|

市场调查报告书

商品编码

1639534

印尼塑胶包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Indonesia Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

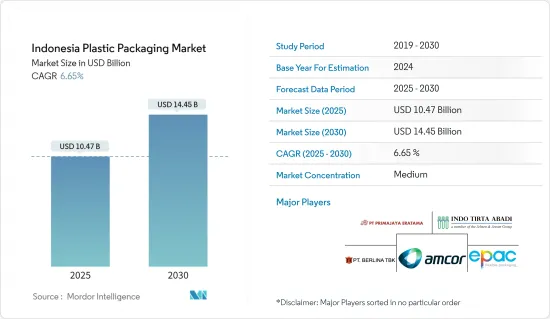

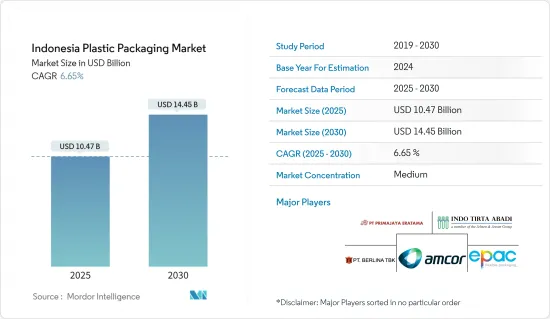

印尼塑胶包装市场规模预计在 2025 年为 104.7 亿美元,预计到 2030 年将达到 144.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.65%。

主要亮点

- 技术的进步和终端用户行业中包装应用的不断扩大是推动印尼包装市场成长的关键因素。该国不断增长的人口和不断增加的人均包装消费量对这一趋势贡献巨大。消费行为的转变,例如对便利产品的需求不断增加以及越来越多地使用塑胶作为传统包装材料的替代品,进一步推动了市场扩张。

- 塑胶包装为包装行业的运作开闢了新的方式。耐用、轻巧和舒适的包装解决方案正在推动整个全部区域塑胶作为包装材料的使用增加。

- 经济成长以及对方便、一次性食品的需求推动了印尼软包装产量的成长。在软包装产品类型中,由于人们生活节奏快、劳动人口众多,印度的即食食品市场正在不断扩大,因此预计小袋包装将占据主要份额。受访的市场预计将选择低成本的替代品来包装液体和饮料,因此软包装很可能会被广泛使用,因为它比其他类型的包装更便宜。

- 目前该地区的 LDPE 包装价格较低,这意味着使用这种材料的额外成本对商家的影响很小。由聚丙烯、聚异戊二烯和聚氨酯製成的外科口罩的需求也在增加。

- 塑胶污染已成为全球性环境问题,许多研究都强调了其对生态系统的负面影响。作为回应,印尼实施了限制塑胶使用的法规。由于塑胶树脂价格上涨,印尼塑胶包装市场目前面临重大挑战。这一趋势导致树脂成本上涨的恢復延迟,并降低了现有本地製造商的盈利。

印尼塑胶包装市场趋势

聚对苯二甲酸乙二醇酯(PET)占据最大市场占有率

- 由于重量轻且耐用, 宝特瓶越来越多地被用来代替玻璃瓶。这一转变使得运输瓶装水和其他饮料变得更加经济高效。 PET 的透明度和固有的二氧化碳阻隔性能使其适用于各种应用。该材料可轻鬆製成瓶子和其他形状,并且可以透过色素、紫外线防护和氧气阻隔等添加剂来增强其性能,以满足特定品牌的要求。

- 在硬质包装方面,PET 可用于生产各种产品的微波食品托盘和瓶子,包括软性饮料、水、果汁、运动饮料、啤酒、调味品和食品容器。家庭护理、饮料和个人护理等多个领域对宝特瓶的需求都在增长。这种成长主要受消费者偏好以及 PET 的关键属性(如重量轻、可回收性高)的推动。

- 随着牛奶需求的增加,包装的生产也随之增加。这种成长带动了对新製造设施的投资、生产能力的扩大和 PET 包装技术的发展。

- 经济合作暨发展组织预测,未来几年印尼的原料乳製品消费量将会增加。经济合作暨发展组织预测,未来几年印尼原乳消费量将成长,年均成长率约为人均1公斤(+24.88%),2031年将达到人均1.2公斤消费量。

- 预计新鲜乳製品消费量的增加将对印尼宝特瓶包装市场产生正面影响。 宝特瓶是包装各种产品(包括乳製品)的常用材料。

食品板块呈现显着成长

- 快速的都市化以及超级市场、大卖场、杂货店、便利商店和购物中心的兴起正在扩大袋和袋子的市场。食品和饮料行业的成长也将对市场产生积极影响。此外,消费者对环保产品的偏好转变也推动了对非生物分解塑胶袋和袋子的需求。

- 根据美国农业部(USDA)的报告,印尼为美国原料供应商满足食品加工产业的原料需求提供了绝佳机会。美国是印尼第三大农产品供应国,市场占有率11%。到2023年,大豆和乳製品将占美国对印尼农产品出口的一半左右。

- 自 2024 年 10 月 17 日起,印尼的许多食品、原料、添加剂和所有加工食品都必须获得清真认证。

- 随着对清真认证食品的需求增加,对符合清真标准的包装的需求也可能随之增长。这可能会导致经过认证或专门设计用于处理清真产品的塑胶包装的需求增加。

- 有机食品产业经常强调永续性和环境责任。这一趋势可能会刺激更环保的塑胶包装解决方案的开发和采用,例如生物分解性塑胶和可回收的塑胶。公司可能会投资创造符合有机市场价值的包装。

- 据有机贸易协会称,2022 年印尼有机包装食品消费约 1,570 万美元。预计到 2025 年将成长至 1,900 万美元。

印尼塑胶包装产业概况

市场处于半静态状态并由少数主要企业推动。 Amcor Group、Prima Jaya Eratama、PT ePac Flexibles Indonesia、PT Berlina Tbk 和 PT Indo Tirta Abadi 在满足日益增长的包装解决方案需求方面发挥着至关重要的作用。这些公司不仅正在摆脱传统的塑胶包装,而且还在跟上消费者对永续塑胶替代品日益增长的偏好。为了加强市场地位,这些公司正在调整策略,扩大产品供应,并积极寻求以永续性为重点的合作伙伴关係和收购。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 越来越多地采用轻量化包装方法

- 增加环保包装和再生塑料

- 市场挑战

- 原料(塑胶树脂)价格上涨

- 政府法规和环境问题

第六章 市场细分

- 硬质塑胶包装

- 材料类型

- 聚乙烯 (PE)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 聚苯乙烯 (PS) 和发泡聚苯乙烯 (EPS)

- 聚氯乙烯(PVC)

- 其他材料

- 产品类型

- 瓶子和罐子

- 托盘和容器

- 其他产品类型

- 材料类型

- 软质塑胶包装

- 材料类型

- 聚乙烯 (PE)

- 双轴延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 聚氯乙烯(PVC)

- 乙烯 - 乙烯醇(EVOH)

- 其他材料

- 产品类型

- 小袋

- 包包

- 薄膜和包装

- 其他产品类型

- 材料类型

- 最终用户产业

- 食物

- 饮料

- 卫生保健

- 化妆品和个人护理

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Amcor Group

- Prima Jaya Eratama

- PT ePac Flexibles Indonesia

- PT Berlina Tbk

- PT Indo Tirta Abadi

- Sonoco Products Company

- PT Solusi Prima Packaging

- PT Hasil Raya Industries

- PT Indonesia Toppan Printing

第八章投资分析

第九章:市场的未来

The Indonesia Plastic Packaging Market size is estimated at USD 10.47 billion in 2025, and is expected to reach USD 14.45 billion by 2030, at a CAGR of 6.65% during the forecast period (2025-2030).

Key Highlights

- Technological advancements and expanding end-user industry packaging applications are key factors driving the growth of Indonesia's packaging market. The country's increasing population and rising per capita packaging consumption contribute significantly to this trend. Consumer behavior shifts, including the growing demand for convenience products and the increased adoption of plastic as an alternative to traditional packaging materials, further propel market expansion.

- Plastic packaging has implemented new ways for the packaging industry to function. Durable, lightweight, and comfortable packaging solutions have augmented the use of plastics as a packaging material across the region.

- Economic growth and the need for single-serve, on-the-go convenience foods in Indonesia have increased flexible packaging production. Among flexible packaging product types, pouches are expected to hold a significant share due to the country's increasing market for Ready-to-Eat (RTE) foods, owing to the busy lifestyle and many working populations. The studied market is anticipated to opt for a low-cost alternative for liquid and beverage packaging and hence see wide usage of flexible packaging as it is cheaper than other types of packaging.

- The price of LDPE packaging is currently low in the region, which means that the additional cost of using the material will have minimal impact on sellers. The demand for surgical masks made of polypropylene, polyisoprene, and polyurethane has also increased.

- Plastic pollution has emerged as a global environmental concern, with numerous studies highlighting its detrimental effects on ecosystems. In response, Indonesia has implemented regulations to curb plastic usage. The Indonesian plastic packaging market now faces significant challenges due to rising plastic resin prices. This trend has resulted in delays in recovering increased resin costs and diminished profitability for established local manufacturers.

Indonesia Plastic Packaging Market Trends

Polyethylene Terephthalate (PET) Occupies the Largest Market Share

- Due to their lightweight and durable nature, PET bottles are increasingly replacing glass bottles. This shift allows for more cost-effective transportation of mineral water and other beverages. PET's transparency and inherent CO2 barrier properties suit it for various applications. The material can be easily moulded into bottles or other shapes, and its properties can be enhanced with additives such as colourants, UV blockers, and oxygen barriers to meet specific brand requirements.

- In rigid packaging, PET produces microwavable food trays and bottles for various products, including soft drinks, water, juices, sports drinks, beer, condiments, and food containers. The demand for PET bottles is growing across multiple sectors, including home care, beverages, and personal care. This growth is primarily driven by consumer preferences and PET's key attributes, such as its lightweight nature and high recyclability.

- Increased demand for milk will necessitate more packaging production. This growth can lead to investment in new manufacturing facilities, expanded production capabilities, and technological advancements in PET packaging.

- The Organisation for Economic Cooperation and Development forecasts that Indonesia's consumption of fresh milk products will increase over the coming years. They project a compound annual growth rate of approximately one kilogram per capita (+24.88%) and estimate that by 2031, the consumption per capita will reach 5.01 kg.

- This anticipated rise in fresh dairy product consumption is expected to impact Indonesia's PET bottle packaging market positively. PET bottles are a commonly used material for packaging various products, including dairy items.

Food Segment to Show Significant Growth

- Rapid urbanization and the growing number of supermarkets, hypermarkets, grocery stores, convenience stores, and shopping centers increase the market for pouches and bags. The growth of the food and beverage industry also positively impacts the market. Futhermore, the changing consumer preferences towards eco-friendly products also drive the need for non-biodegradable plastic pouches and bags.

- The United States Department of Agriculture (USDA) reports that Indonesia presents substantial opportunities for United States ingredient suppliers to meet the raw material needs of its food processing industry. The United States ranks as the third-largest agricultural supplier to Indonesia, holding an 11% market share. In 2023, soybeans and dairy products constituted approximately half of all US agricultural exports to Indonesia.

- Starting October 17, 2024, halal certification will become mandatory for numerous foods, ingredients, additives, and all processed food products in Indonesia.

- As the demand for halal-certified food products rises, there will be a parallel need for packaging that meets halal standards. This could lead to increased demand for plastic packaging that is certified or specifically designed to handle halal products.

- The organic food sector often emphasizes sustainability and environmental responsibility. This trend can drive the development and adoption of more eco-friendly plastic packaging solutions, such as biodegradable or recyclable plastics. Companies will likely invest in creating packaging that aligns with the organic market's values.

- According to the Organic Trade Association, in 2022, the consumption value of organic packaged food in Indonesia amounted to around USD 15.7 million. The value was forecast to increase to USD 19 million in 2025.

Indonesia Plastic Packaging Industry Overview

The market is semi-consolidated and driven by several key players. Amcor Group, Prima Jaya Eratama, PT ePac Flexibles Indonesia, PT Berlina Tbk, and PT Indo Tirta Abadi are pivotal in addressing the surging demand for packaging solutions. These companies are not only moving away from conventional plastic packaging but are also aligning with the growing consumer preference for sustainable plastic alternatives. To bolster their market presence, these firms are fine-tuning their strategies, broadening their product offerings, and actively seeking collaborations and acquisitions, with a pronounced focus on sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging Methods

- 5.1.2 Increased Eco-friendly Packaging and Recycled Plastic

- 5.2 Market Challenges

- 5.2.1 High Price of Raw Material (Plastic Resin)

- 5.2.2 Government Regulations and Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 Rigid Plastic Packaging

- 6.1.1 Material Type

- 6.1.1.1 Polyethylene (PE)

- 6.1.1.2 Polyethylene terephthalate (PET)

- 6.1.1.3 Polypropylene (PP)

- 6.1.1.4 Polystyrene (PS) and Expanded polystyrene (EPS)

- 6.1.1.5 Polyvinyl chloride (PVC)

- 6.1.1.6 Other Material Types

- 6.1.2 Product Type

- 6.1.2.1 Bottles and Jars

- 6.1.2.2 Trays and containers

- 6.1.2.3 Other Product Types

- 6.1.1 Material Type

- 6.2 Flexible Plastic Packaging

- 6.2.1 Material Type

- 6.2.1.1 Polyethene (PE)

- 6.2.1.2 Bi-orientated Polypropylene (BOPP)

- 6.2.1.3 Cast polypropylene (CPP)

- 6.2.1.4 Polyvinyl Chloride (PVC)

- 6.2.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.2.1.6 Other Material Types

- 6.2.2 Product Type

- 6.2.2.1 Pouches

- 6.2.2.2 Bags

- 6.2.2.3 Films & Wraps

- 6.2.2.4 Other Product Types

- 6.2.1 Material Type

- 6.3 End-user Industry

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Cosmetics and Personal Care

- 6.3.5 Other End-user Industry

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group

- 7.1.2 Prima Jaya Eratama

- 7.1.3 PT ePac Flexibles Indonesia

- 7.1.4 PT Berlina Tbk

- 7.1.5 PT Indo Tirta Abadi

- 7.1.6 Sonoco Products Company

- 7.1.7 PT Solusi Prima Packaging

- 7.1.8 PT Hasil Raya Industries

- 7.1.9 PT Indonesia Toppan Printing