|

市场调查报告书

商品编码

1637889

游戏化:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Gamification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

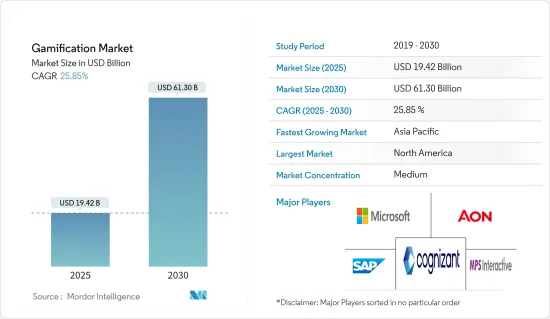

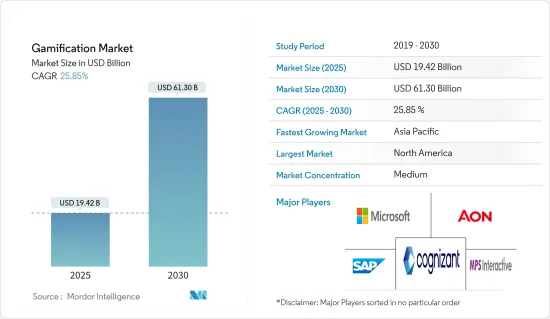

游戏化市场规模预计到 2025 年为 194.2 亿美元,预计到 2030 年将达到 613 亿美元,预测期内(2025-2030 年)复合年增长率为 25.85%。

智慧型手机和行动装置的激增极大地增强了游戏化市场。越来越多的公司正在意识到游戏化的潜力,并利用它来塑造人类行为并推动创新、生产力和参与。行动技术的普及为成功的游戏化策略创造了肥沃的土壤,为企业提供了以更具互动性和吸引力的方式与受众建立联繫的新方式。

主要亮点

- 行动装置的日益复杂化进一步支持了这种成长,它们透过提供扩增实境(AR) 和虚拟实境 (VR) 等高级功能来丰富游戏化体验。

- 此外,与社交网路的整合允许用户共用他们的经验,扩大平台的影响力。与社交媒体的整合允许游戏化应用程式透过允许用户与他们的网路共用他们的成就和进展来吸引更广泛的受众,从而产生病毒式传播效果。

- 行动应用程式允许负责人甚至透过一个问题进行调查,并从目标受众那里收集有价值的见解。这种即时回馈机制使公司能够更有效地调整其行销策略,以确保满足不断变化的客户需求和偏好。

- MIT(麻省理工学院)最近的一项研究发现,敏捷组织不仅加速收益成长,而且盈利也比非敏捷组织高出 30%。这凸显了采用灵活、响应迅速的业务实践以及游戏化策略以实现最佳结果的重要性。此外,收集和分析游戏化互动资料的能力使公司能够更深入地了解消费行为,从而开展更有针对性和更有效的行销宣传活动。

- 虽然越来越多的公司正在采用游戏化,但许多公司都以相当通用的方式这样做,严重依赖积分系统、排行榜和徽章。这种方法缺乏竞争与合作之间的微妙平衡,有可能削弱其潜力。

- 未来,我们将看到人工智慧和机器学习等先进技术的整合激增。公司和供应商不仅在学习,而且还在磨练他们的解决方案,随着时间的推移变得更加直观和高效。人工智慧和机器学习技术可以透过提供个人化体验、预测使用者行为以及调整内容以保持用户参与来增强游戏化。

- 因此,随着公司寻求利用其潜力来建立更复杂、更有效的游戏化策略,对这些技术的投资预计在不久的将来会增加。

游戏化市场趋势

零售业占据最大市场占有率

- 近年来,零售业经历了显着成长,销售额稳步成长。越来越注重在社群媒体上传播个人品牌的客户透过寻求适合他们的体验和产品来推动这一趋势。

- 将游戏化纳入零售商的行销策略不仅可以增加娱乐性,还可以培养顾客和员工的正向行为。结果是带来更身临其境的品牌体验,最终导致销量增加。

- 根据《哈佛商业评论》的一篇报导,游戏化是提高客户维繫的强大工具。据报道,游戏化可将客户维繫提高 5%,将利润提高 25% 至 95%,并且通常会带来更好的业务成果。例如,品牌在其产品上使用扫描器可读代码,以奖励扫描它们的客户忠诚度积分。从增强发现和参与度到建立品牌宣传和忠诚度,零售商越来越多地将游戏化融入客户的购物旅程中。

- 零售游戏化是电子商务中快速成长的趋势,并且正在迅速获得采用。线上零售商正在加倍投入互动体验来推动销售,而游戏化应用程式在增加潜在客户和转换方面也被证明是有效的。此外,游戏化是一个强大的工具,不仅可以获得新客户,还可以客户维繫。

- 零售公司越来越多地采用创新的游戏化策略来提高消费者参与度、建立品牌忠诚度并改善零售体验。据 Tapjoy 称,Z 世代正在引领这一趋势,77% 的人每天都会玩手机游戏。 2023 年 2 月至 2024 年,全球女性手机游戏玩家平均每天花在休閒游戏上的时间为 22 分钟,超过男性游戏玩家的平均时间 20.6 分钟。值得注意的是,北美男性玩家对此类别最不感兴趣。因此,零售商,特别是杂货业的零售商,正在认识到有效吸引这一有影响力的人群的策略的重要性。

- 零售商和品牌可以为用户提供进度图表,以从游戏化中获得更多价值。这些图表可以突出显示重要指标,例如过去的购买历史记录、好友公告以及新产品类别的更新。透过在「胜利」和「奖励」之间取得适当的平衡,零售商可以吸引顾客并带来实际的商业性利益。

预计北美将占据最大市场占有率

- 北美行销领域拥有成熟的游戏化市场。这种趋势不仅限于行销,还被用于区域范围内的产品开发和创新。在北美,很大一部分人口使用智慧型手机和互联网,游戏化的采用激增,特别是透过社群媒体工具的整合。

- 自业界诞生以来,包括 Adobe、NBC、Walgreens、eBay、Panera 和 Threadless 等消费品牌在内的知名公司都推出了大规模的游戏化计划。此外,Oracle、Cisco 和销售团队等 B2B 公司已认识到游戏化在消费化中发挥的重要作用,并将其纳入本地企业策略。

- 这些公司特别被游戏化提高参与度和忠诚度的能力所吸引,随着时间的推移,透过重复访问和病毒式传播,参与度和忠诚度平均增加 30%。除了参与度之外,游戏化的经济效益也值得关注。例如,美国跨国软体公司 Autodesk 报告试用使用量增加了 40%,转换率增加了 15%。此外,跨国公司正在扩大在北美市场的业务,以满足对游戏化解决方案不断增长的需求。

游戏化产业概况

游戏化市场竞争适中,少数主要企业主导市场。这些领先的参与企业正在积极拓展国际市场,利用策略联盟来增加市场占有率和盈利。透过利用此类联合倡议,我们的目标是加强我们的竞争并实现全球市场的永续成长。

例如,2024 年 7 月,Xplor Technologies 旗下的着名精品健身软体平台 Xplor Mariana Tek 宣布推出一套游戏化工具,旨在提高健身工作室成员的参与度。该平台的最新功能旨在透过将竞争和成就元素融入工作室体验中,加强社区建设并提高会员保留率。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 基于行动装置的游戏化势头强劲

- 众包被认为是创新和发展的巨大机会

- 市场限制因素

- 製造复杂性和较低的投资报酬率

第六章 市场细分

- 按发展

- 本地

- 在云端

- 按尺寸

- 小型企业

- 大公司

- 按平台

- 开放平台

- 封闭式/企业平台

- 按行业分类

- 零售

- 银行

- 政府机构

- 医疗保健

- 教育/研究

- 资讯科技和电讯

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Cognizant Technology Solution Corp.

- MPS Interactive Systems Limited

- Microsoft Corporation

- SAP SE

- Aon PLC

- Axonify Inc.

- IActionable Inc.

- Bunchball Inc.

- Ambition

- G-Cube

第八章投资分析

第九章 市场机会及未来趋势

The Gamification Market size is estimated at USD 19.42 billion in 2025, and is expected to reach USD 61.30 billion by 2030, at a CAGR of 25.85% during the forecast period (2025-2030).

The surge in smartphones and mobile devices has significantly bolstered the gamification market. As businesses increasingly recognize gamification's potential, they are leveraging it to shape human behavior, driving innovation, productivity, and engagement. The widespread adoption of mobile technology has created a fertile ground for gamification strategies to thrive, offering new avenues for businesses to connect with their audiences in more interactive and engaging ways.

Key Highlights

- This growth is further supported by the increasing sophistication of mobile devices, which now offer advanced features such as augmented reality (AR) and virtual reality (VR), enhancing the gamification experience.

- Moreover, users can now share their experiences by integrating with social networks, amplifying the platform's impact. Social media integration allows gamified applications to reach a broader audience as users share their achievements and progress with their networks, creating a viral effect.

- Marketers, leveraging mobile apps, can conduct surveys, even single-question ones, gathering valuable insights from their target audience. This real-time feedback mechanism enables businesses to tailor their marketing strategies more effectively, ensuring they meet the evolving needs and preferences of their customers.

- Recent research from MIT highlights that agile organizations not only witness accelerated revenue growth but also enjoy a 30% higher profitability compared to their non-agile counterparts. This underscores the importance of adopting flexible and responsive business practices in conjunction with gamification strategies to achieve optimal results. Furthermore, the ability to collect and analyze data from gamified interactions provides businesses with deeper insights into consumer behavior, allowing for more targeted and effective marketing campaigns.

- While businesses are increasingly adopting gamification, many are doing so in a rather generic manner, relying heavily on point systems, leaderboards, and badges. This approach, lacking a nuanced balance between competition and collaboration, risks undermining the method's potential, with an estimated 80% of efforts falling short of expectations.

- Looking ahead, the integration of advanced technologies like AI and ML is poised to surge. Enterprises and vendors are refining solutions that not only learn but also evolve to be more intuitive and efficient over time. AI and ML technologies can enhance gamification by providing personalized experiences, predicting user behavior, and adapting content to keep users engaged.

- Consequently, investments in these technologies are projected to rise in the near future as businesses seek to leverage their potential to create more sophisticated and effective gamification strategies.

Gamification Market Trends

Retail Segment Holds Largest Market Share

- The retail sector is experiencing substantial growth, with sales increasing steadily in recent years. Customers, increasingly focused on projecting their personal brand on social media, are driving this trend by seeking tailored experiences and products.

- Integrating gamification into a retailer's marketing strategy not only adds entertainment but also cultivates positive behaviors among both customers and employees. This, in turn, leads to a more immersive brand experience and, ultimately, higher sales.

- According to an HBR article, gamification is a potent tool for enhancing customer retention. It is reported to boost retention rates by 5%, elevate profits by 25% to 95%, and generally yield superior business outcomes. For instance, brands are leveraging scannable codes on products, rewarding customers with loyalty points upon scanning. From enhancing discovery and engagement to fostering brand advocacy and loyalty, retailers are increasingly weaving gamification into the fabric of the customer shopping journey.

- Retail gamification, a burgeoning trend in e-commerce, is witnessing rapid adoption. Online retailers are doubling down on interactive experiences to drive sales, with gamification apps proving their mettle in boosting leads and conversions. Moreover, gamification is not just about attracting new customers; it is also a powerful tool for retaining them.

- Retailers are increasingly adopting innovative gamification strategies to enhance consumer engagement, build brand loyalty, and improve the retail experience. Gen Z is leading this trend, with 77% participating in daily mobile gaming, according to Tapjoy. From February 2023 to 2024, global female mobile gamers spent an average of 22 minutes daily on casual games, surpassing their male counterparts, who averaged 20.6 minutes. Notably, male gamers in North America showed the least interest in this category. Consequently, retailers, particularly in the grocery sector, are recognizing the importance of tailoring their strategies to effectively engage this influential demographic.

- Retailers and brands can extract even more value from gamification by offering users progress charts. These charts can highlight key metrics, such as past purchases, friend referrals, and updates on new product categories. By striking a balance between 'wins' and 'rewards,' retailers can engage their audience and drive tangible commercial benefits, ensuring customers keep coming back for more.

North America Anticipated to Hold Largest Market Share

- The North American marketing sector boasts a mature gamification market. This trend extends beyond marketing, increasingly being leveraged for product development and innovation on a regional scale. With a significant portion of the population utilizing smartphones and the internet, North America has experienced a surge in gamification adoption, particularly through the integration of social media tools.

- Prominent companies, including consumer brands such as Adobe, NBC, Walgreens, eBay, Panera, and Threadless, have initiated substantial gamification projects since the industry's inception. In addition, B2B enterprises like Oracle, Cisco, and Salesforce have incorporated gamification into their regional enterprise strategies, recognizing its critical role in consumerization.

- These organizations are particularly attracted to gamification's ability to enhance engagement and loyalty, with an average increase of 30% over time, driven by repeat visits and viral diffusion. Beyond engagement, the financial benefits of gamification are noteworthy. For example, Autodesk, an American multinational software company, reported a 40% increase in trial usage and a 15% rise in conversion rates, while Extraco Bank achieved a remarkable 700% increase in client acquisitions. Furthermore, global corporations are expanding their presence in the North American market to address the growing demand for gamification solutions.

Gamification Industry Overview

The gamification market features moderate competition, with a few key players leading. These dominant players actively broaden their reach into international markets, employing strategic collaborations to bolster their market share and profitability. By leveraging these collaborative initiatives, they aim to enhance their competitive positioning and drive sustained growth in the global market.

For instance, in July 2024, Xplor Mariana Tek, a prominent boutique fitness software platform under Xplor Technologies, unveiled a suite of gamification tools designed to enhance engagement among fitness studio members. The platform's latest features aim to strengthen community building and improve member retention by incorporating elements of competition and achievement into the studio experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Mobile-based Gamification Gaining Momentum

- 5.1.2 Crowdsourcing Seen as a Major Opportunity in Innovation and Development

- 5.2 Market Restraints

- 5.2.1 Manufacturing Complications and Lower ROI

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 On-cloud

- 6.2 By Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Platform

- 6.3.1 Open Platform

- 6.3.2 Closed/ Enterprise Platform

- 6.4 By End-user Vertical

- 6.4.1 Retail

- 6.4.2 Banking

- 6.4.3 Government

- 6.4.4 Healthcare

- 6.4.5 Education and Research

- 6.4.6 IT and Telecom

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cognizant Technology Solution Corp.

- 7.1.2 MPS Interactive Systems Limited

- 7.1.3 Microsoft Corporation

- 7.1.4 SAP SE

- 7.1.5 Aon PLC

- 7.1.6 Axonify Inc.

- 7.1.7 IActionable Inc.

- 7.1.8 Bunchball Inc.

- 7.1.9 Ambition

- 7.1.10 G-Cube