficiency advantages, is expected to increase. East Asia has many power generation companies; thus, its nations are expected to see an increased demand for rotary pumps.

- China is one of the leading rotary lobe pump makers in Asia-Pacific, and its products are used in all applications. Another important commercial application is pharmaceuticals. China is putting a lot of effort into domestic drug production. As a result, the pharma industry has a greater need for the installation of rotary lobe pumps.

- The utilization of rotary pumps is being further complemented by recent expansion in infrastructural improvements and continuous industrialization in emerging markets like India and China. As a result, there will likely be more competition in developing nations' rotary pump markets, which will continue to be highly consolidated among the top rotary pump producers.

- Market participants are using an optimal price strategy for rotary pumps to gain a competitive edge in the fiercely competitive local marketplaces of the above-growing economies. As a result, China and India are the most profitable markets for rotary pumps and are predicted to continue to rule the area.

- China issued its 14th Five-Year Plan in June 2022. According to the IEA, it has an ambitious goal of having 33% of electricity generated by renewable sources by 2025, including an 18% target for wind and solar technology. China has put in place more than 33 policy efforts to boost renewable electricity, especially in fields like solar and wind energy, to achieve this. These variables are anticipated to have a significant impact on market growth in the area throughout the projection period.

Rotary Pumps Industry Overview

The rotary pump market is moderately fragmented due to product differentiation, which provides companies with innovation potential. Some key players in the market are Dover Corporation, Xylem Inc., and Colfax Corporation. Some recent developments in the market are:

- September 2022 - At WEFTEC 2022, NETZSCH unveiled its newest product line, PERIPRO Peristaltic Pumps. These NETZSCH hose pumps have a robust design for use in demanding applications and large rollers for increased durability and reduced energy use. The TORNADO T1 Rotary Lobe Pump is a part of the launch of the new product line. It is a very adaptable option for wastewater treatment applications that need high flow at low to medium pressures in a small, compact package in just about any orientation and installation.

- May 2022 - ITT Inc introduced a new technology generation for the i-ALERT whole machine health monitoring ecosystem. The i-ALERT3 sensor is made to more rapidly, precisely, and affordably monitor and log the temperature and vibration of any spinning machine. Employing a wider vibration frequency range detects and diagnoses mechanical and electrical faults in rotary pumps, motors, and other industrial machinery before they happen.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Focus on Waste-Water Management Systems in most Developing Countries

- 4.2.2 Focus on Retrofitting of Existing Energy-Efficient Pumps

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 North America

- 5.1.1 By Type

- 5.1.1.1 Vane

- 5.1.1.2 Screw

- 5.1.1.3 Progressive Cavity (PC)

- 5.1.1.4 Lobe

- 5.1.1.5 Gear

- 5.1.2 By End-user Vertical

- 5.1.2.1 Oil and Gas

- 5.1.2.2 Power Generation

- 5.1.2.3 Chemical and Petrochemical

- 5.1.2.4 Food and Beverage

- 5.1.2.5 Water and Wastewater

- 5.1.2.6 Pharmaceutical

- 5.1.2.7 Other End-user Verticals

- 5.1.3 By Country

- 5.1.3.1 United States

- 5.1.3.2 Canada

- 5.1.1 By Type

- 5.2 Europe

- 5.2.1 By Type

- 5.2.1.1 Vane

- 5.2.1.2 Screw

- 5.2.1.3 Progressive Cavity (PC)

- 5.2.1.4 Lobe

- 5.2.1.5 Gear

- 5.2.2 By End-user Vertical

- 5.2.2.1 Oil and Gas

- 5.2.2.2 Power Generation

- 5.2.2.3 Chemical and Petrochemical

- 5.2.2.4 Food and Beverage

- 5.2.2.5 Water and Wastewater

- 5.2.2.6 Pharmaceutical

- 5.2.2.7 Other End-user Verticals

- 5.2.3 By Country

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Rest of Europe

- 5.2.1 By Type

- 5.3 Asia-Pacific

- 5.3.1 By Type

- 5.3.1.1 Vane

- 5.3.1.2 Screw

- 5.3.1.3 Progressive Cavity (PC)

- 5.3.1.4 Lobe

- 5.3.1.5 Gear

- 5.3.2 By End-user Vertical

- 5.3.2.1 Oil and Gas

- 5.3.2.2 Power Generation

- 5.3.2.3 Chemical and Petrochemical

- 5.3.2.4 Food and Beverage

- 5.3.2.5 Water and Wastewater

- 5.3.2.6 Pharmaceutical

- 5.3.2.7 Others End-user Verticals

- 5.3.3 By Country

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.1 By Type

- 5.4 Latin America

- 5.4.1 By Type

- 5.4.1.1 Vane

- 5.4.1.2 Screw

- 5.4.1.3 Progressive Cavity (PC)

- 5.4.1.4 Lobe

- 5.4.1.5 Gear

- 5.4.2 By End-user Vertical

- 5.4.2.1 Oil and Gas

- 5.4.2.2 Power Generation

- 5.4.2.3 Chemical and Petrochemical

- 5.4.2.4 Food and Beverage

- 5.4.2.5 Water and Wastewater

- 5.4.2.6 Pharmaceutical

- 5.4.2.7 Other End-user Verticals

- 5.4.3 By Country

- 5.4.3.1 Brazil

- 5.4.3.2 Mexico

- 5.4.3.3 Argentina

- 5.4.3.4 Rest of Latin America

- 5.4.1 By Type

- 5.5 Middle East and Africa

- 5.5.1 By Type

- 5.5.1.1 Vane

- 5.5.1.2 Screw

- 5.5.1.3 Progressive Cavity (PC)

- 5.5.1.4 Lobe

- 5.5.1.5 Gear

- 5.5.2 By End-user Vertical

- 5.5.2.1 Oil and Gas

- 5.5.2.2 Power Generation

- 5.5.2.3 Chemical and Petrochemical

- 5.5.2.4 Food and Beverage

- 5.5.2.5 Water and Wastewater

- 5.5.2.6 Pharmaceutical

- 5.5.2.7 Other End-user Verticals

- 5.5.3 By Country

- 5.5.3.1 United Arab Emirates

- 5.5.3.2 Saudi Arabia

- 5.5.3.3 South Africa

- 5.5.3.4 Rest of Middle East & Africa

- 5.5.1 By Type

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Dover Corporation

- 6.1.2 Colfax Corporation

- 6.1.3 SPX Flow Inc.

- 6.1.4 Xylem Inc.

- 6.1.5 IDEX Corporation

- 6.1.6 Atlas Copco AB

- 6.1.7 Pfeiffer Vacuum Technology AG.

- 6.1.8 ULVAC Inc.

- 6.1.9 Busch Systems

- 6.1.10 Gardner Denver Holdings Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219