|

市场调查报告书

商品编码

1639380

管包装:市场占有率分析、产业趋势与成长预测(2025-2030 年)Tube Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

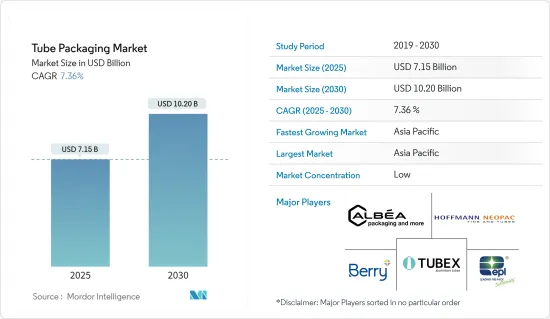

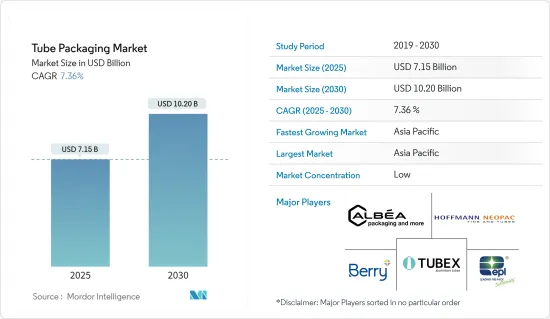

管包装市场规模预计在 2025 年为 71.5 亿美元,预计到 2030 年将达到 102 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.36%。

主要亮点

- 管包装因其用户友好的设计、便携性以及产品存储和分配的多功能性而成为化妆品和个人护理领域的热门包装选择。受都市化、千禧世代人口激增和可支配收入增加的推动,软管包装市场呈现上升趋势。随着都市区的发展,人们对化妆品的认识和可及性正在提高。城市发展加上可支配收入的增加为市场参与者提供了有利可图的机会,大大增加了对管包装的需求。

- 目前,具有先进多层阻隔结构的积层软管占据市场主导地位。其优异的阻挡性能不仅延长了产品的保质期,还能阻挡氧气、光线和细菌,推动了日益增长的需求。

- 全球软管包装领域的需求正在快速成长,尤其是口腔清洁用品领域。随着大众对口腔卫生重要性的认识不断提高,牙科护理的费用也上升。这些日益增长的担忧以及不断变化的生活方式正在推动全球管包装市场的成长,并刺激对专业口腔护理产品的需求。

- 此外,化妆品包装行业正在经历技术復兴,并专注于改善用户体验。整合刷子、海绵头、带泵的管子和其他新颖的施用器等创新正在推动这一需求。

- 然而,软管包装市场受到严格法规的困扰。虽然这些法规优先考虑产品安全和环境永续性,但它们也会影响製造流程、材料选择和市场的整体成长轨迹。遵守这些法规通常需要在研发方面进行大量投资,这会增加管包装製造商的生产成本。

软管包装市场趋势

塑胶管正在彻底改变各行各业的现代包装

- 塑胶管用于各种行业,包括化妆品、个人护理、食品和製药。减少运输成本和能源浪费,确保产品安全并延长保质期。此外,它每次挤压后都能恢復原状的能力以及其奢华的外观进一步刺激了市场需求。

- 积层软管包装正成为塑胶包装的主流趋势。该管由多层层压箔製成,其外层和内层之间有一个集成的塑胶屏障。它们迅速走红的主要原因是其具有保湿等功能,从而保护了产品的完整性。这使得它成为化妆品包装的主要成分,尤其是护肤品。

- 亚洲国家,尤其是中国和印度对积层软管的需求日益增加。这些管子用于包装各种产品,从药品和口腔保健用品到食品、化学品和化妆品。在印度,都市化、可支配收入的增加和有组织的零售业的扩张正在推动化妆品消费的激增,进一步推动了对永续管包装的需求。

- 口腔卫生对整体健康至关重要,良好的习惯可以预防许多牙齿问题。人们对牙齿健康的认识不断提高、牙齿问题日益增多以及口腔护理治疗的重要性不断提高,推动了口腔护理管市场的发展。

- 为了追求环境的永续性,口腔护理品牌优先使用再生和可再生塑胶。高露洁棕榄迈出了重要一步,已将其全球约 60% 的牙膏 SKU 转换为可回收管。高露洁牙膏销量占据全球牙膏市场的 41% 的绝对份额,将对管包装市场产生影响。根据该公司的年度报告,口腔、个人和家庭护理部门的销售额预计将从 2022 年的 38.2 亿美元增加到 2023 年的 39.3 亿美元。

- 此外,印度领先的草药和阿育吠陀品牌(如 Ayurveda、Dabur、Himalaya 和 Patanjali)正在透过 Babool 和 Dant Kranti 等热门产品线来多样化其产品线,从而进一步推动了对积层软管的需求。如此。

亚洲化妆品市场不断成长,推动创新软管包装解决方案的需求

- 随着亚洲人民生活方式和生活水准的提高,健康和卫生意识的增强,对化妆品和药品的需求显着增加。

- 在该国,软管包装的需求主要来自化妆品和个人护理领域。管包装的多功能性和便利性使其成为从乳霜、乳液到凝胶等各种产品的理想选择。软管不仅可以确保准确分配并保护产品免受污染,还可以增强货架吸引力,使其成为许多化妆品品牌的首选。

- 此外,独立经营美容产业对环保包装解决方案的需求日益增长。这一趋势很大程度上是由具有环保意识的消费者积极寻求永续的替代品所推动的。因此,许多独立美容品牌开始转向生物分解性、可回收或可再填充的管状产品,力求满足消费者的偏好并减轻对环境的影响。

- 除了其他优点之外,由于节省成本和卓越的阻隔保护作用,积层软管正在国内化妆品和医药行业逐渐取代塑胶和铝。同时,铝管的阻隔性加上增强的功能性正在推动製药和个人护理领域的需求。

- 根据中国国家统计局的资料,预计2023年中国化妆品零售额将达到约585.4亿美元,高于2022年的556.3亿美元。

- 化妆品收益的增加可能会刺激公司投资先进的包装解决方案。这些投资可能会带来管包装材料的进步、创新设计和增强的功能,从而提高化妆品行业的整体包装品质。

软管包装产业概况

软管包装市场较为分散,众多参与者争夺主导地位。随着新进入者即将进入市场,竞争预计将进一步加剧。作为回应,现有参与者越来越多地转向强有力的竞争策略,强调技术创新、策略收购和高度重视研发。其他主要企业包括 Berry Global Inc.、EPL Limited (Essel Propack Limited)、Hoffmann Neopac AG、Albea SA、Tubex Aluminium Tubes、CTLpack group slu 和 Amcor plc。

- 2024 年 10 月 Hoffmann Neopac AG 在米兰 CPHI 上展示了其最新创新:Polyfoil® 单材料阻隔 (MMB) 迷你管。新型 Polyfoil® MMB Mini 管为需要强阻隔性的产品(包括精选药品、牙科和眼科製剂)提供了无铝包装替代品。这种紧凑型管不仅扩展了 Neopac 的高阻隔单一材料解决方案组合,也代表了永续高阻隔包装技术领域的重大飞跃。

- 2024 年 1 月,高端护肤和化妆品公司 Groupe Clarins 与化妆品管供应商 Albea Tubes 合作,推出了一种名为 EcoLittle Top 的新型环保样品包装解决方案。娇韵诗集团旨在透过推出 EcoLittle Top 来升级其样品管,这是 Alvear 样品管 EcoTop 系列的最新成员。这种尖端设计消除了一个部件,使整个管的重量减少了 47%。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 生态系分析

- 行业标准和法规

- 技术展望

- 进出口分析

- 原料分析

第五章 市场动态

- 市场驱动因素

- 软包装趋势推动软管包装市场成长

- 方便包装需求不断成长

- 市场挑战

- 包装业监管

第六章 市场细分

- 依封装类型

- 挤

- 捻

- 其他封装类型

- 按材质

- 塑胶

- 纸板

- 铝

- 按应用

- 化妆品和洗护用品

- 医疗保健和製药

- 食物

- 居家护理

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor plc

- Berry Global Inc.

- EPL Limited(Essel Propack Limited)

- Hoffmann Neopac AG

- CCL Industries Inc.

- Precision Concepts International

- Albea SA

- HCT Group

- Tubex Aluminium Tubes

- E2Global Inc.

- Global Tube spa

- CTLpack group slu

第八章投资分析

第九章 市场机会与未来趋势

The Tube Packaging Market size is estimated at USD 7.15 billion in 2025, and is expected to reach USD 10.20 billion by 2030, at a CAGR of 7.36% during the forecast period (2025-2030).

Key Highlights

- Tubes have become a prevalent packaging choice in the cosmetics and personal care sector, due to their user-friendly design, portability, and versatility in storing and dispensing products. The tube packaging market is on an upward trajectory, fueled by urbanization, a burgeoning millennial demographic, and rising disposable incomes. As urban areas evolve, there is heightened awareness and accessibility to cosmetic products. Coupled with increased disposable income, this urban development presents lucrative opportunities for market players, significantly amplifying the demand for tube packaging.

- Laminated tubes, with their advanced multi-layered barrier structure, currently dominate the market. Their superior barrier properties not only extend product shelf-life but also shield against oxygen, light, and bacteria, driving their heightened demand.

- The global tube packaging sector is witnessing a surge in demand, particularly from the oral care segment. As public awareness of oral hygiene's significance rises, so do dental care costs. These heightened concerns, alongside evolving lifestyles, are propelling the tube packaging market's global growth and spurring demand for specialized oral care products.

- Furthermore, the cosmetic packaging sector is undergoing a technological renaissance, with a pronounced focus on elevating user experience. Innovations like integrated brushes, sponge heads, pump-equipped tubes, and other novel applicators are fueling this demand.

- However, the tube packaging market grapples with stringent regulations. While these regulations prioritize product safety and environmental sustainability, they also influence manufacturing processes, material choices, and the market's overall growth trajectory. Adhering to these regulations often necessitates hefty investments in research and development, which can escalate production costs for tube packaging producers.

Tube Packaging Market Trends

Plastic Tubes are Revolutionizing Modern Packaging across Various Industries

- Plastic tubes are used in diverse industries, including cosmetics, personal care, food, and pharmaceuticals. They reduce transportation costs and energy waste, ensure product safety, and extend shelf life. Additionally, their ability to return to shape after each squeeze and a premium appearance further fuel their market demand.

- Laminated tube packaging is emerging as a dominant trend in plastic packaging. Manufactured from multi-layer laminate foil, these tubes boast integrated plastic barriers between the outer and inner layers. Their surge in popularity is mainly due to features like moisture retention, which safeguard product integrity. This makes them a staple in cosmetic packaging, especially for skincare items.

- Asian nations, particularly China and India, are witnessing a rising demand for laminated tubes. These tubes are being utilized for packaging a spectrum of products, from pharmaceuticals and oral care items to food, chemicals, and cosmetics. In India, urbanization, increasing disposable incomes, and the expansion of organized retail drive a surge in cosmetic consumption, further amplifying the demand for sustainable tube packaging.

- Oral hygiene is paramount for overall health, with good practices preventing numerous dental issues. The oral care tube market is witnessing a boost, driven by heightened awareness of dental health, rising dental problems, and the importance of oral care therapies.

- In a bid for environmental sustainability, oral care brands prioritise using recycled or renewable plastics. Taking a significant step, Colgate-Palmolive Company has transitioned about 60% of its global toothpaste SKUs to recyclable tubes. Holding a dominant 41% share of the worldwide toothpaste market, Colgate's rising sales in toothpaste are poised to influence the tube packaging market. Their annual report shows that their oral, personal, and home care segment saw a revenue uptick from USD 3.82 billion in 2022 to USD 3.93 billion in 2023.

- Additionally, leading Herbal and Ayurvedic brands in India, such as Ayurveda, Dabur, Himalaya, and Patanjali, are diversifying their product lines with popular variants like Babool and Dant Kranti, further driving the demand for laminated tubes.

Asia's Rising Cosmetic Market Fuels Demand for Innovative Tube Packaging Solutions

- As the Asian population elevates its lifestyle and living standards, there's a notable surge in the demand for cosmetic and pharmaceutical products, driven by heightened awareness of health and hygiene.

- In the country, the demand for tube packaging is predominantly driven by the cosmetics and personal care sector. The versatility and convenience of tube packaging make it ideal for a variety of products, from creams and lotions to gels. Tubes not only ensure precise dispensing and protect products from contamination but also enhance shelf appeal, solidifying their status as a favored choice among numerous cosmetic brands.

- Furthermore, the independently owned and operated company (indie) beauty segment is witnessing a growing demand for eco-friendly packaging solutions. This trend is largely attributed to environmentally conscious consumers actively seeking sustainable alternatives. Consequently, many indie beauty brands are turning to biodegradable, recyclable, or refillable tube options, aiming to resonate with these consumer preferences and mitigate their environmental footprint.

- Additionally, while the personal care industry holds a significant share of the end-use market for laminated tubes, there's a notable trend: laminate tubes, prized for their cost-saving benefits and superior barrier protection, are poised to gradually supplant plastic and aluminum in the country's cosmetics and pharmaceutical sectors. Meanwhile, the high barrier properties of aluminum tubes, coupled with enhancements, are boosting demand in both the pharma and personal care segments.

- Data from the National Bureau of Statistics of China reveals that in 2023, China's retail sales of cosmetics reached approximately USD 58.54 billion, marking an uptick from USD 55.63 billion in 2022.

- This uptick in cosmetics revenue could spur companies to channel investments into pioneering packaging solutions. Such investments might lead to advancements in tube packaging materials, innovative designs, and enhanced functionalities, thereby elevating the overall packaging quality in the cosmetics sector.

Tube Packaging Industry Overview

The tube packaging market is fragmented, with numerous players vying for dominance. The anticipated entry of new players is set to heighten this competition. In response, established players are increasingly turning to robust competitive strategies, emphasizing innovation, strategic acquisitions, and a pronounced focus on R&D. Notable players in this arena include Berry Global Inc., EPL Limited (Essel Propack Limited), Hoffmann Neopac AG, Albea S.A., Tubex Aluminium Tubes, CTLpack group s.l.u, Amcor plc, and others.

- October 2024: At CPHI Milan, Hoffmann Neopac AG launched its latest innovation: the Polyfoil(R) Mono-Material Barrier (MMB) Mini tubes. These new Polyfoil(R) MMB Mini tubes offer an aluminum-free packaging alternative, catering to products that demand robust barrier properties, including select pharmaceutical, dental, and ophthalmic formulations. These compact tubes not only broaden Neopac's esteemed portfolio of high-barrier mono-material solutions but also mark a notable leap forward in the realm of sustainable high-barrier packaging technology.

- January 2024: Groupe Clarins, a luxury skincare and cosmetics firm, has partnered with Albea Tubes, a supplier of cosmetic tubes, to introduce a new eco-friendly sample packaging solution called EcoLittle Top. Groupe Clarins aims to upgrade its sample tubes by incorporating the EcoLittle Top, the newest addition from Albea Tubes' EcoTop collection. This cutting-edge design eliminates one component, resulting in a 47% reduction in the tube's overall weight.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 Industry Standards & Regulations

- 4.5 Technology Outlook

- 4.6 Import-Export Analysis

- 4.7 Raw Material Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Flexible Packaging Trend Propels Tube Packaging Market Growth

- 5.1.2 Increasing Demand for Convenience Packaging

- 5.2 Market Challenges

- 5.2.1 Regulations in the Packaging Industry

6 MARKET SEGMENTATION

- 6.1 By Type of Package

- 6.1.1 Squeeze

- 6.1.2 Twist

- 6.1.3 Other Type of Package

- 6.2 By Material

- 6.2.1 Plastic

- 6.2.2 Paperboard

- 6.2.3 Aluminum

- 6.3 By Application

- 6.3.1 Cosmetics & Toiletries

- 6.3.2 Healthcare & Pharmaceutical

- 6.3.3 Food

- 6.3.4 Homecare

- 6.3.5 Other Application

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor plc

- 7.1.2 Berry Global Inc.

- 7.1.3 EPL Limited (Essel Propack Limited)

- 7.1.4 Hoffmann Neopac AG

- 7.1.5 CCL Industries Inc.

- 7.1.6 Precision Concepts International

- 7.1.7 Albea S.A.

- 7.1.8 HCT Group

- 7.1.9 Tubex Aluminium Tubes

- 7.1.10 E2Global Inc.

- 7.1.11 Global Tube s.p.a.

- 7.1.12 CTLpack group s.l.u