|

市场调查报告书

商品编码

1639468

热固性塑胶:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Thermosetting Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

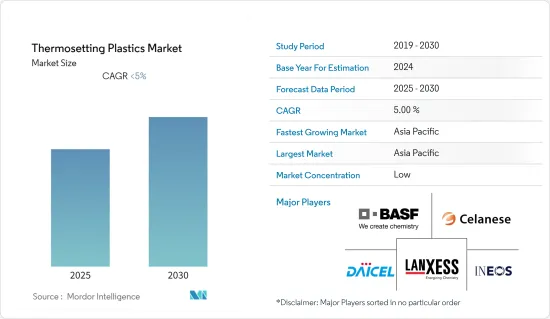

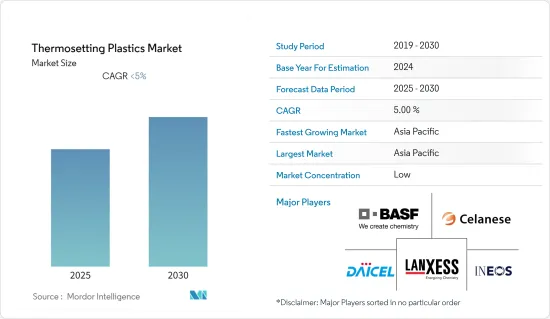

预计热固性塑胶市场在预测期内复合年增长率将低于 5%

主要亮点

- COVID-19 大流行对市场产生了负面影响。当疫情爆发时,计划暂时停止,以防止感染传播,限制了对热固性塑胶材料的需求。然而,该行业预计将在 2021 年復苏,并且市场将在整个预计的十年中遵循类似的轨迹。

- 亚太地区建筑业的扩张是该市场的关键驱动因素。此外,汽车产业对聚氨酯的需求不断增加预计将推动市场成长。相反,政府对使用热固性塑胶作为材料的严格规定可能会阻碍所研究市场的成长。

- 对生物基热固性塑胶的需求不断增长预计将在未来几年提供市场成长机会。亚太地区主导全球市场,其中中国和印度等国家的消费量最高。

热固性塑胶市场趋势

建筑业需求增加

- 热固性塑胶是交联聚合物,由于具有耐化学性、耐热性、结构完整性、轻质、硬度、不溶性、耐热性和电阻等优异性能,广泛应用于建设活动。热固性聚合物通常优选用于建筑和建筑的结构应用,例如黏合剂和密封剂、隔热材料、屋顶、管道、桥樑以及土木结构的修復和恢復。

- 环氧树脂和不饱和聚酯在建筑业有广泛的应用。环氧树脂用于管道、储槽、压力容器、夹具、固定装置和增强材料等应用,具有高机械强度、耐化学性和电绝缘性能。

- 根据牛津经济研究院预测,到 2025 年,全球建筑业预计将达到 13.3 兆美元。根据美国人口普查局的数据,2022 年 12 月美国各地的建筑支出为 18,098 亿美元。环比来看,12月份建筑业较2021年12月成长7.7%,总支出达16,810亿美元。这反过来又被认为促进了热固性塑胶市场的成长。

- 欧盟统计局也指出,2021年住宅建设将占欧盟GDP的5.6%左右。整个欧盟的比例各不相同,塞浦路斯为 7.6%,德国和芬兰为 7.2%,希腊为 1.3%,爱尔兰为 2.1%,拉脱维亚为 2.2%,波兰为 2.3%。此外,印度建筑业预计将以 7.8% 的复合年增长率发展,从 2022 年的 2,500 亿美元增至 2027 年的 5,300 亿美元。

- 在预测期内,上述国家建筑业的成长是热固性塑胶市场的关键驱动因素。

亚太地区主导市场

- 亚太地区的建筑业是最大的建筑业之一,并且由于快速成长的国家的存在、快速的都市化以及基础设施支出的增加而正在稳步发展。除了建筑业外,汽车业、黏合剂和密封剂市场以及电子业都是亚太地区的重要产业,在亚太地区的市场发展中发挥重要作用。

- 中国的建筑业在国家经济成长中发挥重要作用,是国家最大的产业之一。根据国家统计局(NBS)数据,2022年第四季中国建筑业产值约2,760亿元人民币(400亿美元),比上一季(276亿美元)成长50%。

- 日本国土交通省的数据显示,2022年建筑业总投资约66.99兆日圆(5,081.6亿美元),与前一年同期比较成长0.6%。

- 此外,菲律宾统计局(PSA)在2022年年度报告中表示,车辆和两轮车维修与前一年同期比较GDP年增7.6%做出了巨大贡献。该细分市场是最重要的贡献者,约占整体成长的 8.7%。

- 此外,在印度,印度品牌公平基金会(IBEF)在其报告中指出,政府将在2022-23年联邦预算中向道路运输和公路部支出6000亿印度卢比(约77.2亿美元)。 。

- 中国也是最大的汽车生产国和消费国。中国工业协会(CAAM)的报告显示,2022年中国汽车销量与前一年同期比较成长约2.1%。 2021年,汽车销量为2627万辆,而2022年,销量约2686万辆。

- 这种投资成长将导致汽车产业的建设活动和电子产品增加,预计将在预测期内增加对热固性塑胶的需求。

- 由于这些因素,热固性塑胶市场预计在预测期初期将出现温和成长。

热固性塑胶产业概况

热固性塑胶市场是细分的,没有一家公司拥有很大的份额(就收益而言)。市场上的主要企业使用各种策略来满足消费者的需求。全球热固性塑胶市场的顶级製造商包括(排名不分先后)塞拉尼斯公司、安盛公司、大赛璐公司、英力士公司、BASF等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 亚太地区建筑业的成长

- 汽车业对聚氨酯的需求增加

- 抑制因素

- 严格的政府法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 技术简介

第五章 市场区隔(以金额为准的市场规模)

- 类型

- 不饱和聚酯

- 聚氨酯

- 苯酚

- 环氧树脂

- 胺基

- 醇酸

- 乙烯基酯

- 其他的

- 最终用户产业

- 建造

- 黏合剂和密封剂

- 电子设备

- 车

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Alchemie Ltd.

- Asahi Kasei Corporation

- BASF SE

- BUFA GmbH & Co. KG

- Celanese Corporation

- Daicel Corporation

- DSM

- Eastman Chemical Company

- INEOS

- Kanoria Chembond Pvt. Ltd.

- Lanxess AG

- LG Chem

- Mitsubishi Engineering-Plastics Corporation

- NIHON GOSEI KAKO Co.,Ltd

- Polynt SpA

- Resonac Holdings Corporation

- Solvay

- Sumitomo Bakelite Co., Ltd.

- U-PICA Company Ltd.

- Westlake Corporation

第七章 市场机会及未来趋势

- 对生物基热固性塑胶的需求不断增长

简介目录

Product Code: 50183

The Thermosetting Plastics Market is expected to register a CAGR of less than 5% during the forecast period.

Key Highlights

- The COVID-19 pandemic negatively impacted the market. Given the pandemic, construction projects were temporarily halted to prevent the spread, limiting demand for thermosetting plastic materials. However, the industry picked up speed in 2021, and the market is expected to follow a similar trajectory throughout the projection decade.

- The expanding construction sector in Asia-Pacific is a primary driver of the market under consideration. Furthermore, increased demand for polyurethane in the automotive industry is expected to boost the market growth. On the contrary, stringent government regulations on the usage of thermosetting plastics as a material are likely to hamper the growth of the market studied.

- The growing demand for bio-based thermosetting plastics will likely act as an opportunity for market growth in the coming years. Asia-Pacific dominates the global market, with the largest consumption from countries such as China and India.

Thermosetting Plastics Market Trends

Increasing Demand from Construction Industry

- Thermosetting plastics are cross-linked polymers that are widely used in construction activities due to their excellent properties such as chemical resistance, heat resistance, structural integrity, being lighter in weight, providing hardness, insolubility, thermal and electrical resistance, and so on. Thermosetting polymers are typically favored for structural applications in buildings and architecture, such as adhesives and sealants, thermal insulation, roofing, piping, bridge constructions, and civil structure repair and rehabilitation.

- Epoxies and unsaturated polyesters have wide applications in the construction industry. Epoxies are used for pipes, tanks, pressure vessels, tooling jigs, fixtures, and reinforcements applications and exhibit high mechanical strength, chemical resistance, and electrical insulating properties.

- According to Oxford Economics, the worldwide construction industry is predicted to reach USD 13.3 trillion by 2025. According to the United Census Bureau, overall construction spending in the United States in December 2022 was USD 1,809.8 billion. On a month-on-month basis, the construction sector increased by 7.7% in December compared to December 2021, with total spending reaching USD 1,681.0 billion. This, in turn, would have aided the growth of the thermosetting plastics market.

- Eurostat, in its report, also stated that construction in housing accounted for about 5.6% of the EU GDP in 2021. This proportion varied across the EU, ranging from 7.6% in Cyprus to 7.2% in Germany and Finland, 1.3% in Greece, 2.1% in Ireland, 2.2% in Latvia, and 2.3% in Poland. Moreover, the Indian construction sector is predicted to develop at a compound annual growth rate (CAGR) of 7.8%, from USD 250 billion in 2022 to USD 530 billion in 2027.

- During the forecast period, the growing construction industry in the above-mentioned countries is a crucial driving factor for the thermosetting plastics market.

Asia-Pacific to Dominate the Market

- The Asia-Pacific construction sector is one of the largest, and it has been steadily developing due to the presence of fast-growing countries, rapid urbanization, and rising infrastructure spending. Aside from the construction sector, the automotive industry, the adhesives and sealants market, and the electronics industry are all prominent sectors in the region that play an important role in the market's evolution throughout the Asia Pacific region.

- The construction business in China plays an important role in the country's economic growth and is one of the largest industries in the country. According to the National Bureau of Statistics (NBS) of China, construction output in China was valued at around CNY 276 billion (USD 40 billion) in the fourth quarter of 2022, representing a 50% increase over the previous quarter (USD 27.6 billion).

- According to Japan's Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), overall investment in the construction sector in 2022 was roughly JPY 66,990 billion (USD 508.16 billion), a 0.6% rise over the previous year.

- In its annual report for 2022, the Philippine Statistical Authority (PSA) also stated that motorcars and motorbike maintenance contributed significantly to the country's 7.6% GDP growth over the previous year. The segment was the most important contributor, accounting for around 8.7% of overall growth.

- Moreover, in India, the India Brand Equity Foundation (IBEF), in its report, stated that in the Union Budget 2022-23, the government announced an outlay of INR 60,000 crores (USD 7.72 billion) for the Ministry of Road Transport and Highways.

- China is also the largest producer and consumer of automotive vehicles. The China Association of Automobile Manufacturers (CAAM) reported that, compared to the previous year, China's automobile sales increased by about 2.1% in 2022. In comparison to the 26.27 million automobiles sold in the year 2021, around 26.86 million were sold in 2022.

- This investment growth led to an increase in construction activities and electronics in the automotive industry, leading to an expected increase in the demand for thermosetting plastics over the forecast period.

- As a result of these factors, the thermosetting plastics market is expected to experience moderate growth in the initial years of the forecast period.

Thermosetting Plastics Industry Overview

The thermosetting plastics market is fragmented, with no company holding a major share in the market (in terms of revenues generated). Prominent companies in the market are using different strategies to meet consumer demand. The top manufacturers of the global thermosetting plastic market include (not in any particular order) Celanese Corporation, Anxess, Daicel Corporation, Ineos, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Industry in Asia-Pacific

- 4.1.2 Rising Demand for Polyurethane in the Automotive Industry

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Unsaturated Polyesters

- 5.1.2 Polyurethanes

- 5.1.3 Phenolic

- 5.1.4 Epoxy

- 5.1.5 Amino

- 5.1.6 Alkyd

- 5.1.7 Vinyl Ester

- 5.1.8 Other Types

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Adhesive and Sealants

- 5.2.3 Electronics and Appliances

- 5.2.4 Automotive

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alchemie Ltd.

- 6.4.2 Asahi Kasei Corporation

- 6.4.3 BASF SE

- 6.4.4 BUFA GmbH & Co. KG

- 6.4.5 Celanese Corporation

- 6.4.6 Daicel Corporation

- 6.4.7 DSM

- 6.4.8 Eastman Chemical Company

- 6.4.9 INEOS

- 6.4.10 Kanoria Chembond Pvt. Ltd.

- 6.4.11 Lanxess AG

- 6.4.12 LG Chem

- 6.4.13 Mitsubishi Engineering-Plastics Corporation

- 6.4.14 NIHON GOSEI KAKO Co.,Ltd

- 6.4.15 Polynt S.p.A.

- 6.4.16 Resonac Holdings Corporation

- 6.4.17 Solvay

- 6.4.18 Sumitomo Bakelite Co., Ltd.

- 6.4.19 U-PICA Company Ltd.

- 6.4.20 Westlake Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Bio-based Thermosetting Plastics

02-2729-4219

+886-2-2729-4219