|

市场调查报告书

商品编码

1637911

北美网路安全:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Cyber Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

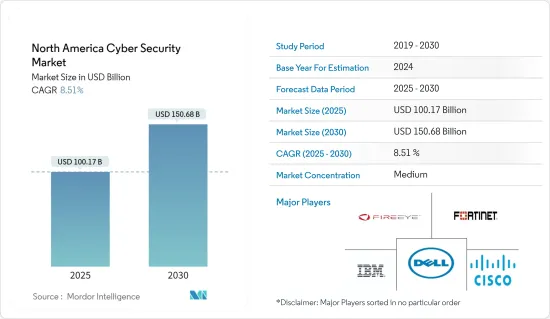

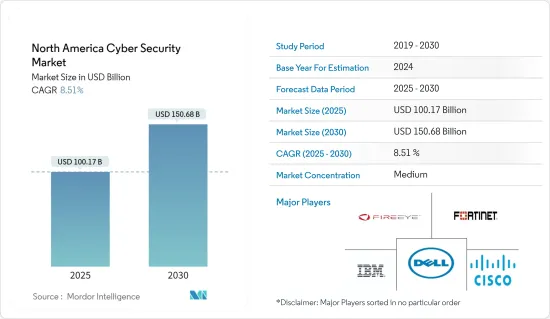

北美网路安全市场规模预计在 2025 年为 1,001.7 亿美元,预计到 2030 年将达到 1,506.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.51%。

随着北美网路普及率的提高,网路安全解决方案的采用预计也会增加。此外,无线网路的扩展以适应行动装置也增加了资料脆弱性。

主要亮点

- 北美是世界领先的数位化国家之一。未来几年,科技将带来重大变化。机器人技术、感测器技术、3D 列印、巨量资料和人工智慧都是有可能改变社会的技术发展的例子。随着数位化进程,国家资料安全需要加强。

- 网路攻击的频率和复杂程度日益提高,推动了北美采用网路安全解决方案。

- 此外,在美国,许多行业都受到 HIPPA、GDPR 和 PCI DSS 等法规的约束,组织必须实施这些法规,而监管要求的提高正推动许多组织实施网路安全解决方案。

- 预计在预测期内,勒索软体和 DDoS 攻击将进一步增加,其中更多攻击将针对网路安全解决方案采用率较低地区的大型组织。此外,勒索软体即服务产品和建构套件预计将加剧这种成长,为新手和技术较低的犯罪分子提供易于使用的工具。

- 随着网路、云端处理等新服务平台的使用增多,解决方案的透明度也随之降低,用户评估风险和漏洞、记录安全性变得越来越困难。

北美网路安全市场趋势

航太、国防和资讯技术产业正在推动市场成长

- 该地区正在大力投资网路安全解决方案,以避免智慧财产权被盗以及监控和控制国防系统和能力的系统受到损害。为了跟上现代国防进步的步伐,美国等国家已经开发了无人驾驶飞行器和高超音速武器等新技术。这些进步在很大程度上依赖资料和连接,因此很容易受到破坏和攻击。这使得该地区更加需要专注于制定措施来保护敏感资讯。

- 美国航太工业协会致力于推动加强航太和国防工业的政策。 BAE Systems PLC、通用动力公司和芬梅卡尼卡公司等国防相关企业正在努力为国防工业开发网路安全解决方案,尤其是网路安全解决方案和软体,以防止针对军事软体系统的网路攻击。

- 此外,加拿大政府正在与加拿大武装部队和北美航太司令部 (Norad) 合作开展倡议,以识别和减轻对关键民用设施的网路威胁。电网、水质净化水厂和运输系统等关键位置尤其需要注意防止可能破坏民用基础设施的攻击。

美国占有较大的市场占有率

- 美国在打击网路安全威胁方面具有战略优势,因为赛门铁克、英特尔安全、IBM 安全、戴尔 EMC 等主要企业都设在美国,并在网路空间发挥重要作用,同时也支持新兴企业。这样的地位那。凭藉对创新和多重战略伙伴关係关係的关注,美国研究市场已成为技术领域的突出产业之一。

- 2023财年,美国政府提案的网路安全预算为108.9亿美元,较上年度增加。这些联邦网路安全资助措施旨在支持广泛的网路安全战略,保障政府安全并加强关键基础设施和重要技术的安全。

- 根据世界经济论坛(WEF)《2022年全球安全展望》报告,2021年上半年勒索软体攻击大幅增加,全球攻击量增加了151%。美国联邦调查局(FBI)警告称,全球有 100 种勒索软体在传播。

- 此外,鑑于俄罗斯与乌克兰之间的衝突以及针对该国的几乎无休止的威胁宣传活动和漏洞披露,美国国务院将于 2022 年 4 月成立一个新机构,即网络空间和数字政策办公室 (CDP) . )正式启动。拜登政府寻求将网路安全融入美国外交关係,该办公室将负责制定网路防御和隐私保护方面的政策和方向。该办公室由参议院核准的网路大使监督,为物理战争随时可能蔓延至网路战争打开了大门。

- 网路安全解决方案和网路威胁侦测软体的投资正在不断增加。随着诈欺意识的增强,从小型企业到大型企业,美国公司正在采用更严格的解决方案来保护资料,并采取措施儘早发现风险并做出更快的回应。 ,并鼓励将资金投入该行业。

北美网路安全产业概况

北美网路安全市场相当集中,因为它由多个全球和地区参与者组成。主要企业正致力于创新生产技术以提高效率。此外,参与者正在采取伙伴关係、合併和收购等策略性倡议。

2022年3月,Google Cloud宣布将收购网路安全公司Mandiant,这是一家基于SaaS的主动安全公司。此次收购凸显了安全对所有企业(无论规模大小)的重要性,因为网路犯罪已经影响到该国每家公司。此次全现金收购对 Mandiant 的估值为每股 23 美元,总收购价为 54 亿美元。一旦收购获得必要的股东和监管机构核准,Mandiant 将成为 Google Cloud 的一部分。

2022 年 3 月,HelpSystems 宣布已签署合併协议,收购託管侦测和回应 (MDR) 服务供应商 AlertLogic。该公司的 MDR 解决方案专注于缓解组织因网路攻击增加以及能够预防和补救网路攻击的熟练专业人员严重短缺而面临的巨大压力。 Alert Logic 是 HelpSystems 网路安全产品组合的基石。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业指引及政策

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 网路安全事件和报告法规迅速增加

- 日益增加的 M2M/IoT 连线要求企业加强网路安全措施

- 市场限制

- 网路安全专家短缺

- 高度依赖传统身分验证方法且缺乏准备

- 市场机会

- 物联网、BYOD、人工智慧和机器学习在网路安全领域的发展趋势

第六章 市场细分

- 依产品类型

- 解决方案

- 身分和存取管理

- 威胁侦测和预防(统一威胁管理和威胁缓解)

- 安全和漏洞管理

- 新一代防火墙

- IDS/IPS

- 安全资讯和事件管理

- DDOS 缓解

- 其他解决方案

- 服务

- 解决方案

- 按部署

- 在云端

- 本地

- 按最终用户产业

- 航太、国防与情报

- 银行、金融服务和保险

- 卫生保健

- 製造业

- 零售

- 公共工程

- 资讯科技/通讯

- 其他最终用户产业

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 供应商市场占有率分析

- 公司简介

- Cisco Systems Inc.

- Cyber Ark Software Ltd

- Dell Technologies Inc.

- FireEye Inc.

- IBM Corporation

- Fortinet Inc.

- Imperva Inc.

- Intel Security(Intel Corporation)

- Palo Alto Networks Inc.

- Proofpoint Inc.

- Rapid7 Inc.

- Symantec Corporation

第八章投资分析

第九章:市场的未来

The North America Cyber Security Market size is estimated at USD 100.17 billion in 2025, and is expected to reach USD 150.68 billion by 2030, at a CAGR of 8.51% during the forecast period (2025-2030).

The adoption of cybersecurity solutions is expected to increase with the increasing penetration of the Internet throughout North America. Also, the expanding wireless network catering to mobile devices has enhanced data vulnerability.

Key Highlights

- North America is one of the world's leading digital nations. Over the next few years, technology will bring about significant changes. Robotics, sensor technology, 3D printing, big data, and artificial intelligence are all examples of technological developments that have the potential to change society. As digitization increases, the nation's data security needs to be increased.

- The increasing frequency and sophistication of cyber-attacks are driving the adoption of cybersecurity solutions in North America.

- Moreover, the growing regulatory requirement leads many organizations to adopt and invest in cybersecurity solutions, as many industries in the United States are subject to regulations such as HIPPA, GDPR, and PCI DSS, which require the organization to implement.

- Ransomware and DDoS attacks are expected to increase further during the forecast period and, even more, targeted against large organizations in regions where the adoption rate is not as quick for cybersecurity solutions. Also, ransomware-as-a-service offerings and their construction kits have been estimated to fuel this increase, particularly as an easy tool for novice or low-skilled criminals.

- The rising usage of new service platforms, such as online and cloud computing, results in less transparent solutions, making it more difficult for users to assess risk and vulnerability and document their security.

North America Cyber Security Market Trends

Aerospace, Defense, and Intelligence Industry to Drive the Market Growth

- The region invests heavily in cybersecurity solutions to avoid intellectual property theft and compromise systems that monitor and control the country's defense systems and capabilities. To keep pace with modern defense advancements, countries like the United States have developed new technologies, such as unmanned vehicles, hypersonic weapons, etc. These advancements depend highly on data and connectivity, making them susceptible to breaches and attacks. Thus, there is a growing necessity for the region to focus on developing countermeasures to safeguard critical information.

- The US Aerospace Industries Association focused on promoting policies strengthening the aerospace and defense industry. Defense companies, such as BAE Systems PLC, General Dynamics Corporation, and Finmeccanica SpA, are engaged in developing cybersecurity solutions in the defense industry, especially in developing network security solutions and software, preventing cyber-attacks on military software systems, indicating the demand for these solutions in the aerospace and defense sector.

- Moreover, the Canadian Government is taking initiatives in collaboration with the Canadian military and North American Aerospace Defence Command (Norad) to identify and mitigate cyber threats to critical civilian sites. The critical sites, like power grids, water treatment plants, or traffic systems, are especially focused on preventing attacks that could shut down civilian infrastructure.

United States to Hold Significant Market Share

- The country is strategically positioned to combat cybersecurity threats with key players like Symantec, Intel Security, IBM Security, and Dell EMC based in the country, along with the support of start-ups playing a major role in cyberspace. With a focus on innovations and multiple strategic partnerships, the studied market in the United States has become one of the prominent industries in the technological space.

- For the fiscal year 2023, the government of the United States proposed a USD 10.89 billion budget for cyber security, representing an increase from the previous fiscal year. These federal resources for cyber security are set to support a broad-based cyber security strategy for securing the government and enhancing the security of critical infrastructure and essential technologies.

- According to the world economic forum's Global Security Outlook 2022 report, Ransomware attacks saw a significant boost in the first six months of 2021, with global attack volume increasing by 151%. The United States Federal Bureau of Investigation (FBI) has warned that 100 different ransomware strains are circulating globally.

- Moreover, in light of the Russia - Ukraine conflict and a virtually endless cycle of threat campaigns and vulnerability disclosures towards the country, the US State Department, in April 2022, launched a new agency, the Bureau of Cyberspace and Digital Policy (CDP), responsible for developing online defense and privacy-protection policies and direction as the Biden administration seeks to integrate cybersecurity into America's foreign relations. The bureau, supervised by a cyber ambassador confirmed in the Senate, opened the door when physical war could flow into cyber warfare anytime.

- Increased investments in the industry mark the country for cybersecurity solutions and cyber threat detecting software. With the increased awareness amongst companies from small to large enterprises, US companies are deploying more rigid solutions to protect data and installing fraud and threat detection programs to find risks at an earlier stage to respond at an earlier stage driving the injection of funds into the industry.

North America Cyber Security Industry Overview

The North America cybersecurity market is fairly consolidated as it comprises several global and regional players. The key players are focusing on innovation in production technologies to improve efficiency. Moreover, players adopt strategic initiatives such as partnerships, mergers, and acquisitions.

In March 2022, Google Cloud announced it was acquiring cybersecurity firm Mandiant, a player in proactive SaaS-based security. The acquisition underscores the importance of security for all businesses, regardless of scale, as cybercrime is increasingly affecting all companies in the nation. The acquisition is all cash, valuing Mandiant at USD 23 per share in a deal worth USD 5.4 Billion. Mandiant will become a part of Google Cloud once the deal receives requisite stockholder and regulatory approvals.

In March 2022, HelpSystems declared that it had signed a merger agreement to acquire AlertLogic, a player in managed detection and response (MDR) services. The company's MDR solutions focus on reducing the intense pressure faced by organizations due to the increase in cyberattacks and the significant shortage of skilled professionals available to prevent and repair cyberattacks. Alert Logic will be the basis of HelpSystems' cybersecurity portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Competitive Rivalry within the Industry

- 4.3.5 Threat of Substitute

- 4.4 Industry Guidelines and Policies

- 4.5 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapidly Increasing Cybersecurity Incidents and Regulations Requiring Their Reporting

- 5.1.2 Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Professionals

- 5.2.2 High Reliance on Traditional Authentication Methods and Low Preparedness

- 5.3 Market Opportunities

- 5.3.1 Rise in the Trends of IoT, BYOD, Artificial Intelligence, and Machine Learning In Cybersecurity

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Solutions

- 6.1.1.1 Identity and Access Management

- 6.1.1.2 Threat Detection and Prevention (Unified Threat Management and Threat Mitigation)

- 6.1.1.3 Security and Vulnerability Management

- 6.1.1.4 Next Generation Firewall

- 6.1.1.5 IDS/IPS

- 6.1.1.6 Security Information and Event Management

- 6.1.1.7 DDOS Mitigation

- 6.1.1.8 Other Solution Types

- 6.1.2 Services

- 6.1.1 Solutions

- 6.2 By Deployment

- 6.2.1 On-cloud

- 6.2.2 On-premise

- 6.3 By End-user Industry

- 6.3.1 Aerospace, Defense, and Intelligence

- 6.3.2 Banking, Financial Services, and Insurance

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Retail

- 6.3.6 Public Utility

- 6.3.7 IT and Telecommunication

- 6.3.8 Other End-user Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor market Share Analysis

- 7.2 Company Profiles

- 7.2.1 Cisco Systems Inc.

- 7.2.2 Cyber Ark Software Ltd

- 7.2.3 Dell Technologies Inc.

- 7.2.4 FireEye Inc.

- 7.2.5 IBM Corporation

- 7.2.6 Fortinet Inc.

- 7.2.7 Imperva Inc.

- 7.2.8 Intel Security (Intel Corporation)

- 7.2.9 Palo Alto Networks Inc.

- 7.2.10 Proofpoint Inc.

- 7.2.11 Rapid7 Inc.

- 7.2.12 Symantec Corporation