|

市场调查报告书

商品编码

1637909

高强度钢:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)High Strength Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

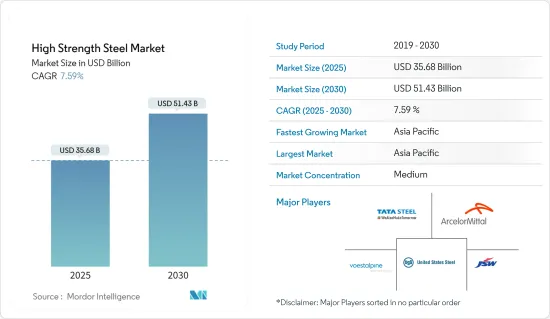

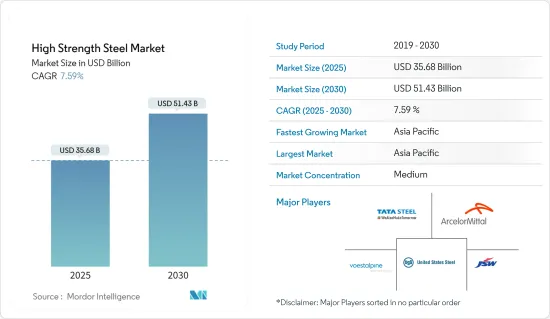

高强度钢市场规模预计在 2025 年为 356.8 亿美元,预计到 2030 年将达到 514.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.59%。

该地区的 COVID-19 疫情对市场产生了不利影响,导致需求下降、生产力下降、供应链中断和地区关闭。然而,市场在 2021 年表现出显着成长,并在 2022 年继续成长。

主要亮点

- 短期内,建设产业和汽车产业的需求不断增长是推动市场成长的一些因素。

- 另一方面,高生产成本和高技术限制可能会阻碍市场成长。

- 然而,预计亚太地区的工业和基础设施发展将在预测期内提供大量机会。

- 预计亚太地区将主导市场,并在预测期内以最高的复合年增长率成长。

高强度钢市场趋势

在汽车产业的应用日益广泛

- 高强度钢广泛应用于汽车工业,以减轻车辆的整体重量,同时增加其在某些区域的刚度和能量吸收。

- 高强度钢具有机械性能、厚度和宽度能力等多种特性,增加了其在汽车行业的需求。

- 通常,汽车工业中钢材的强度由其化学成分、热历史和微观结构控制,而这些成分、热历史和微观结构会因製造过程中经历的变形过程而改变。

- 高强度钢比传统钢具有多种优势,特别是在汽车行业,因为该行业的重量是燃油效率的考虑因素。其机械性能、焊接性、疲劳性、静态强度、阴极保护和氢脆性能已被证明对汽车工业有益。

- 德国领先欧洲汽车市场,其41个组装和引擎生产厂占欧洲汽车总产量的三分之一。德国是汽车工业主要製造地之一,聚集了设备製造商、材料及零件供应商、引擎製造商、系统整合等多个领域的製造商。例如,根据OICA的预测,2022年德国汽车产量将达到36,778,820辆,较2021年成长11%。因此,预计该国汽车产量的增加将导致高抗拉强度钢板市场的需求增加。

- 印度汽车产业的投资不断增加和进步预计将增加高强度钢的消费量。例如,塔塔汽车在2022年4月宣布,计划在未来五年内向其乘用车业务投资30.8亿美元。预计这将对该国的高强度钢市场产生积极影响。

- 此外,运输车辆的需求不断增加,推动了高强度钢市场的发展。受强劲需求和消费者对私家车而非公共交通的偏好推动,印度汽车产业预计将在 2023 年成为亚太地区最强劲的汽车产业。例如,根据OICA的数据,该国2022年的汽车产量将达到54,566,857辆,比2020年增加24%。因此,随着汽车製造业的整体成长,该地区的高强度钢市场可能会扩大。

- 此外,美国是世界第二大汽车销售和生产市场。例如,根据 OICA 的数据,2022 年美国汽车产量将达到 10,063,390 辆,比 2021 年增加 10%。因此,由于汽车产量的增加,预计燃料添加剂的需求将会增加。

- 增加使用高强度钢来提高燃油效率和减轻车辆重量可能会促进汽车行业的市场成长。

中国主宰亚太地区

- 中国占据亚太地区高强度钢市场的最大份额。预计在整个预测期内,该国活性化的投资和建设活动将推动对高强度钢的需求。

- 以国内生产毛额计算,中国是亚太地区最大的经济体。中国的成长率仍然很高,但随着人口老化以及经济从投资向消费、从製造业向服务业、从外部需求向内部需求再平衡,成长率正在逐渐下降。

- 近年来,中国一直是世界主要基础设施投资国和贡献国之一。例如,根据中国国家统计局的数据,2022年中国建筑业产值将达到27.63兆元(41,085.81亿美元),比2021年增加6.6%。

- 此外,汽车产业仍然是中国最大的产业,这对近期的发展来说是一个好兆头。例如,根据OICA的预测,2022年汽车产量将达到27.2061亿辆,较2021年成长3%。因此,预计该国汽车生产的这种积极情况将推动高强度钢市场需求的上升趋势。

- 此外,中国将在未来三年内超越美国成为全球最大的航空旅行市场。然而,中国对航空业的需求仍持续呈指数级增长。例如,2023年4月空中巴士在法国对中国进行国事访问期间,与中国航空工业合作伙伴签署了新的合作协议。未来20年,中国航空运输量预计将以每年5.3%的速度成长,明显高于全球3.6%的平均值。这将导致2023年至2041年期间对客机和货机的需求为8,420架,占未来20年全球约39,500架新飞机总需求的20%以上。因此,航空业的这些扩张预计将对高强度钢市场产生向上的需求。

- 根据联合国贸易和发展委员会预测,2022年中国商船数量将达到115154艘,较2021年的108481艘增长约6.1%。因此,预计商业航运的增加将导致高强度钢市场的需求增加。

- 因此,随着国内各终端用户领域的成长,预计未来几年对高强度钢的需求将大幅增加。

高强度钢业概况

高强度钢市场呈现部分盘整态势。该市场的主要企业(不分先后顺序)包括安赛乐米塔尔、美国钢铁公司、塔塔钢铁、JSW、Vostalpine AG 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑业需求快速成长

- 汽车产业需求增加

- 其他驱动因素

- 限制因素

- 生产成本上升

- 其他阻碍因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 双相不銹钢

- 淬硬钢

- 碳锰钢

- 其他产品类型

- 按应用

- 车

- 施工机械

- 黄色商品和采矿设备

- 航空和航海

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ArcelorMittal

- ChinaSteel

- CITIC Heavy Industries Co., Ltd.

- JSW Steel

- NIPPON STEEL CORPORATION

- Nucor Corporation

- POSCO

- SAIL

- SSAB AB

- Tata Steel

- United States Steel Corporation

- Voestalpine AG

第七章 市场机会与未来趋势

- 亚太地区工业和基础设施发展

- 其他机会

The High Strength Steel Market size is estimated at USD 35.68 billion in 2025, and is expected to reach USD 51.43 billion by 2030, at a CAGR of 7.59% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic in the region, including decreased demand and productivity, supply chain disruptions, and regional lockdowns. However, the market showed significant growth in 2021 and continued to grow in 2022.

Key Highlights

- Over the short term, increasing demand from the construction and automotive industries are some factors driving the growth of the market studied.

- On the flip side, high production costs and high technological constraints will likely hinder the market's growth.

- Nevertheless, industrial and infrastructural development in Asia-Pacific is anticipated to provide numerous opportunities over the forecast period.

- The Asia-Pacific region is expected to dominate the market and will also witness the highest CAGR during the forecast period.

High Strength Steel Market Trends

Increasing Applications in the Automotive Industry

- High-strength steels are widely used in the automotive industry to reduce overall vehicle weight while increasing stiffness and energy absorption in some areas.

- High-strength steels have several properties that increase their demand in the automotive industry, including mechanical properties, thickness, and width capabilities.

- In general, the strength of steel in the automotive industry is controlled by its microstructure, which varies depending on its chemical composition, thermal history, and the deformation processes it goes through during the production process.

- High-strength steel has several advantages over conventional steel, particularly when weight is a consideration for fuel efficiency in the automotive industry. Their mechanical properties, weldability, fatigue, static strength, cathodic protection, and hydrogen embrittlement performance have proven to be beneficial to the automotive industry.

- Germany leads the European automotive market, with 41 assembly and engine production plants contributing to one-third of Europe's total automobile production. Germany, one of the leading manufacturing bases of the automotive industry, is home to manufacturers from different segments, such as equipment manufacturers, material and component suppliers, engine producers, and whole system integrators. For instance, according to OICA, in 2022, automobile production in Germany amounted to 36,77,820 units, which showed an increase of 11% compared to 2021. Therefore, increasing the production of automobiles in the country is expected to create an upside demand for high strength steel market.

- Increased investments and advancements in the automobile industry in India are expected to increase the consumption of high-strength steel. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This is expected to positively impact the high-strength steel market in the country.

- Moreover, the growing demand for transport vehicles drives the high-strength steel market. In 2023, India's automotive sector is predicted to be the strongest in the Asia-Pacific region, owing to strong demand and consumers' preference for personal vehicles over public transportation. For instance, according to OICA, in 2022, automobile production in the country amounted to 54,56,857 units, which showed an increase of 24% compared to 2020. Therefore, the region's high-strength steel market is likely to expand as a result of the rise in overall automobile manufacturing.

- Furthermore, the United States is the second-largest vehicle sales and production market globally. For instance, according to OICA, in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create an upside demand for the fuel additives market.

- Increasing the usage of high-strength steel for better fuel efficiency and lightweight vehicles will boost the market growth in the automotive industry.

China to Dominate the Asia-Pacific Region

- China holds the largest Asia-Pacific market share for high strength steel market. The demand for the high-strength steel market is expected to rise throughout the forecast period due to rising investments and construction activity in the country.

- China is the largest economy in the Asia-Pacific region in terms of GDP. The growth in the country remains high but is gradually diminishing as the population is aging, and the economy is rebalancing from investment to consumption, manufacturing to services, and external to internal demand.

- China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to 27.63 trillion yuan (USD 4108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, automotive continues to remain the country's largest sector and reflects positive signs for the near future. For instance, according to OICA, in 2022, automobile production in the country amounted to 2,70,20,615 units, which shows an increase of 3% compared with 2021. Therefore, such a positive scenario in the production of automobiles in the country is expected to create an upside demand for high strength steel market.

- Furthermore, China is on course to overtake the United States as the world's biggest air travel market within the next three years. Still, the country's appetite for aviation continues to grow exponentially. For instance, on April 2023, during a French state visit to China, Airbus signed new cooperation agreements with China's Aviation industry partners. Over the next 20 years, China's air traffic is forecast to grow at 5.3% annually, significantly faster than the world average of 3.6%. This will lead to a demand for 8,420 passenger and freighter aircraft between 2023 and 2041, representing more than 20% of the world's total demand for around 39,500 new aircraft in the next 20 years. Therefore, these expansions from the aviation industry are expected to create an upside demand for high strength steel market.

- According to UNCTD, China had 1,15,154 merchant ships in 2022, which showed an increase of around 6.1% compared to 2021, amounting to 1,08,481 merchant ships. Therefore, the increase in merchant ships is expected to create an upside demand for high strength steel market.

- Hence, with the growth in the various end-user sectors in the country, the demand for high-strength steel is expected to increase significantly in the upcoming years.

High Strength Steel Industry Overview

The High Strength Steel Market is partially consolidated in nature. The major players in this market (not in a particular order) include ArcelorMittal, United States Steel Corporation, Tata Steel, JSW, and voestalpine AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Increasing Demand from Construction Sector

- 4.1.2 Increasing Demand from Automobile Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Costs of Production

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Dual Phase Steel

- 5.1.2 Bake Hardenable Steel

- 5.1.3 Carbon Manganese Steel

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Construction

- 5.2.3 Yellow Goods and Mining Equipment

- 5.2.4 Aviation and Marine

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 ChinaSteel

- 6.4.3 CITIC Heavy Industries Co., Ltd.

- 6.4.4 JSW Steel

- 6.4.5 NIPPON STEEL CORPORATION

- 6.4.6 Nucor Corporation

- 6.4.7 POSCO

- 6.4.8 SAIL

- 6.4.9 SSAB AB

- 6.4.10 Tata Steel

- 6.4.11 United States Steel Corporation

- 6.4.12 Voestalpine AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Industrial and Infrastructural Development in Asia-Pacific

- 7.2 Other Opportunities