|

市场调查报告书

商品编码

1639376

西班牙可再生能源:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Spain Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

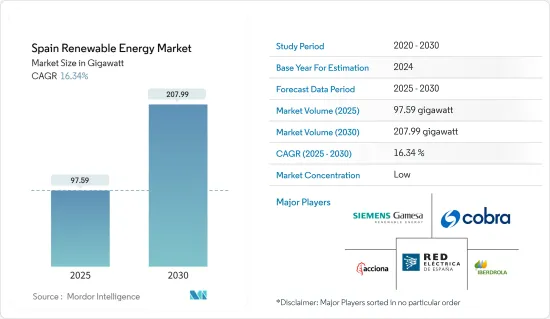

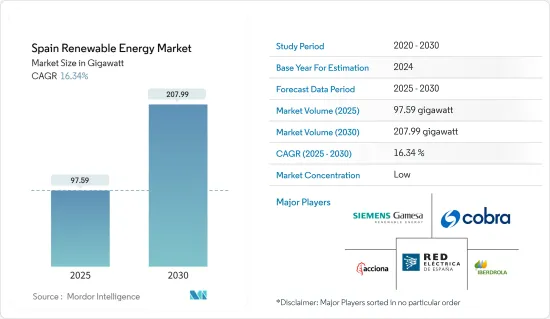

西班牙可再生能源市场规模预计到2025年为97.59吉瓦,预计2030年将达到207.99吉瓦,预测期间(2025-2030年)复合年增长率为16.34%。

市场受到 COVID-19 爆发的负面影响,导致计划因区域停工和供应链中断而延误。目前,市场已达到疫情前水准。

主要亮点

- 西班牙的可再生能源市场预计在未来几年将出现强劲成长。这一增长的两个关键因素是有利的天气条件以及国家和区域论坛筹集的大量资金。

- 然而,由于发电灵活性问题,市场面临瓶颈,因为再生能源不像其他传统燃料那样提供短期灵活性,而是需要长期备用计划。

- 该国计划在2035年完全淘汰核能发电和燃煤发电。国家能源计画中的碳排放目标正在将核能排除在能源结构之外。 7座核能发电厂中,有4座已计画在2030年关闭,2030年核能比例将达7%左右,高于2020年的22%。这项倡议预计将为再生能源能源市场带来充足的机会。

西班牙可再生能源市场趋势

风能技术可望主导市场

- 近年来,国际论坛和私人企业对西班牙风电技术进行了大量投资,风电发电份额迅速增加。截至2022年,风力发电将占该国可再生能源发电的约43%。

- 根据西班牙政府2021年发布的国家综合能源和气候计划,预计到2030年风力发电机装置容量将增加一倍以上。许多海上和陆上计划正在排队,以加速西班牙的风电生产。

- 根据Red Electrica预计,2022年西班牙累积风电装置容量将达29,729兆瓦,年增率约4%。随着新风发电工程的增加,对风力发电的需求预计将增加,这将在预测期内推动市场。

- 2023 年 2 月,雷普索尔开始在西班牙卡斯蒂利亚莱昂的第一个可再生能源发电计划PI 生产清洁能源。 PI计划包含7个风电场,总设备容量175MW。

- 随着这些发展,风力发电预计将主导西班牙的可再生能源发电市场。

政府法规和政策可能带动市场

- 西班牙政府宣布了多项计划和措施,以促进发电领域的可再生能源成长。由于这些倡议和计划投资,到 2021 年,可再生能源将占总发电量的约 42%。

- 根据国际可再生能源机构的数据,2022年西班牙可再生能源总设备容量为67,909兆瓦,较2021年成长9.05%。由于政府对可再生能源的支持措施,可再生能源装置容量预计将继续增加。

- 例如,为了遵守欧盟法规并实现国家温室气体排放(GHG)减排目标,西班牙政府通过了2021-2030年国家能源与气候综合计画(PNACC)。该十年计画旨在透过减少电力、交通和工业部门的温室气体排放总量来实现碳中和。

- 2021年12月,西班牙政府核准了支持可再生能源计划的公私融资措施,希望快速实现绿色能源转型。根据该计划,政府已拨款超过77.7亿美元公共资金用于创新绿色能源技术。

- 2022年7月,西班牙生态学转型和人口挑战部(MITECO)REER宣布了第三次和第四次可再生能源竞标。西班牙国家综合能源和气候计画(PNIEC)的目标是可再生能源发电可再生能源发电西班牙74%的电力,并计划目前每3吨温室气体排放减少1吨。据 MITECO 称,REER竞标是其到 2030 年实现这些目标的计划的关键要素。

- 此类政府措施预计将在未来几年推动市场成长。

西班牙可再生能源产业概况

西班牙可再生能源市场适度细分。主要企业包括(排名不分先后)Siemens Gamesa Renewable Energy SA、Acciona SA、Iberdrola SA、Cobra Group 和 Red Electrica Corporation SA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 可再生能源结构(2022)

- 可再生能源装置容量及预测至2028年(单位:GW)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 增加太阳能和风力发电的采用

- 政府支持措施和宏伟目标

- 抑制因素

- 可再生能源併入主电网

- 促进因素

- 供应链分析

- PESTLE分析

第五章 按技术细分市场

- 水力发电

- 风力

- 阳光

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Siemens Gamesa Renewable Energy SA

- Acciona SA

- Iberdrola SA

- Cobra Group

- Red Electrica Corporacion SA

- Saclima Solar Fotovoltaica SL

- Tudela Solar SL

- IM2 Systems SLU

- JinkoSolar Holding Co. Ltd

- Solaria Energia y Medio Ambiente SA

第七章 市场机会及未来趋势

- 燃煤发电厂和核能发电厂的退役为可再生能源产业创造了机会

The Spain Renewable Energy Market size is estimated at 97.59 gigawatt in 2025, and is expected to reach 207.99 gigawatt by 2030, at a CAGR of 16.34% during the forecast period (2025-2030).

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns and supply chain disruptions leading to delays in projects. Currently, the market reached pre-pandemic levels.

Key Highlights

- The renewable energy market in Spain is expected to have robust growth in the coming years. The growth can be attributed to two main factors, favorable weather conditions and the availability of substantial funds raised by national and regional forums.

- However, the market can also face bottlenecks due to dispatch-flexibility issues, as renewables do not provide short-term flexibility as other traditional fuels; instead, they need long-term backup plans.

- The country has planned the complete phase-out of nuclear and coal-fired power by 2035. The targets to reduce carbon emissions in the national energy plans have prompted the country to eliminate nuclear power from the energy mix. Out of seven nuclear power plants, four are already scheduled to be closed by 2030, making the share of nuclear power from 22% in 2020 to around 7% in 2030. The initiative is likely to create ample opportunities for the renewables-based energy market.

Spanish Renewable Energy Market Trends

Wind Technology is Expected to Dominate the Market

- The country witnessed huge investments in wind technology by international forums and private players in recent years, which resulted in rapid growth in wind-generated power share. The share of wind power generation in the country's renewable energy mix was around 43% as of 2022.

- The installed capacity of wind turbines is anticipated to more than double by 2030, according to the Spanish government's National Integrated Energy and Climate Plan, published in 2021. Many offshore and onshore projects are queued up to accelerate wind power generation in the country.

- According to Red Electrica, in 2022, Spain's total cumulative wind power capacity accounted for 29,729 MW, with an annual growth rate of approximately 4%. With the increase in new wind projects, demand for wind energy is expected to increase, which, in turn, will drive the market in the forecast period.

- In February 2023, Repsol began generating clean energy at PI, its first renewable project in Castilla y Leon, Spain. The PI project includes seven wind farms with a total installed capacity of 175 MW.

- On account of such developments, wind energy generation is expected to dominate Spain's renewable energy market.

Government Policies and Regulations May Drive the Market

- The Spanish government has released several plans and policies to promote the growth of renewable energy in the power generation sector. These initiatives and project investments have resulted in around 42% of renewables share in the total power production as of 2021.

- According to International Renewable Energy Agency, in 2022, the total installed renewable energy in Spain was 67,909 MW, with an increase of 9.05% compared to 2021. With the supportive government policies for renewable energy, the renewable installed capacity is expected to increase in the future.

- For instance, to comply with EU regulations and reach the nation's greenhouse gas emission (GHG) reduction goals, the Spanish government adopted the integrated National Energy and Climate Plan (PNACC) for 2021-2030. The ten-year plan seeks to achieve carbon neutrality by reducing the gross total GHG emissions from the power, transportation, and industrial sectors.

- In December 2021, the Spanish government approved the public-private funding measure to support renewable energy projects with the hope that it will help in achieving the green energy transition as soon as possible. Under the plan, the government allocated over USD 7.77 billion in public funds for innovative green energy technologies.

- In July 2022, REER, the Spanish Ministry for Ecological Transition and the Demographic Challenge (MITECO) announced the third and fourth renewable energy auctions. To generate 74% of Spain's electricity from renewable sources and save one out of every three tonnes of greenhouse gas emissions now emitted, the Spanish National Integrated Energy and Climate Plan (PNIEC) intend to develop 60 GW of renewable energy sources. According to MITECO, REER auctions are a key component of the plan to reach these objectives by 2030.

- Such government initiatives are expected to bolster market growth in the coming years.

Spanish Renewable Energy Industry Overview

Spain's renewable energy market is moderately fragmented. Some of the major companies include (in no particular order) Siemens Gamesa Renewable Energy SA, Acciona SA, Iberdrola SA, Cobra Group, and Red Electrica Corporation SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2022

- 4.3 Renewable Energy Installed Capacity and Forecast, in GW, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Adoption Of Solar And Wind Energy

- 4.6.1.2 Supportive Government Policies And Ambitious Targets

- 4.6.2 Restraints

- 4.6.2.1 Integrating Renewables into the Main Electricity Grid

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION BY TECHNOLOGY

- 5.1 Hydro

- 5.2 Wind

- 5.3 Solar

- 5.4 Other Technologies

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Gamesa Renewable Energy SA

- 6.3.2 Acciona SA

- 6.3.3 Iberdrola SA

- 6.3.4 Cobra Group

- 6.3.5 Red Electrica Corporacion SA

- 6.3.6 Saclima Solar Fotovoltaica SL

- 6.3.7 Tudela Solar SL

- 6.3.8 IM2 Systems SLU

- 6.3.9 JinkoSolar Holding Co. Ltd

- 6.3.10 Solaria Energia y Medio Ambiente SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Phasing Out Of Coal-fired and Nuclear Power Plants To Create Opportunities For Renewable Sector