|

市场调查报告书

商品编码

1639370

液体包装纸盒:市场占有率分析、行业趋势和成长预测(2025-2030 年)Liquid Packaging Cartons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

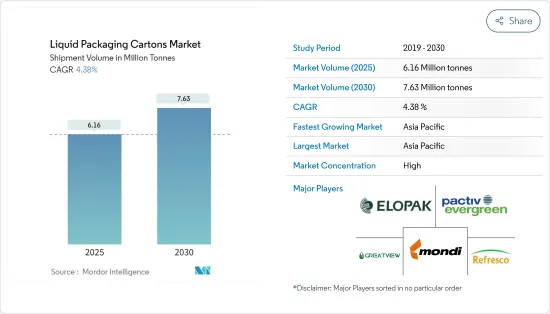

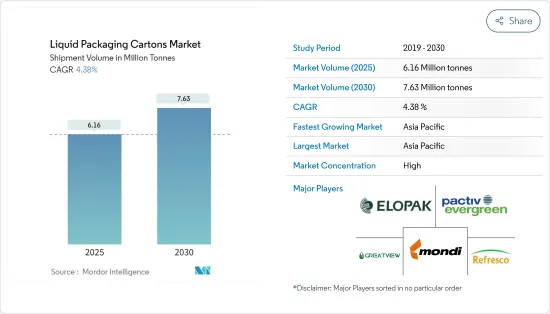

根据出以出货量为准,液体包装纸箱市场规模预计将从 2025 年的 616 万吨扩大到 2030 年的 763 万吨,预测期间(2025-2030 年)的复合年增长率为 4.38%。

市场成长的主要驱动力之一是饮料行业的成长,该行业涉及快速消费品(FMCG)的追踪、保存和安全运输和储存。消费者健康意识的增强和繁忙的日程安排导致消费者对健康的已调理食品、便携式饮料和膳食补充剂的偏好发生变化,这将成为预测期内的另一个增长动力。

主要亮点

- 随着高端、奢侈品需求的不断增长,纸箱的需求也将不断增加。纸箱的技术和设计创新,包括更好的印刷技术和生质塑胶等尖端材料的使用,正在大大提高其市场吸引力。

- 消费者和品牌对永续产品的需求正在刺激液体包装纸盒的使用增加。这种变化的推动因素包括人们环保意识的增强、减少对化石资源依赖的动力、以及材料性能和功能增强的持续技术创新。

- 随着消费者越来越意识到有机产品的好处,例如减少接触杀虫剂和其他污染物,有机饮料的需求将会飙升。消费者在选择饮料时优先考虑永续性和环境友善性,通常认为有机产品比传统产品更具永续。随着对健康和保健关注的不断提高,消费者越来越多地选择有机饮料来增强健康的生活方式。

- 永续包装正成为许多消费者购买决策的一个重要因素。随着越来越多的人意识到塑胶等材料对环境的影响,这种影响预计会越来越大。

- 原材料和能源价格上涨、对纸张收集的担忧导致再生纤维短缺以及全球供应链危机的影响日益加剧,这给造纸业带来了衝击。然而,疫情过后对液体包装纸盒市场造成影响的主要因素包括对价值链各阶段的影响,其中包括工业层面的劳动力、原料供应、以及各个网点的饮料需求不确定等。

液体包装纸箱市场趋势

液态奶市场占有率

- 由于牛奶(包括巴氏杀菌牛奶和调味牛奶)消费量的增加,盒装牛奶市场正在经历强劲成长。这种成长的动力源自于快速成长的富裕消费群体,以及对适合当今快节奏生活方式的便利、健康选择日益增长的需求。人们对牛奶健康益处的认识不断提高,进一步刺激了对牛奶的需求。印度、美国和中国等国家的各种牛奶消费量均显着增加,包括巴氏杀菌奶、超高温牛奶、调味奶、混合奶和无乳糖牛奶。

- 根据美国农业部的资料,美国原乳产量预计将小幅增加,从 2023 年的 2,266 亿磅增加到 2024 年的 2,282 亿磅。根据美国农业部对外农业服务局的数据,到2023年,印度的牛奶消费量将达到8,745.5万吨,位居世界首位。

- 随着牛奶产量和消费量不断增加,纸盒包装提供了创新的潜力。这些进步包括增强的阻隔技术以延长保质期、用户友好功能以增加便利性以及环保倡议以减少对环境的影响——所有这些都为乳製品生产商和消费者提供了同样的服务。

- 包装製造商(包括生产牛奶纸盒的製造商)越来越多地采用数位化联网包装。这种转变将促进销售,提高消费者参与并加深消费者理解。

- 例如,利乐国际公司强调,利乐互联包装将加速企业的数位转型。为每种包装产品创建和管理独特的数位身分使企业能够利用消费者参与解决方案。

预计亚太地区市场将大幅成长

- 过去二十年,受永续性理念、技术创新和诱人的经济因素推动,中国液体包装市场显着成长。随着消费者对包装的认知和互动不断演变,中国供应商正在转向永续性。

- 这种转变正在推动从传统的硬包装解决方案转向创新的、环保的纸板纸盒的转变。人们对使用者友善包装和增强产品保护的需求日益增长,凸显了液体包装作为可行、经济高效的替代方案的重要性。

- 液体包装纸箱可确保内容物的安全、防止污染并延长产品保存期限。食用液体(牛奶、果汁、番茄酱)、软性饮料、水等皆采用液体包装纸箱包装。牛奶纸盒保存期限较长,污染风险较低。预计液体包装的消费量将比过去十年增长更快,因为纸盒在使用后更容易重新封闭。

- 日本的液体包装纸盒常用于牛奶、果汁等产品。这些纸箱延长了产品的保质期并确保了新鲜度。对环保包装的需求日益增长,推动了创新,产生了由可回收和生物分解性材料製成的纸箱。

- 日本市场对包装和即饮饮料的偏好日益增长,这一细分市场的成长凸显了人们对于便捷、便携包装解决方案的普遍趋势。

- 受牛奶、果汁和其他各种饮料消费等关键因素的推动,印度对液体包装的需求正在上升。

液体包装纸箱产业概况

液体包装纸盒市场趋于整合,由 Elopak、Mondi Group 和 Tetra Pak 等老牌公司营运。设计、技术和应用的创新可以为企业带来永续的竞争优势。据观察,市场现有企业透过伙伴关係活动、重视研发和创新活动采取适度的竞争策略。预计製造能力将随着这些趋势而变化,从而导致竞争公司之间的竞争加剧。

产品创新可以提供永续的竞争优势。由于许多参与者将这个市场视为增强其产品供应的有利机会,因此预计预测期内企业集中度将进一步提高。

该市场具有中等程度的退出障碍、较高的品牌偏好度和中等程度的广告支出。总体而言,竞争对手之间的敌意预计会很高。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 新进入者的威胁

- 竞争对手之间的竞争强度

- 疫情对市场的影响

第五章 市场动态

- 市场驱动因素

- 对环保包装的需求不断增加

- 有机产品饮料的需求不断增加

- 市场限制

- 来自玻璃和塑胶包装等替代品的竞争

第六章 市场细分

- 按液体类型

- 牛奶

- 汁

- 机能饮料

- 其他液体类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 北美洲

第七章 竞争格局

- 公司简介

- Elopak AS

- Pactiv Evergreen Inc.

- Mondi PLC

- Greatview Aseptic Packaging Co. Ltd

- Refresco Group

- Rotopacking Materials Ind. Co. LLC

- SIG Global Pte. Ltd

- Tetra Pak International SA

- Nippon Paper Industries Co. Ltd

- UFlex Limited

- Lami Packaging(Kunshan)Co. Ltd

第八章投资分析

第九章:市场的未来

The Liquid Packaging Cartons Market size in terms of shipment volume is expected to grow from 6.16 million tonnes in 2025 to 7.63 million tonnes by 2030, at a CAGR of 4.38% during the forecast period (2025-2030).

One of the main factors contributing to market growth is the growing beverage industry, which tracks, conserves, and ensures the safe transit and storage of fast-moving consumer goods (FMCG). With growing health awareness and busy schedules, consumers' shifting preferences for healthy ready-to-eat (RTE), on-the-go drinks, and dietary supplements are expected to function as another growth-inducing element during the forecast period.

Key Highlights

- As premium and luxury products surge in demand, so does the demand for cartons, often linked to these high-end offerings. Technological and design innovations in cartons, including superior printing techniques and the adoption of cutting-edge materials like bioplastics, have significantly boosted their market appeal.

- Consumer and brand demand for sustainable products is fueling the rise in liquid packaging carton usage. This shift stems from heightened environmental awareness, a push to reduce reliance on fossil resources, and ongoing innovations in materials boasting enhanced properties and functionalities.

- The demand for organic beverages surges as consumers become more aware of the advantages of organic products, such as reduced exposure to pesticides and other contaminants. Consumers prioritize sustainability and eco-friendliness in their beverage choices, often viewing organic products as more sustainable than their conventional counterparts. With a heightened focus on health and wellness, consumers increasingly turn to organic beverages to bolster their healthy lifestyles.

- Sustainable packaging is increasingly becoming a significant factor in many consumers' purchasing decisions. This level of influence is expected to increase further as more people become aware of the environmental impacts of materials such as plastic.

- Rising raw material and energy prices, shortages of recycled fibers due to concerns over wastepaper recovery, and the growing influence of the global supply chain crisis impacted the paper industry. However, the key factors that affected the liquid packaging cartons market after the pandemic include the impact on each stage of its value chain, including the workforce at an industrial level, raw material supply, and uncertain beverage demand at different outlets.

Liquid Packaging Cartons Market Trends

Milk Liquid Type Segment Holds Significant Market Share

- The milk carton packaging market is experiencing robust growth, fueled by rising milk consumption, including pasteurized and flavored varieties. This uptick is attributed to a burgeoning affluent consumer base and an escalating demand for convenient, health-conscious choices, a response to today's fast-paced lifestyles. A heightened awareness of milk's health benefits further spurred its demand. Countries like India, the United States, and China are witnessing a notable uptick in the consumption of diverse milk types, from pasteurized and UHT to flavored, recombined, and lactose-free variants.

- Data from the US Department of Agriculture indicates a slight uptick in US milk production, projecting 228.2 billion pounds in 2024, up from 226.6 billion pounds in 2023. The USDA Foreign Agricultural Service reports that India led global fluid cow milk consumption in 2023, tallying 87,455 thousand metric tons.

- As milk production and consumption continue to rise, there is a potential for innovation in carton packaging. Such advancements could cater to the unique demands of dairy producers and consumers, encompassing enhanced barrier technologies for extended shelf life, user-friendly features for convenience, and eco-friendly initiatives to mitigate environmental impact.

- Packaging manufacturers, including those producing milk cartons, are increasingly adopting digitally connected packaging. This shift will boost sales, enhance consumer engagement, and deepen their understanding of consumers.

- For instance, Tetra Pak International SA emphasizes that its Tetra Pak Connected Package facilitates businesses' digital transformation. Creating and managing unique digital identities for every packaged product enables businesses to leverage consumer engagement solutions akin to practices long adopted by various industries: establishing direct connections with consumers for deeper insights.

Asia-Pacific Expected to Witness Significant Growth in the Market

- Over the past two decades, China has witnessed remarkable growth in liquid packaging, driven by sustainability concerns, technological innovations, and appealing economic factors. As consumer perceptions and interactions with packaging evolve, vendors in China are pivoting toward sustainability.

- This shift has led to a move from traditional rigid packaging solutions to innovative and eco-friendly paperboard carton packaging. The rising demand for user-friendly packaging and enhanced product protection highlights the growing prominence of liquid packaging as a viable and cost-effective alternative.

- Liquid packaging cartons provide content safety and protection from contaminants, prolonging the product's shelf life. Edible liquids (milk, juice, tomato sauce), soft drinks, water, etc., are packaged in liquid packing cartons. The shelf life of milk cartons is longer, and the risk of contamination is lower. Due to the ease of re-closing the cartons after use, the consumption of liquid packing containers is expected to grow faster than in the last decade.

- Japan's liquid packaging cartons are the go-to for items like milk juices. These cartons extend product shelf life and ensure freshness. The rising demand for eco-friendly packaging has spurred innovations, resulting in cartons made from recyclable and biodegradable materials.

- As the Japanese market witnesses a growing preference for packaged and ready-to-drink beverages, this segment's expansion highlights a broader trend toward convenient and portable packaging solutions.

- In India, the demand for liquid cartons is on the rise, fueled by critical factors such as the consumption of milk, fruit juices, and various other beverages, and so does the demand for liquid cartons.

Liquid Packaging Cartons Industry Overview

The liquid packaging carton market is consolidated, with incumbents like Elopak, Mondi Group, and Tetra Pak operating. Design, technology, and application innovation may give companies a sustainable competitive advantage. The market incumbents have been identified to adopt moderate competitive strategies through partnership activities, emphasis on R&D, and innovative activities. Manufacturing capability is expected to shift toward such trends, strengthening the competitive rivalry.

Product innovation may bring about a sustainable, competitive advantage. The firm concentration ratio is expected to grow more during the forecast period as several players consider this market a lucrative opportunity to consolidate their product offerings.

The market has a moderately high level of barriers to exit, a high preference for established brands, and a moderate level of advertising expense. Overall, the competitive rivalry is expected to be high.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of Substitutes

- 4.3.4 Threat of New Entrants

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of the Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Eco-friendly Packaging

- 5.1.2 Growing Demand for Organic Product-based Beverages

- 5.2 Market Restraints

- 5.2.1 Competition from Substitutes, such as Glass and Plastic Packaging

6 MARKET SEGMENTATION

- 6.1 By Liquid Type

- 6.1.1 Milk

- 6.1.2 Juices

- 6.1.3 Energy Drinks

- 6.1.4 Other Liquid Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.5 Middle East & Africa

- 6.2.5.1 United Arab Emirates

- 6.2.5.2 Saudi Arabia

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Elopak AS

- 7.1.2 Pactiv Evergreen Inc.

- 7.1.3 Mondi PLC

- 7.1.4 Greatview Aseptic Packaging Co. Ltd

- 7.1.5 Refresco Group

- 7.1.6 Rotopacking Materials Ind. Co. LLC

- 7.1.7 SIG Global Pte. Ltd

- 7.1.8 Tetra Pak International SA

- 7.1.9 Nippon Paper Industries Co. Ltd

- 7.1.10 UFlex Limited

- 7.1.11 Lami Packaging (Kunshan) Co. Ltd