|

市场调查报告书

商品编码

1639533

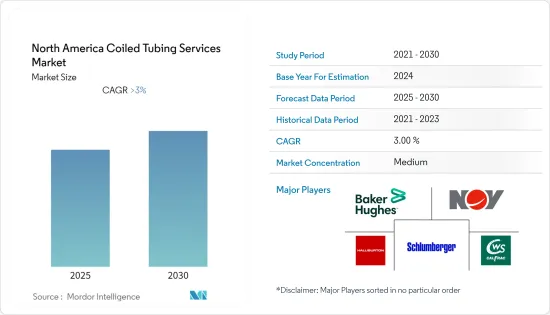

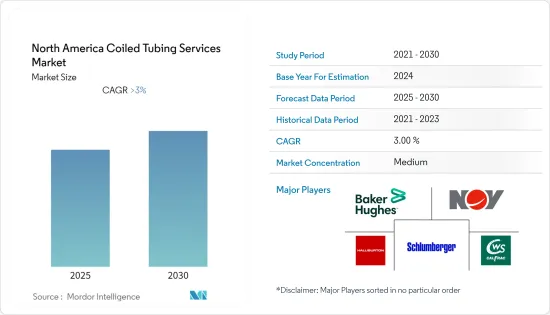

北美挠曲油管服务:市场占有率分析、产业趋势与成长预测(2025-2030)North America Coiled Tubing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计北美挠曲油管服务市场在预测期内将维持3%以上的复合年增长率。

2020 年市场受到 COVID-19 的负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从中期来看,页岩油气的新发现和投资增加预计将推动所研究市场的成长。

- 同时,原油价格波动和高昂的维护成本预计将阻碍预测期内北美挠曲油管服务的成长。

- 深水和超深水蕴藏量的开发预计将在预测期内为北美挠曲油管服务市场提供利润丰厚的成长机会。

- 美国在市场上占据主导地位,并且在预测期内可能保持最高的复合年增长率。这种增长是由于几个盆地页岩油气开发的增加以及为了更好地进入地层而从垂直井转向水平井的转变。

北美挠曲油管服务市场趋势

油井作业领域主导市场

- 使用挠曲油管进行修井是最优选的技术,因为挠曲油管装置可以进行增产、再射孔、流体泵送、打捞、防砂和区域隔离等操作。井眼性能改善和井眼清洗的资本支出增加预计将推动井眼干预领域的发展。

- 2021年北美天然气产量达约9,342亿立方米,与前一年同期比较成长约2%。北美生产的天然气大部分生产美国,2021年占该地区总产量的82%。

- 墨西哥湾成熟的海上油田和美国其他陆上油田对修井作业的需求正在推动挠曲油管服务市场的发展。北美持续的页岩活动以及主要上游营运商的存在,正在为挠曲油管服务市场创造长期合约机会。

- 2021年12月,康菲石油公司阿拉斯加国家石油储备GMT-2石油计划开始生产。此计划预计高峰期产量为 30,000 桶/天。该计划的开发成本为140万美元。

- 2022年2月,BP PLC宣布启动墨西哥湾赫歇尔扩建计划。 Herschel 计划成为 2022 年在全球实施的四个重大计划中的计划一个。计划的第一阶段包括开发新的海底生产系统。第一口井高峰期时,该平台年总产量预计将增加10,600桶油当量/日。

- 增加石油和天然气产量的投资将成为市场成长的驱动力。加拿大石油生产商协会(CAPP)宣布,全球天然气和石油需求的快速成长可能导致该领域的投资连续第二年大幅增加。 CAPP预计2022年投资额为328亿美元,较2021年的269亿美元增加近60亿美元。

- 因此,石油和天然气探勘和生产活动的活性化导致油井干预需求的扩大,从而提振了北美挠曲油管服务市场。

美国主导市场

- 儘管油价波动,美国对传统型蕴藏量的追求导致钻探的油井多于实际完工的油井。该国的钻机效率正在上升,每年钻机可钻探的井数正在快速增加。

- 2021年,美国石油产量达1,660万桶/日,较上年略有成长。 2019年,石油产量创历史新高。美国目前的石油产量比世界上任何其他国家都多。

- 预计该国挠曲油管服务市场将受到井基生产扩张和新钻水平井横向长度持续增加的推动。

- 美国被认为是新技术的温床,挠曲油管服务设备和相关企业的大幅扩张以及具有竞争力的价格,使马苏挠曲油管服务修井变得更加可行。

- 截至2019年,美国是最大的石油和天然气生产国。该国现有活跃油气井超过90万口,自2010年以来已钻探超过13万口。 2018年,美国发现了三项重大石油发现,其中两处位于墨西哥湾:位于2,000 m深处的Barrymore (545 Mb)和位于2,300 m深处的Appomattox (140 Mb)。

- 二迭纪盆地和巴肯福德的成熟油田需要采取干预措施来提高油井产能。因此,美国挠曲油管服务市场主要透过钻井活动和成熟油田的再开发来成长。

北美挠曲油管服务产业概况

北美挠曲油管服务市场适度细分。市场上的主要企业包括(排名不分先后)贝克休斯公司、Calfrac Well Services Ltd.、哈里伯顿公司、National-Oilwell Varco Inc.和斯伦贝谢有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 目的

- 钻孔

- 完全的

- 干得好

- 钻孔位置

- 陆上

- 离岸

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Baker Hughes Co.

- Calfrac Well Services Ltd

- Conquest Completion Services LLC

- Essential Energy Services Ltd

- Halliburton Company

- Key Energy Services LLC

- National-Oilwell Varco Inc.

- Schlumberger Ltd

- STEP Energy Services

- Superior Energy Services

- Trican Well Service Ltd

第七章 市场机会及未来趋势

简介目录

Product Code: 51070

The North America Coiled Tubing Services Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing investments in new discoveries and shale oil and gas are expected to drive the growth of the market studied.

- On the other hand, the volatile crude oil prices and high maintenance cost are expected to hamper the growth of the North American coiled tubing services during the forecast period.

- The development of the deepwater and ultra-deepwater reserves are likely to create lucrative growth opportunities for the North American coiled tubing services market during the forecast period.

- The United States dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increased shale oil and gas development in several basins, along with a shift from vertical to horizontal wells for greater formation access.

North America Coiled Tubing Market Trends

Well Intervention Segment to Dominate the Market

- Coiled tubing well intervention is the most preferred technique as the coiled tubing unit allows for operations such as stimulation, re-perforation, fluid pumping, fishing, sand control, and zonal isolation. The increasing capital expenditure on well performance enhancement and well cleaning is expected to drive the well intervention segment.

- Natural gas production in North America amounted to some 934.2 billion cubic meters in 2021, which represented an increase of nearly 2% compared to the previous year and the highest figure reported during the study period. The majority of the natural gas produced in North America originates in the United States, which accounted for 82% of the region's total production in 2021.

- The demand for well intervention operations in maturing offshore fields in the Gulf of Mexico and other onshore fields in the United States is driving the coiled tubing services market. The continuous shale activities in North America, with the presence of major upstream operators, are also presenting long-term contract opportunities for the coiled tubing services market.

- In December 2021, ConocoPhillips started production at its GMT-2 oil project in the National Petroleum Reserve-Alaska. The project is expected to produce 30,000 b/d at its peak. The development costs for the project were USD 1.4 million.

- In February 2022, BP PLC announced the start of the Herschel Expansion project in the Gulf of Mexico. Herschel was planned to be the first of the four major projects to be delivered globally in 2022. Phase 1 of the project comprises the development of a new subsea production system. At its peak, the first well is expected to increase the platform's annual gross production by an estimated 10,600 barrels of oil equivalent a day.

- Increased investments to boost oil and natural gas production will drive the market's growth. The Canadian Association of Petroleum Producers (CAPP) announced that rapid growth in global demand for natural gas and oil may see a trend of significant investment in the sector for the second consecutive year. CAPP projected an investment of USD 32.8 billion in 2022, a nearly USD 6 billion increase over the USD 26.9 billion invested in 2021.

- Therefore, increasing oil and gas exploration and production activities leading to greater well intervention demand are boosting the coiled tubing services market in North America.

United States to Dominate the Market

- Despite the volatile crude oil prices scenario, the quest for unconventional reserve production in the United States resulted in the drilling of more wells than their actual completion. Rig efficiency in the country is on the rise, and the number of wells a rig can drill each year is increasing at a significant pace.

- In 2021, oil production in the United States reached 16.6 million barrels per day, a slight increase from the previous year. In 2019, oil production reached the highest point in history. The United States currently produces more oil than any other country in the world.

- The coiled tubing services market in the country is expected to be driven by the expanding production in the well base and an ever-increasing lateral length in newly drilled horizontal wells.

- The United States is considered a ground for new technology, with a significant build-up of coiled tubing units and related companies keeping the rates competitive, making coiled tubing workovers more viable.

- As of 2019, the United States is the largest producer of oil and gas. There are more than 900,000 active oil and gas wells in the country, and more than 130,000 have been drilled since 2010. In 2018, the United States witnessed three significant oil discoveries, including two in the Gulf of Mexico, at Ballymore (545 Mb), at a depth of 2,000 m underwater, and at Appomattox (140 Mb), at a depth of 2,300 m underwater.

- The matured oil and fields of the Permian Basin and Bakken Ford require intervention operations to increase the productivity of the wells. Therefore, the coiled tubing services market in the United States is primarily growing through drilling activities and redevelopment of matured fields.

North America Coiled Tubing Industry Overview

The North American coiled tubing services market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Baker Hughes Co., Calfrac Well Services Ltd, Halliburton Company, National-Oilwell Varco Inc., and Schlumberger Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Drilling

- 5.1.2 Completion

- 5.1.3 Well Intervention

- 5.2 Location

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Co.

- 6.3.2 Calfrac Well Services Ltd

- 6.3.3 Conquest Completion Services LLC

- 6.3.4 Essential Energy Services Ltd

- 6.3.5 Halliburton Company

- 6.3.6 Key Energy Services LLC

- 6.3.7 National-Oilwell Varco Inc.

- 6.3.8 Schlumberger Ltd

- 6.3.9 STEP Energy Services

- 6.3.10 Superior Energy Services

- 6.3.11 Trican Well Service Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219