|

市场调查报告书

商品编码

1639541

主动资料市场占有率分析、产业趋势与统计、成长预测(2025-2030)Active Data Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

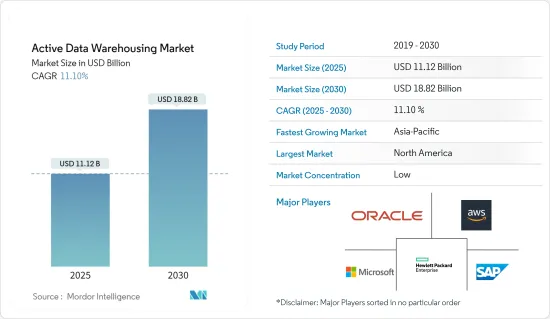

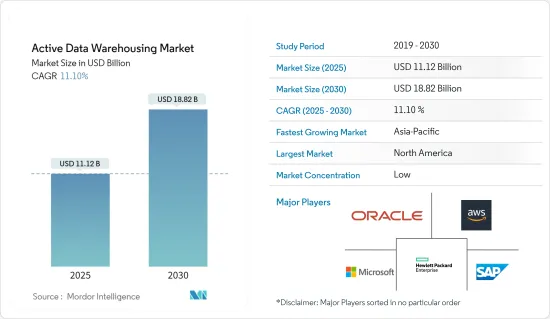

活动资料仓储市场规模预计到 2025 年为 111.2 亿美元,预计到 2030 年将达到 188.2 亿美元,预测期内(2025-2030 年)复合年增长率为 11.1%。

预计新兴市场的需求成长也将为预测期内的活跃资料仓储市场提供新的机会。

主要亮点

- 在对下一代商业智慧的持续需求以及组织产生的资料量不断增加等因素的推动下,主动资料仓储市场正在经历重大变化。 ADW 允许使用者即时存取大量复杂资讯。资料组织得高效且良好,因此预计将在预测期内推动市场成长。对低延迟、高速分析的需求不断增长,加上商业智慧在企业管理中的作用日益增强,预计将显着推动市场需求。

- 此外,据Oracle称,在近90%的人口居住在都市区的巴西,SKY Brasil拥有约29%的直接入户卫星服务市场占有率。该公司选择在与 Oracle Siebel CRM 整合的 Oracle 云端基础架构上运作的 Oracle 自治资料仓储来执行即时进阶行销分析。与先前的本地解决方案相比,客户能够将部署和上运作时间缩短 90%,同时将基础设施成本降低 60%。此外,ADW 与将资料集中在一处可显着降低计算成本。

- 此外,ADW 与将资料整合到一处相结合,可显着降低计算成本,预计这也将对市场成长产生积极影响。除了这些趋势之外,在全球范围内,公司间巨量资料趋势的显着上升正在导致对分析的需求增加,这也有望支持市场成长。市场上的供应商还采用基于资源使用的云端资料仓储定价模型来扩展运算能力以满足需求,并在使用高峰时轻鬆缩减规模。这解决了供应商所需的规模经济和客户所需的灵活性问题。然而,固定容量的资料仓储迫使组织购买超出其所需的运算容量。

- 由于人们对资料管理的日益关注和复杂性的增加,资料仓储在实际应用中越来越受到关注,特别是在金融、商业、医疗保健和其他行业。企业流程的数位化导致 IT 产业采用具有资料分析功能的新技术先进业务。因此,现代资料仓储系统促进了数位业务营运所需的即时、企业范围的分析和资讯洞察的开发。

- 然而,主动资料仓储市场受到实施成本高和网路威胁日益增加等多种因素的限制。

- COVID-19 对市场产生了多种影响。例如,在 Bart Works 和国际分析研究所 (IIA) 对 300 名美国分析专业人士进行的一项调查中,超过 43% 的受访者表示他们会针对 COVID-19 问题做出实质选择。是他们行动的一个重要因素。疫情期间,企业缩减了业务、削减成本并关闭了办公室。在家工作范式的盛行给企业带来了挑战。随着这些发展,云端基础的资料仓储的采用预计将加速。这场大流行为资料仓储实施带来了许多好处,包括成本效率、获得大型技能库和增强的可扩展性。

主动资料仓储市场趋势

智慧型手机的普及推动市场成长

- 行动电话,尤其是智慧型手机,越来越受到不同人群的欢迎。现代资讯和通讯技术(ICT)使用户能够快速获取所需的资讯。根据 GSMA 的数据,截至去年,全球活跃 iOS 和 Android 智慧型手机数量超过 62 亿部,预计到 2025 年将达到 74 亿部。此外,行动技术在各种电脑系统中的使用正在增加,例如资料仓储(DW)、商业智慧(BI)系统和资料分析系统。

- 行动电话充当资料库并储存大量用户资料。可以根据使用者核准的条款和条件对储存的资料进行分析。可以透过各种活跃的资料仓储来搜寻和分析资料,以收集多种使用者特征。智慧型手机用户需要大量的云端资料库来进行资料访问,因此需要资料仓储解决方案并推动市场成长。

- 此外,由于中国、巴西和印度等新兴国家智慧型手机使用量的增加和社群媒体流量的增加,资料流也随之增加,因此需要更多的功能,例如即时资料储存。

- 此外,各国智慧型手机使用量的增加预计也将推动市场成长。例如,根据资讯和广播部的数据,2022年11月,印度行动电话用户数将超过12亿,其中智慧型手机用户达到6亿。此外,除了相对较低的资料通讯费用外,智慧型手机的普及也导致人们在行动装置上消费更多的资讯和娱乐。

预计北美将占据较大市场占有率

- 与欧洲和亚洲的组织相比,美国的组织在多个行业中显着采用了分析。由于庞大的需求和供应商的存在,美国被认为是市场上的重要国家。此外,根据 GSMA 的数据,北美去年拥有 3.29 亿行动服务用户,占总人口的 84%。由于该地区大多数新的独特客户来自美国,该地区通讯业者的整体潜在市场已接近饱和状态。到 2025 年,该地区预计将成长 1,200 万用户,其中 75% 将由美国提供。

- 该国的消费者也重视即时回应问题的供应商。因此,许多零售公司正在采用主动资料仓储的概念来支援忠诚度管理应用程序,这些应用程式在保留消费者方面发挥关键作用。

- 行动宽频的普及导致巨量资料分析和云端运算的成长。据估计,美国将成为资料仓储部署的潜在市场,到 2022 年,大量公司将采用分析技术,促使多家公司从本地部署转向基于云端基础的部署。此外,由于贸易活动的增加和该国公司数量的增加,物流活动预计也会增加。然而,不断增加的公共债务预计将推高通货膨胀并限制小贩的活动。

- 据微软称,人工智慧驱动的虚拟代理正在为新兴管道做出巨大贡献。自然语言处理和机器学习等功能能够提供 24/7 的智慧、对话式和敏捷解决方案。这表明公司重视并投资于提高客户满意度。因此,对此类复杂平台和分析的需求可能会继续以稳定的速度资料。

- 市场的另一个主要驱动力是对具有 BI 功能的解决方案的需求不断增长。该市场是由政府倡议和医生增加资料分析来推动的,以改善疾病检测和预防等基层医疗。因此,许多医疗保健组织正在增加在积极的资料仓储方面的支出,以进一步节省成本。在预测期内,保险公司和其他 BFSI 公司对即时分析和 BI 的需求不断增加,预计将加强美国对 ADW 的需求。

主动资料仓储产业概述

主动资料仓储市场高度细分,来自微软公司、甲骨文公司和 SAP SE 等国内外参与企业的激烈竞争。科技的进步也为企业带来了显着的竞争优势,市场上也出现了多种联盟。

2022 年 5 月,戴尔技术公司和 Snowflake Inc. 宣布就一个新计划建立合作伙伴关係,将其本地储存产品组合中的资料与 Snowflake 资料云端连接起来。该云端原生平台称为 Snowflake Data Cloud,旨在消除对单独资料湖和仓库的需求,同时实现整个企业的安全资料共用。聚合来自各种软体即服务和云端平台的资料集,并将其提供给所有使用者。同样在 2022 年 5 月,Oracle 和着名企业云端资料管理供应商 Informatica 宣布建立策略合作关係,使 Informatica 的资料整合和管治解决方案能够在 Oracle 云端基础架构上使用。此外,Oracle 还指定 Informatica 为 OCI 上资料仓储和 Lakehouse 解决方案的首选企业云端资料管治和整合合作伙伴。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 各行业越来越多地采用商业智慧和巨量资料分析解决方案

- 智慧型手机的普及可能会推动市场成长

- 市场问题

- 实施需要大量资源和时间消耗

- 日益增加的网路威胁可能会抑制市场成长

第六章 市场细分

- 依部署类型

- 本地

- 云

- 杂交种

- 按公司规模

- 小型企业

- 大公司

- 按行业分类

- BFSI

- 製造业

- 医疗保健

- 零售

- 其他行业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 其他亚太地区

- 其他的

- 北美洲

第七章 竞争格局

- 公司简介

- Treasure Data Inc.

- Cloudera Inc.

- Snowflake Computing Inc.

- Oracle Corporation

- Hewlett Packard Enterprise Company

- Microsoft Corporation

- SAP SE

- Amazon Web Services, Inc.

- VMware Inc.(Pivotal Software Inc.)

- Huawei Technologies Co. Ltd

- Teradata Corporation

- Kognitio Ltd

- IBM Corporation

第八章投资分析

第9章市场的未来

The Active Data Warehousing Market size is estimated at USD 11.12 billion in 2025, and is expected to reach USD 18.82 billion by 2030, at a CAGR of 11.1% during the forecast period (2025-2030).

Additionally, the growth in demand from developing nations is anticipated to open up new opportunities for the active data warehousing market throughout the projection period.

Key Highlights

- The active data warehousing market is poised for a significant shift, owing to factors like the ongoing demand for next-gen business intelligence coupled with the growing amount of data organizations generate. ADW allows users to access an enormous range of complex information in real-time. The data is organized efficiently and relevantly, which is anticipated to aid market growth over the forecast period. The rising demand for low latency and high-speed analytics, combined with the growing role of business intelligence in enterprise management, is expected to drive the market demand significantly.

- Further, according to Oracle, in Brazil, with nearly 90% of the population living in urban areas, SKY Brasil has approximately 29% market share for direct-to-home satellite services. The company opted for Oracle's Autonomous Data Warehouse running on Oracle Cloud Infrastructure, integrated into Oracle's Siebel CRM, to perform real-time, sophisticated marketing analytics. The deployer achieved 90% less time in deployment and commencing production than its previous on-premise solution while realizing 60% of infrastructure cost savings. Furthermore, ADW significantly diminishes the cost of computing, coupled with combining data in a single location, which is further projected to impact market growth positively.

- Additionally, ADW substantially decreases the cost of computing, coupled with combining data in a single location, which is also expected to impact the market growth positively. Along with these factors, globally, the significant rise in the Big Data trend in organizations is leading to the increasing demand for analytics, which is also projected to aid market growth. Also, to scale the computing capacity to match the demand and effortlessly scale back down when the usage peaks, vendors in the market have been following resource usage-based models for the pricing of cloud data warehousing. It addresses the issues of economies of scale that vendors may look for and the flexibility that clients demand. However, fixed-capacity data warehouses force organizations to buy more computing capacity than needed.

- Data warehousing has generated a lot of interest in real-world applications, notably in finance, business, healthcare, and other industries, as a result of growing concerns about data management and rising complexity. Digitalizing corporate processes led to the adoption of new technologically advanced operations with data analytics capabilities in the IT industry. As a result, modern data warehouse systems facilitate the development of the real-time, enterprise-scale analytics and information insights required for digital business operations.

- However, the market for active data warehousing is being restrained by various factors, including high installation costs and increased cyber threats.

- COVID-19 created a mixed impact on the market. For instance, in a survey of 300 analytics professionals in the US, Burtch Works and the International Institute for Analytics (IIA) revealed that over 43% of respondents said that analytics was a crucial factor in their actions to make essential choices in response to the COVID-19 problem. Companies scaled back operations due to the pandemic epidemic, reduced expenses, and closed offices. The widespread adoption of the work-from-home paradigm presents another difficulty for firms. Cloud-based data warehouse installations are anticipated to be accelerated by such developments. The pandemic provided numerous advantages for adopting data warehousing, including cost-effectiveness, access to a large skill pool, and enhanced scalability.

Active Data Warehousing Market Trends

Rising Penetration of Smartphones may Drive the Market Growth

- Mobile phones, especially smartphones, are becoming increasingly widespread among various people. Users may get essential information rapidly owing to modern information and communication technology (ICT). According to the GSMA, there are more than 6.2 billion active iOS and Android smartphones worldwide as of last year, and it is expected to reach 7.4 billion by 2025. Additionally, the usage of mobile technology is increasing across a range of computer systems, including Data Warehouse (DW), Business Intelligence (BI) systems, and Data Analytic systems.

- Mobile phones act as a database, where a considerable amount of user data is stored. The stored data can be subjected to analysis as per the T&C approval by the user. The data can be retrieved and analyzed by various active data warehouses to collect multiple traits of the user. Smartphone users need a vast cloud database for data access, thereby needing data warehousing solutions, driving market growth.

- Further, an increasing data stream necessitates more capabilities, including real-time data storage, as a result of the rising smartphone usage in emerging nations like China, Brazil, and India, as well as the increased social media traffic.

- Moreover, the growing smartphone usage across various countries is anticipated to drive market growth. For instance, according to the Ministry of Information and Broadcasting, in November 2022, India had more than 1.2 billion mobile phone subscribers, including 600 million smartphone users. Furthermore, it was mentioned that in addition to having relatively cheap data rates, the widespread usage of smartphones has led to individuals consuming a lot of information and entertainment on their mobile devices.

North America is Expected to Hold a Significant Market Share

- The United States organizations are significant adopters of analytics across several verticals, compared with European or Asian organizations. The United States is considered an essential country in the market because of the considerable demand and presence of vendors. Also, according to GSMA, there were 329 million mobile service subscribers in North America last year, or 84% of the total population. With most of the region's new unique customers coming from the United States, the total addressable market for the operators in the area is approaching close to saturation. The United States would provide 75% of the 12 million more users anticipated in the region by 2025.

- Also, consumers in the country value vendors that provide real-time assistance with their issues; hence, many retail organizations are adopting active data warehousing concepts to enhance loyalty management applications that play a crucial role in retaining consumers.

- The growth of mobile broadband led to increased Big Data analytics and cloud computing in the country. The United States, with a considerable number of analytics adopters in 2022, encouraged multiple enterprises to switch from on-premise to cloud-based deployment, which is estimated to be an addressable market for data warehouse installations. Furthermore, logistics activities are expected to increase with the rise in trade activities and the growing number of businesses in the country. However, the ever-increasing public debt of the country is expected to drive the inflation rate up, thus curtailing small vendors' activities.

- As per Microsoft, AI-driven virtual agents have contributed significantly toward emerging channels. Features like natural language processing and machine learning possess capabilities to deliver smart, conversational, and fast solutions 24/7. It indicates the importance and spending that companies direct toward improving customer satisfaction. Therefore, the demand for such sophisticated platforms and analytics will continue to help register a steady growth rate of active data warehousing.

- Another key driver in the market is the increasing need for solutions with BI capabilities. Government initiatives and increased data analytics physicians use for improved primary care, such as the detection and prevention of diseases, are driving the market. Thus, many healthcare organizations have started spending more on active data warehousing to increase cost savings. Over the forecast period, the increasing demand for real-time analytics and BI from insurance and other BFSI companies is expected to bolster the demand for ADW in the United States.

Active Data Warehousing Industry Overview

The Active Data Warehousing Market is highly fragmented, with several domestic and international players in a fairly-contested market space, including Microsoft Corporation, Oracle Corporation, SAP SE, etc. Technological advancements are also bringing considerable competitive advantage to companies, and the market is also witnessing multiple partnerships.

In May 2022, Dell Technologies Inc. and Snowflake Inc. announced a partnership on a new project to link data from its on-premises storage portfolio with the Snowflake Data Cloud. A cloud-native platform called Snowflake Data Cloud is intended to do away with the need for separate data lakes and warehouses while enabling safe data sharing throughout enterprises. It allows users to aggregate datasets from various software-as-a-service and cloud platforms and make them available to any user. Also, in May 2022, Oracle and Informatica, a prominent provider of enterprise cloud data management, announced a strategic relationship that will enable Informatica's data integration and governance solutions to be used with Oracle Cloud Infrastructure. Additionally, Oracle has designated Informatica as a recommended partner for enterprise cloud data governance and integration for data warehouse and lakehouse solutions on OCI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Adoption of Business Intelligence and Big Data Analytics Solutions in Various Industries

- 5.1.2 Rising Penetration of Smartphones may Drive the Market Growth

- 5.2 Market Challenges

- 5.2.1 High Consumption of Resources and Time Required for Implementation

- 5.2.2 Growing Cyber Threats may Restrain the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Type of Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.1.3 Hybrid

- 6.2 By Size of Enterprise

- 6.2.1 Small and Medium-sized Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Industry Vertical

- 6.3.1 BFSI

- 6.3.2 Manufacturing

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Other Industry Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Treasure Data Inc.

- 7.1.2 Cloudera Inc.

- 7.1.3 Snowflake Computing Inc.

- 7.1.4 Oracle Corporation

- 7.1.5 Hewlett Packard Enterprise Company

- 7.1.6 Microsoft Corporation

- 7.1.7 SAP SE

- 7.1.8 Amazon Web Services, Inc.

- 7.1.9 VMware Inc. (Pivotal Software Inc.)

- 7.1.10 Huawei Technologies Co. Ltd

- 7.1.11 Teradata Corporation

- 7.1.12 Kognitio Ltd

- 7.1.13 IBM Corporation