|

市场调查报告书

商品编码

1639377

物联网中间件:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)IoT Middleware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

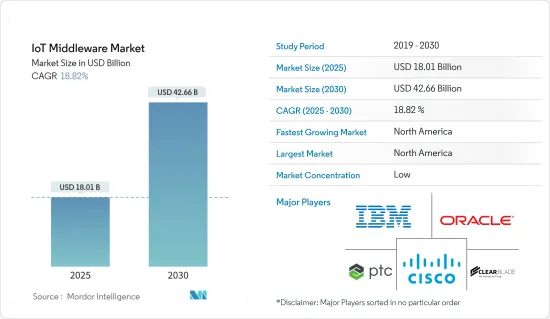

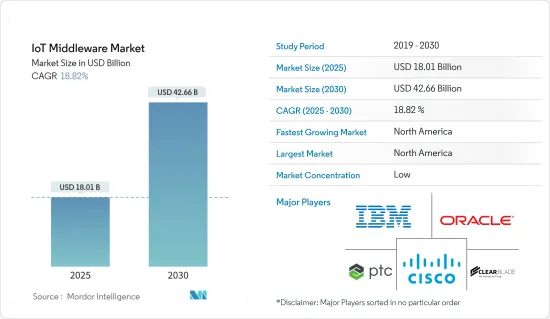

物联网中介软体市场规模预计在 2025 年为 180.1 亿美元,预计到 2030 年将达到 426.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 18.82%。

主要亮点

- 製造业、汽车业和医疗保健等终端用户产业越来越多地采用物联网技术,正在积极推动市场成长。在传统製造业进行数位转型的同时,物联网正在引发新一轮智慧互联的工业革命。这正在改变各行业处理系统和机器中日益复杂的流程的方式,以提高效率并减少停机时间。随着越来越多的设备连接到互联网,这些设备之间无缝协作和连接的需求也随之增加,这使得物联网中间件成为企业关注领域。

- 此外,物联网中介软体市场在各个领域都面临巨大的需求。这是由联网设备数量的不断增长以及管理它们产生的大量资料的需要所推动的。物联网中间件在终端用户领域的整合可望简化业务、增强服务交付并创造新的商机。

- 采用与产业无关的应用中间件对于降低未来物联网解决方案变化的复杂性起着关键作用。此外,随着物联网越来越多地融入行动装置、机器、装置、平板电脑等,需要一个平台来支援和整合这项需求。

- 智慧城市计划等政府措施预计将产生对物联网中介软体的需求。互联建筑、智慧工厂和智慧家庭等趋势预计将为市场创造机会。此外,智慧城市概念展示了物联网在能源、废弃物和基础设施领域的巨大前景。

物联网中介软体市场趋势

製造业可望实现高成长

- 工业 4.0 和物联网是整个物流链开发、生产和管理的新技术方法的核心,即智慧工厂自动化。随着工业4.0 和物联网的兴起,製造业发生了巨大转变,迫使企业开发敏捷、更智慧的製造流程,以利用机器人技术补充和增强人力,并透过减少因工艺故障导致的工业事故的技术来推进生产。

- 连网设备和感测器的广泛采用使得 M2M通讯成为可能,从而推动了製造业产生的资料点数量的激增。这些资料点的范围可以是描述材料经过一个製程週期所需时间的指标,也可以是更高阶的计算,例如汽车产业的材料应力容量。

- 物联网中间件可以实现基于物联网的工厂自动化以及基于物联网的虚拟製造应用,使製造商能够在主要生产设施中部署物联网设备。物联网中间件可以实现基于物联网的虚拟製造应用和基于物联网的工厂自动化。物联网中间件使製造业的四个基本要素——产品、人员、流程和基础设施——能够无缝运作。

- 此外,有抱负的製造商的一个关键考虑因素是透过支援跨多个设备的客製化和简化的软体升级的开放式架构来提高灵活性。因此,预计该领域将受益于开放原始码物联网中间件开发的快速兴起。

- 此外,全球製造业正在增加对新兴技术的投资,为製造业采用物联网中间件创造了巨大的成长机会。例如,联邦银行 2022 年 1 月的一项调查发现,42% 的澳洲製造商计划在未来两到三年内投资与智慧自动化和机器人流程自动化相关的新兴技术领域。行动、连结和物联网(IoT)领域的投资是第二大意向投资领域,有 40% 的製造商有意向投资。

预计北美将占据主要市场占有率

- 北美预计将成为一个突出的市场,因为物联网在该地区重要的收益终端用户行业中发挥着日益重要的作用,而这主要得益于对联网汽车、智慧型能源计划、家庭自动化和智慧製造的关注。美国和加拿大是巨量资料、物联网和行动等技术的早期采用者,为物联网中间件市场创造了巨大的成长机会。

- 美国正处于第四次工业革命的边缘。资料正在大规模生产中使用,并与整个供应链中的各种製造系统整合。因此,资讯科技的出现和物联网在製造业、工业和汽车等广泛应用领域的日益广泛使用为业务营运带来了新的维度。

- 该地区的製造商依靠 IIoT 平台进行一般流程最佳化、仪表板和视觉化以及状态监控。中小企业在将新技术融入现有系统方面变得更加灵活,而大型製造商则在数位化方面投入了巨额预算。

- 此外,当前投入、人事费用上升以及来自全球主要製造商的竞争环境也是一个主要驱动力,公司被迫采用物联网等新技术来保持竞争力并维持其营业利润率。

- 支持这一趋势的是先进製造业伙伴关係(AMP) 2.0 的形成,旨在将工业转变为一所大学。联邦政府正在投资新兴技术和智慧製造倡议,例如智慧製造领导联盟(SMLC),以促进和鼓励广泛采用製造智慧。这些市场趋势也有望凸显市场对物联网中介软体解决方案的需求。

物联网中介软体产业概况

物联网中介软体市场竞争激烈,并透过为企业推出创新解决方案来颠覆传统 IT 产业。市场企业纷纷采取产品创新、併购等重大策略,提升产品能力,维持竞争力。该市场领域的知名参与者包括思科系统公司、IBM 公司、甲骨文公司、ClearBlade 公司和 PTC 公司。

2023 年 3 月,专门的物联网解决方案供应商 Alliot Technologies 宣布推出名为 Symbius 的突破性物联网中介软体平台。该创新平台旨在消除与蜂巢式物联网相关的障碍。 Symbius 具有将记录资料解码为标准化格式的独特功能,这使其成为同类平台中的先驱平台之一。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 评估 COVID-19 对物联网中介软体生态系的影响

第五章 市场动态

- 市场驱动因素

- 开放原始码平台开发

- M2M通讯的兴起

- 市场限制

- 物联网中间件开发涉及的复杂技术

- 物联网中介软体应用分析

- 应用程式管理

- 资料管理

- 其他应用

第六章 市场细分

- 按平台

- 应用程式支援

- 设备管理

- 连线管理

- 按最终用户产业

- 製造业

- 卫生保健

- 能源与公共产业

- 运输和物流

- 农业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Cisco Systems Inc.

- IBM Corp.(Red Hat Inc.)

- Oracle Corporation

- ClearBlade Inc.

- PTC Inc.

- Arrayent Inc.

- Axiros GmbH

- Davra Networks

- Amazon Web Services Inc.

- Bosch.IO GmbH

- MuleSoft LLC(Salesforce Company)

第八章投资分析

第九章 市场机会及前景

The IoT Middleware Market size is estimated at USD 18.01 billion in 2025, and is expected to reach USD 42.66 billion by 2030, at a CAGR of 18.82% during the forecast period (2025-2030).

Key Highlights

- The growing adoption of IoT technology across end-user industries, such as manufacturing, automotive, and healthcare, is positively driving the market's growth. With the traditional manufacturing sector amid a digital transformation, IoT is fueling the next industrial revolution of intelligent connectivity. This is changing how industries approach increasingly complex processes of systems and machines to improve efficiency and reduce downtime. With the growth in the number of devices connected to the internet, there is a greater need for seamless collaboration and connectivity between those devices, thus making IoT middleware a significant focus area for businesses.

- Additionally, the IoT Middleware market is witnessing substantial demand in various This is driven by the need to manage the growing number of connected devices and the vast amount of data they generate. The integration of IoT middleware in end-user sectors is expected to streamline operations, enhance service delivery, and create new business opportunities.

- Adopting an industry-agnostic application middleware plays a vital role in reducing the complexity of future changes to their IoT solutions. Further, with the growing integration of IoT into mobile devices, machinery, equipment, and tablets, among other devices, the need for a platform to support and integrate such demands has become necessary.

- Government initiatives, such as smart city projects, are expected to create demand for IoT middleware. Trends, such as connected buildings, smart factories, and smart homes, are expected to create opportunities for the market. Moreover, the smart cities' concept has marked a great prospect with the IoT in the energy, waste, and infrastructure sectors.

IoT Middleware Market Trends

Manufacturing Expected to Have the High Potential Growth

- Industry 4.0 and IoT are at the center of new technological approaches for developing, producing, and managing the entire logistics chain, otherwise known as smart factory automation. Massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT require enterprises to adopt agile, smarter, and innovative ways to advance production with technologies that complement and augment human labor with robotics and reduce industrial accidents caused by process failure.

- With the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a surge in data points that are generated in the manufacturing industry. These data points can be of various kinds, ranging from a metric describing the time taken for the material to pass through one process cycle to a more advanced one, such as calculating the material stress capability in the automotive industry.

- IoT Middleware can implement IoT-based virtual manufacturing applications as well as IoT-based factory automation, which encourages manufacturers to deploy IoT devices in key manufacturing establishments. Another factor driving the market growth is the advantage of IoT in attaining "informed" manufacturing. IoT middleware enables four essential elements of manufacturing, such as Products, People, Processes, and Infrastructure, to work seamlessly.

- Also, a significant consideration while aiming for the manufacturing industry is the promotion of flexibility through open architectures that support customization and streamlined software upgrades across multiple devices. Therefore, this segment is expected to benefit from the rapid emergence of Open-source IoT middleware developments.

- Additionally, manufacturing organizations in many countries worldwide are increasingly investing in emerging technologies, thus creating significant growth opportunities for adopting IoT middleware in the manufacturing sector. For instance, according to a survey conducted by CommBank in January 2022, 42% of Australian manufacturers intend to invest in the emerging technology area relating to intelligent automation and robotic process automation over the next two to three years. Investment in mobile, connectivity, and the Internet of Things (IoT) was among the second intended investment areas, with 40% of manufacturers intending to invest.

North America Region is Anticipated to Holds Major Market Share

- North America is expected to be a prominent market due to the growing role of IoT among the significant revenue-generating end-user industries of the region, driven by the deployment of connected cars, smart energy projects, home automation, and a focus on smart manufacturing. The US and Canada are the early adopters of technologies, such as Big Data, IoT, and mobility, and it creates significant growth opportunities for the IoT middleware market.

- The United States is on the verge of the fourth industrial revolution. Data is being used on a large scale for production while integrating it with a wide variety of manufacturing systems throughout the supply chain. Therefore, the emergence of information technology and the increased usage of IoT across a wide range of manufacturing, industrial, and automotive applications have added a new dimension to conducting business operations.

- Manufacturers in the region rely on IIoT platforms for general process optimization, dashboards and visualization, and condition monitoring. SMEs are becoming increasingly flexible in incorporating new technologies with their existing systems, whereas large manufacturers have massive budgets for digitization.

- Another significant driver is the prevalence of an environment of increasing input, labor cost, and competition from large global manufacturers, which is expected to attract investment in technologies such as IoT to remain competitive and maintain operating margins.

- Aiding this trend is the formation of the "Advanced Manufacturing Partnership (AMP) 2.0," an initiative undertaken to make the industry universities. The federal government is investing in emerging technologies and smart manufacturing initiatives, such as the Smart Manufacturing Leadership Coalition (SMLC), to drive and facilitate the broad adoption of manufacturing intelligence. Such trends in the market are also expected to emphasize the need for IoT middleware solutions in the market.

IoT Middleware Industry Overview

The IoT middleware market is highly competitive, poised to disrupt the traditional IT industry by introducing innovative solutions for enterprises. Market players are embracing key strategies such as product innovation, mergers, and acquisitions to enhance their product functionality and maintain their competitive edge. Notable companies operating in this market landscape include Cisco Systems Inc., IBM Corp., Oracle Corporation, ClearBlade Inc., and PTC Inc., among others.

In March 2023, Alliot Technologies, a specialized provider of IoT solutions, introduced its groundbreaking IoT Middleware platform called Symbius. This innovative platform is designed to eliminate the barriers associated with cellular IoT. Symbius is set to become one of the pioneering platforms of its kind, offering the unique capability to decode recorded data into a standardized format.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the IoT Middleware Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Developments Across Open-source Platforms

- 5.1.2 Increasing M2M Communications

- 5.2 Market Restraints

- 5.2.1 Complex Technologies Pertaining to the Development of IoT Middleware

- 5.3 Analysis of IoT Middleware Applications

- 5.3.1 Application Management

- 5.3.2 Data Management

- 5.3.3 Other Applications

6 MARKET SEGMENTATION

- 6.1 By Platform

- 6.1.1 Application Enablement

- 6.1.2 Device Management

- 6.1.3 Connectivity Management

- 6.2 By End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Healthcare

- 6.2.3 Energy and Utilities

- 6.2.4 Transportation and Logistics

- 6.2.5 Agriculture

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 IBM Corp. (Red Hat Inc.)

- 7.1.3 Oracle Corporation

- 7.1.4 ClearBlade Inc.

- 7.1.5 PTC Inc.

- 7.1.6 Arrayent Inc.

- 7.1.7 Axiros GmbH

- 7.1.8 Davra Networks

- 7.1.9 Amazon Web Services Inc.

- 7.1.10 Bosch.IO GmbH

- 7.1.11 MuleSoft LLC (Salesforce Company)