|

市场调查报告书

商品编码

1639457

零售业手势姿态辨识-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Gesture Recognition in Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

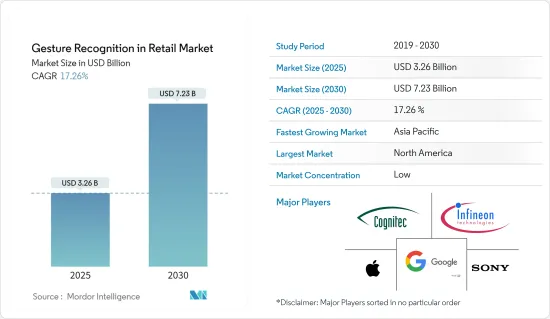

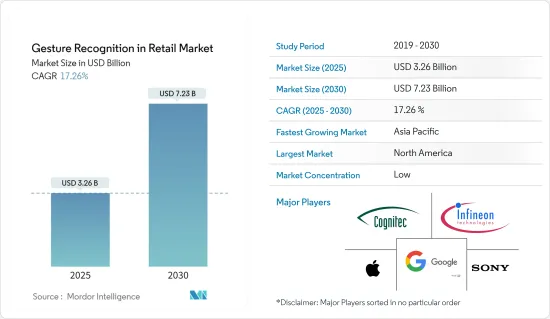

零售业手势姿态辨识市场规模预计到 2025 年为 32.6 亿美元,预计到 2030 年将达到 72.3 亿美元,预测期内(2025-2030 年)复合年增长率为 17.26%。

该市场预计将受益于全球人均收入的成长、技术进步和零售数位化的不断发展。物联网 (IoT) 的日益普及以及对产品消费舒适性和便利性日益增长的需求也推动了市场扩张。

根据全球改善营养联盟预测,到 2022 年,印度食品零售店数量预计将达到约 1,300 万家。这包括传统商店和新商店。自 2013 年以来,它一直在持续成长,但主要是透过传统零售商。许多零售店被认为可以为所调查的市场提供扩大的机会。人们已经创建了各种原型,以使手势检测比键盘和滑鼠等传统介面工具更便宜。手势越来越受到主要供应商的关注,因为它们富有表现力,易于与环境互动,并能有效地传达讯息。

各种门禁系统都需要可靠的人员识别。此类系统的范例包括 ATM、笔记型电脑和行动电话。如果潜在的诈骗不符合强大、可靠的身份验证要求,他们可能会获得对这些系统的存取权。为了加强存取控制系统的安全性,引入了双重认证(T-FA),它结合了两个因素来对使用者进行身份验证。预计这些因素将推动所研究的市场。

此外,零售商可以使用脸部辨识技术来实现更快、无摩擦的交易,透过丰富的分析来提高客户满意度,提供有针对性的广告,并提高商店安全性并为 VIP 和忠诚度计画会员提供个性化体验。投资智慧零售技术可确保商店继续提供最佳的店内体验,进而提高品牌忠诚度和销售量。

电脑视觉辨识手部动作的能力对于人机互动的未来发展至关重要。手势多样,具有多种意义,时空变化;人类的手是复杂的非刚性物体,难以辨识;而电脑视觉本身就是一个非姿势问题。

COVID-19 大流行使得非接触式通讯变得至关重要。原本被置于AR/VR和生物识别背景下的手势姿态辨识也因此受益匪浅。如果能够开发出独立于平台的手势侦测系统,将会有很大的市场发展空间。此外,随着消费者对 AR/VR 系统越来越熟悉,并且需要与萤幕的互动最少,他们的应用可能会扩展到各个行业。智慧型手机和广告空间现在正在协同工作,无缝地发送相关广告并在数位领域传递讯息。

这是对各国将实施的众多智慧城市计划的回应。

零售市场手势姿态辨识的趋势

非接触式技术预计将占据主要份额

非接触式技术非常节能,无需人工干预即可自动关闭,从而减少能源损失和成本。企业可以使用卫生槓桿等简单的手动措施来保护员工免受污染表面的影响。与健康相关的费用和罚款的可能性较低,有助于抵消实施非接触式技术所产生的成本。非接触式科技有潜力实现并改善以便利为中心的更精简、自主和愉快的消费者体验。

此外,语音辨识软体允许使用者口头执行任务。例子包括苹果的 Siri、谷歌的 Home 和亚马逊的 Alexa。中小型公司开发用于商业和公共用途的语音辨识软体,例如声控 ATM 和火车票务机。企业可以减少输入时间,摆脱手动记录的束缚,并允许客户使用声控、免触控设备透过语音将事件新增至日历。

此外,非接触式手势姿态辨识可以根据商店扒手和辱骂顾客的资料库对进入商店的每个人筛检,从而识别并防止重复犯罪。一旦配备脸部辨识软体的摄影机识别出犯罪分子并允许适当、安全地接近他们,系统就会迅速告知员工犯罪分子的身份、商店内的位置以及列入黑名单的原因。以这种方式创建已知罪犯的黑名单可以减少并消除错误和偏见。此策略还可以让您的防损人员腾出时间来专注于确保客户和员工的安全。

基于非接触式手势姿态辨识的 POS 系统可以快速、轻鬆地验证客户身份并启用付款。与先前的生物识别技术类似,客户无需信用卡或智慧型手机即可完成交易。手势姿态辨识技术可用于阻止非法贸易。即使您的窃贼或智慧型手机被盗,最新的反身分技术也可以防止窃贼欺骗脸部辨识系统。该技术透过验证镜头前的脸部是否为真人并与资料库匹配来阻止假冒行为。

根据美国人口普查局预测,到2022年终,零售总额将达到约7.1兆美元,与前一年同期比较增加约5亿美元。一些世界顶级零售公司的总部都位于美国,包括沃尔玛、好市多和亚马逊。尤其是亚马逊,随着电子商务在全球的扩张,收益呈现惊人的成长。如此巨大的零售额预计将推动所研究的市场。

亚太地区成长最快

根据统计和规划实施部 (MOSPI) 的数据,印度的消费支出从 2022 年第二季的 227,981 亿印度卢比(2,463.2 亿美元)增至 2022 年第三季的 222,957.2 亿卢比。此外,根据内务部的数据,2021年家庭平均每月在线上购买杂货的支出超过2,300日元,而家用电子电器产品的支出略高于1,200日元。 2021年,家庭每月线上支出将接近16,000日圆。这可能是零售商实施手势姿态辨识系统以改善客户体验的机会。

此外,根据全球农业资讯网路的数据,到 2022 年,印度将约有 1,300 万家杂货零售店。此类别包括传统零售商和新零售商。自2013年以来,门市数量稳定成长,但大部分为传统门市。此外,根据中国国家统计局的数据,2021年全国零售连锁店数量为292,383家。

未来的研究应该扩展提案的技术并将其与物联网(IoT)集成,以实现完全自动化并提高非理想条件下的手势姿态辨识分割效能。开发了深度学习的高效虹膜影像分割技术,以提高非理想虹膜影像的分割性能,例如不同大小的虹膜、深色虹膜、眼镜或眼睑遮挡、光照、不合作样本、镜面反射等。

市场上的供应商正在开发新产品以赢得市场占有率。例如,2022年3月,人工智慧云端供应商百度人工智慧云端宣布推出人工智慧手语平台,让用户在几分钟内创建用于手语翻译和现场口译的数位化身。作为百度人工智慧云端数位化身平台 XiLing 推出的新产品,该平台旨在透过增加自动手语翻译的使用来帮助残障人士和听力障碍 (DHH) 群体消除沟通障碍。

随着中国经济的成长,消费需求和生活方式、消费方式正在发生显着变化。零售品牌和购物中心正在采用新技术,实现零售各个方面的数位化,提高整个价值链的效率并降低营运成本,并透过积极创新和製定提供复杂的零售服务、零售产品和零售空间。经营模式

零售业手势姿态辨识产业概况

零售手势姿态辨识市场较为分散。主要企业包括索尼公司、苹果公司和谷歌公司。产品发布、高额研发支出、联盟和收购是这些公司维持激烈竞争的主要成长策略。

2023年2月,全球全像扩增实境(「AR」)技术供应商微美全像开发了3D手势追踪演算法。它使用数学演算法来解码人类手势并透过收集目标手势的位置并将其运动转换为视讯画面内的连续点的轨迹来监视使用者手势。 3D手势追踪演算法是电脑视觉中的重要研究领域。该系统使用手势、相机姿势和位置资讯来追踪使用者动作,这在一定程度上解决了视讯串流中的手势追踪问题。

2022 年 7 月,为各种电子应用领域的客户提供服务的全球半导体先驱意法半导体宣布推出其最新的 FlightSense 飞行时间 (ToF) 多区域感测器。它与一组基本的软体演算法相结合,描述了用于用户检测、手势姿态辨识和入侵者警告的承包解决方案,特别适合 PC 市场。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 利用市场促进和市场约束因素

- 市场驱动因素

- 越来越依赖手势与机器通信

- 零售业更多地使用支援手势姿态辨识的设备

- 市场限制因素

- 与手势姿态辨识技术相关的演算法、数学和其他复杂性

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章技术概况

第六章 市场细分

- 依技术

- 基于触摸的手势姿态辨识

- 非接触式手势姿态辨识

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Apple Inc

- Cognitec Systems GmbH

- Crunchfish AB

- Elliptic Labs

- GestureTek, Inc.

- Google LLC

- Infineon Technologies AG

- Intel Corporation

- Microsoft Corporation

- Omron Corporation

- Sony Corporation

第八章投资分析

第九章 市场机会及未来趋势

The Gesture Recognition in Retail Market size is estimated at USD 3.26 billion in 2025, and is expected to reach USD 7.23 billion by 2030, at a CAGR of 17.26% during the forecast period (2025-2030).

The market will likely benefit from rising global per capita income, technological developments, and more digitization in the retail industry. The expanding use of the Internet of Things (IoT) and the growing need for comfort and convenience in product consumption are also driving market expansion.

As per the Global Alliance for Improved Nutrition, there will be around 13 million retail food stores in India by 2022. This included both conventional and new merchants within the sector. While there has been consistent growth since 2013, it has been chiefly constituted of traditional retailers. Many retail establishments would provide opportunities for the studied market to expand. Various prototypes have been created to make hand gesture detection more affordable than conventional interface tools like keyboards and mice. Hand gestures are highly expressive, easily interact with the environment, and effectively transmit information may cause leading suppliers' rising interest.

Reliable personal recognition is required by a wide variety of access control systems. Examples of these systems include ATMs, laptops, and cellular phones. If these systems fail to meet the demands of reliable and robust authentication, potential imposters may gain access to these systems. To enhance the security of access control systems, two-factor authentication (T-FA) has been introduced, wherein two factors are combined to authenticate a user. Such factors are expected to drive the studied market.

Further, retailers can use facial recognition technology to create faster and more frictionless transactions, increase customer satisfaction through rich analytics, offer targeted advertising, better manage employee attendance and store security, and personalize experiences for VIPs and loyalty program members. Investments in smart retail technology will guarantee that merchants continue giving the best in-store experience possible, improving brand loyalty and sales.

The capacity of computers to visually recognize hand movements is critical for the future development of HCI. However, vision-based recognition of hand gestures, particularly dynamic hand gestures, is a difficult interdisciplinary challenge for three reasons: hand gestures are diverse, have multiple meanings, and vary spatiotemporally; the human hand is a complex non-rigid object that is difficult to recognize; and computer vision is an ill-posed problem in and of itself.

The COVID-19 pandemic made contactless communication essential. Gesture recognition, which was relegated to AR/VR and biometric authentication background, benefited from this. The market had a lot of room for growth if platform-independent gesture detection systems were developed. Additionally, consumers' familiarity with AR/VR systems and the minimum interaction required with screens can broaden its application in various industries. Smartphones and the advertising space worked together to seamlessly transmit relevant ads and deliver information in the digital sphere.

This is in response to numerous smart city projects that would be implemented in various nations.

Gesture Recognition in Retail Market Trends

Touchless Technology is Expected to hold the Major Share

Touchless technology is more energy efficient because it shuts off automatically rather than requiring human involvement, resulting in less energy loss and cost. Simple, manual measures, such as sanitary levers, can be used by businesses to safeguard personnel from contaminated surfaces. The lower likelihood of health-related charges and fines offsets costs incurred due to deploying touchless technology. Touchless technology has the potential to enable or improve a more streamlined, self-directed, and enjoyable consumer experience, with convenience at its center.

Further, with voice recognition software, users can carry out tasks verbally. Examples include Apple's Siri, Google's Home, and Amazon's Alexa. Small businesses have created voice recognition software for commercial and public uses, like voice-activated ATMs and train ticketing devices. Businesses may reduce typing time, do away with retaining manual records, and enable customers to audibly add events to their calendars by using voice-activated, touch-free devices.

Moreover, touchless gesture recognition can identify and prevent repeat offenders by screening everyone who enters the store against a database of known shoplifters and rowdy patrons. The system quickly provides workers with the offender's identification, location within the store, and reasons for block-listing when cameras equipped with face recognition software identify offenders to ensure that the person is approached appropriately and safely. By creating this block list of known offenders, mistakes and biases are lessened and eliminated. Also, this strategy frees up loss prevention staff, allowing them to concentrate on ensuring the security of customers and employees.

Touchless-based gesture recognition point-of-sale (POS) systems can rapidly and easily verify customer identity and allow payments. Customers do not require a credit card or smartphone to complete the transaction, similar to previous biometric verification techniques. Using gesture recognition technology can help stop fraudulent transactions. The most recent anti-spoofing technology stops thieves from fooling the facial recognition system even if a user's card or smartphone is stolen. This technique prevents efforts at spoofing by ensuring that the face in front of the camera is a real person and matches the database.

According to US Census Bureau, total retail sales will have reached roughly USD 7.1 trillion by the end of 2022, an increase of approximately half a billion US dollars over the previous year. Several world's top retail corporations, such as Walmart, Costco, and Amazon, are headquartered in the United States. Amazon, in particular, has seen exceptional revenue growth in line with the global expansion of e-commerce. Such huge retail sales are expected to drive the studied market.

Asia-Pacific to Witness the Fastest Growth

According to the Ministry of Statistics and Programme Implementation (MOSPI), India's consumer spending climbed from INR 22079.81 billion ( USD 246.32 Billion) in the second quarter of 2022 to INR 22295.72 billion (USD253.07 Billion) in the third quarter. Further, According to Statistics Bureau Japan, the average monthly household spending on online food purchases in 2021 was over JPY 2.3 thousand, whereas spending on home electronics was only over JPY 1.2 thousand. In 2021, monthly household online spending was close to JPY 16,000. This may create an opportunity for retail players to deploy gesture recognition systems to enhance the customer experience.

Moreover, According to Global Agriculture Information Network, In 2022, there will be around 13 million retail grocery stores in India. Within the category, this encompassed both traditional and new retailers. While there has been a consistent number growth since 2013, it was largely made of traditional stores. Further, According to the National Bureau of Statistics of China, in 2021, there were 292,383 retail chain stores across the country.

Future studies should extend and integrate the proposed technology with the Internet of Things (IoT) to achieve full automation and increase gesture recognition segmentation performance in less-than-ideal conditions. To improve segmentation performance for non-ideal iris images, including different-sized iris, dark iris, occlusions owing to spectacles or eyelids, illumination, non-cooperative samples, and specular reflections, a high-efficiency iris image segmentation technique based on deep learning was developed.

The vendors in the market are developing new products to capture the market share. For instance, in March 2022, Baidu AI Cloud, a provider of AI clouds, unveiled an AI sign language platform capable of producing digital avatars for sign language translation and live interpretation in minutes. This platform, released as a new product of Baidu AI Cloud's digital avatar platform XiLing, promises to help break down communication barriers for the deaf and hard-of-hearing (DHH) community by increasing access to automated sign language translation.

As China's economy has grown, consumer demand and living and spending patterns have altered noticeably. Retail brands and shopping centers have continued to seize the business opportunities created by new consumption actively, not only by adopting new technologies to realize digitalization of all aspects of retail, improving the efficiency of the entire value chain, and lowering operating costs, but also by actively innovating and formulating new business models to create refined retail services, retail products, and retail space.

Gesture Recognition in Retail Industry Overview

The gesture recognition in the retail market is fragmented. Some key players are Sony Corporation, Apple Inc., and Google LLC. Product launches, high expenses on research and development, partnerships and acquisitions, etc., are the prime growth strategies these companies adopt to sustain the intense competition.

In February 2023, WiMi Hologram Cloud Inc., a global Hologram Augmented Reality ("AR") Technologies provider, created a 3D gesture tracking algorithm. This is a way of monitoring a user's gesture by collecting the target gesture's position and translating its movement into a continuous trail of points in a video frame to decode human gestures using mathematical algorithms. A three-dimensional gesture tracking algorithm is an important area of research in computer vision. The system tracks user motions using gestures, camera attitude, and position information, which somewhat helps solve the gesture-tracking problem in video streams.

In July 2022, STMicroelectronics, a global semiconductor pioneer servicing clients across various electronics applications, released its latest FlightSense Time-of-Flight (ToF) multi-zone sensor. When delivered with a suite of essential software algorithms, the combination provides a turnkey solution for user detection, gesture recognition, and intruder warning, specifically suited for the PC market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Dependence on Gestures to Communicate with Machines

- 4.3.2 Increasing Use of Devices Supporting Gesture Recognition Across the Retail Sector

- 4.4 Market Restraints

- 4.4.1 Algorithms, Mathematical and Other Complexities Associated with the Gesture Recognition Technology

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Touch-based Gesture Recognition

- 6.1.2 Touch-less Gesture Recognition

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Apple Inc

- 7.1.2 Cognitec Systems GmbH

- 7.1.3 Crunchfish AB

- 7.1.4 Elliptic Labs

- 7.1.5 GestureTek, Inc.

- 7.1.6 Google LLC

- 7.1.7 Infineon Technologies AG

- 7.1.8 Intel Corporation

- 7.1.9 Microsoft Corporation

- 7.1.10 Omron Corporation

- 7.1.11 Sony Corporation