|

市场调查报告书

商品编码

1639350

北美声学感测器:市场占有率分析、行业趋势、统计数据、成长预测(2025-2030 年)NA Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

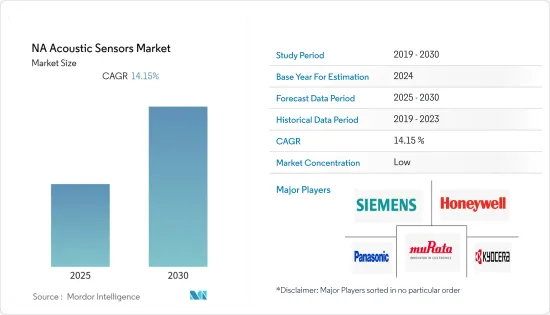

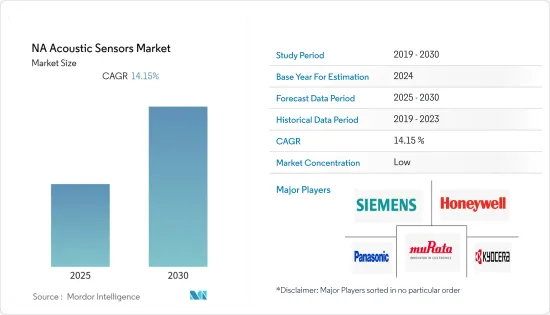

预计预测期内北美声学感测器市场复合年增长率将达到 14.15%。

主要亮点

- 由于表面波声学感测器可用于电视传输和无线电中产生传输讯号,预计在整个预测期内将快速增长。 SAW 装置在射频应用中用作滤波器,并且是卫星通讯终端和基地台的关键元件。

- 此外,声学感测器最近在汽车应用方面的需求激增。电动车马达完全无声,可能会对粗心的行人造成危险。这就是为什么所有新型电动和混合动力汽车都需要声音警报系统。因此,人们对交通管理日益增长的关注可能会推动市场向前发展。

- MEMS 结合了硅基微电子技术和微加工技术,被认为是 21 世纪最有前景的技术之一,具有改变工业产品和消费产品的潜力。由于其高灵敏度和无线操作能力,新型基于声波的 MEMS 设备为广泛的应用提供了潜在的技术平台。

- 在新冠肺炎疫情的第一阶段,由于整个州处于封锁状态并且多家生产设施关闭,受调查市场的供应链出现中断。不过从2020年第二季开始,需求和生产开始復苏,反映了半导体产业的趋势。

北美声学感测器市场趋势

通讯可望推动市场成长

- 通讯业是声学感测器的最大消费者,主要受智慧型手机和基地台的推动。为了支援不断成长的客户群,电信业者正在安装越来越多的塔和基地台。此外,大多数手机和类似的设备已经配备了麦克风/扬声器,以相对较低的入门成本支援声学感测应用程式。

- 即时视讯串流需要高频宽。结合通讯和光纤通讯的混合方法可以透过提供高品质的即时视讯串流来帮助克服这一障碍。声学透过「薄」通道维持网路拓扑和传输控制。如果光学通道发生故障,则使用声学通道提供视讯的静态帧。

- 由于美国和加拿大等已开发经济体和新兴经济体中智慧型手机、平板电脑和其他电子设备的使用不断增加,预计预测期内声学感测器的销售将增长。

消费性电子产品对錶面声波的需求日益增加

- 智慧型手机销售的成长以及射频技术在家用电子电器中的日益发展和使用,正在推动该地区声学感测器和其他相关设备的销售,从而扩大了市场分析的范围。

- 随着 LTE、4G 尤其是 5G 智慧型手机製造业的不断增长,表面声波 (SAW) 具有巨大的成长潜力。射频滤波器正成为各种行动电话的典型组件,因为它们将无线电讯号与这些设备用于传输和接收讯息的众多频宽分离。在 2.7 GHz 以下频率范围内,新的增强型 SAW 滤波器提供了比竞争性 BAW 滤波器更高性能的解决方案,随着 5G 技术的兴起,其发展前景越来越光明。

- 大多数主要的智慧型手机製造商,包括苹果、三星和 LG,都在其最新的 5G 设备中使用 RF 滤波器。 SAW 感测器的进步为 4G 和 5G 多模行动装置提供了更节能的 RF 路径,与同类现成的替代方案相比,该路径成本更低,并且具有与OEM目的地的性能指标。此外,许多学者一直致力于研究将SAW MEMS麦克风用作无线被动加速计和压力感测器的潜力。

北美声学感测器产业概况

声学感测器是一种製造相对简单的设备。因此,市场分散,Honeywell、西门子股份公司、Panasonic、村田製造、京瓷等许多全球和本地製造商为市场动态做出了贡献。在这种环境下,企业专注于透过策略性收购、合作伙伴关係和技术创新来扩大业务。最近的趋势如下:

- 2021 年 6 月-在美国领空,美国机器人公司正在推动超视距 (BVLOS) 无人机操作的最新技术。该公司最近与科学应用与研究协会(SARA)建立了合作关係。 SARA 的基于声学的飞机识别系统——地面声学感测器阵列 (TASA),被美国机器人公司的 Scout 系统采用,可以在飞行时成功识别其他飞机并使其保持安全距离。

- 2021 年 2 月 - BMP384 是 Bosch Sensortec 推出的耐用压力感测器,采用紧凑的设计,具有高精度。 BMP384强大的性能和低功耗使其适用于工业、家用电器和消费性电器产品等恶劣环境。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 最终用户快速增加

- 製造成本低

- 市场限制

- 技术困难

第六章 市场细分

- 按类型

- 有线

- 无线的

- 按波浪类型

- 表面波

- 体波

- 透过感测参数

- 温度

- 压力

- 扭力

- 按应用

- 航太和国防

- 车

- 消费性电子产品

- 卫生保健

- 资讯科技/通讯

- 其他的

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Siemens AG

- Honeywell

- Murata Manufacturing Co., Ltd.

- Vectron International, Inc.(Microchip technology Incorporated)

- ifm efector, inc.

- Dytran Instruments, Inc.

- Campbell Scientific, Inc.

- Panasonic Corporation

- KYOCERA Corporation

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 48720

The NA Acoustic Sensors Market is expected to register a CAGR of 14.15% during the forecast period.

Key Highlights

- Due to its use in television transmitters and radios to create signals for transmission, the surface wave acoustic sensor is predicted to rise rapidly throughout the forecast period. SAW devices are needed as filters in radio frequency applications and are critical components in satellite communication terminals and base stations.

- Furthermore, acoustic sensors have lately seen a surge in demand in automotive applications. The complete quiet of electric automobile motors may be a danger to unwary pedestrians. As a result, all new electric and hybrid cars will require auditory warning systems. As a result, increased worries about traffic management will propel the market forward.

- By merging silicon-based microelectronics with micromachining technology, MEMS has been designated as one of the most promising technologies of the twenty-first century, having the potential to change both industrial and consumer products. Because of their great sensitivity and ability to work wirelessly, new acoustic-wave-based MEMS devices provide a potential technology platform for a wide range of applications.

- The examined market experienced supply chain disruption during the first phase of the COVID-19 due to statewide lockdown and shutdown of several production facilities. However, from the second quarter of 2020, the market began to experience a resurgence in demand and output, mirroring the semiconductor industry trend.

North America Acoustic Sensors Market Trends

Telecommunications is Expected to Drive Market Growth

- The telecommunications industry is the largest consumer of acoustic sensors, primarily driven by smartphones and base stations. With telecom companies setting up more and more towers to support the ever-increasing customer base, base stations are increasing. Moreover, most of the telephone devices and other similar gadgets already have microphones/speakers installed, which support acoustic-sensing applications with a relatively low deployment cost.

- High bandwidth is required for real-time video streaming. A hybrid approach that blends acoustic and optical communications can assist overcome this barrier by providing high-quality real-time video streaming. Acoustic keeps the network topology and transmission control on a "thin" channel. When the optical channel fails, the acoustic channel is utilized to provide still frames of video.

- Owing to the increasing usage of smartphones, tablets, and other electronic devices in developed and developing economies such as the United States Canada, acoustic sensors are expected to witness growth during the forecast period.

Growing Need For Surface Acoustic Wave In The Consumer Electronics

- Due to increased smartphone sales and increased use of developing RF technologies in consumer electronics, sales of acoustic sensors and other associated equipment have seen a large increase in the region, broadening the breadth of the market analyzed.

- The increasing manufacturing of LTE, 4G, particularly 5G smartphones, presents significant growth potential for Surface Acoustic Wave (SAW). As they separate radio signals from the many spectrum bands utilized by various cellphones to receive and send information, RF filters are becoming typical components in these devices. In the sub-2.7 GHz frequency region, new enhanced SAW filters provide a higher performance solution than competitive BAW filters, resulting in more development prospects as 5G technology emerges.

- The majority of well-known smartphone manufacturers, including Apple, Samsung, and LG, use RF filters in their latest 5G devices. SAW sensor advancements also provide for more power-efficient RF routes in 4G and 5G multimode mobile devices at a cheaper cost than competing commercial alternatives with comparable performance metrics for original equipment makers (OEMs). Many academics are also looking at the possibilities of using the SAW MEMS microphone as a wireless passive accelerometer and pressure sensor.

North America Acoustic Sensors Industry Overview

Acoustic sensors are a relatively simple device to manufacture. Consequently, the market is fragmented with many global as well as local manufacturers, contributing to the market dynamics including Honeywell, Siemens AG, Panasonic, Murata, KYOCERA Corporation, etc. Under such conditions, the companies are focusing on expanding their business through strategic acquisitions, partnerships, and innovations. Some of the recent developments are:-

- June 2021 - Within US airspace, American Robotics is pushing the state-of-the-art for Beyond-Visual-Line-Of-Sight (BVLOS) drone operations. Scientific Applications & Research Associates and the corporation recently formed a cooperation (SARA). SARA's Terrestrial Acoustic Sensor Array (TASA), an acoustics-based aircraft identification system, is used by American Robotics' Scout System to successfully identify other aircraft and keep a safe distance from them while in flight.

- February 2021 - The BMP384 is a durable pressure sensor from Bosch Sensortec that delivers precision in a small design. The BMP384's strong performance and low power consumption make it suited for tough settings in industrial, consumer electronics, and household appliances.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growing Numbe of End-users

- 5.1.2 Low Manufacturing Costs

- 5.2 Market Restraints

- 5.2.1 Technical Difficulties

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Wave Type

- 6.2.1 Surface Wave

- 6.2.2 Bulk Wave

- 6.3 By Sensing Parameter

- 6.3.1 Temperature

- 6.3.2 Pressure

- 6.3.3 Torque

- 6.4 By Application

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Consumer Electronics

- 6.4.4 Healthcare

- 6.4.5 IT and Telecom

- 6.4.6 Others

- 6.5 By Country

- 6.5.1 United States

- 6.5.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Honeywell

- 7.1.3 Murata Manufacturing Co., Ltd.

- 7.1.4 Vectron International, Inc. (Microchip technology Incorporated)

- 7.1.5 ifm efector, inc.

- 7.1.6 Dytran Instruments, Inc.

- 7.1.7 Campbell Scientific, Inc.

- 7.1.8 Panasonic Corporation

- 7.1.9 KYOCERA Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219