|

市场调查报告书

商品编码

1639536

硬焊焊合金 -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)Braze Alloys - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

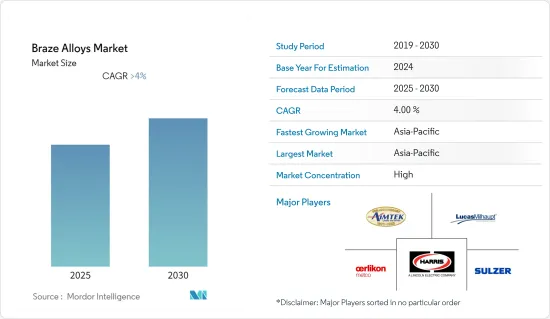

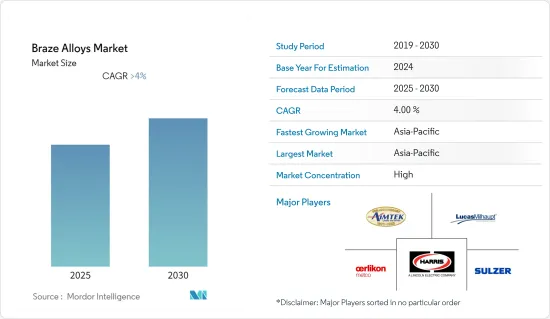

预计硬焊焊合金市场在预测期内复合年增长率将超过 4%。

COVID-19 大流行对市场产生了负面影响。不过,目前估计已达到疫情前的水平,预计将继续稳定成长。

主要亮点

- 与焊接和锡焊等製程相比,硬焊製程的采用率不断提高,汽车业对铝硬焊合金的需求不断增加,预计将推动市场的发展。

- 另一方面,基底金属价格波动可能会减缓市场成长。

- 未来几年,真空硬焊技术的成长预计将为市场提供成长机会。

- 预计亚太地区将占据最大份额,并且在未来五年内复合年增长率最高。

硬焊焊合金市场趋势

汽车领域预计将主导市场

- 硬焊合金用于汽车领域的各种连接目的。不同种金属零件使用填充金属或硬焊合金连接,其熔点低于被连接零件或基体金属的熔点。

- 二极体雷射硬焊、熔炉/真空硬焊和金属惰性气体 (MIG)硬焊通常用于汽车连接应用。

- 焊焊合金在汽车製造的主要应用包括ABC柱与车顶的连接、C柱的雷射光束或等离子焊焊、行李箱盖的雷射光束焊焊、燃料箱的MIG焊焊以及车身结构中的铝可电镀。

- 根据国际汽车製造商组织(OICA)的数据,2022年OICA成员国新车销售或註册数量接近6,900万辆。

- 根据欧洲汽车工业协会(ACEA)预计,2022年全球乘用车产量将超过6,800万辆,与前一年同期比较成长7.9%。此外,2022年北美地区汽车产量成长10.3%,达到1,040万辆,主要由于美国的高需求。

- 此外,汽车製造商和贸易业者协会估计,2022 年英国将生产超过 775,000 辆汽车。另外,2023 年 1 月英国生产了约 68,600 辆汽车。

- 大众汽车是美国最受欢迎的汽车品牌。 2021年,福斯市场占有率最高,接近9%,其次是奥迪(7.16%)和宝马(7.08%)。

- 由于上述因素,预计汽车领域将在预测期内主导市场。

亚太地区主导市场

- 中国、印度和日本等亚太国家生产市场上最多的硬焊料。这是因为中国、印度和日本的汽车、电子电气、建筑和航太工业都在成长。

- 中国已成为各类汽车产销售量最大、最具主导地位的国家。根据中国工业协会预计,2022年中国汽车产量与前一年同期比较%。产量预计将从2021年的约2,608万台增至2022年的约2,700万台。

- 印度汽车工业协会也表示,22财年印度製造的汽车总数将接近2,300万辆。摩托车占据大部分市场份额,约占总产量的74%。

- 根据日本汽车经销商协会(JADA)预测,2022年丰田将以约125万辆的销量领先日本国内销量。丰田汽车的销量是第二名的两倍多。位居第二的铃木 2022 年销量略高于 60 万辆。

- 市场可能会受益于商业建筑领域的逐步成长,特别是办公空间的建设。此外,由于住宅销售和现有住宅翻新的增加,亚太地区的住宅需求也在增加。

- 根据中国国家统计局的数据,2022年第四季中国建筑产值约2,760亿元人民币(400亿美元)。这比上一季(276 亿美元)成长了 50%。

- 此外,根据日本国土交通省的数据,2022年整个建筑业的投资预计与前一年同期比较增长约0.6%,达到约66.99兆日圆(5,081.6亿美元)。

- 此外,根据印度工商联合会 (FICCI) 的数据,到 2022 年,印度大都会圈将根据 PMAY 计划建造或批准约 550 万套和 1,140 万套住宅。

- 反过来,这些将在未来几年推动该地区的硬焊焊合金市场。

硬焊合金产业概况

硬焊合金市场因其性质而部分整合。在该市场营运的主要公司包括(排名不分先后)Aimtek Inc.、The Harris Products Group、Lucas-Milhaupt Inc.、Oerlikon Metco 和 Sulzer Ltd.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 与焊接和焊焊等製程相比,硬焊製程的采用率有所提高

- 汽车产业对铝硬焊料的需求不断增加

- 抑制因素

- 基底金属价格波动

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(金额/数量))

- 基底金属

- 铜

- 金子

- 银

- 铝

- 其他基底金属

- 最终用户产业

- 车

- 航太/国防

- 电力/电子

- 建造

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)分析**/市场排名分析

- 主要企业策略

- 公司简介

- Aimtek Inc.

- Prince Izant Company(Bellman-Melcor)

- Cupro Alloys Corporation

- Indian Solder and Brazing Alloys

- Johnson Matthey

- Lucas-Milhaupt Inc.

- Morgan Advanced Materials

- OC Oerlikon Management AG(Oerlikon Metco)

- Saru Silver Alloy Private Limited

- Sulzer Ltd.

- The Harris Products Group

- VBC Group

第七章 市场机会及未来趋势

- 真空焊焊技术的发展

The Braze Alloys Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 pandemic had a negative impact on the market. However, it has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The increasing adoption rate of the brazing process over processes like welding and soldering and the increasing demand for aluminum brazing alloys from the automotive industry are expected to drive the market.

- On the other hand, the changing prices of base metals are likely to slow the market's growth.

- In the years to come, the growth of vacuum brazing technology is likely to give the market a chance to grow.

- The Asia-Pacific region is expected to have the biggest share of the market and the highest CAGR over the next five years.

Braze Alloys Market Trends

The Automotive Segment is Expected to Dominate the Market

- Braze alloys are utilized in the automobile sector for a variety of joining purposes. Different metallic pieces are connected using a metallic filler, i.e., braze alloys, having a lower melting temperature than the linked parts' or base metal's melting point.

- Also, the filler metal might be used as a wire, a thin plate, or a paste, depending on how it will be used by the end user.Diode laser brazing, furnace/vacuum brazing, and metal inert gas (MIG) brazing are commonly used for automotive joining applications.

- Some of the key applications of braze alloys in automotive manufacturing include joining the ABC pillars to the roof, laser beam or plasma brazing on the C-pillar, laser beam brazing on the trunk cover, MIG brazing of the fuel tank tube, aluminum-plated or non-coated steel sheets in the structure area of the automotive body, and others.

- According to the Organization Internationale des Constructeurs d'Automobiles (OICA), the total number of new automobile sales or registrations in the OICA member countries was close to 69 million units in 2022.

- Also, the European Automobile Manufacturers' Association (ACEA) said that more than 68 million passenger cars were made worldwide in 2022, which was 7.9% more than the year before.Furthermore, car manufacturing in the North American region increased by 10.3% in 2022 to 10.4 million units, mostly due to high demand in the United States.

- Additionally, the Society of Motor Manufacturers and Traders estimated that over 775,000 cars would be made in the United Kingdom in 2022. Aside from that, around 68,600 cars were manufactured in the United Kingdom in January 2023.

- The report by the SMMT also stated that Volkswagen was the most popular car brand among people in the United Kingdom. In 2021, Volkswagen had the highest market share of close to 9%, followed by Audi (7.16%) and BMW (7.08%).

- Due to the aforementioned factors, the automotive segment is expected to dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific countries, such as China, India, and Japan, had the most braze alloys on the market. This was because China, India, and Japan's automotive, electrical and electronics, construction, and aerospace industries were all growing.

- China has been the largest and most dominant nation in terms of vehicle production and sales of all types. The Chinese Association of Automobile Manufacturers says that China made 3.4% more cars in 2022 than it did the year before. About 27 million cars were expected to be made in 2022, up from about 26.08 million in 2021.

- Also, the Society of Indian Automobile Manufacturers said that the total number of cars made in India in FY 2022 would be close to 23 million. Two-wheelers, which made up about 74% of the total production, held the majority of the market share.

- According to the Japan Automobile Dealers Association (JADA), Toyota was the leading car manufacturer in Japan, selling around 1.25 million vehicles domestically in 2022. Toyota reported more than twice as many unit sales as the runner-up. Suzuki, which came in second, sold slightly over 600,000 vehicles in 2022.

- The market in question is likely to benefit from the gradual growth of the commercial construction sector, especially when it comes to building office space. Also, the demand for residential buildings in the Asia-Pacific region is growing because of the rise in home sales and the renovation of existing homes.

- According to the National Bureau of Statistics of China, the value of China's construction output in the fourth quarter of 2022 was around CNY 276 billion (USD 40 billion). This was a 50% increase from the previous quarter (USD 27.6 billion).

- Also, the overall investment in the construction sector was predicted to be around JPY 66,990 billion (USD 508,16 billion) in 2022, up roughly 0.6% from the previous year, according to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) of Japan.

- Also, the Federation of Indian Chambers of Commerce and Industry (FICCI) said that around 5.5 million and 11.4 million homes were built and approved under the PMAY plan in India's metropolitan areas in 2022.

- In turn, all of these things should drive the market for braze alloys in the region over the next few years.

Braze Alloys Industry Overview

The brazing alloys market is partially consolidated in nature. Some of the major players operating in the market (in no particular order) include Aimtek Inc., The Harris Products Group, Lucas-Milhaupt Inc., Oerlikon Metco, and Sulzer Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Adoption Rate of Brazing Process Over Processes like Welding and Soldering

- 4.1.2 Increasing Demand for Aluminum Brazing Alloys from the Automotive Industry

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Base Metals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Base Metal

- 5.1.1 Copper

- 5.1.2 Gold

- 5.1.3 Silver

- 5.1.4 Aluminum

- 5.1.5 Other Base Metals

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Electrical and Electronics

- 5.2.4 Construction

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aimtek Inc.

- 6.4.2 Prince Izant Company (Bellman-Melcor)

- 6.4.3 Cupro Alloys Corporation

- 6.4.4 Indian Solder and Brazing Alloys

- 6.4.5 Johnson Matthey

- 6.4.6 Lucas-Milhaupt Inc.

- 6.4.7 Morgan Advanced Materials

- 6.4.8 OC Oerlikon Management AG (Oerlikon Metco)

- 6.4.9 Saru Silver Alloy Private Limited

- 6.4.10 Sulzer Ltd.

- 6.4.11 The Harris Products Group

- 6.4.12 VBC Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Vacuum Brazing Technology

![焊焊合金市场 [贱金属:初级和次级;製程:铜、金、铝、银、镍和其他(钴、青铜、铁和钙)] - 全球产业分析、规模、份额、成长、趋势和预测,2023-2031 年](/sample/img/cover/42/default_cover_6.png)