|

市场调查报告书

商品编码

1639459

越南太阳能 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)Vietnam Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

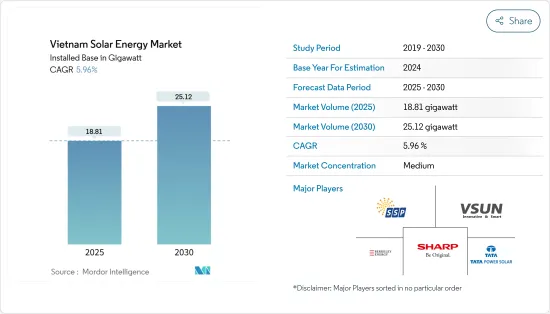

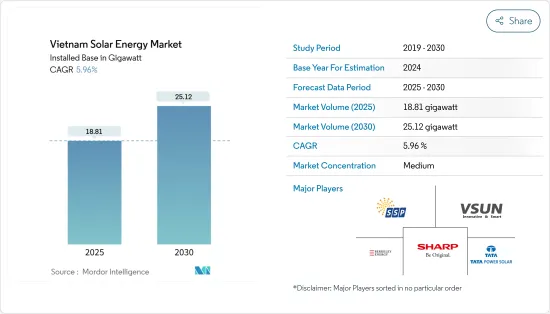

越南太阳能市场规模(装置量)预计将从2025年的19.26吉瓦扩大到2030年的21.73吉瓦,预测期间(2025-2030年)复合年增长率为2.44%。

主要亮点

- 从中期来看,可再生能源发电产业投资的增加、重点地区电力需求的增加以及国家加强从石化燃料发电转型的力度是预测期内的市场驱动因素。

- 另一方面,研究期间越来越多地采用替代清洁能源来源以及太阳能发电工程的高昂初始投资成本预计也将阻碍市场成长。

- 越南电力发展第七计画计划在八年内将可再生能源的份额提高到10%。该国还计划减少进口燃煤电力的使用,为太阳能市场创造巨大机会。

越南太阳能市场趋势

光伏(PV)领域预计将主导市场

- 由于太阳能模组成本的下降及其在发电和热水等各种应用中的多功能性,预计光伏(PV)领域将在预测期内占据最大的市场占有率。

- 根据IRENA 2024年可再生能源统计数据,越南太阳能发电装置容量从2022年的16,698MW增加至2023年的约17,077MW。这一增长归因于越南大规模部署太阳能发电装置,尤其是公共事业。工业和贸易部(MOIT)进一步计划在未来几年增加太阳能装置容量。

- 2023年5月,越南政府启动了1,350亿美元的能源战略。光伏(PV)系统将透过净计量计画安装在该国一半的住宅屋顶上。政府希望在八年内成为电力出口国。

- 此外,越南近年来太阳能发电工程显着成长。政府也实施了支持措施和奖励,鼓励对包括太阳能在内的可再生能源的投资。政府已向主要电力公司分配了多个计划,以改善全国的基础设施,并在未来一年增加全国的能源产量。

- 例如,截至2024年2月,政府宣布海浪绿色氢能太阳能光电园区容量为4,300兆瓦,计画于2027年开始试运行,胡志明市屋顶太阳能光电园区、顺南太阳能发电公司装置容量为630MW的工厂计画于2027年开始试运行我们宣布了诸如 Project 之类的计划。这些计划预计将在未来几年增加全部区域的太阳能产量。

- 由于上述发展,预计太阳能发电领域在预测期内将占据越南最大的市场占有率。

电力需求增加带动市场需求

- 越南能源部预测,由于新发电厂的发展落后于该国能源消耗的快速扩张,该国将出现电力短缺。

- 由于工业化和经济现代化的进步,越南的能源需求预计在未来七年将以每年8%以上的速度成长。

- 政府宣布了修订计划,到2024年将整体供电量增加4.4千瓦时,达到3106亿度。该措施恰逢该国经济快速復苏,电力需求不断增加。

- 2024年第一季,越南电力实现商业发电量626.6亿度,较2023年同期成长11.42%。预计2024年4月至2024年7月,能源需求总量为1114.68亿度,比原计划增加23亿度。

- 此外,越南预计未来两年将需要 96,500 兆瓦的电力,未来七年将需要 129,500 兆瓦的电力,以满足不断增长的需求。为了满足不断增长的电力需求,到2030年,越南每年将需要约100亿美元。由于资本要求较高,政府允许越南能源产业公司 100% 外资持股。

- 根据世界能源资料统计回顾,2022年越南全国发电量为180.4兆瓦时,较2021年成长2.3%。到2023年,太阳能将占该国总发电量的很大一部分,并且在未来几年可能会增加。

- 太阳能发电工程的实施部分满足了越南日益增长的电力需求。这些计划在实现该国能源结构多元化、减少对石化燃料的依赖以及满足不断增长的电力需求方面发挥关键作用。近年来,全部区域的投资大幅增加。

- 例如,中国太阳能板製造商天合光能在2023年11月宣布,未来几年将投资4.2亿美元用于全部区域屋顶太阳能发电工程的研发。此类投资将有助于即将推出的发电工程满足预测期内不断增长的电力需求。

- 因此,越南正在重点发展再生能源来源,以满足未来的电力需求,这推动了越南太阳能市场的成长。

越南太阳能产业概况

越南的太阳能市场是半固定的。市场上营运的主要企业包括(排名不分先后)Song Giang Solar Power JSC、Vietnam Sunergy Joint Stock Company、Sharp Energy Solutions Corporation、Berkeley Energy Commercial & Industrial Solutions 和 Tata Power Solar Systems Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 可再生能源结构(越南,2023 年)

- 2029年太阳能装置容量及预测(单位:GW)

- 政府法规和措施

- 最新趋势和发展

- 市场动态

- 促进因素

- 加大可再生能源产业投资

- 主要州电力需求增加

- 抑制因素

- 更多采用替代清洁能源来源

- 促进因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 技术部分

- 光伏(PV)

- 聚光型太阳光电(CSP)

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- SONG GIANG SOLARPOWER JSC

- Vietnam Sunergy Joint

- SONG GIANG SOLARPOWER JSC

- Vietnam Sunergy Joint

- Sharp Energy Solutions Corporation

- TATA POWER SOLAR SYSTEMS LTD

- Vivaan Solar Private Limited

- B.Grimm Power Public Co Ltd

- ACWA Power Company

- Wuxi Suntech Power Co. Ltd

- Berkeley Energy Commercial & Industrial Solutions

- 市场排名分析

第七章 市场机会及未来趋势

- 越南电力发展七计划旨在提高可再生能源比例

The Vietnam Solar Energy Market size in terms of installed base is expected to grow from 19.26 gigawatt in 2025 to 21.73 gigawatt by 2030, at a CAGR of 2.44% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the increasing investments in the renewable energy industry, increasing electricity demand in major provinces, and the country's growing efforts to transition from fossil fuel-based power generation are among the factors expected to drive the market during the forecast period.

- On the other hand, market growth is also expected to be hindered by the increasing adoption of alternative clean energy sources and high initial investment costs of solar projects during the study period.

- Nevertheless, Vietnam's Power Development Plan VII intends to boost the share of renewable energy to 10% in eight years. The country also plans to reduce the use of imported coal-fired electricity, culminating in a major opportunity for its solar energy market.

Vietnam Solar Energy Market Trends

The Solar Photovoltaic (PV) Segment is Expected to Dominate the Market

- The solar PV segment will likely account for the largest market share during the forecast period, in line with the declining costs of solar modules and their versatility in various applications, like electricity generation and water heating.

- According to the IRENA Renewable Energy Statistics 2024, the installed solar PV capacity in Vietnam was around 17,077 MW in 2023, up from 16,698 MW in 2022. The growth resulted from massive deployments of solar PV installations in Vietnam, particularly for utility projects. The Ministry of Industry and Trade (MOIT) has more plans to increase the solar PV installed capacity over the coming years.

- In May 2023, the Vietnamese government launched a USD 135 billion energy strategy. Through a net-metering scheme, half of the country's residential rooftops will be outfitted with photovoltaic (PV) systems. The government hopes to be a power exporter in eight years.

- Furthermore, Vietnam has experienced significant growth in solar PV projects in recent years. The government has also implemented supportive policies and incentives to encourage investments in renewable energy, including solar power. The government has allotted several projects to leading solar companies to improve infrastructure across the country and increase energy production over the coming year across the country.

- For instance, as of February 2024, the government announced several projects, including Hai Lang Green Hydrogen Solar PV Park, with a capacity of 4,300 MW and expected to be commissioned by 2027; Ho Chi Minh Rooftop Solar PV Park, with a capacity of 1,000 MW and to be commissioned by 2025; Thuan Nam Solar Power Plant Project, with a capacity of 630 MW and to be commissioned by 2027. These projects are likely to increase solar energy production across the region in the coming years.

- Owing to the aforementioned developments, the solar PV segment is expected to have the largest market share in Vietnam during the forecast period.

Increasing Electricity Demand is Driving Market Demand

- The Vietnamese Ministry of Energy has projected that the country is expected to suffer power shortages because the development of new power plants is lagging behind the rapidly expanding energy consumption in the country.

- Energy demand in Vietnam is expected to rise by more than 8% annually over the next seven years, in line with increasing industrialization and economic modernization.

- The government unveiled a revised plan to raise the supply of power by 2024 to 310.6 billion kWh overall, an increase of 4.4 kWh. This action is consistent with the nation's quick economic recovery, which has increased electricity demand.

- In the first quarter of 2024, Vietnam Power achieved a commercial power output of 62.66 billion kWh, an increase of 11.42% over the same period in 2023. With preparations spanning April through July 2024 and a total energy requirement of 111.468 billion kWh, the plan represents a 2.3 billion kWh increase over the prior plan.

- Moreover, Vietnam is expected to need 96,500MW of electricity in the next two years and 129,500MW in the next seven years to meet the rising demand. To meet the upcoming electricity demand, Vietnam requires around USD 10 billion annually until 2030 to cater to the growing demand. Owing to such high capital requirements, the government has allowed 100% foreign ownership of Vietnamese companies in the energy industry.

- According to the Statistical Review of World Energy Data, in 2022, electricity generation across the country was 180.4 Terawatt-hours, an increase of 2.3% compared to 2021. Solar energy registered a significant share in the total electricity generation across the country in 2023, which is likely to rise in the coming years.

- The implementation of solar PV projects has partly fulfilled Vietnam's increased electricity demand. These projects play a crucial role in diversifying the country's energy mix, reducing reliance on fossil fuels, and meeting growing electricity needs. Investments have risen significantly across the region in the past few years.

- For instance, in November 2023, Trina Solar, a Chinese solar panel manufacturer, announced an investment of USD 420 million for research and development in rooftop solar power projects across the region in the coming years. These types of investments help upcoming solar projects to fulfill the rising electricity demand during the forecast period.

- Thus, Vietnam is focusing on renewable energy sources to meet the future electricity demand, which is propelling the growth of its solar energy market.

Vietnam Solar Energy Industry Overview

The Vietnamese solar energy market is semi-consolidated. Some of the major companies operating in the market (in no particular order) include Song Giang Solar Power JSC, Vietnam Sunergy Joint Stock Company, Sharp Energy Solutions Corporation, Berkeley Energy Commercial & Industrial Solutions, and Tata Power Solar Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, Vietnam, 2023

- 4.3 Solar Energy Installed Capacity and Forecast, in GW, till 2029

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Investments in the Renewable Energy Industry

- 4.6.1.2 Increasing Electricity Demand in Major Provinces

- 4.6.2 Restraints

- 4.6.2.1 Increasing Adoption of Alternative Clean Energy Sources

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 SONG GIANG SOLARPOWER JSC

- 6.3.2 Vietnam Sunergy Joint

Stock Company

- 6.3.3 Sharp Energy Solutions Corporation

- 6.3.4 TATA POWER SOLAR SYSTEMS LTD

- 6.3.5 Vivaan Solar Private Limited

- 6.3.6 B.Grimm Power Public Co Ltd

- 6.3.7 ACWA Power Company

- 6.3.8 Wuxi Suntech Power Co. Ltd

- 6.3.9 Berkeley Energy Commercial & Industrial Solutions

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Vietnam's Power Development Plan VII Intends to Increase the Share of Renewable Energy