|

市场调查报告书

商品编码

1639426

穿戴式健康感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Wearable Health Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

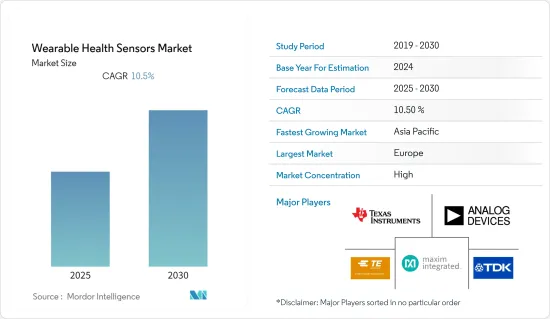

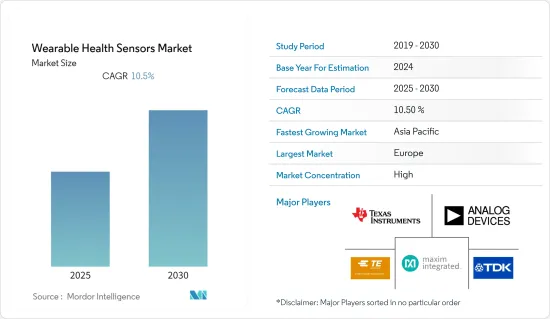

穿戴式健康感测器市场预计在预测期内实现 10.5% 的复合年增长率

主要亮点

- 穿戴式感测器利用智慧型手机的无线连接、强大的应用处理和储存功能,正在寻找新的使用案例,例如远端患者监护,其中患者行为资料分析可以直接发送给医生,从而进一步推动市场成长。的。

- 此外,2022年8月,麻省理工学院的工程师开发了一种没有内建蓝牙模组的可穿戴无线感测器。这是一种可穿戴感测器,无需任何板载晶片或电池即可进行无线传输。该计划为无晶片无线感测器铺平了道路。这种名为「电子皮肤」的新感测器是一种压电材料的超薄半导体薄膜,贴在皮肤上,可以感知身体的振动。它也不需要电源。

- 健康感测器设备的技术进步可以帮助临床医生识别患病风险高的患者,这有望推动市场成长。例如,2021 年1 月,Biosticker 将为医院和家庭护理环境中的临床医生提供,这是一种非常先进的贴身感测器,可轻鬆监测生命体征并提供可付诸行动的见解。了独特的机会併发症。

- 人们对医疗保健的认识不断提高,对智慧健康感测器技术和监测设备产生了新的需求,这些技术和设备可以感知健康状况并向使用者提供回馈,以提高安全性。随后,2021 年 2 月,加州大学圣地牙哥分校的工程师开发出一种可以戴在脖子上的柔软、有弹性的皮肤贴片。此贴片可测量配戴者的葡萄糖、乳酸、酒精和咖啡因含量,同时监测血压和心率。此外,它还分析了人体的几个生化水平和心血管系统的迹象。

- 穿戴式感测器在医疗保健领域广泛应用的主要驱动因素是低成本 MEMS 技术、低功耗微控制器以及高效可靠的远端检测模组。此外,Honeywell也提供26PC SMT(表面黏着技术)系列压力感测器。这种小型、低成本、高价值的压力感测解决方案取代了医疗专业人员将听诊器放在压力袖带下聆听血液流动声音的需要。

- 机器学习和人工智慧能力,尤其是在当今的医疗保健行业,正在将医疗专业技能提升到新的水平。与此相配套的是,支援物联网的可穿戴感测器的价格也在下降,使得製造商能够製造出更实惠的可穿戴设备,从而使各个行业能够开发适合其自身系统和业务的产品,采用它正变得越来越普遍。此外,过去几年穿戴式装置的销量大幅成长。

- 此外,智慧型手錶的发展。 Amazfit Bip U Pro 和 BOAT Xplorer 于 2021 年 4 月在印度推出。智慧型手錶的 PPG 生物辨识追踪光学感测器可持续监测心率。

- 此外,全球人口正在推动家庭医疗保健的趋势。 COVID-19疫情加速了远端患者监护和连续诊断设备(包括医疗穿戴装置)的使用。穿戴式感测器透过不断测量血压、血糖水平、心率和其他活动来帮助监测一个人的健康状况。此外,2021年2月,加拿大卫生署通过一项临时命令,核准了带有温度感测器的BactiGuard导尿管用于预防感染。此次核准是由于 COVID-19,因为 Bactiguard 导管往往可以降低重症患者继发性感染的风险。

穿戴式健康感测器市场趋势

医疗保健产业主导穿戴式健康感测器市场

- 随着人们对医疗保健认识的不断提高,对能够检测健康状况并向用户提供反馈以提高安全性的智慧感测器技术和监测设备的需求也日益增长。健康感测器的小型化将为其应用带来巨大好处,因为小型化感测器具有高度的灵活性,可以併入各种设备中以即时获取资讯。

- 例如,2022 年 5 月,医疗科技新兴企业Movano Inc. 宣布将利用射频技术开发取得专利的系统晶片(SoC) 平台,用于将一系列感测器整合到未来的医疗穿戴装置中。该公司已开始对能够感测血液和葡萄糖的原型进行 Beta 测试。

- 此外,各种医疗监测系统使用不同类型的感测器,这些感测器已被开髮用于持续监测患者的某些身体参数。可用于测量心率、体氧水平和体温的各种生物感测器连接到 Arduino Nano 开发板,并使用 Node MCU ESP8266 无线通讯将记录的讯号传输到伺服器。

- 例如,2021年8月,雅培报告了GUIDE-HF临床试验的资料,显示其CardioMEMSHF系统降低了纽约心臟协会(NYHA)II、III和IV级心臟衰竭患者的死亡率。 CardioMEMS 是一种小型可植入感测器,旨在无线测量和追踪肺动脉压力和心率。这些压力变化甚至在患者出现症状之前就已显示心臟衰竭正在恶化。

- 此外,穿戴式装置在医疗分析中发挥重要作用,从装置收集的资料可用于分析和诊断疾病。从测量脑电波的耳机,到包含感测装置的衣服,再到血压监测仪,这些都将个人健康监测提升到一个新的水平。此外,2021 年 9 月,Rockley 光电宣布正在扩大其非侵入性生物标记感测技术的应用范围,以支援更广泛的医疗设备和设备。

- 此外,压力感测器在呼吸监测中发挥重要作用,并用于人工呼吸器中监测患者的呼吸。压力感测器是人工呼吸器的关键部件,为对抗 COVID-19 的患者提供急需的呼吸辅助。基于MEMS的压力感测器可以帮助改进和改善传统人工呼吸器,避免呼吸过程中的各种损坏。

- 此外,2022 年 7 月,呼吸辅助科技公司 Inspira Technologies OXY BHN Ltd 宣布开发 HYLA 血液感测器。 Inspira 的非侵入式光学血液感测器旨在进行即时连续血液监测,无需抽取实际血液样本即可提醒医生患者临床状况的即时变化。

欧洲占有较大市场占有率

- 欧洲穿戴式健康感测器市场的显着成长得益于感测器成本的下降和智慧型手机的普及。消费者健身意识的不断增强以及健身追踪和监测应用程式的易用性正在推动市场的发展。

- 根据 GSMA 预测,2021 年欧洲将有 4.74 亿人(占总人口的 86%)订阅行动服务,预计到 2025 年这一数字将增长到 4.8 亿。此类家电的发展预计将进一步推动市场成长。

- 随着穿戴式装置在医疗保健和医疗产业中的日益流行,欧洲市场的公司正在为这些应用推出新的创新感测器。

- 例如,2021年7月,全球硅光电技术公司Rockley Photonics推出了完整的全端「腕上诊所」数位健康感测器系统。 Rockley 的感测器模组和相关的消费性穿戴装置参考设计能够监测多种生物标记,包括血压、核心体温、酒精、乳酸、水合物和葡萄糖趋势。

- 此外,无线技术正在欧洲扩展,大大提高了感测器的通讯能力。感测器的小型化与降低的功耗相结合,使其能够以美学角度融入各种设备中,并在寻求将科技与时尚相结合的年轻用户中引起了极大的关注。

- 例如,8sense 是一家德国穿戴式装置新兴企业,製造了世界上第一个具有虚拟教练功能的智慧背部感测器。 8sense 系统将位置和运动分析与即时互动和训练相结合,定期对使用者的姿势提供回馈。这款可连接教练机旨在增强和保护您的健康和工作效率,它可以帮助您更积极地就坐,并让您了解办公室里的实际健身水平。

- 预计该市场在人口老化的西欧国家将出现强劲成长。使用穿戴式装置监测和追踪健康状况正在产生对穿戴式健康感测器的巨大需求。 2021 年 8 月,Masimo 宣布 Masimo SafetyNet Alert 获得 CE 标誌并在西欧上市,这是一款专为家庭使用而设计的动脉血氧饱和度监测和警报系统。 Masimo SafetyNet Alert 具有可穿戴指尖脉搏血氧计感测器,该感测器具有讯号提取技术,可与配套的家庭医疗中心和智慧型手机应用程式进行无线通讯。

- 医疗保健占据可穿戴感测器市场的很大一部分,尤其是在英国和法国等新兴市场。国防和资讯娱乐领域的应用不断增加预计将增强市场。主要趋势是开发新的应用。

穿戴式健康感测器产业概况

穿戴式健康感测器市场竞争适中,由几家领先公司组成。从市场占有率来看,目前市场主要被几家主要企业所占据。它还显示出良好的成长率,主要企业正在投资研发,透过推出新产品或对现有产品进行技术升级来增强产品系列。随着企业专注于製造专利产品,预计市场竞争将更加活跃。

2022 年 2 月,美国医疗设备製造商雅培实验室宣布推出一款消费者健康手錶,可以追踪关键的身体讯号,帮助使用者更了解并采取措施改善整体健康状况。款名为「Lingo」的生物穿戴装置。这使得生物骇客能够使用连续的资料流,而不是零星的手指刺穿测试、尿液样本或呼吸测试。

2021 年 12 月,专门从事下一代 GPS 的公司 NextNavi 与 Bosch Sensortec 建立合作伙伴关係。该公司专门为家用电器提供感测解决方案,使气压感测器的垂直放置更加精确。 NextNav 认证计画对 Bosch Sensortec 气压感测器进行严格测试,以确保其在广泛应用场景中的准确性和性能超过严格的标准。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 评估新冠肺炎疫情对市场的影响

- 市场驱动因素

- 医疗服务对持续监测的需求日益增加

- 智慧型设备中高性能感测器的兴起

- 生理感测器的小型化

- 市场限制

- 缺乏通用标准和互通性问题

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链分析

- 技术简介

第五章 市场区隔

- 按类型

- 压力感测器

- 温度感测器

- 位置感测器

- 其他类型

- 按最终用户产业

- 卫生保健

- 家电

- 运动/健身

- 其他最终用户产业

- 按地区

- 亚太地区

- 欧洲

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- TE Connectivity Ltd

- Analog Devices Inc

- TDK Corporation

- Texas Instruments Incorporated

- Maxim Integrated Products Inc

- Infineon Technologies AG

- STMicroelectronics Inc.

- Arm Limited

- Fraunhofer IIS

- mCube Inc.

第七章投资分析

第 8 章:市场的未来

The Wearable Health Sensors Market is expected to register a CAGR of 10.5% during the forecast period.

Key Highlights

- Leveraging wireless connectivity, powerful application processing, and smartphone storage capabilities, wearable sensors are finding new use cases, such as remote patient monitoring, where the patient's motion data analysis can be sent directly to the physician, which may further boost the market growth.

- Furthermore, In August 2022, engineers from the Massachusetts Institute of Technology developed wearable wireless sensors without the Bluetooth module housed in them. It is a wearable sensor that transmits wirelessly without onboard chips or batteries. This project opens an avenue toward chip-free wireless sensors. The new sensor, called - 'e-skin', is an ultrathin semiconductor film of piezoelectric material which adheres to the skin, sensing the body's vibration. It also does not require any power source.

- Technological advances in health sensor devices can assist clinicians in identifying patients at high risk of disease, which is expected to drive market growth. For instance, in January 2021, Biosticker, a highly advanced on-body sensor that allows effortless monitoring of vital signs and actionable insights, was provided to clinicians from patients in hospitals or home care settings, creating a unique opportunity for the early detection of complications.

- The increased level of awareness concerning healthcare has created an emerging need for smart health sensor technologies and monitoring devices that can sense and provide users feedback about their health status for increased safety. Further, in February 2021, engineers at the University of California, San Diego, developed a soft, elastic skin patch that can be worn around the neck. It measures the wearer's glucose, lactate, alcohol, and caffeine levels while monitoring blood pressure and heart rate. Additionally, it analyzes several biochemical levels and cardiovascular signs in the human body.

- The key factors in the proliferation of wearable sensors in healthcare are the availability of low-cost MEMS technologies, low-power microcontrollers, and efficient and reliable telemetry modules. Furthermore, Honeywell offers the 26PC SMT (Surface Mount Technology) Series pressure sensor. This small, low-cost, high-value pressure sensing solution replaces the need of the healthcare professional to place a stethoscope under the pressure cuff, to hear the noise of the rushing blood.

- Machine learning and AI capabilities are taking healthcare professionals' skills to the next level, especially in the current healthcare industry. In support of this, IoT-compatible wearable sensors are also witnessing a decline in pricing, which leads to manufacturers offering wearable devices at a more affordable rate, thus encouraging various industries to adopt products catered to their systems and operations. Additionally, there has been a significant increase in the number of wearable devices sold over the past few years.

- Furthermore, as technical devices require continuous R&D for various features, industry players' ongoing technological advances are fueling the development of smartwatches. Amazfit Bip U Pro and BOAT Xplorer were launched in India in April 2021. PPG bio-tracking optical sensors in smartwatches continuously monitor heart rate.

- Further, the global population is driving a trend toward home healthcare. The COVID-19 pandemic accelerated the use of remote patient monitoring and continuous diagnostic devices, including medical wearables. Wearable sensors help monitor a person's health, as they constantly measure their blood pressure, glucose concentrations, heart rate, and other activities. Moreover, in February 2021, Health Canada approved Bactiguard's urinary catheter with temperature sensor for infection prevention through an Interim Order. This approval was driven by COVID-19, as Bactiguard's catheters tend to reduce the risk of secondary infections for critically ill patients.

Wearable Health Sensors Market Trends

Healthcare Industry Holds a Dominant Share in Wearable Health Sensors Market

- The increased level of awareness concerning healthcare has created an emerging need for smart sensor technologies and monitoring devices that are able to sense and provide feedback to users about their health status for increased safety. Miniaturization of health sensors will lead to significant benefits in their application since smaller versions of sensors are more flexible, and they can be embedded in a variety of devices to obtain real-time information.

- For instance, in May 2022, MovanoInc., a medical technology start-up, started using radiofrequency technology to develop a patented system-on-chip (SoC) platform for a range of sensors to be incorporated into future medical wearables. The company has started the beta testing of a prototype that will be able to perform blood and glucose sensing.

- Further, various healthcare monitoring systems use different types of sensors developed to monitor specific body parameters of the patient continuously. Different biosensors available to measure heart rate, body oxygen level, and temperature are attached to the Arduino Nano board, and recorded signals are sent to the server using Node MCU ESP8266 wireless communication.

- For instance, in August 2021, Abbott reported data from the GUIDE-HF clinical trial, where its CardioMEMSHF System reduced mortality in New York Heart Association (NYHA) Class II, III, and IV heart failure patients. A small implantable sensor, CardioMEMS, is designed to measure and track pulmonary artery pressure and heart rate wirelessly. These pressure changes suggest deteriorating heart failure even before patients feel symptoms.

- Moreover, wearable devices play a significant role in healthcare analytics, where the data collected from the device can be used to analyze and diagnose disease. From headsets that measure brainwaves to clothes that include sensing devices, BP monitors, etc., these have taken personal health monitoring to a new level. Furthermore, in September 2021, Rockley Photonics announced that the company had expanded the range of possible applications for its non-invasive biomarker sensing technology to support a wider range of medical equipment and devices.

- Further, pressure sensors hold significant importance in respiratory monitoring and are used in ventilators to monitor patients' breathing. Pressure sensors are critical components in ventilators and provide necessary breathing assistance to patients battling COVID-19. MEMS-based pressure sensors contribute to advancing and improving conventional ventilators to avoid various injuries during the ventilation process.

- Additionally, in July 2022, Inspira Technologies OXY B.H.N Ltd, a respiratory support technology company, announced the development of the HYLA blood sensor. Inspira's non-invasive optical blood sensor is designed to perform real-time and continuous blood monitoring to alert physicians of immediate changes in a patient's clinical condition without taking actual blood samples.

Europe holds Significant Market Share

- The significant growth in Europe's Wearable Health Sensors market is being stimulated by the reduced costs of sensors and the increasing adoption of smartphones. The growing consciousness among consumers regarding fitness and the easy availability of applications that track and monitor fitness are driving the market ahead.

- According to the GSMA, 474 million people in Europe (86% of the population) subscribed to mobile services in 2021, with this figure expected to rise to 480 million by 2025. Such developments in consumer electronics will further drive market growth.

- With the increasing trend of wearable gadgets in the healthcare and medical industry, companies in the European market have been launching new and innovative sensors for such applications.

- For instance, in July 2021, Rockley Photonics, a global silicon photonics technology company, launched its complete full-stack, "clinic-on-the-wrist" digital health sensor system. Rockley's sensor module and associated reference designs for consumer wearable devices could monitor multiple biomarkers, including blood pressure, core body temperature, alcohol, lactate, body hydration, and glucose trends.

- Further, expanding wireless technology in Europe has considerably improved sensors' communication capabilities. The miniaturization, coupled with the reduction in power requirement of sensors, has enabled their integration into various devices in an aesthetic manner, thus generating significant buzz among the younger users who are seeking a combination of technology and fashion.

- For instance, 8sense is a wearable start-up from Germany that makes the world's first smart back sensor with a virtual coach. The 8sense system regularly gives feedback on the user's posture, combining position and movement analysis with real-time interaction and training. Designed to enhance and protect health and productivity, this attachable coach helps to sit more actively and informs about actual fitness levels in the office.

- The market is expected to register high growth in Western European countries, owing to the increasing aging population. The use of wearables to monitor and track their well-being creates a significant demand for wearable health sensors. In August 2021, Masimo announced the CE marking and launch in western Europe of Masimo SafetyNet Alert, an arterial blood oxygen saturation monitoring and alert system designed for the home. Masimo SafetyNet Alert features a Signal Extraction Technology wearable fingertip pulse oximetry sensor that communicates wirelessly to an accompanying Home Medical Hub and smartphone app.

- Healthcare accounts for a significant chunk of the wearable sensors market, particularly in developed markets like the United Kingdom and France. Increasing applications in the fields of Defense and Infotainment are expected to enhance the market. The development of novel applications is the primary trend.

Wearable Health Sensors Industry Overview

The wearable health sensors market is moderately competitive and consists of several major players. In terms of market share, few significant players currently dominate the market. It also has a lucrative growth rate, with key players investing in R&D to strengthen their product portfolios by launching novel products and technologically upgrading their existing products. Players' focus on manufacturing patent products is expected to fuel market competition.

In February 2022, Abbott Laboratories, a US-based medical device company, developed consumer bio wearables called Lingo that can track key body signals to help users better understand their overall health and take steps to improve it. It may allow biohackers to use a continuous stream of data rather than sporadic finger-prick tests, urine samples, and breath readings.

In December 2021, NextNav, a company specializing in next-generation GPS, teamed up with Bosch Sensortec. This company specializes in sensing solutions for consumer electronics, enabling more exact vertical placement in barometric pressure sensors. The NextNav Certified program will put Bosch Sensortec's barometric pressure sensors through rigorous testing to ensure that their accuracy and performance exceed strict standards across various application scenarios.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment on Impact of COVID-19 on the market

- 4.3 Market Drivers

- 4.3.1 Increasing Need for Continuous Monitoring In Healthcare Services

- 4.3.2 Rising Growth toward Advanced Functions Sensors in Smart Gadgets

- 4.3.3 Miniaturization of Physiological Sensors

- 4.4 Market Restraints

- 4.4.1 Dearth of Common Standards and Interoperability Issues

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Value Chain Analysis

- 4.7 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Pressure Sensor

- 5.1.2 Temperature Sensor

- 5.1.3 Position Sensor

- 5.1.4 Other Types

- 5.2 By End User Industry

- 5.2.1 Healthcare

- 5.2.2 Consumer Electronic

- 5.2.3 Sports/Fitness

- 5.2.4 Other End User Industries

- 5.3 By Geography

- 5.3.1 Asia Pacific

- 5.3.2 Europe

- 5.3.3 Latin America

- 5.3.4 Middle East and Africa

- 5.3.5 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 TE Connectivity Ltd

- 6.1.2 Analog Devices Inc

- 6.1.3 TDK Corporation

- 6.1.4 Texas Instruments Incorporated

- 6.1.5 Maxim Integrated Products Inc

- 6.1.6 Infineon Technologies AG

- 6.1.7 STMicroelectronics Inc.

- 6.1.8 Arm Limited

- 6.1.9 Fraunhofer IIS

- 6.1.10 mCube Inc.