|

市场调查报告书

商品编码

1639479

金属罐 -市场占有率分析、行业趋势/统计、成长预测(2025-2030)Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

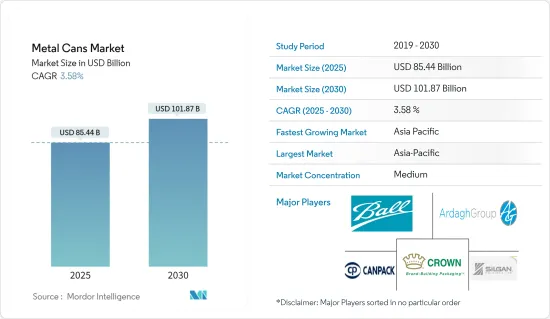

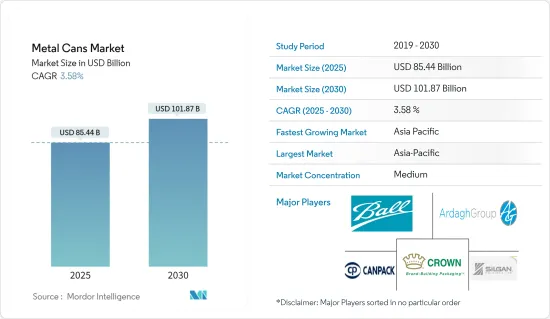

金属罐市场规模预计到2025年为854.4亿美元,预计到2030年将达到1018.7亿美元,预测期内(2025-2030年)复合年增长率为3.58%。

金属罐因其耐运输、密封盖、搬运粗暴、易于回收等显着特点而备受关注。

主要亮点

- 金属罐的高回收性是市场推广因素之一。铝罐完全防潮。罐头不生锈、耐腐蚀,是所有包装中保存期限最长的之一。它还具有刚性、稳定性、阻隔性等诸多优点。

- 铝罐短缺持续影响食品和饮料产业,与餐饮业相比,家庭和杂货用饮料的需求增加。许多知名市场相关人员已宣布投资建立新的製造基础设施,以满足不断增长的订单并解决铝罐短缺。

- 2023 年 9 月,可持续铝解决方案的知名供应商诺贝丽斯公司与北美领先的铝罐製造商鲍尔公司签署了一项重要协议。根据合同,诺贝丽斯将向整个北美的波尔製造工厂供应铝板。

- 消费者对包装中应用非致癌性材料的认识不断提高,以及对轻质包装的需求不断增加,为金属罐市场提供了高成长前景。然而,金属罐很难使用,因为它们可以被聚乙烯和聚对苯二甲酸乙二醇酯(PET)等聚合物基包装材料取代。

金属罐产业细分

食品领域预计将占据市场主要份额

- 全球生活方式的变化导致消费者选择更容易准备的食物。年轻人和独居者消费更多的罐头食品。这些用户时间紧迫且预算有限,因此他们选择成本较低且便利性较高的产品。

- 许多普通罐头消费者选择罐头是因为其方便且成本低。罐头更方便,需要更少的能源和烹饪时间。大多数罐头食品的准备时间比一般餐点少 40%。

- 铝罐有助于长期维持食品品质。铝罐完全无法渗透氧气、光线、湿气和其他污染物。它不生锈、耐腐蚀,是保质期最长的产品之一。铝罐的安全性是首屈一指的。

- 透过防篡改和防篡改包装,消费者可以确信他们的产品已安全准备和交付。除了食品和饮料之外,铝还用于各种产品的包装,包括气雾剂、油漆和其他消费品。据牙买加农产品监管局(JACRA)称,2023年日本进口铝罐数量约为6,000万个空罐和4.3亿个实际罐。

- 根据 FCC 和加拿大统计局的报告,到 2024 年,竞争可能会非常激烈,特别是在自有品牌罐装和冷冻食品领域。此外,从原材料和包装成本上涨到薪资上涨等多种因素预计将超过名目销售成长,从而限制 2024 年利润率的扩张。

预计北美将占据很大的市场份额

- 由于健康饮料、碳酸软性饮料、健康饮料和蔗糖素果汁的需求增加,预计北美在预测期内将对金属罐的需求产生积极影响。此外,一些重要的参与企业将透过广泛的促销活动和新的研究影响业务发展。

- 影响美国产品需求的主要因素是食品和零售业。该国的杂货店和超市比以往任何时候都多,该国食品和零售业的扩张很大程度上归功于小家庭的增加。因此,对较小包装单元的需求正在增加。

- 2023 年 6 月,主要企业的可持续铝解决方案提供商诺贝丽斯(Novelis Inc.) 与可口可乐公司授权的北美装瓶商合约代理商可口可乐装瓶商销售与服务公司签署了一项新的长期协定.诺贝丽斯将为可口可乐公司在北美的授权装瓶商提供可口可乐公司品牌系列的铝罐板。其中包括诺贝丽斯位于 Bay Minette 的工厂的供应,该工厂目前正在建设中,计划于 2025 年开始试运行。

- 此外,美国的生活方式增加了对金属罐的需求。选择健康食品是因为忙碌的日程几乎没有时间做饭。罐头透过提供简单的包装和即用食品来实现这一目标。金属罐预计将推动市场成长,因为它们可以长时间保持食品的新鲜度和品质。

金属罐产业概况

金属罐市场已成为半固体市场,Ball Corporation、Ardagh Group、Mauser Packaging Solutions、Silgan Containers LLC 和 Crown Holdings Inc. 等主要公司都在参与其中。市场参与企业正在采取联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2023年11月,毛瑟包装解决方案公司收购了专门生产锡钢气雾罐和钢桶的墨西哥知名製造商Taenza SA de CV。 Taenza 总部位于墨西哥城,在墨西哥各地拥有五个製造工厂和 850 多名员工。该公司的产品线包括气雾喷雾罐、钢桶和油漆罐,为油漆、被覆剂和化学品行业的各类客户提供服务。

- 2023 年 11 月,Sonoco 和 Ball Corporation 签署了一项重要协议。根据该协议,Sonoco,特别是透过其 Sonoco Phoenix 部门,将专门为食品罐供应带有易开、全面板端部的球。此次合作增强了 Sonoco 作为 Ball 主要供应商的地位,并扩大了这种创新食品罐的共同行销和销售工作。

- 2023 年 9 月,Ardagh Group 和 Crown Holdings Inc. 正与罐头製造商协会 (CMI) 合作,以提高铝製饮料罐的回收率。为此,我们将资助位于加州一家回收设施的人工智慧和机器人公司 EverestLab 的机器人。位于加州弗雷斯诺的卡利亚环境公司 (Caglia Environmental) 已将机器人部署到其材料回收设施 (MRF) 的「最后机会线」。透过这项策略倡议,我们的目标是每年收集超过 100 万个用过的饮料罐 (UBC)。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 大流行的市场影响评估

第五章市场动态

- 市场驱动因素

- 由于能源消耗减少,包装的可回收性高

- 酒精和非酒精饮料的消费增加

- 市场限制因素

- 存在替代包装解决方案,例如聚对苯二甲酸乙二醇酯

第六章 市场细分

- 依材料类型

- 铝

- 钢

- 按最终用户产业

- 食物

- 饮料

- 化妆品/个人护理

- 药品

- 画

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Ball Corporation

- Ardagh Group

- Mauser Packaging Solutions

- Silgan Containers LLC

- Crown Holdings Inc.

- DS Containers Inc.

- CCL Container Inc.

- Toyo Seikan Group Holdings Ltd

- Pacific Can China Holdings Limited

- Universal Can Corporation

- CPMC HOLDINGS Limited(COFCO Group)

- Showa Denko KK

- Independent Can Company

- Hindustan Tin Works Ltd

- Saudi Arabian Packaging Industry WLL(SAPIN)

第八章投资分析

第九章 市场机会及未来趋势

The Metal Cans Market size is estimated at USD 85.44 billion in 2025, and is expected to reach USD 101.87 billion by 2030, at a CAGR of 3.58% during the forecast period (2025-2030).

The metal cans market is gaining prominence because of its distinct features, like transportation resistance, hermetically sealed cover, rough handling, and easy recyclability.

Key Highlights

- The high recyclability of metal cans is one of the significant drivers of the market. Aluminum cans deliver complete protection against moisture. Cans do not rust, are corrosion-resistant, and provide one of the most extended shelf lives considering any packaging. It also offers many benefits, such as rigidity, stability, and high barrier properties.

- The aluminum can shortage continues to affect the food and beverage industry, as the beverage demand for home consumption and grocery increased compared to restaurants. Many prominent market players have announced investments to set up new manufacturing infrastructures to fulfill the increased orders and tackle the shortage of aluminum cans.

- In September 2023, Novelis Inc., a prominent provider of sustainable aluminum solutions, signed a significant deal with Ball Corporation, a leading aluminum can manufacturer in North America. The agreement entails Novelis supplying aluminum sheets to Ball's manufacturing facilities across North America.

- The rise in consumer awareness concerning the application of non-carcinogenic materials in packaging and increased demand for lightweight packing are generating high growth prospects for the metal cans market. However, metal cans are challenging to use due to the possibility of replacing them with polymer-based packaging materials, including polyethylene and polyethylene terephthalate (PET).

Metal Cans Industry Segmentation

The Food Segment is Expected to Hold a Significant Share in the Market

- Changing lifestyles at a global level resulted in consumers opting for easy-to-cook food. The younger and individually living populations are consuming more canned food. These users have less time and are budget-restrained, thus opting for products with lower costs and higher convenience.

- Many regular consumers of canned foods choose the products due to the convenience offered and lower cost. Canned foods are more convenient and require less energy and cooking time. Most canned foods take 40% less time to prepare than regular meals.

- Aluminum cans help to preserve the quality of food for a long time. Aluminum cans are completely impervious to oxygen, light, moisture, and other pollutants. They don't rust, are corrosion-resistant, and have one of any package's most extended shelf life. The safety record of aluminum-based food canning is unrivaled.

- Consumers may rest certain that their items have been safely prepared and delivered as they are tamper-resistant and have tamper-evident packaging. Aside from food and beverages, aluminum is used for packaging various products, including aerosols, paint, and other consumer goods. According to the Jamaica Agricultural Commodities Regulatory Authority (JACRA), the import volume of aluminum cans to Japan in 2023 was around 60 million empty aluminum cans and 430 million actual aluminum cans.

- According to reports from the FCC and Statistics Canada, 2024 is poised to witness intense rivalry, particularly in private-label canned and frozen goods. Moreover, a confluence of factors, ranging from rising raw material and packaging expenses to escalating wages, is projected to outpace nominal sales growth, thereby constraining margin enhancements for the year.

North America is Expected to Hold a Significant Share in the Market

- North America is anticipated to positively influence the demand for metal cans during the forecast period due to the increasing demand for healthy beverages, carbonated soft drinks, health drinks, and sucralose juices. Additionally, several significant players impact the business's development through extensive promotional efforts and new research.

- The food and retail industries are the primary factors influencing product demand in the United States. The country has more grocery shops and superstores than ever before, and the expansion of the country's food and retail industries is primarily due to the rise in the number of smaller homes. Consequently, it is driving the demand for smaller packing units.

- In June 2023, Novelis Inc., a leading sustainable aluminum solutions provider, announced it had signed a new long-term contract with Coca-Cola Bottlers' Sales & Services Company, the contracting agent for The Coca-Cola Company's authorized North American bottlers. Novelis is expected to supply Coca-Cola's authorized North American bottlers with aluminum can sheets for The Coca-Cola Company's family of brands. This includes supply from Novelis' plant in Bay Minette, which is currently under construction and expected to begin commissioning in 2025.

- Also, because of the way of life in the United States, there is a greater need for metal cans. Individuals choose wholesome food that is ready to eat and can make it quickly since they have hectic schedules that leave them with little time for cooking. By offering easy packaging and foods that are ready to use, canned food accomplishes this goal. Metal cans are expected to boost the market's growth because they can keep food fresh and high-quality for an extended period.

Metal Cans Industry Overview

The metal cans market is semi-consolidated, with the presence of major players like Ball Corporation, Ardagh Group, Mauser Packaging Solutions, Silgan Containers LLC, and Crown Holdings Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023: Mauser Packaging Solutions acquired Taenza SA de CV, a prominent Mexican manufacturer specializing in tin-steel aerosol cans and steel pails. Based in Mexico City, Taenza has an extensive presence with five manufacturing facilities across the country and a workforce exceeding 850 employees. Its product line includes aerosol spray cans, steel pails, and paint cans, catering to a varied clientele in the paint, coatings, and chemical sectors.

- November 2023: Sonoco and Ball Corporation signed a significant agreement. Under this agreement, Sonoco, specifically through its Sonoco Phoenix business unit, exclusively supplies balls with easy-open, full-panel ends for their food cans. This collaboration solidifies Sonoco's role as Ball's primary supplier and also extends to a joint marketing and sales effort for these innovative food cans.

- September 2023: Ardagh Group and Crown Holdings Inc. are collaborating with the Can Manufacturers Institute (CMI) to boost aluminum beverage can recycling rates. They are achieving this by funding a robot from EverestLab, an artificial intelligence and robotics company, for a California recycling facility. Caglia Environmental, operating in Fresno, CA, deployed this robot on its "last chance line" at the material recovery facility (MRF). This strategic move aims to salvage over 1 million additional used beverage cans (UBC) annually, which would otherwise head to the landfill.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability of the Packaging Due to Less Usage of Energy

- 5.1.2 Increasing Consumption of Alcoholic and Non-alcoholic Beverages

- 5.2 Market Restraints

- 5.2.1 Presence of Alternate Packaging Solutions as Polyethylene Terephthalate

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Cosmetics and Personal Care

- 6.2.4 Pharmaceuticals

- 6.2.5 Paint

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Italy

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Ardagh Group

- 7.1.3 Mauser Packaging Solutions

- 7.1.4 Silgan Containers LLC

- 7.1.5 Crown Holdings Inc.

- 7.1.6 DS Containers Inc.

- 7.1.7 CCL Container Inc.

- 7.1.8 Toyo Seikan Group Holdings Ltd

- 7.1.9 Pacific Can China Holdings Limited

- 7.1.10 Universal Can Corporation

- 7.1.11 CPMC HOLDINGS Limited (COFCO Group)

- 7.1.12 Showa Denko KK

- 7.1.13 Independent Can Company

- 7.1.14 Hindustan Tin Works Ltd

- 7.1.15 Saudi Arabian Packaging Industry WLL (SAPIN)