|

市场调查报告书

商品编码

1637920

手势姿态辨识:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Gesture Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

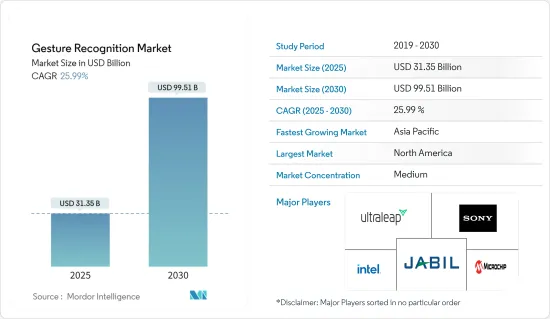

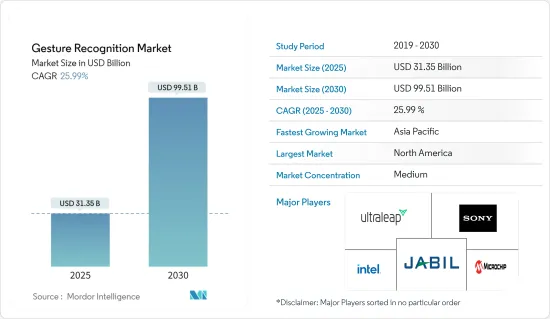

手势姿态辨识市场规模在 2025 年预计为 313.5 亿美元,预计到 2030 年将达到 995.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 25.99%。

主要亮点

- 人工智慧(AI)的发展正在催生基于手势姿态辨识的设备。此外,手势姿态辨识技术领域的最新技术进步,加上终端用户行业的日益采用,预计将在未来几年推动市场的发展。

- 随着各行各业对支援手势的电子设备的接受度不断提高,手势姿态辨识技术越来越多地被用于人机交互,例如切换电视频道或广播电台。手势姿态辨识的应用在许多领域正在增加。

- 该领域的最新趋势之一是使用手势姿态辨识进行人机互动。使用手势姿态辨识来控制电脑应用程式的技术也得到了发展。

- 随着技术的不断发展,所研究市场中的公司正在製造具有新颖和创新功能的产品。Omron Corporation开发了手势姿态辨识技术,该技术可以透过参考摄影机捕捉到的影像同时识别人的手和手指的位置、形状和运动。

- 此外,手势姿态辨识技术引起了消费者和OEM的极大关注,因为它提高了使用者在使用各种电子产品时的便利性。全球製造商正在创新,为一系列家用电器添加手势姿态辨识功能,使其更安全、更可靠、更便利。此外,非接触式手势姿态辨识的需求主要源自于各领域对更好的使用者体验、易用性和日益增强的数位化的需求。

- 手势姿态辨识应用系统由几个关键的硬体和软体组件组成,所有组件必须紧密整合才能提供引人注目的使用者体验。然后,特殊演算法解释处理后的资料,并将动作转换为电脑可以理解的可操作命令。然后,应用程式将这些可操作的命令与必须自然且引人入胜的用户回馈相结合。除了解决方案的整体复杂性之外,演算法和应用程式越来越多地在处理、储存和其他资源有限的嵌入式系统上实现。

- 此外,手势姿态辨识生态系统中人工智慧和机器学习等先进技术的整合正在进一步扩大研究市场。人工智慧和机器学习技术的广泛应用将彻底改变手势姿态辨识,提供增强各种模式转移,包括医疗保健、智慧导航、家用电器、扩增实境游戏、家庭自动化、即时视讯串流、虚拟购物等等。

手势姿态辨识市场趋势

触控式手势姿态辨识市场预计将占据主要市场占有率

- 基于触控的手势姿态辨识包括广泛用于消费性电子产品的单点触控和多点触控萤幕。一种基于触控的功能可以在多种装置上使用,例如智慧型手机。例如,您只需轻轻一按即可存取智慧型手机的功能表列。由于具备上述基本功能的笔记型电脑和智慧型手机普及率很高,基于触控的手势姿态辨识领域占据了市场的很大一部分。

- 此外,随着越来越多的家用电器(如智慧型手机和笔记型电脑)采用并具有基于触控的手势姿态辨识功能,这些电器的广泛采用预计将对市场成长产生积极影响。随着各大公司将重点转向亚太地区,特别是印度,推出成本较低、基于触控的手势姿态辨识智慧型手机,智慧型手机预计在未来几年将继续成长。例如,根据GSMA资料,预计2022年全球智慧型手机普及率将达到68%。

- 智慧型手机使用基于多点触控的手势姿态辨识来实现放大、缩小和用三根手指截图等功能。笔记型电脑的垫片内建了交换桌面和存取功能表等 Windows 10 功能。目前,由于配备上述基本功能的笔记型电脑和智慧型手机市场渗透率高,基于触控的手势姿态辨识领域在调查市场中占据主导地位。预计预测期内该部分将保持不变。

- 智慧型手机製造商目前正在推出具有基于触控的手势姿态辨识功能的智慧型手机,例如双击即可进入睡眠/唤醒状态。此外,笔记型电脑製造商正在推出具有触控手势姿态辨识的低成本产品,使该技术更加容易获得。

- 此外,基于触控的手势姿态辨识设备在工业应用中越来越受欢迎。该行业的工作环境需要能够在恶劣条件下运作的坚固设备,包括戴着手套和用油手操作。这些产品还需要特定的基于行业的安全和标准认证,使其成为实施该行业使用的产品的优质解决方案。

预计北美将占很大份额

- 北美是手势姿态辨识技术应用领域的市场先驱和领先创新者。 Jabil Inc.、Leap Motion Inc. 和 GestureTek Inc. 等供应商的总部都设在该地区。与世界其他地区相比,该地区的研发投资不断增加,因此预计该地区采用该技术将进一步促进市场成长。

- 此外,高檔汽车对基于手势的使用者介面的需求不断增长,推动了该地区汽车行业对手势姿态辨识的需求。消费者对先进汽车功能的偏好日益增加,以及OEM製造商在研发方面的大量投资可能会推动产品的采用。

- 需求方面,由于更换週期的缩短和主要消费群体购买力的回升,预计美国将继续保持其作为家电主要市场之一的地位。预计在预测期内,手势姿态辨识技术将在家庭电器中最广泛的应用。可携式电子产品和无线通讯的需求不断增长预计将推动该地区市场的发展。美国是世界最大的消费性电子产品消费国之一。美国也被称为技术先进的国家,这使其成为许多电子製造商的目标。

- 此外,该地区在零售业中占有重要地位。手势姿态辨识技术在零售业的采用预计也将成长,进一步推动该地区的市场成长。总部位于奥克拉荷马州的连锁杂货店 Reasor 安装了互动式显示器,将公司的标誌和讯息投射到地板上。顾客可以走过展示台,并透过简单的手势和肢体动作与其互动。

手势姿态辨识行业概况

手势姿态辨识市场竞争适中,少数大型参与者扮演重要角色。这些产业巨头目前占据主导的市场占有率,并积极推行扩大海外市场影响力的策略。为了实现这一目标,他们正在建立策略联盟,以扩大市场占有率并提高盈利。

最近,2023 年 6 月,知名手部侦测和空中触觉技术供应商 Ultraleap 发布了令人兴奋的公告。 Ultraleap 宣布 BrightSign 的 XC5媒体播放机将支援其 TouchFree 解决方案。这种整合为数数位电子看板带来了新的参与和互动性,为寻求创新方式吸引受众的企业和组织开闢了丰富的可能性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 技术进步和对高效 HMI 成本效益功能的需求

- 人工智慧和机器学习技术的进步以及感测器价格的下降

- 终端用户产业越来越多地使用支援手势姿态辨识的设备

- 市场限制

- 使用手势姿态辨识技术所涉及的演算法、数学和其他复杂性

- 由于使用者介面始终开启,手势感应器消费量大量电池电量

第六章 市场细分

- 依技术分类

- 基于触摸的手势姿态辨识

- 非接触式手势姿态辨识

- 按最终用户产业

- 航太和国防

- 车

- 家电

- 游戏

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Intel Corporation

- Jabil Inc.

- Ultraleap

- Microchip Technology Inc.

- Sony Corporation

- Elliptic Laboratories AS

- Google LLC

- GestureTek Inc.

- Fibaro Group SA

- Eyesight Technologies Ltd

第八章投资分析

第九章 市场机会与未来趋势

The Gesture Recognition Market size is estimated at USD 31.35 billion in 2025, and is expected to reach USD 99.51 billion by 2030, at a CAGR of 25.99% during the forecast period (2025-2030).

Key Highlights

- The development of artificial intelligence (AI) has given rise to gesture-recognition-based devices. Moreover, the recent technological advancements in the field of gesture recognition technology, coupled with increasing adoption among end-user industries, are analyzed to drive the market in the coming years.

- Gesture recognition technology is being increasingly implemented for human-device interaction due to an increased acceptance of gesture-enabled electronic devices across various industry verticals, for example, switching through television channels or radio stations. The use of gesture recognition is increasing in various sectors.

- One recent development in this area is the interaction of humans with machines by using hand gesture recognition. Another development is the use of hand gesture recognition to control computer applications.

- With continuous technological developments, the companies in the market studied have been manufacturing products incorporated with new and innovative features. Omron Corporation has developed gesture recognition technology by simultaneously recognizing the position, shape, and motion of a person's hand or finger by referencing a camera-recorded image.

- Moreover, gesture recognition technology is gaining substantial prominence among consumers and original equipment manufacturers due to increased user convenience when handling various electronic products. Manufacturers worldwide are focusing on innovation to add gesture recognition features in different consumer electronics, which has improved safety, reliability, and convenience. Further, the demand for touchless gesture recognition is governed by the increasing demand for superior user experience, ease of use, and rising digitization across several sectors.

- A gesture recognition application system comprises several key hardware and software components, all of which must be tightly integrated to provide a compelling user experience. Moreover, specialized algorithms subsequently interpret the processed data, translating the movements into actionable commands that a computer can understand. Subsequently, an application integrates these actionable commands with user feedback, which must be natural as well as engaging. Adding to the overall complexity of the solution, the algorithms and applications are increasingly being implemented on embedded systems, with limited processing, storage, and other resources.

- Additionally, the integration of advanced technologies such as artificial intelligence and machine learning in the gesture recognition ecosystem is further expanding the studied market. The proliferation of AI and ML technologies is causing paradigm shifts in Gesture recognition by offering a spectrum of feature-enriching applications in healthcare delivery, smart navigation, consumer electronics, augmented reality gaming, automation of homes, live video streaming, and virtual shopping.

Gesture Recognition Market Trends

Touch-based Gesture Recognition Segment is Expected to Hold Significant Market Share

- Touch-based gesture recognition consists of single- and multi-touch screens, which are widely used in consumer electronics. A single touch-based function can be used in many devices, such as smartphones. For instance, a single-swipe touch can be used to access the menu bar on any smartphone. The touch-based gesture recognition segment accounts for the major portion of the market, owing to the high market penetration of laptops and smartphones that have the aforementioned basic functionalities.

- Moreover, as more and more electronic consumer products such as smartphones and laptops adopt and incorporate touch-based gesture recognition, the proliferation of these consumer electronic products is expected to positively influence the growth of the market. Smartphones are expected to witness continuous growth over the next few years as companies are shifting their focus to the Asia-Pacific region, especially India, by launching low-cost and touch-based gesture recognition feature smartphones. For instance, according to the data from GSMA, the global smartphone penetration rate was estimated at 68% in 2022.

- Multi-touch-based gesture recognition is used in functions such as zoom-in, zoom-out, and three-finger screenshots in smartphones. Functions, such as desktop swap and access to the menu in Windows 10, can be found on the trackpads of laptops. Currently, the touch-based gesture recognition segment dominates the market studied due to the high market penetration of laptops and smartphones that have the aforementioned basic functionalities. The segment is expected to remain the same over the forecast period as well.

- Currently, smartphone manufacturers are launching smartphones that incorporate touch-based gesture recognition features, such as double tap to sleep and wake. In addition, laptop manufacturers are launching low-cost products that use touch-based gesture recognition, thereby augmenting the availability of the technology.

- Additionally, touch-based gesture recognition devices are the preferred choice in industrial applications. The working environment in the industry makes it mandatory for the devices to be rugged and work in extreme conditions, such as being used with gloves and greased hands, etc. Specific industry-based security and standards certifications are also necessary for the products that make the products utilized in the industry a premium solution to implement.

North America is Expected to Have a Major Share

- North America is among the market pioneers and leading innovators in terms of the adoption of gesture recognition technology. Some of the vendors, such as Jabil Inc., Leap Motion Inc., and GestureTek Inc., are headquartered in the region. The growing R&D investments in the region, as compared to the other parts of the world, are expected to further boost the market growth in terms of the adoption of the technology in the region.

- Additionally, there is an increasing demand for gesture recognition in the automotive industry in the region, owing to the increasing demand for gesture-based user interfaces in luxury cars. Growing consumer preference for advanced vehicle features and significant OEM investments in R&D would enhance product penetration.

- In terms of demand, the United States is expected to retain its presence as one of the prominent markets in consumer electronics devices, backed by diminishing replacement cycles and recovery in the spending power of key consumer groups. Consumer electronics is expected to show the maximum adoption of gesture recognition technology during the forecast period. The increase in demand for portable electronic products and wireless communications is expected to drive the market in the current region. The United States is one of the major consumers of consumer electronics in the world. The United States is also known to be a technologically advanced nation, thus becoming a target for several electronics manufacturers.

- Moreover, the region holds a prominent position in the retail industry. The adoption of gesture recognition technology is also expected to grow in the retail industry, further boosting the market growth in the region. Reasor, a grocery store chain based in Oklahoma, installed an interactive display that projects the company's logo and message on the floor. Customers can interact with it when they walk upon it with simple gestures and body movements.

Gesture Recognition Industry Overview

The gesture recognition market exhibits a moderate level of competition, with a select few major players exerting significant influence. Currently, these industry leaders hold a dominant market share and are actively pursuing strategies to expand their reach in foreign markets. To achieve this, they are forging strategic collaborations to enhance their market presence and drive profitability.

In a recent development in June 2023, Ultraleap, a renowned provider of hand tracking and mid-air haptics technologies, made an exciting announcement. They have introduced support for their TouchFree solution on BrightSign's XC5 media players. This integration introduces a new dimension of engagement and interactivity to digital signage, offering diverse possibilities for businesses and organizations seeking innovative ways to captivate their audiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements for Efficient HMI and Demand for Cost-effective Features

- 5.1.2 Evolution of Artificial Intelligence and Machine Learning Technology Augmented with Fall in Sensor Prices

- 5.1.3 Increasing Use of Devices Supporting Gesture Recognition across End-user Industries

- 5.2 Market Restraints

- 5.2.1 Algorithms, Mathematical, and Other Complexities Associated with the Use of Gesture Recognition Technology

- 5.2.2 High Battery Power Consumption by Gesture Sensors, due to the 'Always-on' User Interface

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Touch-based Gesture Recognition

- 6.1.2 Touchless Gesture Recognition

- 6.2 By End-user Industry

- 6.2.1 Aerospace and Defense

- 6.2.2 Automotive

- 6.2.3 Consumer Electronics

- 6.2.4 Gaming

- 6.2.5 Healthcare

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Jabil Inc.

- 7.1.3 Ultraleap

- 7.1.4 Microchip Technology Inc.

- 7.1.5 Sony Corporation

- 7.1.6 Elliptic Laboratories AS

- 7.1.7 Google LLC

- 7.1.8 GestureTek Inc.

- 7.1.9 Fibaro Group SA

- 7.1.10 Eyesight Technologies Ltd