|

市场调查报告书

商品编码

1639494

巨量资料技术:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Big Data Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

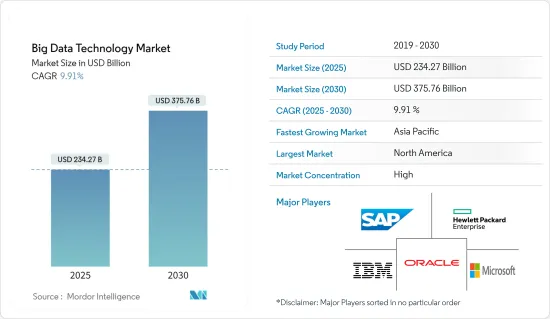

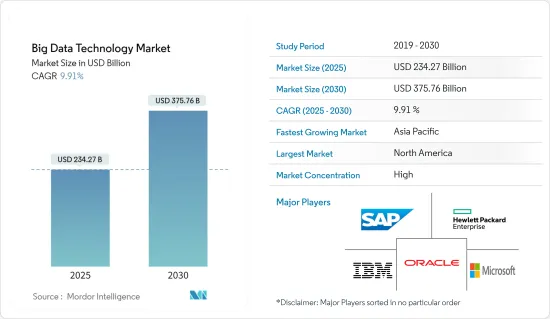

巨量资料技术市场规模在2025年预估为2,342.7亿美元,预估至2030年将达3,757.6亿美元,预测期间(2025-2030年)的复合年增长率为9.91%。

主要亮点

- 巨量资料技术被定义为一种软体公共事业。该技术主要用于分析、处理和提取大型资料和大量高度复杂的结构中的资讯。

- 随着新技术、新设备和通讯的进步,每年产生的资料量都在迅速成长。巨量资料技术和服务市场主要受评估不断增加的结构化和非结构化资料的需求驱动,以便获得可用于未来决策流程的可行见解。

- 随着工业IoT和 M2M 连接的兴起,汽车产业正在为工业 4.0 做好准备。机器人、感测器、条码阅读器和 RFID 如今在该领域的工厂车间已很常见。由于这些小工具的存在,资料产生点激增。

- 供需因素在消费性电子业务中发挥关键作用。该产业部门从巨量资料分析中受益匪浅,使其能够从推动式市场策略转变为拉动式市场策略。

- 此外,产生和储存的大量资料很容易受到相关人员和相关人员的骇客攻击和篡改。这使得储存资料的安全性面临风险。巨量资料技术供应商将立即感受到影响,其声誉也将面临风险。

巨量资料技术市场趋势

零售业占据市场主导地位

- 巨量资料技术和进阶分析正在变革时期零售业。随着电子商务和线上购物的成长以及竞争对手之间的激烈竞争,零售商正在转向巨量资料分析来保持竞争力。

- 巨量资料被应用于整个零售业务流程,以研究客户行为、预测需求、改善定价等。当今零售业的许多巨量资料应用都是由系统范围的成本降低、改善的线上和店内客户体验、资料主导的自适应供应链以及即时分析和定位所驱动的。

- 巨量资料分析的使用使产业能够更了解消费者的行为模式并据此规划生产计画。使用来自公共互联网的巨量资料(例如用户生成内容 (UGC) 和线上客户评论 (OCR)资料)为分析零售业客户行为提供了一种新兴选择。

- 2022年1月,全球资料分析和消费者情报提供者J.D. Power重新推出了其汽车资料解决方案部门管理的三款关键汽车资料产品。这些包括针对车辆识别号码 (VIN) 描述、库存管理、数位零售和办公桌应用的支付和奖励资料的解决方案。

- 零售商使用 MapR Technologies 等供应商提供的巨量资料平台来储存和整合各种线上和线下客户资料、电子商务交易、点选流资料、电子邮件、社群媒体和客服中心记录,并进行分析。

亚太地区将经历最高成长

- 由于人口的成长和电子商务,亚太地区数位产品和服务产生的资料量激增。巨量资料在亚太地区的国际银行中被广泛应用,但越来越多的本地金融机构也开始拥抱大数据,以期获得「后发优势」。

- 互联网使用量的增加使得组织能够存取大量资料。由于这些优势,跨国公司现在将巨量资料视为可操作的知识。

- 最终用户也正在接受巨量资料分析的外包服务模式。资料分析外包是商务策略,其中资料主导的组织将资料委託给服务提供商,以换取获取有见地的报告。提供者将建立和维护基础设施、管理资料并分析资料。管理企业产生的资料非常耗时,而对即时洞察的需求推动了对外包资料分析的需求。

- 为了容纳不断增长的资料,您必须向丛集添加额外的实体伺服器,这既费时又昂贵。云端平台的完全可扩充性为企业提供了无限的储存容量需求。由于这些优势,云端平台变得越来越受欢迎。

- 此外,2023 年 2 月,中国西南地区主要巨量资料中心贵州省宣布计划在 2023 年投资 200 亿元人民币(29 亿美元)用于巨量资料相关计画。该省省长宣布,将加快建设先进的数位基础设施,包括5G、运算网路和资料中心。这些发展预计将促进该地区巨量资料技术的发展。

巨量资料技术产业概况

市场集中度较高,IBM、微软和 SAP 等主要传统参与者占据市场主导地位。企业关心员工和客户资料的隐私和管理,因此他们更信任现有的供应商,而不是新参与企业的供应商。

- 2022 年 12 月-惠普宣布为 HPE GreenLake 推出新的应用程式、分析和开发人员服务。边缘到云端技术使企业能够跨混合云端环境为生产工作负载实施资料优先的现代化计画。透过来自亚马逊网路服务(AWS) 的Amazon Elastic Kubernetes Service (Amazon EKS)、基础设施即程式码和云端原生工具链,HPE GreenLake for Private Cloud Enterprise 扩展了Kubernetes 的容器部署选项,加速了客户的DevOps 和持续集成以及持续配置(CI/CD)环境。

- 2022 年 9 月 – SAS Viya 分析平台在 Microsoft Azure 市场上付费使用制。透过 Microsoft Azure 上功能齐全的 SAS Viya,世界各地的客户现在可以存取关键资料探索、机器学习和模型部署分析。 SAS Viya 配备了广泛的应用程式内学习中心,可协助您快速入门并取得长期成功,并提供多种翻译语言。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场动态

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 资料发现和视觉化工具的广泛采用将推动市场成长

- 市场限制

- 相关人员和第三方对产生的资料进行骇客攻击和篡改是市场成长面临的挑战

第六章 市场细分

- 按出货方式

- 本地

- 云

- 按最终用户产业

- 通讯和 IT

- 能源和电力

- BFSI

- 零售

- 製造业

- 航太和国防

- 工程与建筑

- 医疗保健和製药

- 其他行业(运输和物流、媒体和娱乐)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Hewlett-Packard Company

- Cisco Systems Inc.

- SAS Institute

- Information Builders Inc.

- MicroStrategy Incorporated

- Accenture PLC

第八章投资分析

第九章 市场机会与未来趋势

简介目录

Product Code: 50532

The Big Data Technology Market size is estimated at USD 234.27 billion in 2025, and is expected to reach USD 375.76 billion by 2030, at a CAGR of 9.91% during the forecast period (2025-2030).

Key Highlights

- Big data technology is defined as software utility. This technology is primarily designed to analyze, process, and extract information from a large data set and a huge set of extremely complex structures.

- The amount of data produced is rising quickly yearly due to improvements in new technology, gadgets, and communication. The market for big data technologies and services is primarily driven by the demand for actionable insights that can be used for future decision-making processes by evaluating the constantly growing amounts of structured and unstructured data.

- The automobile sector is positioning itself to be industry 4.0-ready with the rise of industrial IoT and M2M connectivity. Robots, sensors, barcode readers, and RFIDs are now commonplace in this sector's factory floor. Data generation points have drastically risen as a result of these gadgets.

- Supply and demand factors play a significant role in the consumer electronics business. This industry sector has significantly benefited from big data analytics, allowing it to convert from a push market strategy to a pull market strategy.

- Furthermore, the enormous amount of data produced and stored makes it vulnerable to hacking and modification by outside parties or insiders. This will jeopardize the safety of any saved data. The vendors of big data technology, whose reputation would be in danger, will be immediately impacted.

Big Data Technology Market Trends

Retail Industry to Dominate the Market

- With Big Data technologies and sophisticated analytics, the retail sector is undergoing a significant revolution. Retailers are using Big Data analytics to stay competitive due to the growth of e-commerce, online purchasing, and high levels of rivalry.

- Big Data is used throughout the whole retail process in the business to study customer behavior, forecast demand, and improve prices. Most big data applications in retail today are for system-wide cost reduction, enhancing the customer experience both online and in-store, data-driven adaptive supply chains, and real-time analytics and targeting.

- With the use of big data analytics, the industry is now more aware of consumer behavior patterns and can plan production based on these. Using big data from the public internet as user-generated content (UGC) or online customer reviews (OCR) data presents an up-and-coming alternative for analyzing retail customer behavior.

- In January 2022, J.D. Power, a global provider of data analytics and consumer intelligence, relaunched three major automotive data products maintained by the company's Autodata Solutions division. These include solutions for vehicle identification number (VIN) descriptions, inventory management, and payment and incentives data for digital retail and desking applications.

- Retailers may store, integrate, and analyze a wide range of online and offline customer data, e-commerce transactions, clickstream data, email, social media, and call center records using a big data platform provided by vendors like MapR Technologies.

Asia-Pacific to Witness the Highest Growth

- Asia-Pacific is seeing a boom in data produced from digital goods and services due to population expansion and increased e-commerce. While big data has been widely used by Asian-Pacific international banks (APAC), more local institutions are increasingly doing the same to achieve a "second-mover advantage."

- Due to increased Internet usage, organizations can access a vast amount of structured and unstructured data. Due to these advantages, substantial multinational corporations now have their big data evaluated for practical knowledge.

- End users are also embracing big data analytics outsourcing service models. Data analytics outsourcing is a business strategy where a data-driven organization entrusts a service provider with its data in exchange for access to insightful reporting. The provider handles infrastructure setup and maintenance, data management, and data analysis. The need for immediate insights is driving the need for significant data analytics outsourcing because managing the data generated by enterprises takes time.

- More physical servers must be added to the cluster to accommodate the growing data, which takes time and money. A cloud platform's complete scalability gives businesses access to limitless storage capacity on demand. As a result of its advantages, the technology is expanding in areas where it is being used.

- Moreover, In February 2023, Guizhou Province, a major big data hub in southwest China, announced its plan to invest 20 billion yuan (USD 2.9 billion) in big data-related initiatives in 2023. The director of the province announced that the province will accelerate the construction of 5G, computing networks, data centers, and other forms of advanced digital infrastructure. Such developments are expected to boost the growth of big data technology in the region.

Big Data Technology Industry Overview

The market is concentrated, with significant legacy players dominating the market, like IBM, Microsoft, and SAP. Since companies are concerned about the privacy and management of their employee/customer data, they trust established vendors more than new entrants.

- December 2022 - Hewlett-Packard Company has announced new application, analytics, and developer services for HPE GreenLake. With edge-to-cloud technology, businesses can implement a modernization plan that puts data first for production workloads across hybrid cloud environments. Through Amazon Elastic Kubernetes Service (Amazon EKS) Anywhere from Amazon Web Services (AWS), infrastructure-as-code, and cloud-native toolchains, HPE GreenLake for Private Cloud Enterprise offers expanded container deployment options for Kubernetes to support customers' DevOps and continuous integration and continuous deployment (CI/CD) environments.

- September 2022 - The SAS Viya analytics platform is now pay-as-you-go on the Microsoft Azure Marketplace. Customers from all over the world have access to vital data exploration, machine learning, and model deployment analytics thanks to full-featured SAS Viya on Microsoft Azure. It features a rich in-app learning center to help both quick onboarding and long-term success, and it is available in many translated languages.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increasing Adoption of Data Discovery and Visualization Tools is Expanding the Market Growth

- 5.3 Market Restraints

- 5.3.1 Hacking and Tampering of Generated Data by Insiders or Third Party is Challenging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Delivery Mode

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By End-user Vertical

- 6.2.1 Telecom & IT

- 6.2.2 Energy & Power

- 6.2.3 BFSI

- 6.2.4 Retail

- 6.2.5 Manufacturing

- 6.2.6 Aerospace & Defense

- 6.2.7 Engineering & Construction

- 6.2.8 Healthcare & Pharmaceuticals

- 6.2.9 Other End -user Verticals (Transportation & Logistics, Media & Entertainment)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Oracle Corporation

- 7.1.4 SAP SE

- 7.1.5 Hewlett-Packard Company

- 7.1.6 Cisco Systems Inc.

- 7.1.7 SAS Institute

- 7.1.8 Information Builders Inc.

- 7.1.9 MicroStrategy Incorporated

- 7.1.10 Accenture PLC

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219