|

市场调查报告书

商品编码

1639437

工业机器人:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Industrial Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

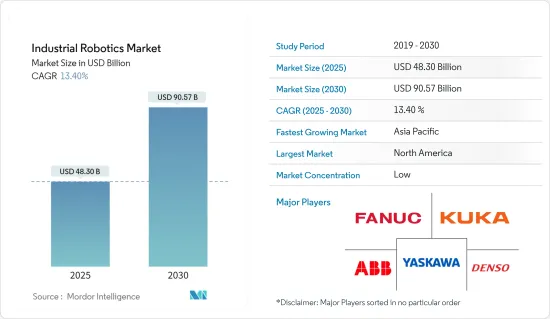

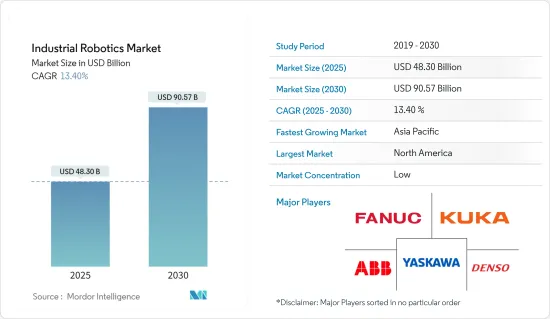

2025 年工业机器人市场规模预计为 483 亿美元,预计到 2030 年将达到 905.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.4%。

主要亮点

- 工业机器人在製造业的工业自动化中发挥关键作用,现在工业中的许多核心业务都由机器人管理。随着各地区经济的成长,电子商务、电子、汽车等产业也蓬勃发展。

- 物联网的日益普及以及各地区对机器人技术的投资对市场的成长做出了巨大贡献。例如,《中国製造2025》的推出,旨在透过转向注重品质和创新主导的製造业,全面升级中国工业。

- 最新的工业革命——工业 4.0 推动了协作机器人和人工智慧机器人等新技术的发展,工业界使用机器人来简化许多流程、提高效率并消除错误。职场安全性的提高和生产能力的提高正在刺激产业进一步投资机器人系统。

- 到 2025 年,协作机器人预计将占机器人总销量的 34%(根据国际机器人联合会 (IFR) 的数据),并将应用于塑胶、食品和消费品、半导体和电子、生命科学等行业,以及製药。预计工业机器人的使用将变得更加广泛。同样引起关注的是苹果工厂使用富士康机器人实现的自动化。半导体产业中的IC代工厂是影响当前市场需求的招募企业之一。

- 推动市场发展的关键因素包括对高品质产品的需求不断增长(这需要对製造过程进行适当的端到端可视性)、对节能的需求以及对职场安全的日益关注。据监测北美工业机器人销售情况的先进自动化协会 (A3) 称,技术进步以及製造设施的持续成长也有望推动这一市场的发展。 2022年企业将订购44,196台机器人,比2021年增加11%。

工业机器人市场趋势

汽车业占很大份额

- 在过去的 50 年里,汽车产业已经在组装上使用机器人完成各种製造工序。汽车製造商目前正在探索在更多工序中使用机器人。对于这样的生产线,机器人更有效率、灵活、精确、可靠。这项技术使汽车产业成为机器人最重要的使用者之一,也是全球自动化程度最高的供应链之一。

- 此外,汽车製造过程中自动化程度的提高、人工智慧和数数位化的参与是汽车产业对工业机器人需求增加的主要因素。

- 在当今的汽车产业,机器人技术的进步正在加速,以跟上正在发生的快速变化。机器人解决方案的模拟和虚拟试运行将最大限度地发挥当前汽车行业OEM、新兴企业和供应商的工厂自动化优势。

- 例如,欧洲第二大汽车製造商标致雪铁龙集团正在利用 Universal Robots 的 UR10 协作机器人对其欧洲製造地进行现代化改造。根据瑞银预测,2025年欧洲电动车销量预计将达63亿辆。

- 为了跟上汽车製造业不断变化的格局,许多汽车产业公司都在采用工业机器人。例如,2022 年 1 月,华域汽车系统股份有限公司(以 HASCO 的名义开展业务)将与 ABB 集团在现有合作关係的基础上成立合资企业,以「推进下一代智慧製造」。两家公司声称,合资公司将使他们能够进一步巩固华域汽车在自动化解决方案领域的主导地位,从而使中国客户受益。

- 此外,全球汽车产业的不断发展也支持了汽车零件焊接、堆迭、零件插入、拾取和桶应用以及许多其他用途的工业机器人的发展。此外,2022 年 7 月,Yamaha马达机器人公司宣布将在 Motek 2022 上展出其最新的先进自动化机器人。该公司将展示SCARA机器人、笛卡尔机器人、单轴机器人和LCMR200线性输送机模组,突显其速度、精确度和灵活性。

北美占据主要市场占有率

- 该地区的政府也正在采取倡议,协助开拓机器人市场的最新技术,以鼓励机器人技术的采用。例如,美国联邦政府启动了国家机器人计画(NRI)项目,以加强国内机器人製造能力并鼓励该领域的研究活动。

- 2022年2月,美国钢铁公司与机器人及人工智慧工作室卡内基铸造厂宣布达成战略投资与合作关係。这两家位于匹兹堡的新兴企业将合作利用先进的机器人和人工智慧来加速和扩大工业自动化。利用这笔资金筹措,卡内基铸造厂将在先进製造、工业机器人、整合系统、自主移动和语音分析等领域推广和扩大其工业自动化机器人和人工智慧技术组合。

- 2022年3月,Kinova Robotics推出了加拿大首款工业协作机器人Link 6。 Link 6 是加拿大第一台采用自动化解决方案的协作工业机器人,可提高日常生产率,同时增强产品品质和一致性。 Link 6机械臂的开发和製造充分考虑了每个人的需求,无论您是经验丰富的工业整合商还是没有特定机器人专业知识的操作员,它都能提供长距离和高速度,从而缩短循环时间。我会的。 Kinova 的 Link 6 控制器提供市场上最高的处理能力和记忆体容量。它还支援可选的 GPU,使控制器能够适应未来的 AI 解决方案,同时保持控制器的紧凑。

- 根据先进自动化协会(A3)统计,2021年第二季北美企业订购了98.53亿台机器人,较2020年大幅增加5,196台,带来新的就业机会。此外,根据机器人工业协会 (RIA) 的数据,今年迄今为止工业机器人数量增长的最重要驱动力是汽车OEM为製程自动化购买的机器人数量增加了 83%。

工业机器人产业概况

工业机器人市场高度分散。工业 4.0 正在推动各个地区的数位化进程,为工业机器人市场提供了丰厚的机会。考虑到不时举办的机器人展览会的数量,透明度很高。整体而言,现有参与者之间的竞争非常激烈。预计将会出现大公司和新兴企业之间以创新为重点的收购和合作。市场的主要企业包括ABB和安川电机。该领域的主要发展包括:

- 2024 年 5 月:工业机器人製造商 ABB 在 Automate 2024 上推出其最新的模组化大型机器人。这些机械臂与先前发布的 IRB 5710-5720 和 IRB 6710-6740 型号一起,目前产品系列已拓展到 46 种型号。这些变体可以处理 70 至 620 公斤(约 150 至 1,350 磅)的承重能力。

- 2024 年 3 月,移动工业机器人推出最新产品-自主托盘搬运车 MiR1200。 MiR1200 托盘搬运车配备先进的 3D 视觉技术,旨在简化劳力密集物料输送。机器人可以动态调整其路径,即使存在地板上鬆散的物体或头顶上的障碍物等障碍物也能确保导航。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 更加重视职业安全

- 工业机器人新技术

- 市场限制

- 技术纯熟劳工短缺

第六章 市场细分

- 按机器人类型

- 关节机器人

- 线性机器人

- 圆柱形机器人

- 并联机器人

- SCARA机器人

- 其他机器人

- 按最终用户产业

- 车

- 化学/製造

- 建造

- 电气和电子

- 饮食

- 机械和金属

- 药品

- 其他终端用户产业(橡胶、光学)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 亚洲

- 日本

- 中国

- 印度

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- ABB Ltd.

- Yaskawa Electric Corporation

- Denso Corporation

- Fanuc Corporation

- KUKA AG

- Kawasaki Robotics

- Toshiba Corporation

- Panasonic Corporation

- Staubli Mechatronics Company

- Yamaha Robotics

- Epson Robots

- Comau SPA

- Adept Technologies

- Nachi Robotic Systems Inc.

第八章投资分析

第九章:未来市场展望

The Industrial Robotics Market size is estimated at USD 48.30 billion in 2025, and is expected to reach USD 90.57 billion by 2030, at a CAGR of 13.4% during the forecast period (2025-2030).

Key Highlights

- Industrial robots play a crucial role in manufacturing industrial automation, with many core operations in industries being managed by robots. With economic growth across regions, e-commerce, electronics, and the automotive industry, among others, have increased.

- Rising penetration of the IoT and investments in robotics across regions have been major contributors to the market's growth. For instance, the 'Made in China 2025' announcement aimed to broadly upgrade the Chinese industry by moving toward quality-focused and innovation-driven manufacturing.

- Industry 4.0, the newest industrial revolution, has fueled the development of new technologies, like collaborative robots, AI-enabled robots, etc., and has enabled industries to use robots to streamline many processes, increase efficiency, and eliminate errors. Increased workplace safety and improved production capabilities have further driven industries to invest in robotic systems.

- Owing to collaborative robots, which are estimated to account for 34% of the total robot sales in 2025 (according to the International Federation of Robots (IFR), the penetration of industrial robots is expected to rise across industries, such as plastics, food and consumer goods, semiconductors and electronics, life sciences, and pharmaceuticals. Another notable factory automation is expected at Apple's factories through Foxconn's robots. Semiconductor industry IC foundries have been among the adopters that have impacted the current market demands.

- Some of the major factors driving the market include rising demand for high-quality products (which need proper end-to-end visibility in the manufacturing process), the need for energy conservation, and rising focus on workplace safety. Incremental advancements in technology, coupled with a sustained increase in the development of manufacturing facilities, are also expected to drive this market, for instance, According to the Association for Advancing Automation (A3), which monitors industrial robot sales in North America. Companies ordered 44,196 robots in 2022, 11% more than in 2021.

Industrial Robotics Market Trends

Automotive Industry to Hold Major Share

- For the past 50 years, the automotive industry has used robots in its assembly lines for various manufacturing processes. Currently, automakers are exploring the use of robotics in more procedures. Robots are more efficient, flexible, accurate, and dependable for such production lines. This technology enables the automotive industry to remain one of the most significant robot users and possess one of the most automated supply chains globally.

- Furthermore, the growing adoption of automation in the automotive manufacturing process and the involvement of AI and digitalization are the primary factors increasing the demand for industrial robots in the automotive sector.

- In today's automotive industry, the advancement of robotics technology has accelerated to keep up with the rapid changes in the automotive industry. A robotics solution simulation and virtual commissioning will utilize the maximum benefits of factory automation for OEMs, startups, and suppliers in the present automotive industry.

- For instance, For instance, Europe's second-largest car manufacturer, PSA Group, modernizes its European manufacturing sites with Universal Robots' UR10 collaborative robots. According to UBS, around 6.3 billion electric vehicles are forecast to be sold in Europe in 2025.

- To cater to the changing landscape of automotive manufacturing, many players in the industry are adopting industrial robots. For instance, in January 2022, Huayu Automotive Systems Co., which does business as HASCO, and ABB Group announced that they have created a joint venture building on their existing relationship "to drive the next generation of smart manufacturing." The companies claimed that the joint venture would enable them to further develop HASCO's leading position with automated solutions that benefit customers in China.

- Further, the growing automotive sector worldwide supports the growth of industrial robotics for welding car parts, palletizing, part insertion, pick-and-pale applications, and many other uses. Moreover, in July 2022, Yamaha Motor Robotics announced to showcase of its latest robots for Advanced Automation at Motek 2022. The company will demonstrate SCARA, cartesian and single-axis robots, and the LCMR200 linear conveyor module, highlighting their speed, accuracy, and flexibility.

North America to Hold a Significant Market Share

- The government in the region is also encouraging the adoption of robotics by taking initiatives to support the development of modern technologies in the robotics market. For instance, the US federal government has commenced the National Robotics Initiative (NRI) program to bolster the capabilities of building domestic robots and encourage research activities in the field.

- In February 2022, United States Steel and Carnegie Foundry, a robotics and AI studio, announced a strategic investment and relationship. The two Pittsburgh-based startups will collaborate to accelerate and expand industrial automation powered by advanced robotics and artificial intelligence. Carnegie Foundry will use this funding to market and scale its industrial automation portfolio of robotics and AI technologies in advanced manufacturing, industrial robots, integrated systems, autonomous mobility, speech analytics, and other areas.

- In March 2022, Kinova Robotics introduced Link 6, Canada's first industrial collaborative robot. Link 6 is Canada's first industrial collaborative robot, with automation solutions that increase daily productivity while enhancing product quality and consistency. The Link 6 robotic arm is developed and constructed with any user in mind, both for experienced industrial integrators and operators with no particular robotic expertise, achieving quick cycle times through longer reach and fast movements. The Link 6 controller from Kinova has the market's most processing power and memory capacity. It supports an optional GPU, making it ready for use with future AI solutions while keeping the controller compact.

- Association for Advancing Automation (A3), companies in North America ordered 9,853 million robots in the second quarter of 2021, which is a significant increase compared to 2020, with 5,196 sales, leading to new job opportunities. Further, according to Robotic Industries Association (RIA), the most critical driver of the year-to-date increase in industrial robots was an 83% growth in units purchased by automotive OEMs for process automation.

Industrial Robotics Industry Overview

The industrial robotics market is highly fragmented. Industry 4.0, with digitalization initiatives across regions, provides lucrative opportunities in the industrial robots market. The degree of transparency is high, considering the number of robotic trade exhibits across conducted areas occasionally. Overall, the competitive rivalry among existing players is high. The acquisitions and collaboration of large companies with startups are predicted, focusing on innovation. A few major players in the market are ABB and Yaskawa. Some of the key developments in the area are:

- May 2024: ABB, an industrial robot manufacturer, unveiled its latest modular large robots at Automate 2024. These robot arms, in conjunction with the previously released IRB 5710-5720 and IRB 6710-6740 models, now present a lineup of 46 variants. These variants are capable of managing payloads ranging from 70 to 620 kilograms (approximately 150 to 1,350 pounds).

- March 2024: Mobile Industrial Robots has unveiled its latest product, the MiR1200 autonomous pallet jack. Equipped with advanced 3D vision technology, the MiR1200 Pallet Jack is designed to streamline labor-intensive materials handling. This robot can adapt its route dynamically, ensuring navigation even in the presence of obstacles, such as loose objects on the floor or overhead hindrances.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Emerging Technologies in Industrial Robots

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Type of Robot

- 6.1.1 Articulated Robots

- 6.1.2 Linear Robots

- 6.1.3 Cylindrical Robots

- 6.1.4 Parallel Robots

- 6.1.5 SCARA Robots

- 6.1.6 Other Types of Robot

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Chemical and Manufacturing

- 6.2.3 Construction

- 6.2.4 Electrical and Electronics

- 6.2.5 Food and Beverage

- 6.2.6 Machinery and Metal

- 6.2.7 Pharmaceutical

- 6.2.8 Other End-user Industries (Rubber, Optics)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Germany

- 6.3.3 Asia

- 6.3.3.1 Japan

- 6.3.3.2 China

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Yaskawa Electric Corporation

- 7.1.3 Denso Corporation

- 7.1.4 Fanuc Corporation

- 7.1.5 KUKA AG

- 7.1.6 Kawasaki Robotics

- 7.1.7 Toshiba Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Staubli Mechatronics Company

- 7.1.10 Yamaha Robotics

- 7.1.11 Epson Robots

- 7.1.12 Comau SPA

- 7.1.13 Adept Technologies

- 7.1.14 Nachi Robotic Systems Inc.