|

市场调查报告书

商品编码

1639395

汽车温湿度感测器:市场占有率分析、产业趋势、成长预测(2025-2030)Automotive Temperature and Humidity Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

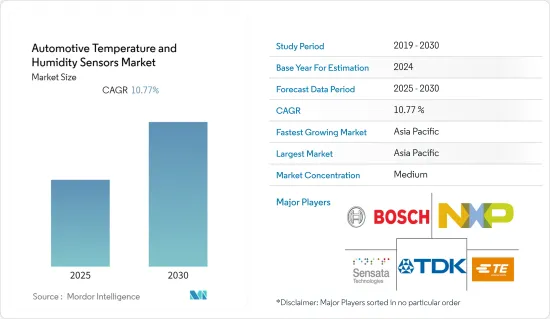

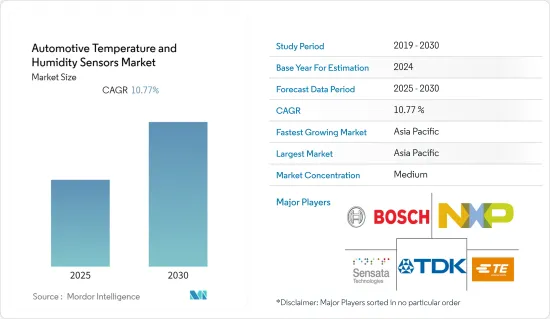

汽车温湿度感测器市场预计在预测期内复合年增长率为10.77%

主要亮点

- 汽车感测器监控温度变化、车顶和敞篷开关底盘解决方案以及座椅位置。温度和湿度感测器整合到 HVAC 系统中,用于预防挡风玻璃起雾和能源管理。汽车经常使用湿度感测器来监测露点并改善空气品质。感测器也放置在排气室附近,以保持尿素品质、液位和温度。此类感测器包括尿素泵压力和废气温度(EGTS)感测器。

- 所有汽车都配备了燃油感知器,可以不断检查燃油的温度,以确定燃油是否有效使用。如果引擎冷运转,燃料的密度会更大,燃烧时间会更长。燃料越热,燃烧所需的时间就越短。这里,主要问题是流入水平的变化,这可能导致汽车某些部件的损坏。此感测器监控油并确保以正确的速度和温度注入。

- 然而,COVID-19对该市场的影响只是暂时的,因为生产和供应链只是停止。一旦疫情后局势正常化,汽车温湿度感测器的生产、供应链和需求将逐渐增加。 COVID-19 后的情况可能会说服公司考虑使用更先进的汽车温度和湿度感测器来提高效率。

- 此外,虽然安全法规推动了感测器的发展,但环境法规是温度感测器应用的关键驱动因素。根据瑞银预测,到 2030 年,全球自动驾驶汽车感测器半导体市场规模预计将达到 300 亿美元。汽车销量的高成长可能会导致预测期内汽车温度和湿度感测器的潜在成长。

- 此外,根据半导体产业协会(SIA)2022年6月的研究显示,2022年4月全球半导体产业销售额为509亿美元,比2021年4月的420亿美元成长21.1%,比2021年4月成长0.7%。这一增长的主要驱动力是工厂自动化带来的高需求以及汽车行业感测器采用量的大幅增加。

- 高系统和安装成本预计将限制市场成长。此外,由于对具有更好技术规格的温度和湿度感测器的需求不断增加,预计市场将需要支援。从感测器的角度来看,潜在的组件供应链中断将减少销售和产量,从而损害市场。

汽车温湿度感测器市场趋势

电动和自动驾驶汽车的增加预计将推动市场发展

- 世界各地的汽车製造商都致力于车辆电气化。汽车需要充电速度更快,一次充电可以行驶更远的距离。这意味着车辆内部的电气和电子电路必须能够处理极高的功率并有效地管理损耗。预计这将对汽车温度感测器产生积极影响,从而需要强大的温度控管解决方案来确保安全关键应用的持续运作。

- 此外,汽车产业的快速电气化也增加了对湿度感测器的需求。随着电动车 (EV) 和混合动力电动车的普及,对电池管理系统的需求正在迅速增加。湿度感测器是电池管理系统的重要组成部分,因为它们透过了解锂离子电池的电流、电压、湿度和温度来提高电动车的安全性。

- 此外,通风过程仅在湿度水平升至阈值以上时启动,这可以减少电力消耗并提高电动车的整体效率。这促进了温度和湿度感测器的市场成长。

- 根据 EV-volumes.com 统计,特斯拉 2021 年销量约 936,200 辆,被 EV Volumes 评为全球最畅销的电动车製造商。以销量计算,特斯拉的市场占有率为 14%。亚军是比亚迪和大众集团。此外,随着中国电动车市场的成长,2021年登记的插电式电动车数量增加。电动车的兴起和普及预计将推动全球对温度和湿度感测器的需求。

- 此外,自动驾驶汽车的日益普及预计也将对市场产生积极影响,因为自动驾驶汽车配备了某些感测器,例如冷却液温度感测器和进气温度感测器。 2020 年 5 月,沃尔沃宣布推出一款配备光达的汽车,用户可以在高速公路上自动驾驶,无需人工干预。

亚太地区实现显着成长

- 亚太地区的成长是由中国和印度等国家不断增长的汽车工业所推动的。预计该地区的安全法规和排放法规将在预测期内显着提振市场。

- 该地区快速的都市化也增加了污染水平,增加了对在引擎和排气装置中配备温度感测器的省油车的需求。Panasonic和 TDK 等市场主要企业均位于日本。

- 此外,亚太地区汽车温度感测器市场也受益于持续的污染控制以及对 ECU 等安全设备不断增长的需求。此外,快速的都市化导致排放气体增加,增加了对在引擎和排气装置中配备温度感测器的省油车的需求。

- 亚太地区新兴经济体的电动车普及率不断提高,这也将支持预测期内的市场成长。例如,中国是感测器生产和消费大国,在全球市场中占有重要地位。

- 根据中国工业协会统计,中国乘用车年产量超过日本、德国、印度和韩国的总和。 2021年,中国汽车销量将跃居世界第一。汽车数量的增加预计将导致该地区对温度和湿度感测器等感测器的需求增加。

汽车温湿度感测器产业概况

汽车温度和湿度感测器市场的竞争温和,并且在过去十年中加剧。然而,随着技术创新和永续产品的兴起,许多公司正在探索新市场、赢得新契约并提高市场占有率,以保持在全球市场的地位。

- 2022 年 11 月 - TDK 公司宣布推出适用于非安全车辆的汽车高温感测器平台解决方案 InvenSense IAM~20380HT,并扩展其 ASIL 和非 ASIL 感测器的智慧汽车产品线。 IAM~20380HT 是一款独立的陀螺仪感测器,可在较宽的温度范围内工作,并为各种汽车应用提供高精度的测量资料。

- 2022 年 6 月 - 瑞萨电子推出新系列温度和相对湿度感测器及相关产品。此相对温度和湿度感测器在小型封装中实现了高精度、快速测量响应时间和超低功耗,支援针对行动装置和恶劣环境的产品开发。这些感测器还可用于汽车和其他行业。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概览(涵盖 COVID-19 的影响)

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 汽车电子元件增加

- 电动车和自动驾驶汽车的成长

- 市场限制因素

- 汽车OEM面临成本压力

第六章 市场细分

- 类型

- 例行(温度、湿度)

- 数字(温度、湿度)

- 车型

- 客车

- 商用车

- 应用程式类型

- 动力传动系统

- 车身电子产品

- 替代燃料汽车

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Delphi Automotive LLP

- TDK Corporation

- TE Connectivity Ltd.

- Sensata Technologies Inc.

- Robert Bosch GmbH

- NXP Semiconductor NV

- Continental AG

- Amphenol Advanced Sensors Germany GmbH

- Panasonic Corporation

- QTI Sensing Solutions

- Murata Corporation

- Analog Devices Inc.

第八章投资分析

第9章 未来的机会

简介目录

Product Code: 49221

The Automotive Temperature and Humidity Sensors Market is expected to register a CAGR of 10.77% during the forecast period.

Key Highlights

- Several automotive sensors monitor temperature changes, chassis solutions for roof and convertible switches, and seat position. Temperature and Humidity sensors are integrated into HVAC systems to prevent the fogging of windscreens and energy management. Vehicles frequently use humidity sensors to monitor the dew point and improve air quality. The sensors are also placed near the exhaust chamber to maintain urea quality, level, and temperature. Some of these sensors include urea pump pressure and exhaust gas temperature (EGTS) sensors.

- Every automobile is equipped with a fuel sensor to constantly check the fuel's temperature to determine whether the fuel utilization is efficient. If the engine's power is cold, a more extended period is taken to burn due to its high density. If the fuel is warm, it will take less time to burn. Here, the main problem is the varying inflow levels which could lead to the injury of certain parts of an automobile. This sensor will monitor the petroleum and ensures that injected at the right speed and temperature.

- However, the effects of COVID-19 on this market are only transient because only the production and supply chain is stalled. As the post-pandemic situation normalized, the production, supply chains, and demand for automotive temperature and humidity sensors gradually increased. The post-COVID-19 case will persuade companies to consider more advanced automotive temperature and humidity sensors to boost efficiency.

- Moreover, while safety regulations have boosted the growth of sensors, environmental regulations have been a significant driver for temperature sensor applications. And as per UBS, the global market for sensor semiconductors in autonomous vehicles is expected to reach a value of USD 30 billion by 2030. High growth in automotive sales may lead to potential growth for the automotive temperature and humidity sensors during the forecast period.

- Further, as per the study conducted by the Semiconductor Industry Association, In June 2022, The Semiconductor Industry Association (SIA) reported that sales for the semiconductor industry worldwide were USD 50.9 billion in April 2022, an increase of 21.1% over the USD 42.0 billion in April 2021 and 0.7% over the USD 50.6 billion in March 2022. The growth is mainly driven by the high demand from factory automation and a significant increase in the adoption of sensors in the automotive industry.

- It is anticipated that the high cost of the systems and installations is anticipated toThe restrict the market growth. Additionally, it is expected that the market will need help due to the growing demand for temperature and humidity sensors with better technical specifications. Potential component supply chain disruptions harm the market by reducing sales and production from a sensor standpoint.

Automotive Temperature and Humidity Sensors Market Trends

Rise in Electric and Autonomous Driving Vehicle is Expected to Drive the Market

- Automotive manufacturers all over the world are focusing on vehicle electrification. Cars need to charge more quickly and have a more extended range on a single charge. This implies electrical and electronics circuits within the vehicle should be able to handle extremely high power and manage losses effectively, creating a need for robust thermal-management solutions to ensure that safety-critical applications remain operational and are expected to impact automotive temperature sensors positively.

- Moreover, The demand for humidity sensors is increasing due to the automotive industry's quick electrification. The need for battery management systems is growing sharply as electric vehicles (EV) and hybrid electric vehicles gain popularity. Humidity sensors are an essential part of battery management systems because they increase the safety of electric vehicles by keeping track of the lithium-ion batteries' current, voltage, humidity, and temperature.

- Additionally, it starts the ventilation process only when the humidity level rises above the threshold, reducing power consumption and boosting the overall effectiveness of electric vehicles. This enables the market growth for humidity and temperature sensors.

- According to EV-volumes.com, Tesla was named the best-selling electric vehicle manufacturer in the world by EV Volumes after selling nearly 936,200 units in 2021. Tesla's market share is 14% based on its sales volume. Among the runners-up were BYD and Volkswagen Group. Also, registrations of plug-in electric vehicles increased in 2021, with the Chinese electric vehicle market growth. Such rise and adoption of EVs will boost the global demand for temperature and humidity sensors.

- Furthermore, The increasing adoption of autonomous cars is also expected to positively impact the market as there specific sensors on an autonomous vehicle, such as a Coolant temperature sensor or an Intake Air Temperature sensor. In May 2020, Volvo announced LIDAR-equipped cars, where the company mentioned that users could drive themselves on highways with no human intervention; the company started its production line in 2022.

Asia Pacific to Witness the Significant Growth

- The growth in the Asia-Pacific region owes to the growing automotive industry in countries such as China and India. The region's safety and emission control regulations are expected to boost the market during the forecast period significantly.

- Rapid urbanization in the region has also resulted in increased pollution levels, thereby propelling the demand for fuel-efficient vehicles that are equipped with a temperature sensor in the engine and exhaust. Major companies in the market, such as Panasonic and TDK, are based out of Japan.

- In addition, the Asia-Pacific automotive temperature sensor market benefits from ongoing pollution regulations and rising demand for safety devices like ECU. Additionally, rapid urbanization has increased emissions, driving demand for fuel-efficient cars with temperature sensors in the engine and exhaust.

- The growing adoption of electric vehicles in the developing countries of Asia Pacific also favors market growth over the forecast period. For Instance, China is the primary producer and consumer of sensors and holds a prominent position in the global market.

- China made up about 32.5% of the world's auto production in 2021; according to the China Association of Automobile Manufacturers (CAAM), China's annual production of passenger cars had surpassed that of Japan, Germany, India, and South Korea put together. In 2021, China ranked first in the world for automobile sales. Such a rise in vehicles will bring more demand for sensors such as temperature and humidity sensors in the region.

Automotive Temperature and Humidity Sensors Industry Overview

The automotive temperature and humidity sensors market is moderately competitive and has gained a competitive edge in the past decade. However, with increased innovations and sustainable products, to maintain their position in the global market, many companies are increasing their market presence by securing new contracts by tapping new markets.

- November 2022 - TDK Corporation announces the release of the InvenSense IAM-20380HT high-temperature automotive sensor platform solution for non-safety automotive applications, as well as the expansion of the Smart Automotive line of ASIL and non-ASIL sensors. The IAM-20380HT is a standalone gyroscope sensor that can function in a wide temperature range and deliver precise measurement data for various automotive applications.

- June 2022 - Renesas Electronics has unveiled a new family of temperature and relative humidity sensors and related products. The recent relative humidity and temperature sensors provide high accuracy, rapid measurement response time, and ultra-low power consumption in a small package size to support deployment in portable devices or products made for harsh environments. These sensors can be used in automotive and other industries as well.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Covers the Impact of COVID-19)

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Number of Electronic Components in Automotive

- 5.1.2 Growth in Electric and Autonomous Driving Vehicles

- 5.2 Market Restraints

- 5.2.1 Cost Pressure on Automotive OEM

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Conventional (Temperature, Humidity)

- 6.1.2 Digital (Temperature, Humidity)

- 6.2 Vehicle Type

- 6.2.1 Passenger Cars

- 6.2.2 Commercial Vehicles

- 6.3 Application Type

- 6.3.1 Power Train

- 6.3.2 Body Electronics

- 6.3.3 Alternative Fuel Vehicles

- 6.3.4 Other Application Types

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 United Arab Emirates

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Delphi Automotive LLP

- 7.1.2 TDK Corporation

- 7.1.3 TE Connectivity Ltd.

- 7.1.4 Sensata Technologies Inc.

- 7.1.5 Robert Bosch GmbH

- 7.1.6 NXP Semiconductor N.V.

- 7.1.7 Continental AG

- 7.1.8 Amphenol Advanced Sensors Germany GmbH

- 7.1.9 Panasonic Corporation

- 7.1.10 QTI Sensing Solutions

- 7.1.11 Murata Corporation

- 7.1.12 Analog Devices Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OPPORTUNITIES

02-2729-4219

+886-2-2729-4219