|

市场调查报告书

商品编码

1639357

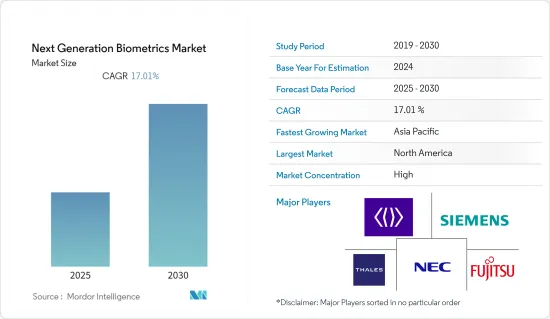

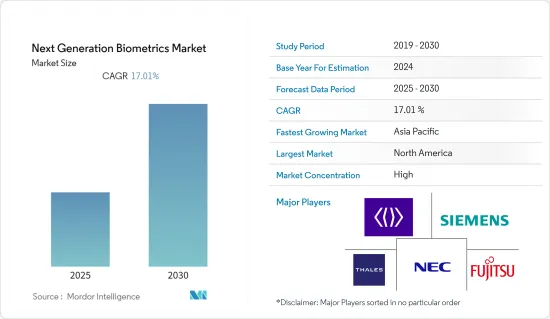

下一代生物辨识技术:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Next Generation Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内下一代生物辨识市场将以 17.01% 的复合年增长率成长。

下一代生物辨识市场的主要趋势之一是商业话语的模式转移,更加重视隐私和减少安全威胁。最终用户越来越多地寻求整合解决方案,而不是依赖传统方法。

主要亮点

- 由于恐怖活动增多以及敏感资料和资讯窃盗增加导致国家安全问题日益严重,下一代生物辨识市场预计将显着成长。例如,2022年8月,智利将引入自动生物识别系统(ABIS),打击组织犯罪。透过比较警察局 (PDI)、民事登记处和国际刑警组织的生物特征记录,该系统可以立即识别已知的罪犯、非法移民和身份不明的死者。

- 全球范围内日益增多的身份诈骗正在限制全球市场的成长。 Onfido 称,身分诈骗诈骗同比增长 43%,犯罪分子变得更加狡猾,使用逼真的 2D/3D 面具和显示攻击(例如在萤幕上显示某人的照片)。诈骗者试图透过部署网路钓鱼策略或其他诈骗方法来欺骗身分验证系统。如今,每 10 名消费者中就有 9 名可以轻鬆使用数位服务,这也为诈骗提供了更大的机会。

- 下一代生物辨识产业正受益于电子卡和生物辨识护照的兴起。例如,哥斯大黎加计划分别于 2021 年 9 月和 2022 年推出生物识别护照。新护照采用了尖端的安全技术,可以拒绝任何诈欺行为。它也符合国际民航组织规定的要求。这些进步可能为整个预测期内的市场发展创造成长机会。

- COVID-19 疫情大大增加了对非接触式生物辨识解决方案的需求,尤其是在医疗保健领域,从而为各行业带来了重大颠覆和调整。先进的多因素和多模态生物识别解决方案由于其准确性和适合 COVID-19 社交距离规范而变得越来越重要。

- 公司应避免使用指纹、掌纹和手键扫描仪,以尽量减少身体接触和病毒传播。这些倡议为脸部认证设备和用户友好的虹膜扫描奠定了基础。疫情感染疾病导致了一种趋势,即采用非接触式生物识别技术来评估脸部、步态和语音辨识以实现准确识别,预计这将有利于市场成长并在预测期内成长。

下一代生物辨识技术市场趋势

银行和金融是成长最快的行业

- 各国央行正在推动生物辨识认证的引入。美国银行、摩根大通和富国银行允许客户使用指纹登入手机银行。此外,银行客服中心正在实施语音认证来识别客户。下一代生物辨识认证可以透过消除密码需求来提高客户满意度,从而增加银行业对生物辨识技术的需求。

- Visa 在 2022 年 5 月进行的一项民意调查发现,86% 的用户渴望在付款时使用生物辨识技术来验证身分。在使用过生物辨识技术的人中,70%的人表示生物辨识技术更简单,46%的人表示生物辨识技术比凭证或密码更安全。因此,由于银行诈骗行为的增加,预计在网路银行和行动付款中采用生物辨识安全技术将促进市场的成长。

- 根据IDEMIA 2021年7月报道,作为全球生物辨识解决方案的先驱,印度银行业现在更热衷于在后疫情时代采用安全实用的生物辨识技术。 IDEMIA 致力于提供一系列尖端的生物辨识保护和交易解决方案。预计BFSI领域的这些发展将在未来几年推动下一代生物辨识市场的发展。

- 随着数位科技在 BFSI 领域应用的不断增多,网路金融和数位化业务在过去几年中变得越来越受欢迎。现在,许多银行都使用生物识别脸部认证透过 ATM 机存取您的帐户,而无需刷卡。例如,2022 年 5 月,万事达卡针对实体店推出了一种生物识别付款方式,这种方式依赖于脸部辨识生物识别,而不是智慧型手机、智慧卡或记忆的密码。

预计亚太地区在预测期内将出现显着成长

- 该地区市场预计将见证新兴经济体的显着成长,预计在预测期内将稳定成长。除消费电子和政府部门外,由于下一代生物辨识技术的应用,该地区的医疗保健产业预计也将实现成长。

- 由于技术创新的不断增加以及生物识别设备在该地区的经济实惠和广泛使用,该地区预计将实现成长。此外,下一代生物辨识产业正在崛起,政府和多个商业部门正在利用这项技术创新来识别个人。

- 游戏零售、银行和金融业、医院等终端用户对生物识别技术的需求日益增长。这种需求对全国市场的扩张产生了重大影响。例如,2021 年 6 月,中国建设银行 (CCB) 与 IDEX Biometrics 合作,选择在其数位人民币计画中采用生物辨识凭证。该银行先前曾推出一款数位人民币钱包应用程式。由于支援 NFC 的生物辨识智慧卡,用户无需智慧型手机即可消费虚拟。

- 亚太国家市场的扩张受到新兴国家经济发展、旅游兴趣日益浓厚以及物联网设备使用率不断提高等因素的推动。例如,2021 年 11 月,「Mantra Softech」与北方邦政府达成协议,使用生物辨识技术分配发行。此外,2021 年 12 月,印度政府作为「DIGI YATRA SCHEME」的一部分,引入了「脸部认证技术」(FRT)用于旅行者登记。这些最近发生的事件预计将加速该地区生物辨识产业的扩张。

- 2022 年 9 月,作为其在亚太地区持续成长的一部分,下一代身分验证平台 Incode 透露,它已与 TOTM Technologies 合作,作为分销商,向印尼提供其身分解决方案 Incode Omni市场。 TOTM Technologies 致力于将 Incode 世界一流的安全、以客户为中心的生物识别解决方案引入印尼,扩大其业务范围。因此,预计亚太地区的这些发展将在预测期内推动下一代生物辨识市场的发展。

下一代生物辨识技术产业概况

下一代生物辨识市场高度分散,许多市场参与者投资于符合市场需求的技术创新。此外,由于预期的未来需求,下一代生物辨识市场竞争激烈。市场的主要企业包括IDEMIA、富士通有限公司、日本电气公司、泰雷兹集团和西门子股份公司。

- 2022 年 9 月:全球领先的数位身分检验和身分验证供应商 Onfido 推出了 Motion,这是一款用于生物辨识的尖端活体解决方案,可改善其真实身分平台。 Motion 通过了 iBeta 2 级认证,可提供流畅、安全且全面的消费者认证。

- 2022 年 8 月:IDEX Biometrics ASA 与 Realtime AS 启动策略合作,打造并商业化全球首款具有冷资料储存和数位财富钱包以及数位身分的 Web3 生物辨识交易卡。符合 EMV 标准的一体化生物辨识付款卡预计将于 2023 年上半年上市。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 电子护照计画的成长趋势

- 生物识别与智慧型手机的整合将推动成长

- 市场限制

- 隐私问题对成长构成挑战

- 初始系统成本高限制了成长

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

第五章 市场区隔

- 按解决方案类型

- 脸部认证

- 指纹认证

- 虹膜辨识

- 掌纹认证

- 签名辨识

- 其他解决方案

- 按行业

- 政府

- 防御

- 旅行和移民

- 家庭安全

- 银行和金融服务

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第六章 竞争格局

- 公司简介

- IDEMIA

- NEC Corporation

- Fujitsu Ltd

- Siemens AG

- Thales Group

- Cross Match Technologies

- Fingerprint Cards AB

- Suprema Inc.

- RCG Holdings Limited

- Safran SA

第七章投资分析

第八章 市场机会与未来趋势

The Next Generation Biometrics Market is expected to register a CAGR of 17.01% during the forecast period.

One of the key trends witnessed in the next-generation biometrics market is a paradigm shift in business discourse toward more privacy and fewer security threats. The end-users are increasingly looking for integrated solutions rather than depending on conventional methods.

Key Highlights

- The next-generation biometric market is anticipated to grow at a significant growth rate due to the rising number of terrorist activities, coupled with the increasing theft activities on the part of crucial data and information that have raised concerns regarding national security. For instance, in August 2022, Chile is implementing an automatic biometric identification system (ABIS) to combat organized crime. By comparing the biometric records of the civil police (PDI), the civil registry, and Interpol, the system would instantaneously identify recognized criminals, illegal migrants, and the deceased who lack any identity.

- The rising identity fraud across the globe is restricting market growth globally. According to Onfido, Identity fraud rose 43% YoY, with sophisticated fraud increasing 57% as criminals employed smarter tactics, utilizing realistic 2D/3D masks and deploying display attacks (for instance, showing a picture of a person on a screen) to try to spoof verification systems. And with 9 out of 10 consumers comfortable accessing digital services, the opportunities for fraudsters are further increasing.

- The next-generation biometric industry benefits from the increase in electronic cards and biometric passports. Costa Rica, for example, in September 2021, is slated to launch its biometric passport in 2022. The new passport was created using the most advanced security technology to reject fraudulent attempts. It also complies with the demands the International Civil Aviation Organization sets forth. Throughout the projected term, these advances may generate growth opportunities for market development.

- The COVID-19 outbreak significantly increased demand for touchless biometrics solutions, particularly in the healthcare sector, and created substantial disturbances and adjustments in various industries. Advanced multifactor and multimodal biometrics solutions are becoming increasingly important due to their accuracy and conformance with COVID-19's social separation norms.

- Companies must refrain from using fingerprint, palm print, and hand-key scanners to minimize physical touch and virus transmission. These actions are laying the groundwork for facial identification equipment and user-friendly iris scanning, which will be applied in several contexts. The outbreak brought about a trend toward contactless biometric technologies that assess face, gait, and speech recognition for accurate identification, which benefitted the market growth and is expected to grow over the forecast period.

Next Generation Biometric Market Trends

Banking and Financial Industry to be the Fastest Growing Sector

- Central Banks are rolling out biometric authentication. Bank of America, JP Morgan Chase, and Wells Fargo allow customers to log in to mobile banking via fingerprint authentication. Voice authentication is also deployed in bank call centres to identify customers. Next-generation biometric authentication can improve customer satisfaction by eliminating the need for passwords and increasing the demand for biometrics in the banking sector.

- A Visa poll from May 2022 found that 86% of users are eager to utilize biometrics to verify their identification while making payments. 70% of respondents who used biometrics said it was simpler to use them, and 46% said they were safer than credentials or PINs. Thus, increasing the adoption of biometric security for internet banking and mobile payments is expected to contribute to the market growth due to increasing banking fraud.

- According to IDEMIA, in July 2021, a pioneer in biometric solutions worldwide, the Indian banking industry is now more eager to implement safe and practical biometric technologies in the post-Covid era. IDEMIA is seeking to provide various cutting-edge biometric protection and transaction solutions. These developments in the BFSI sector are expected to propel next generation biometrics market over the coming years.

- Internet finance and digital operations have become increasingly popular over the past few years due to the increased use of digital technology in the BFSI sector. Many banks now use biometric facial recognition to access accounts through ATMs, eliminating the requirement to punch a card. For instance, in May 2022, Mastercard introduced a biometric payment method for physical establishments that relies on face recognition biometrics instead than smartphones, smart cards, or memorized PINs.

Asia-Pacific to Witness a Significant Growth Rate over the Forecast Period

- The market in the region is expected to witness significant growth in emerging economies, estimated to grow steadily over the forecast period. Apart from the consumer electronics and government sectors, the healthcare sector is expected to experience growth in the application of next-generation biometrics in this region.

- The region is expected to grow with innovation advancement and the region's widespread use of biometric devices at an affordable price. Additionally, the next-generation biometrics industry is increasing as the government and several business sectors use this innovation to identify individuals.

- The need for biometric identification technologies is rising among end-users, such as gaming retail, the banking and financial industry, hospitals, etc. This demand is having a substantial impact on the market's expansion nationwide. For instance, in June 2021, in conjunction with IDEX Biometrics, the China Construction Bank (CCB) chose to employ biometric credentials in its digital renminbi initiatives. The institution previously made available an app for digital yuan wallets. Users will not require a smartphone to utilize virtual currency owing to the NFC-enabled biometrics smart card.

- The rise of the market in the Asia Pacific countries is fuelled by factors including the economic development of developing nations, rising interest in travel, and increased use of IoT devices. For instance, in November 2021, "Mantra Softech" and the administration of Uttar Pradesh reached an agreement to distribute rations using biometrics. Furthermore, in December 2021. the Indian government implemented "Facial Recognition Technology" (FRT) for traveler registration as part of the "DIGI YATRA SCHEME." These recent events are anticipated to accelerate the expansion of the biometric industry in this area.

- In September 2022, as a continuation of its Asia Pacific growth, Incode, the next-generation identity confirmation platform, revealed that it partnered with TOTM Technologies as a distributor to provide identification solutions, Incode Omni, to the Indonesian market. By introducing world-class, safe, and customer-focused biometric solutions from Incode to the area, TOTM Technologies is dedicated to widening the scope of Indonesian businesses. Thus, these developments in the Asia-Pacific region are expected to propel the next-generation biometric market over the forecast period.

Next Generation Biometric Industry Overview

The next-generation biometrics market is highly fragmented due to numerous market players investing in technological innovation aligned with the market need. Moreover, the next-generation biometric market is highly competitive due to the expected demand in the future. Some of the key players in the market are Idemia, Fujitsu Ltd., NEC Corporation, Thales Group, and Siemens AG.

- September 2022: Onfido, the top worldwide digital identity validation, and authentication supplier launched Motion, a cutting-edge liveness solution for biometrics that will improve its Real Identity Platform. Motion is iBeta Level 2 approved and offers smooth, secure, and inclusive consumer verification.

- August 2022: IDEX Biometrics ASA and Realtime AS launched strategic cooperation to create and commercialize the world's inaugural Web3 biometric transaction card with cold storing and digital property wallets, as well as digital identity. In the first half of 2023, the marketplace is predicted to get these all-in-one biometrics payment card that complies with EMV standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Inclination of Growth toward E-Passport Program

- 4.2.2 Integration of Biometrics in Smartphones Driving Growth

- 4.3 Market Restraints

- 4.3.1 Fear of Privacy Invasion Challenging Growth

- 4.3.2 High Initial Cost of Systems Restricting Growth

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Type of Solution

- 5.1.1 Face Recognition

- 5.1.2 Fingerprint Recognition

- 5.1.3 Iris Recognition

- 5.1.4 Palm Print Recognition

- 5.1.5 Signature Recognition

- 5.1.6 Other Types of Solutions

- 5.2 By End-user Vertical

- 5.2.1 Government

- 5.2.2 Defense

- 5.2.3 Travel and Immigration

- 5.2.4 Home Security

- 5.2.5 Banking and Financial Service

- 5.2.6 Healthcare

- 5.2.7 Other End-user Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.5 Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IDEMIA

- 6.1.2 NEC Corporation

- 6.1.3 Fujitsu Ltd

- 6.1.4 Siemens AG

- 6.1.5 Thales Group

- 6.1.6 Cross Match Technologies

- 6.1.7 Fingerprint Cards AB

- 6.1.8 Suprema Inc.

- 6.1.9 RCG Holdings Limited

- 6.1.10 Safran SA