|

市场调查报告书

商品编码

1639460

甲苯:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Toluene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

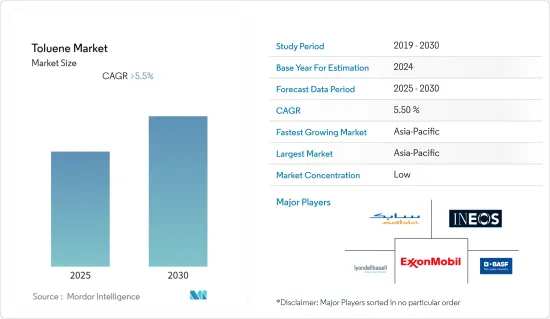

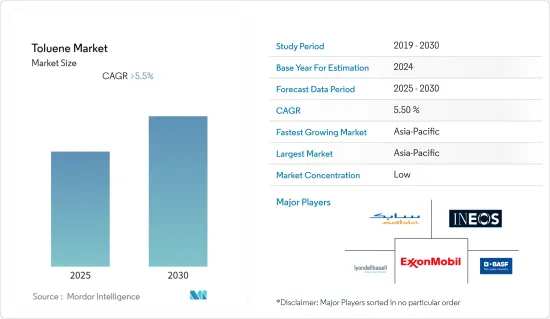

预计在预测期内,甲苯市场的复合年增长率将超过 5.5%。

COVID-19 大流行严重扰乱了市场。几乎所有主要行业都感受到了它的影响,包括汽车、化学品、油漆和涂料以及其他最终用户行业。然而,预计市场将在 2022 年保持成长轨迹。

主要亮点

- 市场研究的关键驱动力之一是甲苯作为溶剂的使用不断增加。严格的政府监管预计将阻碍市场成长。

- 与汽油相比,柴油需求的增加限制了市场成长。

- 苯和二甲苯领域占据市场主导地位,预计在预测期内仍将保持最高的复合年增长率。

- 甲苯二二异氰酸盐(TDI)生产中用量的增加可能是一个机会。

- 亚太地区主导全球市场,其中中国和印度等国家支出最多。

甲苯市场趋势

化学工业应用主导市场

- 甲苯在工业应用中用作溶剂。这些溶剂用于化学工业中的油漆、黏合剂、印刷和皮革鞣製製程等应用。

- 甲苯在大多数化学工业中用作溶剂,也可生产其他类型的化学品,如苯酚、苯甲酸、硝基苯和氯化芐。

- 根据BASF,2021年全球化学品产量(不包括药品)预计将成长4.4%。因此,化学工业应用领域预计将在预测期内主导市场。

- 根据欧洲化学工业理事会(AISBL)预测,全球化学品销售额将从2020年的37,598.9亿美元成长15.2%至2021年的43,323.8亿美元。 2022 年全球化学品产量将成长 2.7%,而 2021 年则成长 7%。中国是全球最大的化学品生产国,占全球化学品销售量的43%。

- 甲苯有时也用于内燃机作为汽油燃料的辛烷值改良剂。无水甲苯用作二行程引擎和四迴圈引擎的燃料。

- 据英国家具报告称,甲苯二二异氰酸盐是生产软质聚氨酯泡沫塑胶的主要成分之一。 PU 泡棉是英国家具製造业使用的关键零件之一。甲苯二异氰酸盐用量的增加促进了甲苯市场的成长。根据聚氨酯泡棉协会统计,北美每年生产超过 15 亿磅的软质聚氨酯泡沫塑胶。

- TDI(甲苯二二异氰酸盐)广泛用于家具、寝具和床垫,也用作生产软质聚氨酯泡棉的中间原料。根据统计,2021年全球TDI需求量为249万吨,高于2020年的237万吨。

- 甲苯是在汽油製造过程中产生的,也用作汽油添加剂,以提高赛车等汽车使用的燃料的辛烷值。 2021年,美国将消耗约32.1亿桶车用汽油,平均每天约3.69亿加仑。

- 由于上述因素,预计预测期内化工产业对甲苯的需求将快速成长。

亚太地区主导市场

- 亚太地区主导全球市场。该地区最大的甲苯市场是中国。

- 中国是亚太地区最大的化学品、油漆、涂料和黏合剂生产国。预计该国产量的增加将推动预测期内对中国市场的研究。

- 2021年5月,PPG宣布完成对中国嘉定油漆涂料工厂的1,300万美元投资。其中包括8条粉末涂料生产线以及粉末涂料技术中心的扩建,从而增强了PPG的研发能力。此次扩建预计将使该厂的产能每年增加8,000吨以上。

- 在 2021-22 年联盟预算中,印度政府为化学和石化部拨款 3,220 万美元。印度政府正在考虑在化学品领域推出生产挂钩激励(PLI)计划,以促进国内製造业和出口。因此,国内甲苯市场可望重振。

- TDI 广泛用于生产发泡聚苯乙烯,而聚苯乙烯泡沫塑料用于製造家具。根据联合国商品贸易统计资料库的数据,2021年,中国是最大的家具出口国,出口额约870亿美元。

- 所有上述因素预计将在预测期内推动该地区的调查市场。

甲苯行业概况

甲苯市场细分,没有大公司占据10%以上的市场占有率。主要参与企业包括埃克森美孚公司、英力士公司、利安德巴塞尔工业公司、沙乌地基础工业公司和BASF公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大甲苯作为溶剂的使用

- 油漆和涂料领域的需求不断增加

- 抑制因素

- 与汽油相比,柴油需求增加

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

- 技术简介

- 贸易分析

- 价格指数

- 监理政策分析

第五章 市场区隔(以金额为准的市场规模)

- 衍生性商品

- 苯和二甲苯

- 汽油添加剂

- 甲苯二二异氰酸盐

- 其他衍生物(苯甲酸、三硝基甲苯、苯甲醛)

- 目的

- 油漆和涂料

- 胶水和墨水

- 火药

- 工业

- 其他用途(医药、溶剂、染料等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Braskem SA

- Chevron Phillips Chemical Company LLC

- China Petroleum & Chemical Corporation(Sinopec)

- China National Petroleum Corporation

- Covestro AG

- CPC Corporation

- Exxon Mobil Corporation

- Formosa Chemicals & Fibre Corporation

- INEOS

- Lyondellbasell Industries NV

- Mitsui Chemicals Inc.

- Mitsubishi Chemical Corporation

- Royal Dutch Shell PLC

- SABIC

- SK Innovation Co. Ltd

- Total SA

- Valero

第七章市场机会与未来趋势

The Toluene Market is expected to register a CAGR of greater than 5.5% during the forecast period.

The COVID-19 pandemic hindered the market badly. The impact can be seen in almost all the major sectors, including automotive, chemicals, paint and coatings, and other end-user industries. However, the market is anticipated to retain its growth trajectory in 2022.

Key Highlights

- One of the major factors driving the market study is the growing usage of toluene as a solvent. Stringent governmental regulations are expected to hinder the growth of the market studied.

- Compared to gasoline, increasing demand for diesel is a restraint for the market's growth.

- The benzene and xylene segment dominated the market and is expected to record the highest CAGR during the forecast period.

- Growing usage in toluene diisocyanate (TDI) production is likely an opportunity.

- Asia-Pacific dominated the global market, with the largest consumption from countries such as China and India.

Toluene Market Trends

Chemical Industry Application to Dominate the Market

- Toluene is used as a solvent in industrial applications. These solvents are used in applications in the chemical industry to produce paints, glues, printing, leather tanning processes, and others.

- Toluene, used by most chemical industries as a solvent, produces other types of chemicals, such as phenol, benzoic acid, nitrobenzene, and benzyl chloride.

- According to BASF, global chemical production (excluding pharmaceuticals) is expected to grow by 4.4% in 2021. Thus, the chemical industry application segment is expected to dominate the market during the forecast period.

- According to The European Chemical Industry Council, AISBL, the worldwide sales of chemicals increased by 15.2% from USD 3759.89 billion in 2020 to USD 4332.38 billion in 2021. In 2022, worldwide chemical production grew by 2.7% compared to a 7% growth in 2021. China is the largest chemicals producer in the world, contributing 43% of global chemical sales.

- Toluene chemical can also be used as an octane booster in gasoline fuels for its application in internal combustion engines. Absolute toluene is used as a fuel for both engine types, i.e., two-stroke and four-stroke engines.

- According to the Furnishing Report in the UK, toluene di-isocyanate is one of the main ingredients used to manufacture flexible polyurethane foams. PU foam is one of the key components used in the UK furniture manufacturing industry. Increasing usage of toluene di-isocyanate contributes to the growth of the toluene market. According to Polyurethane Foam Association, more than 1.5 billion pounds of flexible polyurethane foam are produced annually in North America.

- TDI (Toluene Di-isocyanate) is extensively used in furniture, bedding, and mattresses and as an intermediate raw material in producing flexible polyurethane foam. According to statistics, in 2021, the global demand for TDI was 2.49 million tons, up from 2.37 million tons in 2020.

- Toluene is produced in the manufacturing of gasoline, and it is also a gasoline additive that can be used to improve octane ratings for fuel used in race cars and other automobiles. In 2021, about 3.21 billion barrels of finished motor gasoline were consumed in the United States, an average of about 369 million gallons per day.

- Owing to the abovementioned factors, the demand for toluene from the chemical industry is expected to grow rapidly over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global market. China accounted for the largest market for toluene in the region.

- China is Asia-Pacific's largest producer of chemicals, paints, coatings, and adhesives. Growing production in the country is expected to drive the market studied in China during the forecast period.

- In May 2021, PPG announced the completion of its USD 13 million investment in its paint and coatings facility in Jiading, China. It includes eight new powder coating production lines and an expanded powder coatings technology center expected to enhance PPG's R&D capabilities. The expansion will likely increase the plant's capacity by more than 8,000 tons annually.

- Under the Union Budget 2021-22, the Indian government allocated USD 32.2 million to the Department of Chemicals and Petrochemicals. The Indian government is considering launching a production-linked incentive (PLI) scheme in the chemical sector to boost domestic manufacturing and exports. Thus, it is expected to boost the country's toluene market.

- TDI is extensively used to make foam, which is used for manufacturing furniture. According to the United Nations Comtrade, in 2021, China was the leading country for furniture export, with an export value of approximately USD 87 billion.

- All the factors above are expected to drive the market studied in the region over the forecast period.

Toluene Industry Overview

The toluene market is fragmented, with no major player holding more than 10% of the market share. Some major players include Exxon Mobil Corporation, INEOS, Lyondellbasell Industries NV, SABIC, and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Use of Toluene as a Solvent

- 4.1.2 Escalating Demand from the Paints & Coatings Sector

- 4.2 Restraints

- 4.2.1 Increasing Demand for Diesel as compared to Gasoline

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Trade Analysis

- 4.8 Price Index

- 4.9 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Derivative

- 5.1.1 Benzene and Xylene

- 5.1.2 Gasoline Additives

- 5.1.3 Toluene Diisocyanates

- 5.1.4 Other Derivatives (Benzoic Acid, Trinitrotoluene, and Benzaldehyde)

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Inks

- 5.2.3 Explosives

- 5.2.4 Chemical Industry

- 5.2.5 Other Applications (Pharmaceuticals, Solvents, Dyes, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Braskem SA

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petroleum & Chemical Corporation (Sinopec)

- 6.4.5 China National Petroleum Corporation

- 6.4.6 Covestro AG

- 6.4.7 CPC Corporation

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 Formosa Chemicals & Fibre Corporation

- 6.4.10 INEOS

- 6.4.11 Lyondellbasell Industries NV

- 6.4.12 Mitsui Chemicals Inc.

- 6.4.13 Mitsubishi Chemical Corporation

- 6.4.14 Royal Dutch Shell PLC

- 6.4.15 SABIC

- 6.4.16 SK Innovation Co. Ltd

- 6.4.17 Total SA

- 6.4.18 Valero