|

市场调查报告书

商品编码

1639438

4K 显示解析度:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)4K Display Resolution - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

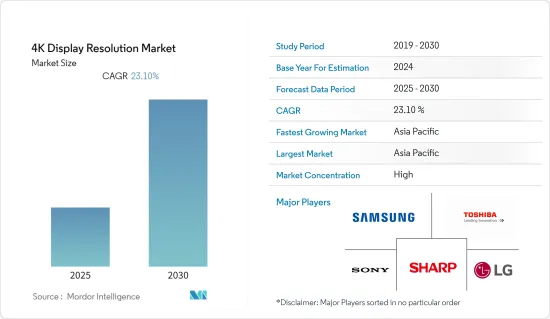

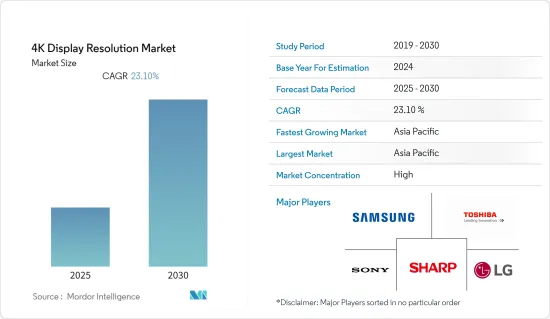

预计预测期内 4K 显示解析度市场将以 23.1% 的复合年增长率成长。

众多参与者进入市场,市场趋势走向分散。 4K显示器製造成本的下降正在推动市场的发展。

为了加速消费者对具有 4K 显示器的高解析度全高清产品的采用,供应商正在将该技术整合到现有产品线中,以降低更换成本。

由于游戏产业的兴起,SONY等主要游戏品牌对游戏机和设备的需求大幅增加。因此,对优质4K LED萤幕的需求不断增加并推动着市场的发展。

自从新冠疫情爆发以来,许多公司都采取了在家工作的文化,这增加了对智慧型手机和笔记型电脑的需求,从而极大地促进了市场的发展。

4K 显示解析度的市场趋势

娱乐和媒体产业占很大份额

预计娱乐和媒体产业仍将是 4K 技术的关键应用产业之一,其驱动因素有很多,包括对更好的游戏体验和丰富娱乐的需求不断增长,以及 4K 内容的可用性不断提高。

现代消费者正在转向 4K 解析度电视,因为它们具有准确的色彩和色域支持,适合图形设计、照片编辑和查看高解析度影像中的精细细节。

微软和SONY等主要游戏机製造商已推出支援 4K 的游戏机,以提供更身临其境和先进的游戏体验。因此,4K 电视和显示器的销量预计会增加。

据SONY称,该公司已在智慧型手机、平板电脑和高清电视上部署了其服务,截至 2022 年 9 月,该网路每月有效用户约为 1.03 亿。

SONY表示,2021财年第三季度,其PS5游戏机总合390万台。此前,2020年其PS5销售量约为780万台。一般来说,PS 游戏机的销售量往往在第三季达到高峰,这与假期季节来临的第四季相对应。

亚太地区维持最高份额

- 日本、韩国和台湾拥有三星、LG、SONY等企业,占4K电视市场的很大份额。此外,该地区消费电子产品的销售量正在上升,对高品质的数位广告产生了需求。

- 由于製造成本较低,4K 电视的平均售价也较低,这将从技术角度推动市场发展。主要企业现在采取与其他科技巨头合作推出新产品的策略,以获得市场占有率。

- 零售业的成长、广告支出的增加、公共和私人基础设施的改善以及 4K数位数位电子看板系统提供的相关好处正在推动该地区市场的发展。

4K 显示解析度产业概览

4K显示分辨率市场相对分散,由几个主要企业组成。从市场占有率来看,目前市场主要被少数几家大公司占据。然而,随着製造成本的下降和竞争的加剧,公司正在采用产品推出策略来提高和占领市场占有率。

2022 年 5 月,SONY发布了新款智慧型手机 Xperia 1 IV。这款智慧型手机专为追求最新智慧型手机技术的人士而设计,包括先进的成像技术、先进的游戏功能和强大的音讯功能,所有这些都包含在紧凑、现代的设计中。配备三个镜头——一个 16 毫米超广角镜头、一个 24 毫米广角镜头和一个全新独特的 85-25 毫米真正光学远摄变焦镜头——使创作者能够捕捉各种各样的内容。此外,它还配备 4K 120Hz HDR 显示屏,亮度提高近 50%,并具有即时 HDR 驱动。

2022 年6 月,三星电子宣布其2022 年Odyssey G85NB、G75NB 和G40B 游戏显示器系列在全球上市,承诺Odyssey G85NB、G75NB 和G40B 游戏显示器将提供市场上最身临其境、最逼真的游戏体验。支持了我们的行业领先地位。根据该公司介绍,G85NB 是世界上第一款 240Hz 4K 游戏显示器,在 32 吋尺寸内提供超沉浸式影像品质、快速反应时间和卓越效能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链

- COVID-19 对产业的影响

第五章 市场动态

- 市场驱动因素

- 高解析度显示产品的需求

- 经济实惠的 4K 显示产品製造

- 市场限制

- 内容製作和广播需要大量投资

- 4K 解析度的频宽分配

第六章 市场细分

- 依产品类型

- 监视器

- 智慧电视

- 智慧型手机

- 其他产品类型

- 按行业

- 航太和国防

- 商业和教育

- 娱乐和媒体

- 零售和广告

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Samsung Electronics Co. Ltd

- LG Display Co. Ltd

- Toshiba Corporation

- Panasonic Corporation

- Sony Corporation

- Sharp Corporation

- Innolux Corporation

- Haier Group Corporation

- Koninklijke Philips NV

- Hisense Group

- BOE Technology Group

- AU Optronics

第八章投资分析

第九章 市场机会与未来趋势

The 4K Display Resolution Market is expected to register a CAGR of 23.1% during the forecast period.

Many players are entering the market, and the market trend is moving toward fragmentation. The decline in the manufacturing cost of 4K displays is driving the market.

To facilitate the adoption of 4K display higher resolutions full HD products by consumers, vendors are integrating the technology into their existing product lines with moderate replacement costs.

The demand for gaming consoles and devices by major gaming brands, like Sony, has seen a significant increase owing to the increasing gaming industry. Thus, the requirement for good 4K LED screens has been increasing, driving the market.

Post-COVID-19, the market has seen a significant boost as the requirements for smartphones and laptops have increased due to the work-from-from culture opted for by many organizations.

4K Display Resolution Market Trends

Entertainment and Media Segment to Hold Major Share

Owing to various factors, such as growing demand for a better gaming experience, enriched entertainment, and the increasing availability of 4K content, the entertainment and media industry is expected to remain one of the primary applications of 4K technology.

Modern consumers are inclined toward TVs with 4K resolution due to the accurate color and color gamut support for graphics designing, photo editing, and examining the fine details of high-resolution images.

Major console manufacturers, like Microsoft and Sony, have released 4K-enabled consoles to offer a more immersive and advanced gaming experience. Hence, the sales of 4K TVs and monitors are expected to increase.

According to Sony, the company has expanded to smartphones, tablets, and HD televisions; as of September 2022, the network had approximately 103 million monthly active users.

Sony stated that the company sold a total of 3.9 million PS5 gaming consoles in the third quarter of the fiscal year 2021. Before that, the company sold around 7.8 million PS5 units in 2020. The sales of PS consoles generally tend to peak in the company's third fiscal quarter, which is the fourth calendar quarter, as people begin to prepare for the holiday season.

Asia-Pacific to Retain Leading Market Share Position

- Japan, South Korea, and Taiwan represent a significant 4K TV market share, with the presence of players such as Samsung, LG, and Sony. Moreover, the increasing sales of consumer electronics in the region drive the demand for high-quality digital advertisements.

- The drop in ASP of 4K TVs due to decreasing manufacturing costs pushes the market to its extent in terms of technology. Key players are now adopting strategies to launch new products in partnerships with other tech giants to gain market share.

- The growing retail sector, rising advertising expenditures, improving public and private infrastructure, and the associated benefits offered by 4K digital signage systems are boosting its market in the region.

4K Display Resolution Industry Overview

The 4K display resolution market is relatively fragmented and consists of several major players. In terms of market share, few major players currently dominate the market. However, with decreasing manufacturing costs and high competition, the companies are adopting product launch strategies to improve and gain market share.

In May 2022, Sony announced the new Xperia 1 IV smartphone, explicitly designed for those looking for the latest in smartphone technology, including advanced imaging technology, evolved gaming capabilities, and powerful audio features, all wrapped in a compact and modern design. It features three lenses: a 16 mm ultra-wide lens, a 24 mm wide lens, and a new unique true optical telephoto zoom 85-25 mm lens, to give creators the ability to capture a wide range of content. Moreover, it has an almost 50% brighter 4K 120Hz HDR display and real-time HDR drive.

In June 2022, Samsung Electronics announced the global availability of the 2022 Odyssey G85NB, G75NB, and G40B gaming monitor lineup, supporting the Odyssey's industry-leading position in delivering the most immersive and realistic gaming experience available in the market. According to the company, the G85NB comes with the world's first 240 Hz 4K gaming monitor and is available in a 32-inch format, offering super-realistic picture quality, rapid response times, and premium performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain

- 4.4 COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for High-resolution Display Products

- 5.1.2 Affordable Manufacturing of 4K Display Products

- 5.2 Market Restraints

- 5.2.1 The Need for High Investment in Content Creation and Broadcasting

- 5.2.2 Bandwidth Allocation for 4K Resolution

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Monitor

- 6.1.2 Smart TV

- 6.1.3 Smartphone

- 6.1.4 Other Product Types

- 6.2 By End-user Vertical

- 6.2.1 Aerospace and Defence

- 6.2.2 Business and Education

- 6.2.3 Entertainment and Media

- 6.2.4 Retail and Advertisement

- 6.2.5 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 LG Display Co. Ltd

- 7.1.3 Toshiba Corporation

- 7.1.4 Panasonic Corporation

- 7.1.5 Sony Corporation

- 7.1.6 Sharp Corporation

- 7.1.7 Innolux Corporation

- 7.1.8 Haier Group Corporation

- 7.1.9 Koninklijke Philips NV

- 7.1.10 Hisense Group

- 7.1.11 BOE Technology Group

- 7.1.12 AU Optronics