|

市场调查报告书

商品编码

1639519

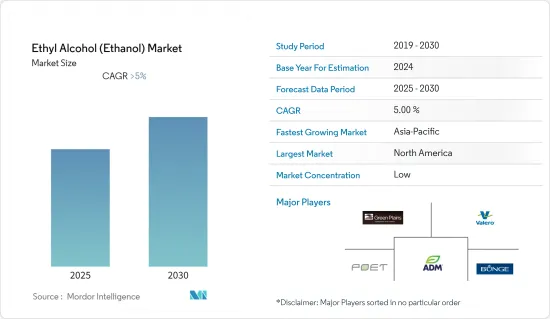

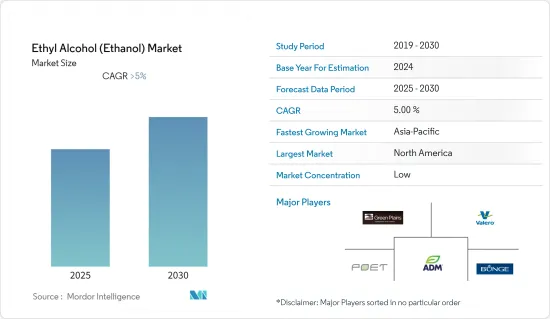

乙醇 (Ethanol) -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)Ethyl Alcohol (Ethanol) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计预测期内乙醇市场复合年增长率将超过 5%

主要亮点

- 推动市场成长的关键因素是对乙醇作为生质燃料的需求增加、啤酒製造和食品加工中使用的增加以及政府采取严格的措施来限制石化燃料的使用。

- 相反,人们对饮酒负面影响的认识不断增强以及混合动力电动车的出现可能会阻碍市场研究的成长。

- 预计在预测期内,用玉米和糖生产乙醇的需求不断增长将为市场创造机会。

- 由于食品加工业的监管收紧和需求的增加,北美在全球市场中占据主导地位。

乙醇市场趋势

汽车和运输领域主导市场

- 几十年来,原油和天然气一直是汽车产业的重要能源来源。由于世界石油和天然气消费量的不断增加以及原油价格的飙升对环境造成的负面影响,生质乙醇等生质燃料被认为是汽车工业替代原油和天然气的潜在燃料。

- 乙醇是最便宜的汽油添加物。有助于降低製造商和消费者的成本。乙醇市场直接受到燃料消费量的影响。

- 透过取代石油产品中的芳烃,乙醇有助于减少大气中有害物质、一氧化碳、颗粒物、氧化亚氮和废气碳氢化合物的排放。

- 据可再生燃料协会称,美国是世界上最大的乙醇燃料生产国。 2021 年,我们生产了 150 亿加仑生质燃料。

- 此外,根据可再生燃料协会的数据,巴西是世界第二大生产国,2021 年产量为 75 亿加仑。此外,巴西是世界领先的生质燃料市场之一,软燃料汽车经过专门开发,使用乙醇比例高于标准汽车的燃料。

- 因此,市场上的所有这些趋势预计将在预测期内推动汽车和运输领域对乙醇的需求。

北美市场占据主导地位

- 北美地区在全球市场占有率中占据主导地位。减少石化燃料使用的严格法规以及食品加工业需求的增加正在推动该地区的乙醇需求。

- 美国、加拿大和墨西哥等国家的政府致力于减少石化燃料的使用及其造成的污染。

- 在这方面,该地区依赖乙醇混合燃料,这是推动该地区乙醇市场成长的关键因素之一。

- 根据《Ethanol Producer》杂誌报道,Poet Biorefining 是美国最大的乙醇生产商。截至 2021 年 12 月,该公司在中西部的 33 家工厂拥有年产 27 亿加仑乙醇的产能,支持该地区的市场成长。

- 根据美国能源资讯署统计,截至2021年1月,美国燃料乙醇产能为175亿加仑/年,与前一年同期比较增加2亿加仑/年。因此,乙醇生产和消费能力的增加可能会提振乙醇需求。

- 因此,所有这些市场趋势预计将在预测期内推动该地区的乙醇需求。

乙醇产业概况

乙醇(乙醇)市场分散。该市场的主要企业包括(排名不分先后)ADM、POET, LLC、Valero、Green Plains Inc. 和 Bunge North America, Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加在汽车产业的使用

- 政府倡议增多

- 抑制因素

- 转向生物丁醇

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 年级

- 食品级

- 工业级

- 医药级

- 实验室级

- 最终用户产业

- 汽车和交通

- 饮食

- 药品

- 化妆品/个人护理

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Advanced BioEnergy LLC

- The Andersons Inc.

- ADM

- BP plc

- Cargill Incorporated

- Flint Hills Resources

- Green Plains Inc.

- INEOS

- HBL

- Kirin Holdings Company, Limited.

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Kemin Industries, Inc.

- POET, LLC

- SABIC

- Sasol

- Solvay

- Valero

第七章 市场机会及未来趋势

- 用玉米和糖生产乙醇的需求激增

简介目录

Product Code: 50935

The Ethyl Alcohol Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- Major factors driving the market studied growth is the rising ethanol demand as biofuel, the growing use in beer production and food processing, and stringent government policies to restrict the usage of fossil fuels.

- Conversely, increased awareness about the ill effects of alcohol consumption and the hybrid electric vehicle advent is likely to hamper the market studied growth.

- The surging demand to produce ethanol from corn and sugar will likely provide opportunities for the market studied during the forecast period.

- North America dominated the market across the world due to increasing regulations and rising demand for the food processing industry.

Ethanol Market Trends

Automotive and Transportation Segment to Dominate the Market

- Crude oil and natural gas were significant energy sources for the automotive industries for many decades. Due to the negative environmental impact of the increasing consumption of crude oil and natural gas worldwide and the high prices of crude oil, biofuels, such as bioethanol, are considered viable alternatives to crude oil and natural gas as fuel for the automotive industries.

- Ethanol is the cheapest additive to petrol. It helps in reducing the cost for manufacturers and consumers. The ethanol market is directly affected by fuel consumption.

- Ethanol helps to reduce the emission of air toxins, carbon monoxide, particulate matter, nitrous oxides, and exhaust hydrocarbons by displacing aromatics in petroleum products.

- According to the Renewable Fuels Association, the United States is the world's largest fuel ethanol producer. The country produced 15 billion gallons of biofuel in 2021.

- Further, according to the Renewable Fuels Association, Brazil is the world's second-largest producer, with 7.5 billion gallons produced in 2021. Additionally, Brazil is one of the world's major biofuel markets, with specially developed flexible-fuel vehicles that run on fuels with a higher ethanol percentage than standard motor vehicles.

- Hence, all such trends in the market are likely to drive the ethanol demand in the automotive and transportation segment during the forecast period.

North America Region to Dominate the Market

- The North American region dominated the global market share. Stringent regulations toward reducing fossil fuel usage and rising demand from the food processing industry are driving the ethanol demand in the region.

- The government in the countries such as the United States, Canada, and Mexico, is focusing on reducing fossil fuel usage and the pollution caused by them.

- In this regard, the region is resorting to ethanol-blended fuels, which is one of the major factors driving the ethanol market growth in the region.

- According to the Ethanol Producer Magazine, Poet Biorefining is the largest ethanol producer in the United States. As of December 2021, the company had an ethanol production capacity of 2.7 billion gallons per annum across 33 plants in the Midwest, supporting the market growth in the region.

- According to US Energy Information Administration, the United States fuel ethanol production capacity was 17.5 billion gallons per year as of January 2021, representing an increase of 0.2 billion gallons per year compared to the previous year. Thus, increased ethanol production and consumption capacities will likely boost ethyl alcohol demand.

- Hence, all such market trends are expected to drive the demand for ethanol in the region during the forecast period.

Ethanol Industry Overview

The ethyl alcohol (ethanol) market is fragmented in nature. Some of the major players in the market include ADM, POET, LLC, Valero, Green Plains Inc., and Bunge North America, Inc., among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in the Automotive Industry

- 4.1.2 Increasing Government Initiatives

- 4.2 Restraints

- 4.2.1 Shifting Focus toward Biobutanol

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Grade

- 5.1.1 Food Grade

- 5.1.2 Industrial Grade

- 5.1.3 Pharmaceutical Grade

- 5.1.4 Lab Grade

- 5.2 End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Food and Beverage

- 5.2.3 Pharmaceutical

- 5.2.4 Cosmetics and Personal Care

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Advanced BioEnergy LLC

- 6.4.2 The Andersons Inc.

- 6.4.3 ADM

- 6.4.4 BP p.l.c.

- 6.4.5 Cargill Incorporated

- 6.4.6 Flint Hills Resources

- 6.4.7 Green Plains Inc.

- 6.4.8 INEOS

- 6.4.9 HBL

- 6.4.10 Kirin Holdings Company, Limited.

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Kemin Industries, Inc.

- 6.4.14 POET, LLC

- 6.4.15 SABIC

- 6.4.16 Sasol

- 6.4.17 Solvay

- 6.4.18 Valero

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Surging Demand to Produce Ethanol from Corn and Sugar

02-2729-4219

+886-2-2729-4219