|

市场调查报告书

商品编码

1639423

欧洲资料中心冷却:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

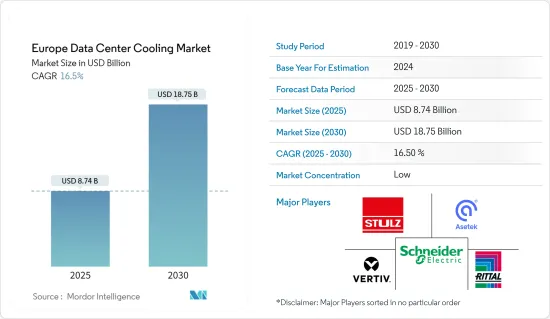

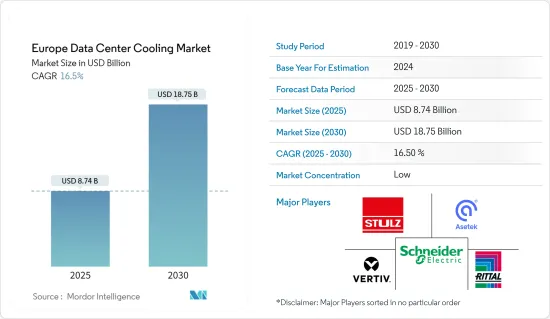

预计 2025 年欧洲资料中心冷却市场价值将达到 87.4 亿美元,预计到 2030 年将达到 187.5 亿美元,预测期(2025-2030 年)的复合年增长率为 16.5%。

中小企业越来越多地采用云端运算、政府对该地区资料安全的监管以及国内公司不断增长的投资是推动该地区资料中心冷却需求的主要因素。

主要亮点

- 冷却技术的选择通常是基于资料中心的位置。随着企业不断寻求削减成本,节能冷却方法正被视为传统冷却方法的潜在替代方案。此外,边缘运算的采用和物联网设备的增加也推动了市场成长。

- 在匈牙利、希腊、波兰和土耳其等新兴欧洲国家, IT基础设施的发展预计将导致电力容量超过50MW的超大规模资料中心设施建设增加。英国、德国和法国拥有欧洲最多的资料中心,市场参与者可以瞄准这些国家投资新技术。这也将使他们能够与即将到来的资料中心营运商伙伴关係,以具有市场竞争力的价格满足市场需求,从而在预测期内促进欧洲资料中心冷却市场的成长。

- 冷却系统占资料中心电力消耗的近40%。公司正尝试透过建立绿色资料中心来解决这个问题。使用绿色资料中心来储存、管理和传递资讯的趋势日益增长,这正在帮助许多软体公司降低能源消费量和整体能源成本。例如,Immersion4 等绿色技术与人工智慧相结合,可以透过实现高效的能源使用和更低的碳足迹来改变资料中心更永续的运作方式。此类绿色资料中心的出现正在推动该地区对冷却设备的需求。

- 资料中心冷却系统的安装需要较高的初始投资,这可能会抑制市场的发展。然而,许多本地供应商和市场先驱正在开发创新解决方案,以低成本改造现有资料中心并降低新设备的安装成本。此外,减少碳排放和停电期间的冷却问题可能会阻碍市场成长。

- 由于新资料中心的安装和现有资料的升级被迫关闭、设备短缺和供应链中断,COVID-19 疫情对市场产生了影响。同时,欧洲国家的资料量和行动资料使用量正在大幅增长,预计将推动整个欧洲资料中心的建立。预计这将在预测期内推动市场成长。预计预测期内政府的支持也将有助于资料中心冷却市场的发展。

欧洲资料中心冷却市场趋势

零售领域可望占据主要市场占有率

- 在零售领域,电子商务和线上消费用户数量的增加预计将产生大量巨量资料,从而推动对资料储存、安全性和低延迟的需求。这推动了该地区的支出和资料中心数量的增加。零售业的快速发展和工业4.0趋势也导致了资料中心的兴起,增加了对冷却设备的需求。

- 随着上网用户数量的不断增加,外国零售公司不断在欧洲国家投资以扩大其储存容量,从而增加了网路流量和资料中心的压力。例如,中国电子商务巨头京东最近确认战略进军欧洲零售业。由于该地区的监管严格,在该地区投资的外国公司可能会选择将资料储存在当地,以缓解资料保护法的过渡。这反过来有望增加资料中心冷却系统的使用,从而在预测期内推动该地区的市场成长。

- 尤其是,根据电子商务基金会的数据,得益于欧洲网路普及率高,欧洲 B2C 电子商务销售额预计将成长约 13%,达到 6,210 亿美元。巨量资料的数量正在增加,这可能导致该地区资料中心和冷却系统的增加。

- 据欧盟统计局称,义大利和波兰的电子商务用户数量正在激增。这导致了大量资料的产生和储存需求的增加。因此,预计欧洲资料中心冷却市场将在预测期内成长。

英国占有最大市场占有率

- 英国的公司正在积极投资新的资料中心,预计这将对预测期内该地区的市场成长产生积极影响。例如,欧洲主机託管和网路公司 Interxion 在伦敦开设了第三个资料中心,扩展了其面向消费者的营运商和 CDN 产品。预计这一发展将提高冷却系统的利用率,从而推动市场成长。

- 德国时尚零售商 H&M 计划在其位于斯德哥尔摩的新资料中心引入冷却和热回收系统。资料中心产生的多余热量将由能源公司 Fortum Varme 分配并重新利用给全市的客户(满载时为 2,500 套现代住宅公寓)。

- 英国拥有欧洲最多的资料中心。市场相关人员可以瞄准这些国家投资新技术。我们还可以与新兴的资料中心营运商伙伴关係,以具有市场竞争力的价格满足他们的需求。

- 采用绿色能源、水回收、零水冷却系统、回收和废弃物管理等绿色和可再生解决方案来建造最永续的资料中心。包括英国在内的欧洲国家的巨量资料量正在增加,对低延迟、大容量资料中心的需求也日益增长,预计这将导致冷却系统的利用率提高。据Science Direct称,预测期内资料中心的能源使用量可能占全球电力供应的2.13%。

- 各行各业的公司都在努力降低营运成本,并越来越多地在全国各地的资料中心冷却系统中使用人工智慧技术。例如,西门子推出了基于人工智慧的热优化,利用 Vigilant AI 产品来增强资料中心冷却系统。

欧洲资料中心冷却产业概况

欧洲资料中心冷却市场比较分散,技术带来的好处以及政府透过对资料中心实施效率法规的支持预计将推动资料中心冷却市场的成长。主要市场参与者包括 IBM 公司、富士通有限公司、日立有限公司、惠普企业和Schneider ElectricSE。随着主要参与者在现有市场中的强势存在,市场渗透率正在不断提高。对创新的日益关注推动了对新技术的需求,这反过来又刺激了对其进一步发展的投资。

- 2024 年 5 月 Rittal 与多家超大规模资料中心营运商合作开发了模组化冷却系统。该解决方案透过直接水冷实现超过1MW的冷却能力。专门针对高功率密度 AI 应用进行调整。

- 2024 年 1 月 Aligned 资料 Centers 是一家技术基础设施公司,为全球超大规模和企业客户提供永续、创新和适应性强的资料中心和按规模建立解决方案。项正在申请专利的解决方案,旨在支援密集的运算要求次世代应用程式和高效能运算,包括人工智慧、机器学习和超级电脑。 DeltaFlow 扩展了 Aligned 的 ExpandOnDemand 功能,为客户提供了无缝扩展和调整的灵活性,以支援不断变化的运算环境。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况(范围:包括与资料中心冷却相关的当前区域趋势的详细分析)

- 冷却的主要成本考量

- 分析与资料中心营运相关的主要成本开销,重点关注资料中心冷却

- 资料中心冷却的关键创新和发展

- 资料中心采用的主要节能技术

第五章 市场动态

- 市场驱动因素(关键因素包括日益关注能源消耗和转向绿色解决方案,这些因素基于未来 5-7 年的相对影响进行绘製)

- 市场动态(监管的动态性质和不断变化的客户需求等关键因素将根据其在未来 5-7 年内的相对影响进行绘製)

- 市场机会

- 封闭式与非封闭式架空地板

- 产业生态系统分析

6. 区域资料中心足迹现况分析

- 资料中心 IT 负载能力与麵积分布区域分析(2017-2030 年)

- 欧洲成熟和新兴资料中心热点区域分析(重点介绍主要成熟和新兴资料中心市场,以实现全面覆盖)

- 直流冷却法规结构的区域分析

第 7 章资料中心冷却市场细分

- 依冷却技术划分(主要趋势、2022-2029 年市场规模估计与预测、未来展望)

- 空气冷却

- CRAH

- 冷却器和节热器

- 冷却塔(涵盖直接冷却、间接冷却及双级冷却)

- 其他的

- 液体冷却

- 浸入式冷却

- 晶片直接冷却

- 后门式热交换器

- 空气冷却

- 按行业

- 资讯科技和电信

- 零售和消费品

- 卫生保健

- 媒体与娱乐

- 联邦政府

- 其他最终用户

- 按国家

- 英国

- 德国

- 俄罗斯

- 丹麦

- 挪威

- 荷兰

- 西班牙

- 波兰

- 瑞士

- 奥地利

- 比利时

- 法国

- 义大利

- 爱尔兰

- 瑞典

第八章 竞争格局

- 公司简介

- Vertiv Group Corp.

- Stulz GmbH

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Asetek A/S

- Alfa Laval AB

- Iceotope Technologies Limited

- Green Revolution Cooling Inc.

- Chilldyne Inc.

- Airedale International Air Conditioning Ltd

第九章投资分析

第十章 市场机会与未来趋势

The Europe Data Center Cooling Market size is estimated at USD 8.74 billion in 2025, and is expected to reach USD 18.75 billion by 2030, at a CAGR of 16.5% during the forecast period (2025-2030).

The growing adoption of cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data center cooling in the region.

Key Highlights

- Cooling technologies are usually selected based on the data centers' geographical location. As companies regularly seek to mitigate costs, energy-efficient cooling methods are being considered the potential alternatives to traditional cooling methods. The market's growth is also fueled by edge computing adoption and the increase in IoT devices.

- Developments in IT Infrastructure in emerging European countries such as Hungary, Greece, Poland, and Turkey are expected to increase the construction of hyperscale data center facilities with over 50 MW power capacity. The United Kingdom, Germany, and France had the highest number of data centers across Europe, and market players can target these countries to invest in their new technologies. Also, they can form partnerships with upcoming data center organizations to cater to market requirements at a competitive price, aiding the growth of the European data center cooling market over the forecast period.

- The cooling systems are responsible for almost 40% of the data center power consumption. Companies are trying to tackle this issue by setting up green data centers. The growing trends toward deploying green data centers for storing, managing, and distributing information have helped many software companies reduce energy consumption and total energy costs. For example, green technologies, such as Immersion4 in combination with AI, are changing how data centers operate to make them more sustainable with efficient energy usage and low carbon footprint. Such green data centers' emergence drives the demand for cooling units in the region.

- Data center cooling systems require a high initial investment to set up, which could restrain the market. However, many local vendors and market players are developing innovative solutions by modifying the existing data centers at a low cost to reduce the cost of setting up a new unit. Additionally, reduced carbon emission and cooling issues during power outages could hamper the growth of the market.

- The COVID-19 pandemic impacted the market owing to lockdowns, shortage of devices, and supply chain disruptions to set up new data centers and update the existing data centers. On the other hand, there is a massive rise in data volume and mobile data usage in European countries, which is anticipated to boost the setup of data centers across Europe. This will propel the market growth over the forecast period. Also, government support is projected to boost the development of the data center cooling market over the forecast period.

Europe Data Center Cooling Market Trends

The Retail Segment is Expected to Hold a Significant Market Share

- In the retail segment, the increasing number of users in e-commerce and online spending is creating an enormous volume of Big Data, which is expected to propel the need for data storage, security, and reduced latency. This boosts the region's expenditure and the number of data centers. Rapid development in the retail sector and Industry 4.0 trends are also responsible for the rise of data centers, enhancing the need for cooling devices.

- Due to the increasing number of online users, foreign retail companies regularly invest in European countries to expand their storage capacity, increasing internet traffic and the load on data centers. For instance, JD.com, a Chinese e-commerce giant, recently confirmed a strategic entry into the European retail sphere. Due to stringent regulations in the region, foreign companies investing in the area may store their data locally for smooth transitions regarding the data protection law. As a result, the usage of data center cooling systems is expected to increase, thereby boosting the market growth in the region over the forecast period.

- Notably, according to the E-commerce Foundation, the European B2C e-commerce turnover is expected to expand by approximately 13% to reach USD 621 billion due to the high internet penetration in the region. It may increase the Big Data volume, leading to more data centers and cooling systems in the area.

- According to Eurostat, Italy and Poland witnessed tremendous growth in e-commerce users. It led to the generation of a vast amount of data, thereby strengthening storage requirements. As a result, the European data center cooling market is expected to grow over the forecast period.

The United Kingdom Accounts For the Largest Market Share

- Companies in the UK are rigorously investing in new data centers, and this is expected to positively impact the market growth in the region over the forecast period. For instance, Interxion, a European colocation and networking company, commenced its third data center in London, expanding carriers and CDNs for consumers. This development is expected to propel cooling system utilization and foster market growth.

- H&M, a fashion retailer in the country, plans to integrate a cooling and heat recovery system in its new data center in Stockholm. The excess heat generated from the data center is reused by Fortum Varme, an energy company, by distributing it to customers (2,500 modern residential apartments at full load) throughout the city.

- The UK recorded the highest number of data centers across Europe. Market players can target these countries to invest in their new technologies. Also, they can form partnerships with upcoming data center organizations to cater to their requirements at a competitive price, which may aid the growth of the European data center cooling market over the forecast period.

- Green and renewable solutions, such as green electricity, water reclamation, zero water cooling systems, recycling, and waste management, are being used to build the most sustainable data centers. Growth in Big Data volume across European countries, including the United Kingdom, is expected to increase the need for low-latency and high-capacity data centers, thereby boosting cooling system utilization. According to Science Direct, data center energy use might account for 2.13% of worldwide electricity supply over the forecast period.

- Companies are regularly trying to reduce their operational cost across their verticals, increasing the AI technology used in data center cooling systems in the country. For instance, Siemens introduced AI-based thermal optimization, wherein the company utilizes Vigilant AI products to enhance cooling systems in data centers.

Europe Data Center Cooling Industry Overview

The European data center cooling market is fragmented as the benefits offered by the technology and support from the government by imposing efficiency regulations on data centers are expected to help the growth of the data center cooling market. Some major market players are IBM Corporation, Fujitsu Ltd, Hitachi Ltd, Hewlett-Packard Enterprise, and Schneider Electric SE. Market penetration is growing with a strong presence of major players in established markets. With the increasing focus on innovation, the demand for new technologies is growing, which, in turn, is driving investments for further developments.

- May 2024: Rittal, in collaboration with multiple hyperscale data center operators, developed a modular cooling system. This solution boasts a cooling capacity exceeding 1 MW, achieved through direct water cooling. It is specifically tailored to cater to the high-power densities of AI applications.

- January 2024: Aligned Data Centers, the technology infrastructure company providing sustainable, innovative, and adaptive scale data centers and build-to-scale solutions for global hyperscale and enterprise customers, introduced its DeltaFlow liquid cooling technology, a patent-pending solution built to support the high-density compute requirements of next-generation applications and high-performance computing, including artificial intelligence, machine learning, and supercomputers. DeltaFlow extended Aligned's ExpandOnDemand capabilities, providing customers the flexibility to seamlessly scale and pivot to support shifting computing environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Coverage: A detailed analysis of the current regional trends related to Data Center Cooling are included in this section)

- 4.2 Key cost considerations for Cooling

- 4.2.1 Analysis of the key cost overheads related to DC operations with an eye on DC Cooling

- 4.2.2 Key innovations and developments in Data Center Cooling

- 4.2.3 Key energy efficiency practices adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers (Key factors such as the increased emphasis on energy consumption, move towards green solutions are mapped based on their relative impact over the next 5-7 years)

- 5.2 Market Challenges (Key factors such as the dynamic nature of regulations, evolving customer needs are mapped based on their relative impact over the next 5-7 years)

- 5.3 Market Opportunities

- 5.4 Comparison of raised floor with containment & raised floor without commitment

- 5.5 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT REGIONAL DATA CENTER FOOTPRINT

- 6.1 Regional Analysis of IT Load Capacity & Area Footprint of Data Centers (for the period of 2017-2030)

- 6.2 Regional Analysis of the Established DC Markets and Emerging DC Hotspots in Europe region (we will include coverage by highlighting major established and emerging DC markets)

- 6.3 Regional Analysis of Regulatory Framework On DC Cooling

7 DATA CENTER COOLING MARKET SEGMENTATION

- 7.1 By Cooling Technology (Key trends, market size estimates & projections for the period of 2022-2029 and future outlook)

- 7.1.1 Air-based Cooling

- 7.1.1.1 CRAH

- 7.1.1.2 Chiller and Economizer

- 7.1.1.3 Cooling Tower (covers direct, indirect & two-stage cooling)

- 7.1.1.4 Others

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-Chip Cooling

- 7.1.2.3 Rear-Door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By End-user Vertical

- 7.2.1 IT & Telecom

- 7.2.2 Retail & Consumer Goods

- 7.2.3 Healthcare

- 7.2.4 Media & Entertainment

- 7.2.5 Federal & Institutional agencies

- 7.2.6 Other End Users

- 7.3 By Country

- 7.3.1 United Kingdom

- 7.3.2 Germany

- 7.3.3 Russia

- 7.3.4 Denmark

- 7.3.5 Norway

- 7.3.6 Netherlands

- 7.3.7 Spain

- 7.3.8 Poland

- 7.3.9 Switzerland

- 7.3.10 Austria

- 7.3.11 Belgium

- 7.3.12 France

- 7.3.13 Italy

- 7.3.14 Ireland

- 7.3.15 Sweden

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Vertiv Group Corp.

- 8.1.2 Stulz GmbH

- 8.1.3 Schneider Electric SE

- 8.1.4 Rittal GmbH & Co. KG

- 8.1.5 Asetek A/S

- 8.1.6 Alfa Laval AB

- 8.1.7 Iceotope Technologies Limited

- 8.1.8 Green Revolution Cooling Inc.

- 8.1.9 Chilldyne Inc.

- 8.1.10 Airedale International Air Conditioning Ltd