|

市场调查报告书

商品编码

1637890

住宅太阳能 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)Residential Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

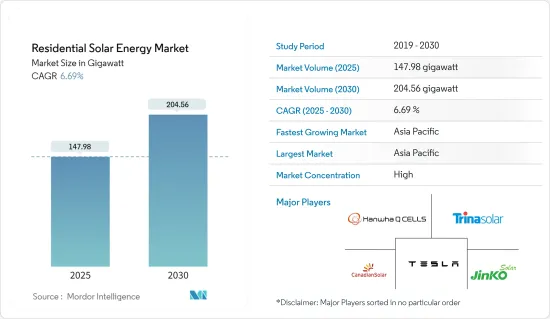

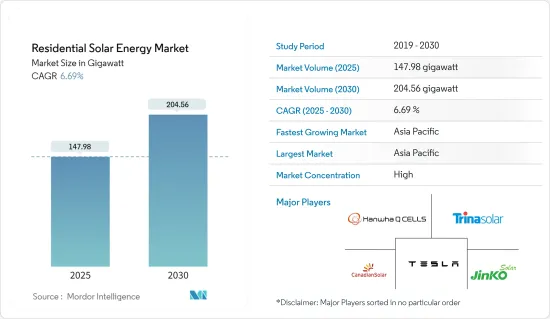

住宅太阳能市场规模预计到2025年为147.98吉瓦,预计2030年将达到204.56吉瓦,预测期间(2025-2030年)复合年增长率为6.69%。

主要亮点

- 从中期来看,政府的有利措施、对即将推出的屋顶太阳能发电工程的投资增加以及太阳能成本下降导致太阳能部署增加等因素预计将在预测期内推动市场发展。

- 另一方面,缺乏资金筹措选择以及整合住宅太阳能係统的困难预计将限制非洲等地区的市场成长。

- 然而,我们已经制定了雄心勃勃的目标,以增加可再生能源在能源结构中的份额。这些国家的政府还计划在未来几年透过安装住宅太阳能係统来增加可再生能源的份额。预计这将在预测期内为住宅太阳能製造商和供应商提供机会。

- 由于能源需求的增加,预计亚太地区将成为预测期内成长最快的市场。这一增长得益于印度、中国和澳大利亚等亚太国家的投资增加和政府支持措施。

住宅太阳能市场的趋势

屋顶太阳能装置的增加推动市场

- 住宅领域采用太阳能係统的增加主要是由于节省电费的预期、对替代电力源的需求以及减少气候变迁风险。

- 由于太阳能发电成本下降、政府对住宅太阳能发电的支持措施、FIT计划和奖励以及各种太阳能目标,预计屋顶太阳能的需求将在预测期内增加。

- 近年来,住宅屋顶太阳能发电的电力成本迅速下降。价格下跌导致全球住宅太阳能发电量大幅增加,许多国家提高了住宅屋顶太阳能光电发电目标。

- 根据太阳能产业协会(SEIA)统计,2023年美国住宅太阳能发电累积设置容量将达到约36,268,000千瓦。总装置容量与前一年同期比较增加23%。容量增加主要是因为家庭电费增加和停电。

- 根据欧洲联合研究中心分析,欧盟屋顶太阳能光电每年可发电680太瓦时。

- 2024年4月,德国议会核准了一系列支持国内太阳能发展的新措施。 40 kW 屋顶太阳能装置将实施上网电价补贴计划,价格将比目前价格水准高出 1.5 美分/千瓦时。此外,新法将大规模安装竞标的地面太阳能发电工程上限从20MW提高到50MW。最后,光电阳台系统和智慧型能源社区在普通家庭的实施将变得更加容易。

- 所有这些因素预计将在预测期内推动住宅太阳能的需求。

亚太地区主导市场

- 亚太地区占全球住宅太阳能市场的30%以上。预计这种主导地位将在预测期内持续下去。

- 印度太阳能发电装置容量从2022年的63.048GW大幅成长至2023年的72.767GW,未来电力需求预计将进一步增加。

- 为满足日益增长的电力需求,实现2030年500吉瓦的可再生能源目标,印度政府计划在2026年将住宅领域屋顶太阳能光电装置容量容量提高至约4吉瓦。因此,为了实现这一目标,政府推出了各种措施,将太阳能引入住宅领域。

- 可再生能源发电部 (MNRE) 併网屋顶太阳能发电计画旨在为屋顶系统的首个 3kW 发电容量提供 40% 的补贴,最高为 10kW 的上限提供 20% 的补贴。

- 除该计划外,由于印度电费上涨,住宅领域的屋顶太阳能市场也被认为具有吸引力。印度的平均电费约为每度6-9印度卢比,并且由于电力需求的增加,可能会上涨。 2023年上半年,印度阿萨姆邦、卡纳塔克邦、马哈拉斯特拉邦、泰米尔纳德邦等邦实施了住宅电价上调。因此,人们很可能在家中安装屋顶太阳能发电系统,以减少或消除电费。

- 到2023年终,中国政府的目标是实现50%的政党和政府建筑屋顶覆盖率、40%的学校、医院等公共设施覆盖率、30%的工业区域、20%的农户覆盖率。电池板。已有31个省、676个地市州报名参加该计划。

- 由于这些因素,预计在预测期内,亚太地区对住宅太阳能的需求将会增加。

住宅太阳能产业概况

住宅太阳能市场较分散。该市场的主要企业包括(排名不分先后)天合光能、阿特斯阳光电力、晶科能源、韩华Q Cells和特斯拉公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 世界可再生能源结构(2023)

- 2029年住宅太阳能装置容量及预测

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 政府有利措施

- 降低太阳能係统的成本

- 抑制因素

- 缺乏融资选择,加上在非洲等地区整合住宅太阳能光电系统有困难

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔-按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 北欧的

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

- 奈及利亚

- 埃及

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Trina Solar Co. Ltd

- Yingli Green Energy Holding Company Limited

- Canadian Solar Inc.

- JinkoSolar Holding Co. Ltd

- JA Solar Holdings Co. Ltd

- Sharp Corporation

- ReneSola Ltd

- Hanwha Q Cells Co. Ltd

- SunPower Corporation

- Tesla Inc.

- List of Other Prominent Players

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 提高可再生能源在世界能源结构总量中所占份额的宏伟目标

简介目录

Product Code: 48265

The Residential Solar Energy Market size is estimated at 147.98 gigawatt in 2025, and is expected to reach 204.56 gigawatt by 2030, at a CAGR of 6.69% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as favorable government policies, increasing investments in upcoming rooftop solar projects, and the reduced cost of solar energy, which has led to increased adoption of solar energy, are expected to drive the market during the forecast period.

- On the other hand, the lack of financing options and the difficulties in integrating residential solar PV systems in regions like Africa are expected to restrain the market's growth.

- However, ambitious targets are being undertaken to increase the renewable share in their energy mix. Governments across these nations also plan to increase the renewable energy share by deploying residential solar PV systems in the coming years. This factor, in turn, is expected to act as an opportunity for residential solar energy manufacturers and suppliers during the forecast period.

- Asia-Pacific is expected to be the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments and supportive government policies in Asia-Pacific countries, including India, China, and Australia.

Residential Solar Energy Market Trends

Increasing Rooftop Solar Installations to Drive the Market

- The increasing adoption of solar PV systems in the residential sector is primarily driven by expected savings in electricity costs, the need for an alternative source of electricity, and the desire to mitigate climate change risk.

- During the forecast period, the demand for rooftop solar PV is expected to increase due to decreasing solar PV costs, supportive government policies for residential solar PV, FIT programs and incentives, and various solar energy targets.

- The cost of electricity for residential rooftop solar PV applications has rapidly declined in recent years. The falling price has resulted in a massive increase in the global residential PV capacity, and many countries are increasing their residential rooftop targets.

- The Solar Energy Industry Association (SEIA) statistics show that, in 2023, the cumulative residential solar PV installed capacity in the United States accounted for about 36.268 GW. The total installed capacity grew by 23% compared to the previous year. The hike in capacity is mainly due to high household electricity bills and power outages.

- A European Joint Research Centre analysis shows that EU rooftop PV could produce 680 TWh of solar electricity annually.

- In April 2024, the German parliament approved a new series of measures to support solar PV development in the country. Rooftop solar PV installations of 40 kW are made eligible for feed-in tariffs that will be EUR 1.5c/kWh higher than current tariff levels. In addition, the new law increases the limit for ground-mounted solar projects from 20 MW to 50 MW in tenders for large-scale installations. Finally, it will become easier for households to deploy PV balcony systems and smart energy communities.

- All such factors are expected to drive the demand for residential solar energy over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for more than 30% of the global residential solar PV market. It is expected to continue its dominance during the forecast period.

- India's solar PV installed capacity increased significantly from 63.048 GW in 2022 to 72.767 GW in 2023, and the demand for power is expected to increase further in the coming years.

- To cater to the rising power demand and meet its renewable energy target of 500 GW by 2030, the Indian government plans to increase the installed capacity of rooftop solar energy in the residential sector to around 4 GW by 2026. Thus, the government has initiated various policies for the residential sector to adopt solar energy to achieve the target.

- The Ministry of New and Renewable Energy (MNRE)'s grid-connected rooftop solar program aims to offer a 40% subsidy for the first 3 kW of generation capacity in rooftop systems and a 20% subsidy up to a 10 kW ceiling.

- Apart from schemes, the rooftop solar energy market for the residential sector seems appealing in India due to its increasing electricity tariff. On average, the electricity tariff in India is around INR 6-9 per unit, which is likely to increase due to a rise in electricity demand. In H1 2023, Indian states like Assam, Karnataka, Maharashtra, and Tamil Nadu raised their tariff for residential users. Hence, people are likely to adopt rooftop solar PV systems in their homes to reduce or make zero electricity bills.

- At the end of 2023, the Chinese government proposed to cover 50% of rooftop space with solar panels on party and government buildings, 40% of schools, hospitals, and other public facilities, 30% of industrial and commercial areas, and 20% of rural households. A total of 676 counties from 31 provinces have registered for the scheme.

- Owing to such factors, the demand for residential solar energy is expected to increase in Asia-Pacific over the forecast period.

Residential Solar Energy Industry Overview

The residential solar energy market is fragmented. Some of the major players in the market (in no particular order) include Trina Solar Co. Ltd, Canadian Solar Inc., JinkoSolar Holding Co. Ltd, Hanwha Q Cells Co. Ltd, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, Global, 2023

- 4.3 Residential Solar Energy Installed Capacity and Forecast, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Favorable Government Policies

- 4.6.1.2 Reduced Cost of Solar Energy Systems

- 4.6.2 Restraints

- 4.6.2.1 Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION - By Geography

- 5.1 North America

- 5.1.1 United States

- 5.1.2 Canada

- 5.1.3 Rest of North America

- 5.2 Europe

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 United Kingdom

- 5.2.4 Italy

- 5.2.5 Spain

- 5.2.6 Russia

- 5.2.7 NORDIC

- 5.2.8 Turkey

- 5.2.9 Rest of Europe

- 5.3 Asia-Pacific

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 Malaysia

- 5.3.6 Thailand

- 5.3.7 Indonesia

- 5.3.8 Vietnam

- 5.3.9 Rest of Asia-Pacific

- 5.4 South America

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Chile

- 5.4.4 Colombia

- 5.4.5 Rest of South America

- 5.5 Middle East and Africa

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 South Africa

- 5.5.4 Qatar

- 5.5.5 Nigeria

- 5.5.6 Egypt

- 5.5.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Trina Solar Co. Ltd

- 6.3.2 Yingli Green Energy Holding Company Limited

- 6.3.3 Canadian Solar Inc.

- 6.3.4 JinkoSolar Holding Co. Ltd

- 6.3.5 JA Solar Holdings Co. Ltd

- 6.3.6 Sharp Corporation

- 6.3.7 ReneSola Ltd

- 6.3.8 Hanwha Q Cells Co. Ltd

- 6.3.9 SunPower Corporation

- 6.3.10 Tesla Inc.

- 6.4 List of Other Prominent Players

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ambitious Targets to Increase the Renewable Share in Total Energy Mix Worldwide

02-2729-4219

+886-2-2729-4219