|

市场调查报告书

商品编码

1639361

北美物联网安全 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)North America IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

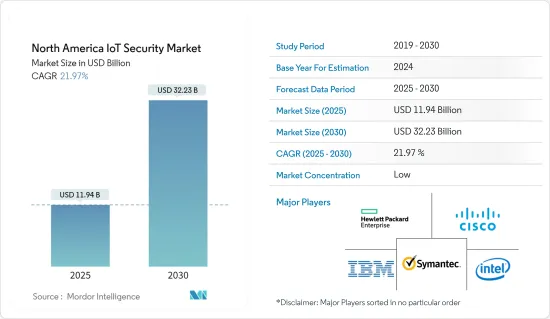

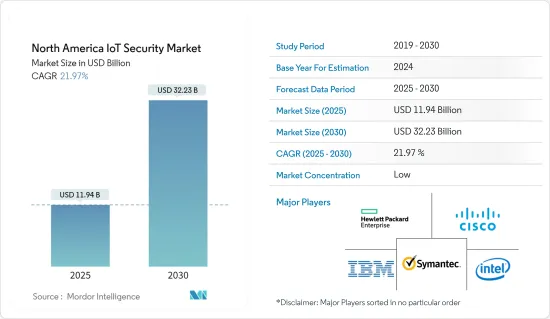

北美物联网安全市场规模预计到 2025 年为 119.4 亿美元,预计到 2030 年将达到 322.3 亿美元,预测期内(2025-2030 年)复合年增长率为 21.97%。

主要亮点

- 新的经营模式和应用程序,加上设备成本的降低,正在推动物联网的采用,从而导致连网型设备装置、穿戴式装置、汽车、仪表和家用电子电器产品的数量不断增加。

- 针对消费者物联网设备的攻击非常普遍,而製造业和类似产业的潜在破坏使威胁更加严重。过去几年,美国和加拿大的各个最终用户产业都面临严重的安全攻击。物联网安全正成为企业、消费者和监管机构关注的重点领域。由于这种关注的增加,世界各地提供基于物联网的解决方案的公司正在对这些解决方案的安全方面进行大量投资。

- 例如,2022年10月,为云端应用程式提供监控安全平台的Datadog, Inc.宣布全面推出云端安全管理。该产品将云端安全态势管理 (CSPM)、云端工作负载安全 (CWS)、警报、事件管理和彙报整合到单一平台中,以协助开发营运和安全团队识别错误配置,以侦测威胁并保护云端原生应用程式.

- 此外,对连网型设备的日益依赖连网型设备需要确保它们的安全。这一显着成长预计将受到业界对部署互联生态系统和 3GPP蜂巢式物联网技术标准化的日益关注的推动。

- 随着连接到互联网的设备数量不断增加,预计网路世界新威胁和攻击的发生和出现将显着增加。物联网设备特别容易受到各种网路攻击,包括资料窃取、假冒、网路钓鱼攻击和 DDoS(拒绝服务)攻击。这些可能导致各种与网路安全相关的威胁,例如勒索软体攻击和其他严重的资料洩露,使企业付出巨大的成本和努力来恢復。

- 然而,设备间的复杂性加上缺乏普及性可能是一个主要问题,可能会限制整个预测期内的整体市场成长。

- 自 COVID-19 爆发以来,物联网攻击有所增加,因此世界各国实施了多项预防措施。随着社区被告知待在家里、学校关闭,多个组织找到了允许员工在家工作的方法。因此,视讯通讯平台的采用有所增加。此外,预计市场将在后 COVID-19 时期见证重大成长机会,特别是随着主要市场参与企业推出各种经济高效的云端基础的混合解决方案。

北美物联网安全市场趋势

资料外洩数量的增加预计将推动市场发展

- 随着连接到互联网的设备数量的增加,预计网路世界将会出现新的威胁和攻击。过去几年北美各个最终用户产业的资料外洩事件的增加就证明了这一点。此类攻击直接针对业务系统或个人,可能导致重大的财务和个人损失。这增加了对容易遭受资料外洩的消费性设备的物联网安全性的需求。

- 此外,医疗保健、製造、BFSI 和汽车等各个最终用户行业的资料外洩数量不断增加,推动了对物联网安全解决方案的需求,以保护互联设备免受网路攻击。例如,根据身分盗窃资源中心发布的 ITRC 2022 年度资料外洩报告,2022 年美国发生了 1,802 起资料外洩事件。美国的资料外洩事件数量已从 2005 年的 157 起大幅增加到 2022 年的 1,802 起。

- 此外,由于物联网需求,云端服务的采用率也很高。随着云端系统在各行业的使用不断增加,这些系统的资料外洩漏洞也越来越大。许多提供者提供多种解决方案,增加了对统一安全平台的需求。物联网安全可以部署在设备和通讯、资料储存和生命週期解决方案中。

- 此外,由于政府加强保护企业免受网路攻击,预计该市场将进一步成长。例如,2023 年 7 月,拜登政府启动了物联网 (IoT) 网路安全指示计划,以保护美国免受与网路连线装置相关的无数安全风险。该计画名为“美国网路信任标誌”,旨在确保美国购买包含针对网路攻击的强大网路安全保护的连网设备。

预计美国将主导市场

- 美国物联网安全市场成长的关键因素是先进技术的高采用率、网路攻击数量的增加以及该国联网设备数量的增加。该国是物联网部署的主要地区之一。其他因素包括该地区数位化和物联网安全支出的增加。

- 此外,该地区也是赛门铁克公司、IBM公司、FireEye公司和Palo Alto Networks公司等重要物联网安全供应商的所在地。供应商正在透过增加产品创新来增加产品系列和市场占有率。例如,2022 年 3 月,网路防火墙供应商 Palo Alto Networks 宣布与 Amazon Web Services 合作推出适用于 AWS 的新 Palo Alto Networks Cloud NGFW。

- 同样在 2022 年 5 月,为电子应用各领域的客户提供服务的全球半导体供应商意法半导体透露了其与意法半导体认证合作伙伴微软的合作细节。其目的是增强新兴物联网应用的安全性。 ST 将其超低功耗 STM32U5 微控制器与 Microsoft Azure RTOS 和 IoT 中间件以及经认证的安全实作 Arm Trusted Firmware-M (TF-M) 安全服务(专门针对嵌入式系统)结合。

- 此外,美国的网路威胁呈上升趋势。根据身分盗窃资源中心的数据,该国的平均违规数量在过去几年中略有增加。 2022 年 10 月,拜登-哈里斯政府将重点放在改善美国网路防御上,建立全面的方法来采取积极行动来加强和保护国家的网路安全。

- 根据GSMA行动智库预测,到2025年终,北美工业和消费性物联网连接总数预计将成长至约54亿个。 2019年,北美地区物联网连接总数达28亿个。该地区工业和消费物联网连接总数的显着增加预计将显着推动整个市场的成长机会。

北美洲物联网安全产业概况

由于该全部区域存在大量区域参与企业,北美物联网安全市场的竞争格局呈现细分的特性。这些市场参与企业越来越多地推出针对各行业的创新解决方案。此外,旨在提高市场占有率的联盟和收购显着增加。

2022 年 12 月,网路安全解决方案供应商 Check Point Software Technologies Ltd. 宣布推出 Check Point Quantum Titan,这是其 Check Point Quantum 网路安全平台的增强版。 Quantum Titan 包含三个软体刀片,利用深度学习和人工智慧 (AI) 的力量,针对高级域名系统漏洞 (DNS) 和网路钓鱼攻击以及自主的物联网安全提供高级威胁防护。 Check Point 的 Quantum Titan 提供物联网设备发现和自动应用零信任威胁保护设定檔来保护物联网设备。

2022 年 12 月,Palo Alto Networks 宣布推出医疗物联网安全,这是一款专为医疗设备设计的全面零信任安全解决方案。该解决方案使医疗保健组织能够安全、快速地部署和管理新的互联技术。网路安全的零信任方法着重于持续检验所有使用者和设备,从而消除组织安全框架内的隐式信任。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 资料外洩增加

- 智慧城市的出现

- 市场限制因素

- 设备间的复杂性和缺乏普遍的立法

第六章 市场细分

- 安全类型

- 网路安全

- 端点安全

- 解决方案

- 软体

- 服务

- 最终用户产业

- 车

- 医疗保健

- 政府机构

- 製造业

- 能源/电力

- 零售业

- BFSI

- 其他的

- 地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Symantec Corporation

- IBM Corporation

- Check Point Software Technologies Ltd.

- Intel Corporation

- Hewlett Packard Enterprise Company

- Cisco Systems Inc.

- Fortinet Inc.

- Trustwave Holdings

- AT&T Inc.

- Palo Alto Networks Inc.

第八章投资分析

第九章 市场机会及未来趋势

The North America IoT Security Market size is estimated at USD 11.94 billion in 2025, and is expected to reach USD 32.23 billion by 2030, at a CAGR of 21.97% during the forecast period (2025-2030).

Key Highlights

- The emerging business models and applications, coupled with the reducing device costs, have been instrumental in driving the adoption of IoT, consequently, the number of connected devices, such as connected machines, wearables, cars, meters, and consumer electronics.

- Attacks on consumer IoT devices are prevalent, and the overall possibility of disruption in manufacturing and similar industries makes the threat more serious. Various end-user industries in the United States and Canada have faced considerable security attacks in various industries in the past few years. IoT security is becoming a significant focus area for businesses, consumers, and regulators. Following such increasing prominence, enterprises that are offering IoT-based solutions worldwide are investing heavily in the security aspect of these solutions.

- For instance, in October 2022, Datadog, Inc., the monitoring and security platform for cloud applications, declared the general availability of Cloud Security Management. This product brings together capabilities from Cloud Security Posture Management (CSPM), Cloud Workload Security (CWS), alerting, incident management, and reporting in a single platform to enable DevOps and Security teams to identify misconfigurations, detect threats, and secure cloud-native applications.

- Moreover, the increasing dependency on connected devices is creating the need to keep the connected devices secure. This significant growth is anticipated to be driven by the growing industry focus on deploying a connected ecosystem as well as the standardization of 3GPP cellular IoT technologies.

- With the growing number of devices connected to the Internet, the cyber world is anticipated to witness a significant rise in the occurrence and emergence of new threats and attacks. IoT devices are particularly vulnerable to various network attacks, such as data theft, spoofing, phishing attacks, and DDoS attacks (denial of service attacks). These can lead to various cybersecurity-related threats like ransomware attacks and other serious data breaches that can take businesses a lot of money and effort to recover from.

- However, the growing complexity among devices, coupled with the lack of ubiquitous legislation, could be a major matter of concern that can limit the overall market's growth throughout the forecast period.

- Since the beginning of COVID-19, there has been an increase in IoT attacks, and hence, countries worldwide have implemented several preventive measures. With communities being asked to stay at home and schools being closed, multiple organizations have found a way to allow their employees to work from their homes. This has resulted in a rise in the adoption of video communication platforms. Moreover, during the post-COVID-19 period, the market is expected to witness significant growth opportunities, especially due to the introduction of various cost-effective cloud-based and hybrid solutions by the leading major market participants.

North America IoT Security Market Trends

Increasing Number of Data Breaches is Anticipated to Drive the Market

- With the increase in the number of devices connected to the Internet, the cyber world is expected to witness a rise in the occurrence and emergence of new threats and attacks. This is evident by the growth in data breaches across the North America region in various end-user verticals over the past few years. These attacks, which directly target business systems and individuals, may potentially lead to enormous financial and personal losses. Thus fueling the need for IoT security for consumer devices that are highly susceptible to data breaches.

- Moreover, the growth in data breaches across the region in various end-user industries, such as healthcare, manufacturing, BFSI, automotive, etc., is driving the need for IoT security solutions to protect their connected devices from cyberattacks. For instance, according to the ITRC 2022 Annual Data Breach Report by Identity Theft Resource Center, the number of data compromises in the United States was 1802 cases in 2022. The number of data compromises in the United States significantly increased from 157 cases in 2005 to 1802 cases in 2022.

- Further, cloud services are experiencing high adoption rates owing to the demand for IoT. This increasing use of cloud systems across various verticals has increased the vulnerabilities of these systems to data breaches. With many providers offering multiple solutions, the need for a uniform security platform is rising. IoT security can be deployed for devices and communication, data storage, and lifecycle solutions.

- Additionally, the market is further expected to grow due to the increasing government initiatives to protect businesses from cyberattacks. For instance, in July 2023, The Biden administration launched an Internet of Things (IoT) cybersecurity labeling program to protect Americans against the myriad security risks associated with internet-connected devices. The program, "U.S. Cyber Trust Mark," aims to help Americans ensure they are buying internet-connected devices that include strong cybersecurity protections against cyberattacks.

United States is Expected to Dominate the Market

- The major crucial factors for the growth of the IoT security market in the United States are the high adoption of advanced technologies, increasing cyberattacks, and a growing number of connected devices in the country. The country is one of the dominant regions for IoT deployment. Other factors include the growth in digitalization and IoT security spending in the region.

- Moreover, the region houses significant IoT Security vendors, including Symantec Corporation, IBM Corporation, FireEye Inc., and Palo Alto Networks Inc., among others. The vendors are strengthening their product portfolio and market presence by boosting their product innovation. For instance, in March 2022, Palo Alto Networks, a provider of network firewalls, declared that it has teamed up with Amazon Web Services to unveil the new Palo Alto Networks Cloud NGFW for AWS, a managed Next-Generation Firewall (NGFW) service designed to simplify securing AWS deployments, allowing organizations to speed their pace of innovation while remaining highly secure.

- Also, in May 2022, STMicroelectronics, a global semiconductor provider serving customers across the spectrum of electronics applications, revealed the details of its collaboration with Microsoft, an ST-authorized partner. The aim was to strengthen the security of emerging Internet-of-things applications. ST is combining its ultra-low-power STM32U5 microcontrollers with Microsoft Azure RTOS & IoT Middleware as well as a certified secure implementation of the Arm Trusted Firmware -M (TF-M) secure services, especially for embedded systems.

- Moreover, the United States is experiencing an increasing number of cyber threats. According to the Identity Theft Resource Center, the average number of breaches in the country has increased marginally over the past few years. In October 2022, The Biden-Harris Administration brought a significant focus to improving the United States' cyber defenses, building a comprehensive approach to take aggressive action to strengthen and safeguard the nation's cybersecurity.

- As per GSMA Intelligence, the total number of industrial and consumer Internet of Things connections in North America is forecast to grow to around 5.4 billion by the end of the year 2025. In 2019, the total number of IoT connections in North America amounted to 2.8 billion connections. Such a significant rise in the overall count of the industrial and consumer Internet of Things connections within the region is expected to propel the market's overall growth opportunities significantly.

North America IoT Security Industry Overview

The competitive landscape of the North American IoT Security Market is characterized by fragmentation due to the presence of numerous regional players across the region. These market participants are increasingly introducing innovative solutions to cater to various industries. Furthermore, the market is experiencing a notable increase in collaborations and acquisitions aimed at enhancing its market presence.

In December 2022, Check Point Software Technologies Ltd., a cybersecurity solutions provider, unveiled Check Point Quantum Titan, an enhancement to the Check Point Quantum cyber security platform. The Quantum Titan release incorporates three software blades that harness the power of deep learning and artificial intelligence (AI) to offer advanced threat prevention against sophisticated domain name system exploits (DNS) and phishing attacks, as well as autonomous IoT security. With Check Point Quantum Titan, the platform now includes IoT device discovery and the automatic application of zero-trust threat prevention profiles to safeguard IoT devices.

In December 2022, Palo Alto Networks introduced Medical IoT Security, a comprehensive Zero Trust security solution designed for medical devices. This solution enables healthcare organizations to securely and rapidly deploy and manage new connected technologies. The zero-trust approach to cybersecurity focuses on continuously verifying every user and device, thereby eliminating implicit trust within the organization's security framework.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Breaches

- 5.1.2 Emergence of Smart Cities

- 5.2 Market Restraints

- 5.2.1 Growing Complexity among Devices, coupled with the Lack of Ubiquitous Legislation

6 MARKET SEGMENTATION

- 6.1 Type of Security

- 6.1.1 Network Security

- 6.1.2 End-point Security

- 6.2 Solution

- 6.2.1 Software

- 6.2.2 Services

- 6.3 End-user Industry

- 6.3.1 Automotive

- 6.3.2 Healthcare

- 6.3.3 Government

- 6.3.4 Manufacturing

- 6.3.5 Energy and Power

- 6.3.6 Retail

- 6.3.7 BFSI

- 6.3.8 Others End-user Industries

- 6.4 Geography

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Symantec Corporation

- 7.1.2 IBM Corporation

- 7.1.3 Check Point Software Technologies Ltd.

- 7.1.4 Intel Corporation

- 7.1.5 Hewlett Packard Enterprise Company

- 7.1.6 Cisco Systems Inc.

- 7.1.7 Fortinet Inc.

- 7.1.8 Trustwave Holdings

- 7.1.9 AT&T Inc.

- 7.1.10 Palo Alto Networks Inc.