|

市场调查报告书

商品编码

1639373

环氧乙烷:市场占有率分析、产业趋势、成长预测(2025-2030)Ethylene Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

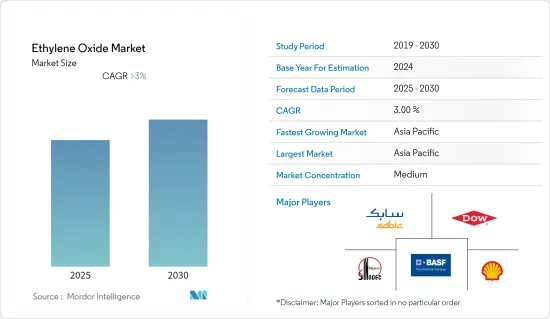

预计环氧乙烷市场在预测期内将维持3%以上的复合年增长率。

2020 年市场受到 COVID-19 的负面影响。全球美容和个人护理行业受到 COVID-19 大流行的严重影响。儘管业界重组从事干洗手剂和清洗产品的生产,但销量下降幅度较大。预计该行业需求将在2021年復苏,并在未来几年保持适度增长。

主要亮点

- 短期来看,PET在食品和饮料行业的使用不断增加,新兴国家对家庭和个人保健产品的需求不断增加,以及防冻剂的需求不断增长是推动市场的关键因素。

- 然而,高暴露对健康和环境的影响可能会阻碍市场成长。

- 在生产中使用生物基乙烯而不是石油基乙烯可能是所研究市场的一个机会。

- 预计亚太地区在预测期内将拥有最高的市场占有率和最快的成长速度。

环氧乙烷市场趋势

纺织业需求增加

- 纺织业是环氧乙烷的主要最终用户产业,其衍生物用作某些化合物的前体,这些化合物提供耐久压榨、氨纶纤维的光稳定性、羊毛的防缩、抗静电、驱虫性能等。

- 印度、中国、美国是世界主要纺织品製造国。由于需求增加、投资扩大和基础设施改善,该领域的需求在预测期内可能会增加。

- 2022 年 5 月,印度在德里 NIFT 启动了 CoEK(卡迪布卓越中心),生产创新面料和服装。其目标是透过引进新设计和采用国际标准来满足国内外消费者的需求。

- 中国是世界领先的纺织品生产国和出口国之一。 2022年10月,我国纺织品产量31.8亿公尺。

- 2022年1月至2022年10月,美国向欧盟出口纺织服饰产品18,0393万美元,向东东南亚国协出口5,0,986万美元。

- 因此,预计所有上述因素都将对预测期内的市场成长产生重大影响。

亚太地区主导市场

- 亚太地区目前主导全球环氧乙烷市场。亚太地区环氧乙烷及其衍生物的主要消费国为中国。

- 亚太地区也是最大的界面活性剂消费国和生产国。产量已达到高水平,成为向美国等已开发国家出口化妆品和个人保健产品的主要基地。

- 中国纺织业是其主要产业之一,也是世界上最大的服饰出口国。 2022年上半年,纺织品服饰出口额与前一年同期比较增加10%。

- 我国是PET树脂生产大国,中油集团和江苏桑芳祥是全球产量最大的生产商,产能超过200万吨。因此,终端用户产业对 PET 的需求不断增长正在推动环氧乙烷需求。

- 该地区也是全球最大的汽车製造地,占据全球近60%的市场。根据OICA统计,2021年汽车产量为2,608万辆,与前一年同期比较成长3%。

- 为了鼓励印度曼尼普尔邦织工的发展,亚马逊印度公司于 2022 年 6 月与曼尼普尔手织机和手工艺品发展公司签署了谅解备忘录。

- 因此,由于上述因素,亚太地区很可能在预测期内确认最高的市场占有率。

环氧乙烷产业概况

环氧乙烷市场部分整合。该市场的主要企业包括(排名不分先后)壳牌公司、中国石化集团公司、陶氏化学公司、沙乌地阿拉伯基础工业公司和BASF。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大 PET 在食品和饮料行业的使用

- 新兴国家对家庭和个人保健产品的需求增加

- 抑制因素

- 高暴露对健康和环境的影响

- 价值链分析

- 波特五力

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 衍生性商品

- 乙二醇

- 单乙二醇 (MEG)

- 二伸乙甘醇(DEG)

- 三甘醇 (TEG)

- 乙氧基化物

- 乙醇胺

- 乙二醇醚

- 聚乙二醇

- 其他衍生性商品

- 乙二醇

- 最终用户产业

- 车

- 农药

- 饮食

- 纤维

- 个人护理

- 药品

- 清洁剂

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- BASF SE

- China Petrochemical Corporation

- Clariant

- Dow

- India Glycols Limited.

- INEOS

- LOTTE Chemical Corporation

- LyondellBasell Industries Holdings BV

- NIPPON SHOKUBAI CO., LTD.

- Reliance Industries Limited.

- Shell plc

- SABIC

- Sasol

第七章市场机会与未来趋势

- 生物基乙烯与石油基乙烯在生产上的利用

The Ethylene Oxide Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. The global beauty and personal care industry has been significantly affected by the COVID-19 pandemic. Though the industry has restructured itself to engage in the production of hand sanitizers and cleaning agents, however, the drop in sales has been significant. The demand from the industry has recovered in 2021 and is likely to grow at a moderate rate in the coming years.

Key Highlights

- Over the short term, the major factors driving the market are the growing usage of PET in the food and beverage industry, increasing demand for household and personal care products in developing countries, and growing demand for antifreeze agents.

- However, the health and environmental effects of high exposure can hinder market growth.

- Using bio-derived ethylene over petro-based ethylene for production can act as an opportunity for the market studied.

- The Asia-Pacific region is expected to witness the highest market share and fastest growth during the forecast period.

Ethylene Oxide Market Trends

Increasing Demand from the Textile Industry

- The textile industry is a major end-user industry for ethylene oxide as the derivatives are used for the treatment of a wide variety of natural and synthetic fibers, as precursors for certain compounds providing durable press, light stabilization of spandex fibers, shrink-proofing wool, static prevention, and mothproofing, among others.

- India, China, and United States represent major textile manufacturing countries in the world. With rising demand, growing investments, and improved infrastructure facilities, the demand from the sector is likely to increase in the forecast period.

- In May 2022, the Center of Excellence for Khadi (CoEK) at NIFT in Delhi was inaugurated in India to produce innovative fabrics and apparel. The aim is to meet the needs of both domestic and foreign consumers by introducing new designs and adopting international standards.

- China is one of the largest producers and exporters of textiles in the world. In October 2022, textile production in China was 3.18 billion meters.

- The United States exported USD 1,803.93 Million worth of textiles and apparel to the European Union while the exports to the ASEAN countries were worth USD 509.86 million from January 2022 to October 2022.

- Thus, all the above-mentioned factors are expected to show a significant impact on the market growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global ethylene oxide market currently. China accounts for the major consumption of ethylene oxide and its derivatives in the Asia-Pacific region.

- Asia-Pacific has also become the largest consumer and producer of surfactants. The production has reached very high levels, becoming a major hub for the exporting of cosmetics and personal care products to developed nations, such as the United States.

- China's textile industry is one of the major industries, and the country is the largest clothing exporter across the world. In the first half of 2022, the export value of textiles and apparel increased by 10% compared to the previous year.

- China is a major producer of PET resins with the PetroChina Group and Jiangsu Sangfangxiang among the largest global manufacturers in terms of volume, with capacities of more than 2 million tons. Thus, the rising demand for PET from end-user industries is driving the demand for ethylene oxide.

- Also, the region is the largest automotive manufacturing hub, registering almost 60% share of the world. According to OICA, in the year 2021, the total production of vehicles stood at 26.08 million units registering an increase of 3% compared to the previous year.

- To encourage the development of weavers and artisans in Manipur, India, Amazon India signed an MoU with Manipur Handloom and Handicrafts Development Corporation Limited in June 2022.

- Hence, owing to the above-mentioned factors, Asia-Pacific is likely to witness the highest market share during the forecast period.

Ethylene Oxide Industry Overview

The ethylene oxide market is partially consolidated in nature. Some of the key players in the market include Shell plc, China Petrochemical Corporation, Dow, SABIC, and BASF SE (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of PET in the Food and Beverage Industry

- 4.1.2 Increasing Demand for Household and Personal Care Products in the Developing Countries

- 4.2 Restraints

- 4.2.1 Health and Environmental Effects over High Exposure

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Derivative

- 5.1.1 Ethylene Glycols

- 5.1.1.1 Monoethylene Glycol (MEG)

- 5.1.1.2 Diethylene Glycol (DEG)

- 5.1.1.3 Triethylene Glycol (TEG)

- 5.1.2 Ethoxylates

- 5.1.3 Ethanolamines

- 5.1.4 Glycol Ethers

- 5.1.5 Polyethylene Glycol

- 5.1.6 Other Derivatives

- 5.1.1 Ethylene Glycols

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Agrochemicals

- 5.2.3 Food and Beverage

- 5.2.4 Textile

- 5.2.5 Personal Care

- 5.2.6 Pharmaceuticals

- 5.2.7 Detergents

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 China Petrochemical Corporation

- 6.4.3 Clariant

- 6.4.4 Dow

- 6.4.5 India Glycols Limited.

- 6.4.6 INEOS

- 6.4.7 LOTTE Chemical Corporation.

- 6.4.8 LyondellBasell Industries Holdings B.V.

- 6.4.9 NIPPON SHOKUBAI CO., LTD.

- 6.4.10 Reliance Industries Limited.

- 6.4.11 Shell plc

- 6.4.12 SABIC

- 6.4.13 Sasol

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage of Bio-derived Ethylene over Petro-based Ethylene for Production