|

市场调查报告书

商品编码

1639399

马来西亚塑胶市场:份额分析、产业趋势、成长预测(2025-2030)Malaysia Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

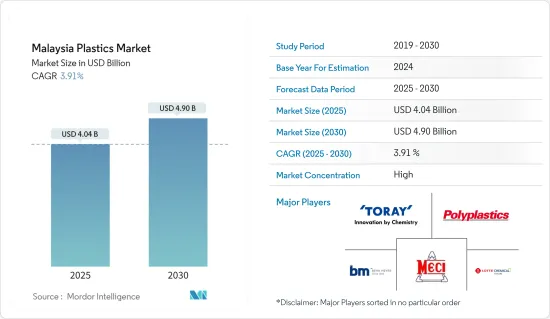

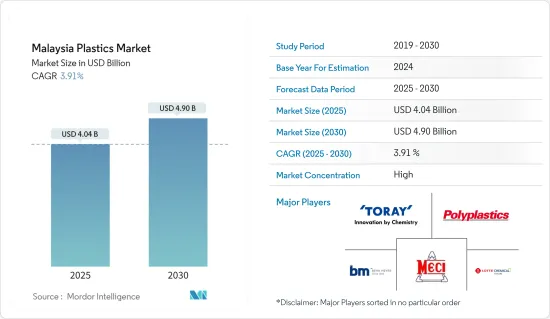

马来西亚塑胶市场规模预计到2025年为40.4亿美元,预计到2030年将达到49亿美元,预测期内(2025-2030年)复合年增长率为3.91%。

马来西亚塑胶市场在 2020 年受到 COVID-19 大流行的负面影响,但随着政府放鬆了大流行期间的监管,2021 年实现了成长。由于对个人产品、医疗产品、药品以及包装食品和饮料的需求不断增长,对软包装的需求巨大。

主要亮点

- 食品和饮料包装领域对塑胶的需求不断增长可能会在短期内推动市场发展。

- 另一方面,对塑胶使用日益增长的环境担忧可能会限制市场成长。

- 航太业的成长、生物分解性塑胶的使用增加以及回收的增加可能会在未来几年提供市场成长机会。

马来西亚塑胶市场趋势

食品和饮料包装应用需求增加

马来西亚是东南亚主要经济体。 2019年,该国GDP成长放缓至4.4%,为2009年全球金融危机以来的最低水准。根据国际货币基金组织的预测,马来西亚经济预计在2021年成长3.1%,并在2022年进一步成长5.4%。

- 包装占据马来西亚塑胶市场最大的应用领域。包装领域越来越多地使用塑胶的主要原因包括耐磨性、耐化学性、易于成型、可回收性、耐穿刺性和高机械强度。

- 根据Malaysian Reserve(TMR Media Sdn Bhd旗下当地资讯提供者)统计,马来西亚每年人均塑胶包装消费量为16.78公斤/人,在东南亚国家中位居最高。

- 其他本地包装製造商包括 Malaysia Packaging Industry Bhd、Bemis Flexipack Sdn Bhd、Amcor Ltd.、Daibochi Plastic and Packaging Industry 和 Bisson Flexipack Sdn Bhd。

由于这些因素,在预测期内会有更多的人希望在该国购买塑胶包装。

对生质塑胶的需求增加

- 生质塑胶是以生物来源原料为原料,经由多种製程製成的材料。它主要是作为传统塑胶的替代品而开发的。

- 生质塑胶在软包装、硬包装、农业和园艺、消费品、纺织产品等方面都有应用。生质塑胶用作优质和品牌有机食品的包装材料。硬质生质塑胶用于化妆品霜和产品包装。

- 根据JEITA统计,2021年全球电子产品製造业,包括笔记型电脑、行动电话、半导体等,成长至3.36兆美元,与前一年同期比较成长11%。预计到 2022 年将达到 35,360 亿美元,可能会影响生质塑胶的需求。

- 生质塑胶主要用于食品领域的食品托盘、优格杯和刀叉餐具等产品。生质塑胶在医疗、农业、家用电子电器、体育和汽车领域越来越受欢迎。

- 生质塑胶为包装行业提供了可再生和可持续的选择,并用于多种应用。根据欧洲生物塑胶的资料,2021年全球生质塑胶产能约241.7万吨。

预计这些因素将在未来几年增加对生质塑胶的需求并推动马来西亚塑胶市场的发展。

马来西亚塑胶工业概况

由于国内塑胶树脂製造商的存在有限,马来西亚的塑胶市场得到整合。主要企业(排名不分先后)包括东丽塑胶有限公司、乐天化学泰坦控股有限公司、Behn Meyer Malaysia 有限公司、宝理亚太有限公司、马来亚电化工业有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 食品和饮料包装应用的需求增加

- 抑制因素

- 环境问题

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格走势分析

- 进出口

第五章市场区隔(市场规模(基于数量))

- 类型

- 传统塑料

- 工程塑料

- 生质塑胶

- 科技

- 吹塑成型

- 挤出成型

- 射出成型

- 其他的

- 应用

- 包装

- 电力/电子

- 建筑/施工

- 汽车和交通

- 家居用品

- 家具/寝具

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介(概述、财务状况、产品/服务、最新趋势)

- Behn Meyer Polymers Sdn Bhd

- BP Plastics Holding Bhd

- Commercial Plastic Industries

- CYL Corporation Bhd

- EE-LIAN Enterprise M Sdn Bhd

- Fu Fong Plastic Industries Sdn Bhd

- Guppy Plastic Industries Sdn Bhd

- Hicom-Teck See Manufacturing Malaysia Sdn Bhd

- Lam Seng Plastics Industries Sdn Bhd

- Lotte Chemical Titan Holding Berhad

- Malayan Electro-Chemical Industry Co. Sdn Bhd

- Meditop Corp Sdn Bhd

- Metro Plastic Manufacturer Sdn Bhd

- Polyplastics Asia Pacific Sdn Bhd

- Sanko Plastics (Malaysia) Sdn Bhd

- Scientex

- Teck See Plastic Sdn Bhd

- Toray Plastics Sdn Bhd

第七章 市场机会及未来趋势

- 航太领域的成长潜力

- 增加可分解塑胶的使用

- 增加塑胶回收

The Malaysia Plastics Market size is estimated at USD 4.04 billion in 2025, and is expected to reach USD 4.90 billion by 2030, at a CAGR of 3.91% during the forecast period (2025-2030).

The Malaysian plastics market was negatively impacted by the COVID-19 pandemic in 2020, but it registered growth in 2021 as governments eased the restrictions imposed during the pandemic. There was a huge demand for flexible packaging due to the growing demand for personal and healthcare products, pharmaceuticals, and packed foods and beverages.

Key Highlights

- The rising demand for plastics from the food and beverage packaging sector may drive the market in the short term.

- On the other hand, rising environmental concerns about the use of plastics are likely to limit market growth.

- Over the next few years, opportunities for the market are likely to come from growth in the aerospace industry, more use of biodegradable plastics, and more recycling.

Malaysia Plastics Market Trends

Rising Demand from Food and Beverage Packaging Applications

Malaysia is a major economy in Southeast Asia. The country's GDP growth moderated to 4.4% in 2019 and was the lowest since the Global Financial Crisis in 2009. Malaysia's economy will contract by -5.6% in 2020, the worst since the Asian Financial Crisis in 1998.Malaysia's economy grew by 3.1% in 2021, and it is further expected to grow to 5.4% in 2022, according to the IMF forecasts.

- Packaging accounts for the largest application segment in the Malaysian plastics market. The prime reasons for the growing application of plastics in the packaging segment include better wear and chemical resistance, ease of molding, recyclability, puncture resistance, and high mechanical strength.

- According to the Malaysian Reserve (a local information provider owned by TMR Media Sdn Bhd), Malaysia's annual per capita plastic packaging consumption is high among Southeast Asian countries, at 16.78 kg/person.

- Other local packaging manufacturers include Malaysia Packaging Industry Bhd, Bemis Flexible Packaging Sdn Bhd, Amcor Ltd., Daibochi Plastic and Packaging Industry, and Bisson Flexipack Sdn Bhd.

During the forecast period, these things are likely to make more people want to buy plastic packaging in the country.

Increasing Demand for Bioplastics

- Bioplastics are substances made from biological sources through different processes. They are mainly developed as alternatives to conventional plastics.

- Bioplastics have applications in flexible packaging, rigid packaging, agriculture and horticulture, consumer goods, and textiles. They are used as packaging materials for wrapping premium and branded organic food. Rigid bioplastics are used for packaging cosmetic creams and products.

- According to JEITA, global electronic product manufacturing, including laptops, mobile phones, semiconductors, and other items, grew by 11% Y-o-Y to USD 3,360 billion in 2021. It is projected to reach USD 3,536 billion in 2022, which may influence the bioplastic demand.

- Bioplastics are mostly used in the food sector for products like food trays, yogurt cups, and cutlery. The popularity of bioplastics is increasing in the medical, agricultural, consumer electronics, sports, and automotive sectors.

- Bioplastics provide the packaging industry with a renewable, sustainable option for various uses. According to European Bioplastics data, in 2021, the global bioplastic production capacity was around 2.417 million tons.

Such factors are expected to boost the demand for bioplastics and drive the Malaysian plastics market in the coming years.

Malaysia Plastics Industry Overview

The Malaysian plastics market is consolidated due to the limited presence of plastic resin manufacturers in the country. The major players (not in any particular order) include Toray Plastics Sdn Bhd, Lotte Chemical Titan Holding Berhad, Behn Meyer Malaysia Sdn Bhd, Polyplastics Asia Pacific Sdn Bhd, and Malayan Electro-Chemical Industry Co. Sdn Bhd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Food and Beverage Packaging Applications

- 4.2 Restraints

- 4.2.1 Environmental Concerns

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Trend Analysis

- 4.6 Imports and Exports

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Traditional Plastics

- 5.1.2 Engineering Plastics

- 5.1.3 Bioplastics

- 5.2 Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Houseware

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 Behn Meyer Polymers Sdn Bhd

- 6.4.2 BP Plastics Holding Bhd

- 6.4.3 Commercial Plastic Industries

- 6.4.4 CYL Corporation Bhd

- 6.4.5 EE-LIAN Enterprise M Sdn Bhd

- 6.4.6 Fu Fong Plastic Industries Sdn Bhd

- 6.4.7 Guppy Plastic Industries Sdn Bhd

- 6.4.8 Hicom-Teck See Manufacturing Malaysia Sdn Bhd

- 6.4.9 Lam Seng Plastics Industries Sdn Bhd

- 6.4.10 Lotte Chemical Titan Holding Berhad

- 6.4.11 Malayan Electro-Chemical Industry Co. Sdn Bhd

- 6.4.12 Meditop Corp Sdn Bhd

- 6.4.13 Metro Plastic Manufacturer Sdn Bhd

- 6.4.14 Polyplastics Asia Pacific Sdn Bhd

- 6.4.15 Sanko Plastics (Malaysia) Sdn Bhd

- 6.4.16 Scientex

- 6.4.17 Teck See Plastic Sdn Bhd

- 6.4.18 Toray Plastics Sdn Bhd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Growth in Aerospace Sector

- 7.2 Increasing Usage of Bio-degradable Plastics

- 7.3 Increase in Recycling of Plastics