|

市场调查报告书

商品编码

1639375

模组化 UPS -市场占有率分析、行业趋势/统计、成长预测 (2025-2030)Modular UPS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

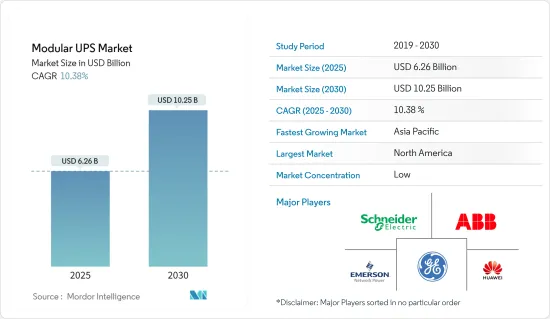

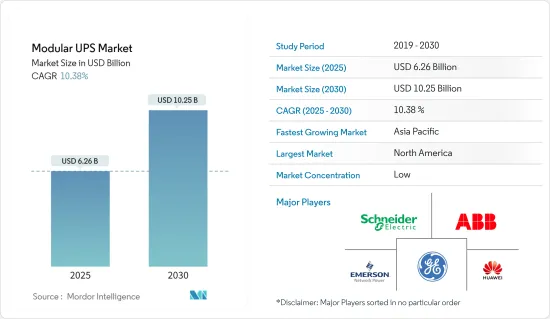

模组化UPS市场规模预计到2025年为62.6亿美元,预计到2030年将达到102.5亿美元,预测期内(2025-2030年)复合年增长率为10.38%。

在通常需要 100% 可用性的资料中心中,电源故障可能会导致资料遗失、关键服务缺失、硬体风险和重大财务损失。因此,资料中心对UPS的需求量很大,以确保持续供电并降低系统故障的风险。由于大规模应用程式和对云端服务依赖的增加,主机託管服务的需求不断增加,为模组化UPS产业提供了新的前景。

主要亮点

- 模组化不断电系统(UPS) 是一种弹性且适应性强的电源保护系统,可调整 UPS 的效能。这些模组可热插拔,并在连接时自动识别。该产品的零功耗停机时间、可靠和稳健的实施预计将提高其采用率。模组化 UPS 系统在需要为重要基础设施提供可靠电力的企业中越来越受欢迎。

- 对新技术进步的需求不断增加,包括云端运算采用、资料储存需求、数位服务、监管要求、不断增长的用户群以及跨区域业务可扩展性。

- 模组化不断电系统(UPS) 系统的主要优点是可扩充性和降低维护成本。超大规模资料中心和託管供应商正在采用模组化 UPS 技术并采用各种架构来最大限度地降低营运成本并保持冗余容量。由于与多个并联 UPS 系统相比,N+1 设计提供了经济高效的冗余、卓越的负载和效率,因此许多组织选择支援 10 kV-A 至 50kVA Select 的较小模组。同时,2N设计保证了精确的负载匹配。

- 模组化系统描述了一种简化且更易于管理的维护方法。这些模组设计为可热插拔,允许在系统保持运作的情况下无缝拆卸、更换和测试。模组化UPS系统的功率容量为10-100kVA、100-250kVA、215kVA及500kVA以上。这些系统广泛应用于不同领域,包括资料中心、工业、通讯、商业、工业、政府和其他垂直领域。

- 然而,模组化 UPS 系统的初始安装成本通常超过传统集中式 UPS 解决方案。儘管模组化方法提供了可扩展性和适应性,但对于注重预算的客户来说,初始资本投资可能会令人望而却步,尤其是财务资源有限的中小型企业和组织。

- 模组化不断电系统UPS 市场受到了 COVID-19 大流行的负面影响。模组化UPS市场的发展受到大规模政府、能源和工业企业倒闭的显着影响。

模组化UPS市场趋势

BFSI 部门确认成长

- 对于投资公司、银行和保险公司等金融机构来说,关键应用至关重要,因为不能容忍因断电造成的中断和资料遗失。三相模组化不断电系统用于保护敏感的金融和银行系统免受电源故障的影响。

- 由于各个行业,特别是金融服务、银行和保险行业的快速现代化和互联网的广泛使用,以及需要各种资料处理和服务系统来提供最高水平的客户服务,对模组化UPS系统的需求不断增加它是透过与商业银行的联繫来推动的。

- 此外,市场成长的关键驱动力之一是金融业需要保持在技术和业务的前沿,否则就有被竞争对手超越的风险。为了减少非法交易并增加全球电子货币、技术和网路资料安全的使用,各国政府正在计划在网路银行的使用方面进行创新。

- 截至2023年6月,中国约有9.43亿人使用行动付款。由于COVID-19的爆发,自2017年以来新用户的成长率开始下降。

- 上述应用的存在以及政府对发展无现金经济国家的支持相信将为市场成长提供充足的机会。

北美占据模组化 UPS 市场最大份额

- 由于 IT/通讯和医疗製造领域的高需求,预计北美将占据模组化 UPS 市场的最大份额。这些组织拥有庞大的营运基地,对资料中心和託管服务的需求不断增长,混合 UPS 解决方案的需求也不断增长。

- 此外,由于 IT 的发展以及对电子商务和数位付款的兴趣增加,美国各地对持续供电的资料中心的需求不断增加,推动了模组化 UPS 的普及。此外,由于对资料和资产被盗的担忧日益增加,当局正在进行定期检查,这有助于市场成长。

- 近年来,拉丁美洲越来越受欢迎。在该地区,乐透、巨量资料、人工智慧等尖端技术正变得越来越普及。该领域的云端使用也在加速。

- 除了建立微电网和本地发电外,营运商还购买冗余电力基础设施(例如 UPS 系统)为其设施供电,为系统製造商创造收入并推动市场向前发展。

模组化UPS产业概况

模组化 UPS 市场高度细分,参与者众多,包括 ABB Ltd、艾默生网路能源、Delta Power Solutions、华为技术、施耐德电气、通用电气和 Gamatronic Electronic Industries Ltd。这表示市场集中度较低。

- 2023 年 7 月 - ABB Ltd. 在印度推出 MegaFlex DPA(分散式并行架构)UPS 解决方案。 ABB的MegaFlex UPS产品线面向UL和IEC市场,功率范围为1.6 MW和1.5 MW。 MegaFlex 解决方案提供卓越的可用性和可靠性,同时提供市场上最小的占地面积,IEC 版本比具有相同额定功率的竞争产品小多达 45%。

- 2023 年 7 月 - 施耐德电机推出 Easy UPS 三相模组化。这款坚固耐用的不断电系统(UPS) 旨在保护关键负载,并具有经过第三方检验的即时插拔功能。 Easy UPS 三相模组的容量为 50 至 250kW,采用 N+1 可扩展配置,并支援用于远端监控服务的 EcoStruxureTM 架构。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 託管和云端服务高速成长

- 低拥有成本和营运成本

- 市场限制因素

- 对资料中心以外的用途缺乏认识

第六章 市场细分

- 按电源容量

- 0~50kVA

- 51~100kVA

- 101~300kVA

- 301kVA以上

- 按最终用户

- 资料中心

- 工业的

- 通讯

- 商业的

- BFSI

- 政府/基础设施

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- ABB Ltd

- Emerson Network Power

- Huawei Technologies Co. Ltd

- Schneider Electric SE

- General Electric

- Delta Electronics Inc.

- AEG Power Solutions

- Riello Elettronica Group

- Eaton Corporation

第八章投资分析

第九章 市场机会及未来趋势

The Modular UPS Market size is estimated at USD 6.26 billion in 2025, and is expected to reach USD 10.25 billion by 2030, at a CAGR of 10.38% during the forecast period (2025-2030).

Data losses, lack of key services, hardware risks and significant financial loss may result from power disturbances in data centers that typically require 100% availability. Therefore, in order to ensure continuous power supply and reduce the risk of system failure, there is a high demand for UPSs in data centers. As a result of the growing reliance on large-scale applications and cloud services, demand for colocation services has increased, offering new prospects for the modular UPS industry.

Key Highlights

- The modular uninterruptible power supply (UPS) is a resilient and adaptable power protection system that regulates UPS performance. The modules are hot-swappable and automatically recognized when connected. The product's adoption is expected to be strengthened by its robust implementation of zero and dependable power downtime. Modular UPS systems are becoming more prevalent among companies that require a dependable power source for their essential infrastructure.

- There has been a growing demand for new technology advancements, such as cloud computing adoption, data storage needs,digital services, regulatory requirements, expanding user base, and business scalability across regions.

- The primary benefits of a modular uninterruptible power supply (UPS) system lie in its capacity for scalable expansion and decreased maintenance expenses. Hyperscale data centers and colocation providers employ modular UPS technology, employing various architectures to minimize operational costs and maintain redundant capacity. Many organizations opt for smaller modules supporting 10-kilovolt amperes to 50 kVA, as N+1 designs offer cost-effective redundancy, superior loading, and efficiency compared to multiple parallel UPS systems. Meanwhile, 2N designs ensure precise load matching.

- Modular systems offer a simplified and more manageable approach to maintenance. The modules are designed to be hot-swappable, allowing for seamless removal, replacement, and testing while the system remains operational. Modular UPS systems have power capacities ranging from 10-100 kVA, 100-250 kVA, 215 kVA, and 500 kVA and above. These systems are widely utilized in diverse sectors, including data centers, industries, telecommunications, commercial, BFSI, government, and other verticals.

- Moroever, the initial installation expenses associated with modular UPS systems typically exceed those of conventional centralized UPS solutions. Although the modular approach provides scalability and adaptability, the upfront capital investment may dissuade budget-conscious clients, particularly those in smaller enterprises or organizations with limited financial resources.

- The modular uninterruptible power supplyUPS market has been negatively affected by the COVID 19 pandemic. The development of the modular UPS market has been greatly influenced by the closure of large government, energy and industrial undertakings.

Modular UPS Market Trends

BFSI Segment to Witness the Growth

- Critical applications that can't be interrupted or data lost due to power failures are critical for financial institutions as investment firms, banks and insurance companies. In order to protect sensitive financial and banking systems from power disturbances, three phases of modular uninterruptible power supplies are used.

- The demand for modular UPS systems has been driven by rapid modernisation and the widespread use of the internet in various sectors, especially in the financial services, banking, and insurance sector, as different data processing and service systems are connected to commercial banks to provide the highest level of customer service.

- Moreover, The one of the main driver for the growth of the market is also the need for the financial sector to remain at the forefront of technology and business or risk being outpaced by its competitors. In order to reduce illegal transactions and to increase the use of electronic cash, technology and internet data security across the world and governments are planning innovation in the use of internet banking.

- As of June 2023, around 943 million people used mobile payments in China as of usage of electronic cash. . The outbreak of COVID-19 has led to an increase in the number of new users, as growth rates for new users have begun to decline after 2017.

- The presence of these above-mentioned applications and government support to develop cashless economy will provide ample opportunities for the growth of the market.

North America Holds the Largest Share in Modular UPS Market

- The market for modular UPS is estimated to be dominated by North America, due to high demand from the IT and telecommunications sectors, as well as health care and manufacturing. These organisations have significant operational bases, increasing the demand for data centres and colocation services as well as an increased need for hybrid UPS solutions.

- Moreover, The demand for data centers, which must be constantly supplied with power, is increased by the development of IT and a rising interest in e Commerce and digital payments across America, making modular UPS more popular. Moreover, regular checks which contribute to market growth are being carried out by the authorities in view of an increasing concern for data and asset theft.

- Latin America has grown in popularity in recent years. Advanced technologies such as lot, big data, and AI are becoming more popular in the region. Cloud use is also accelerating in this sector.

- In addition to establishing microgrids and local power generation, operators purchase redundant power infrastructure, such as UPS systems, to power their facilities, generating income for system makers and propelling the market forward.

Modular UPS Industry Overview

The Modular UPS market is highly fragmented, with a large number of players that includes ABB Ltd, Emerson Network Power, Delta Power Solutions, Huawei Technologies Co. Ltd, Schneider Electric SE, General Electric, Gamatronic Electronic Industries Ltd, and others. This implies that the market concentration is low.

- July 2023 - ABB Ltd announced the launch of MegaFlex DPA (Decentralized Parallel Architecture) UPS solutions in India. ABB's MegaFlex UPS line is aimed at the UL and IEC markets, with a power range of 1.6 and 1.5 MW. The MegaFlex solution provides exceptional availability and dependability while having the smallest footprint on the market, with the IEC version being up to 45 percent less than competitor products of the same power rating.

- July 2023 - Schneider Electric has introduced Easy UPS 3-Phase Modular. This robust uninterruptible power supply (UPS) is designed to protect critical loads while offering third-party verified Live Swap functionality. Easy UPS 3-Phase Modular available in 50-250 kW capacity with N+1 scalable configuration and supports the EcoStruxureTM architecture, which offers remote monitoring services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High growth in Colocation and Cloud Services

- 5.1.2 Low Cost of Ownership and Operations

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness Amongst Non-data Center Applications

6 MARKET SEGMENTATION

- 6.1 By Power Capacities

- 6.1.1 0 - 50 kVA

- 6.1.2 51 - 100 kVA

- 6.1.3 101 - 300 kVA

- 6.1.4 301- Above kVA

- 6.2 By End User

- 6.2.1 Data Centers

- 6.2.2 Industrial

- 6.2.3 Telecommunication

- 6.2.4 Commercial

- 6.2.5 BFSI

- 6.2.6 Government/Infrastructure

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Germany

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Emerson Network Power

- 7.1.3 Huawei Technologies Co. Ltd

- 7.1.4 Schneider Electric SE

- 7.1.5 General Electric

- 7.1.6 Delta Electronics Inc.

- 7.1.7 AEG Power Solutions

- 7.1.8 Riello Elettronica Group

- 7.1.9 Eaton Corporation