|

市场调查报告书

商品编码

1639463

中东和非洲油漆和涂料:市场占有率分析、行业趋势、统计和成长预测(2025-2030)Middle-East and Africa Paints and Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

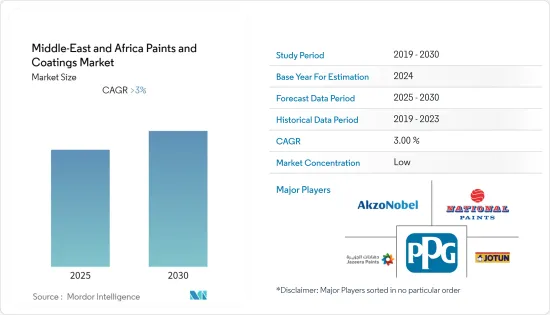

中东和非洲油漆和涂料市场预计在预测期内复合年增长率将超过 3%。

2020年市场受到了COVID-19大流行的影响。然而,2021年,由于各地区基础建设需求增加,市场呈现成长。油漆和被覆剂用于建筑、汽车、运输和木材领域。它们在建筑和施工项目中具有重要的应用,并用于保护结构免受外部伤害。此外,随着政府专注于增加公共支出以实施新计画,预计未来几年市场将扩大。

主要亮点

- 对中东旅游业和建筑业的日益关注是市场研究的关键驱动力。

- 另一方面,汽车行业的放缓预计将阻碍市场成长。

- 在市场区隔方面,建筑涂料占据市场主导地位,由于该地区建设活动的增加,预计该细分市场在预测期内将成长。

- 对环保产品的需求不断增长、阿曼的成长机会以及卡达新豪华房地产计划的计划可能有利于所研究的市场。

中东和非洲油漆和涂料市场趋势

建筑业的需求增加

- 建筑油漆和涂料占据油漆和涂料市场的大部分。建筑涂料用于保护和装饰建筑物的外部。用于粉刷建筑物和住宅。建筑涂料用于多种应用,包括商业建筑、仓库、便利商店、购物中心和住宅。

- 凭藉着阿联酋政府的坚定承诺和资源,建设公司和工程公司即将实施多个大型企划。例如,最近宣布了迪拜米纳拉希德重建和迪拜国际金融中心扩建2.0等大型建设计划。

- 利雅德地铁计划是沙乌地阿拉伯最大的地铁计划,拟兴建6条地铁线路,总长176公里。它将由 Ariyadh 发展局 (ADA) 管理,拥有 85 个车站,包括几个转乘站。

- 卡达开发了重大基础设施计划,为 2022 年 FIFA 世界杯做准备。这些建设计划包括阿尔拜特体育场和哈利法国际体育场,可容纳 6 万人。

- 沙乌地阿拉伯的大规模住宅基础设施开发以及卡达、杜拜和阿布达比的持续建设都推动了该地区对油漆和涂料的需求。

- 在南非,中国投资80亿美元正在兴建约翰尼斯堡莫德方丹新城。该计划将使用位于奥利弗雷金纳德坦博国际机场和桑顿之间的 1,600 公顷土地。拥有中央商务区、国际会展中心、银髮养老产业、娱乐中心、国际住宅区、体育中心、教育训练中心、贸易物流园区等九大功能区,以及一个轻工业园区。

埃及可望迎来良好的市场成长

- 埃及是非洲建筑业最发达的国家。此外,由于一些建筑计划的外国投资增加,预计建筑业将显着发展。埃及的建筑业是世界上成长最快的行业之一,近年来年增率超过9%。该国的建设计划约占非洲全部建设计划的10%。

- 根据埃及财政部的报告,该国的建筑业约占GDP的16.2%。这正在推动该国的油漆和涂料市场。

- 埃及正在其拥有 1000 年历史的首都开罗以东约 50 公里处的一片面积与新加坡相当的沙漠地区建设一座大规模的新行政首都 (NAC)。埃及新行政首都(NAC)建设计划预计2022年启动,并带来建设热潮。总建筑成本预计将超过450亿美元,被誉为解决人口超过2000万的开罗过度拥挤问题的解决方案。

- 埃及是知名市场主要企业建立的汽车製造厂的所在地,其业务遍及世界各地。通用、宝马、现代、丰田等埃及乘用车和轻型商用车的需求不断增长,汽车产量预计将扩大以支持市场需求。

- 根据OICA称,2017年至2021年埃及的乘用车产量大幅成长。

- 此外,埃及拥有非洲最大的建筑业。根据埃及财政部的报告,该国的建筑业约占GDP的16.2%。

中东和非洲油漆涂料行业概况

中东和非洲油漆和涂料市场是细分的。该市场的主要企业包括(排名不分先后)Akzo Nobel NV、Jazeera Paints、Jotun、PPG Industries Inc. 和 National Paints Factories。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 中东旅游业和建筑业日益受到关注

- 其他司机

- 抑制因素

- 汽车业放缓

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 树脂型

- 丙烯酸纤维

- 醇酸

- 聚氨酯

- 环氧树脂

- 聚酯纤维

- 其他的

- 科技

- 水性的

- 溶剂型

- 辐射固化

- 其他的

- 最终用户产业

- 建筑学

- 车

- 木头

- 工业的

- 其他的

- 地区

- 沙乌地阿拉伯

- 卡达

- 科威特

- 阿拉伯聯合大公国

- 伊朗

- 伊拉克

- 奈及利亚

- 南非

- 土耳其

- 坦尚尼亚

- 肯亚

- 阿尔及利亚

- 摩洛哥

- 埃及

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Al-Tabieaa Company

- Akzo Nobel NV

- Asian Paints BERGER

- ATLAS Peintures

- BASF SE

- Basco Paints

- Beckers Group

- Crown Paints Kenya PLC

- DAW SE(Caparol)

- Hempel AS

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd.

- National Paint Factories Co. Ltd.

- Betek Boya Kimya ve Sanayi AS(Nippon Paint Holdings Co. Ltd.)

- PACHIN

- PPG Industries Inc.

- The Sherwin-Williams Company

- RPM International Inc.

- Wacker Chemie AG

- Saba Shimi Aria

- Scib Paints

- Terraco Holdings Limited

- Thermilate Middle East

第七章 市场机会及未来趋势

- 对环保产品的需求不断成长

- 卡达新豪华房地产计划计划

- 阿曼的成长前景

The Middle-East and Africa Paints and Coatings Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was impacted due to the COVID-19 pandemic in 2020. However, the market witnessed growth in 2021 owing to increasing infrastructure demand in various regions. Construction, automotive and transportation, and the wood sectors all employ paints and coatings. They have a significant application in the building and construction business, where they are used to protect structures from external harm. Furthermore, the market is expected to expand in the coming years as governments focus on boosting public spending to undertake new projects.

Key Highlights

- A major factor driving the market studied is the increased focus on tourism and construction in the Middle East.

- On the flip side, the slowdown in the automotive sector is expected to hinder the market's growth.

- Architectural coatings dominated the market, and the segment is expected to grow during the forecast period, owing to the increasing construction activities across the region.

- Rising demand for eco-friendly products, growth prospects in Oman, and plans for new luxury real estate projects in Qatar are likely to act as an opportunity for the market studied.

MEA Paints and Coatings Market Trends

Increasing Demand from the Architectural Sector

- Architectural paints and coatings make up the vast majority of the paints and coatings market. Architectural coatings are used to protect and embellish the characteristics of a building's exterior. They are used to coat structures and residences. Architectural coatings are utilized in various applications, including commercial buildings, warehouses, retail convenience shops, shopping malls, and residential structures.

- The UAE government's strong dedication and resources have established several mega-project prospects for construction and engineering firms. For instance, mega construction projects like the redevelopment of Mina Rashid in Dubai and the Dubai International Financial Centre Expansion 2.0 have all recently been announced.

- The Riyadh Metro Project is the largest metro project in Saudi Arabia which aims to establish six metro lines with a total distance coverage of 176 km. It will be managed by Arriyadh Development Authority (ADA) and served by 85 stations, including several interchange stations.

- Qatar developed major infrastructure projects for the FIFA World Cup in 2022. Al Bayt Stadium and Khalifa International Stadium was one of those construction projects with a capacity of 60,000 seats.

- Massive housing and infrastructure developments in Saudi Arabia and ongoing construction in Qatar, Dubai, and Abu Dhabi are all driving demand for paints and coatings in the region.

- In South Africa, Modderfontein New City is a Chinese-funded USD 8 billion city that is being built in Modderfontein, Johannesburg-South Africa. The project will occupy 1,600-hectare land between OR Tambo International Airport and Sandton. The city will include nine functional zones, the central business district, international conference and exhibition center, silver industry and retirement industry, an entertainment center, international residential community, sports center, education and training center, trade and logistic park, and light industry park.

Egypt to Witness Lucrative Market Growth

- Egypt has the most-developed building sector in Africa. In addition, the construction sector is predicted to develop significantly due to increased foreign investments in several building projects. Egypt's construction sector has been one of the fastest-growing in the world, rising at a rate of over 9% per year during the last several years. Construction projects in the nation accounted for around 10% of all African construction projects.

- As reported by the Egyptian Ministry of Finance, the country's building and construction industry represent approximately 16.2% of the country's GDP. This is boosting the paints and coatings market in the country.

- Egypt is building a massive New Administrative Capital (NAC) about 50 km east of the 1,000-year-old capital Cairo on a tract of the desert the size of Singapore. Building projects in Egypt's New Administrative Capital (NAC) were expected to kick up in 2022, resulting in a construction boom. The city is expected to cost over USD 45 billion and has been hailed as a solution to overcrowding in Cairo, with a population of more than 20 million people.

- Egypt has automobile manufacturing units set up by prominent market leaders operating across the globe. These include GM, BMW, Hyundai, Toyota, and others. The growing demand for passenger cars and light commercial vehicles in the country is expected to upscale the production of auto vehicles, thereby likely to support the market demand.

- According to the OICA, the production of passenger vehicles in Egypt increased significantly from 2017 to 2021.

- Further, Egypt has the most significant construction industry in the African region. The construction industry is growing in the country; as reported by the Egyptian Ministry of Finance, the country's building and construction industry represents approximately 16.2% of the country's GDP.

MEA Paints and Coatings Industry Overview

The paints and coatings market in the Middle East and Africa is fragmented. Key players in the market include (not in any particular order) Akzo Nobel NV, Jazeera Paints, Jotun, PPG Industries Inc., and National Paints Factories Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Focus on Tourism and Construction in the Middle-East

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Slowdown in Automotive Sector

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Sixr

- 5.1 Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Radiation Cure

- 5.2.4 Other Technologies

- 5.3 End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Saudi Arabia

- 5.4.2 Qatar

- 5.4.3 Kuwait

- 5.4.4 United Arab Emirates

- 5.4.5 Iran

- 5.4.6 Iraq

- 5.4.7 Nigeria

- 5.4.8 South Africa

- 5.4.9 Turkey

- 5.4.10 Tanzania

- 5.4.11 Kenya

- 5.4.12 Algeria

- 5.4.13 Morocco

- 5.4.14 Egypt

- 5.4.15 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Al-Tabieaa Company

- 6.4.2 Akzo Nobel NV

- 6.4.3 Asian Paints BERGER

- 6.4.4 ATLAS Peintures

- 6.4.5 BASF SE

- 6.4.6 Basco Paints

- 6.4.7 Beckers Group

- 6.4.8 Crown Paints Kenya PLC

- 6.4.9 DAW SE (Caparol)

- 6.4.10 Hempel AS

- 6.4.11 Jazeera Paints

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co. Ltd.

- 6.4.14 National Paint Factories Co. Ltd.

- 6.4.15 Betek Boya Kimya ve Sanayi AS (Nippon Paint Holdings Co. Ltd.)

- 6.4.16 PACHIN

- 6.4.17 PPG Industries Inc.

- 6.4.18 The Sherwin-Williams Company

- 6.4.19 RPM International Inc.

- 6.4.20 Wacker Chemie AG

- 6.4.21 Saba Shimi Aria

- 6.4.22 Scib Paints

- 6.4.23 Terraco Holdings Limited

- 6.4.24 Thermilate Middle East

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Eco-friendly Products

- 7.2 Plans for New Luxury Real Estate Projects in Qatar

- 7.3 Growth Prospects in Oman