|

市场调查报告书

商品编码

1639543

智慧製造:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

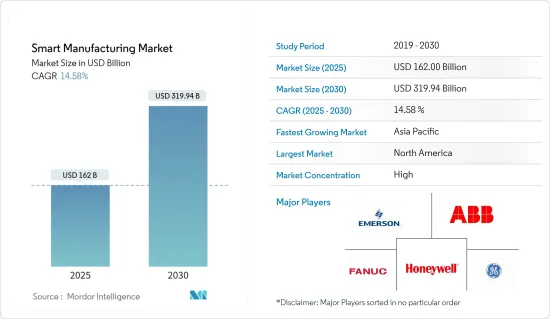

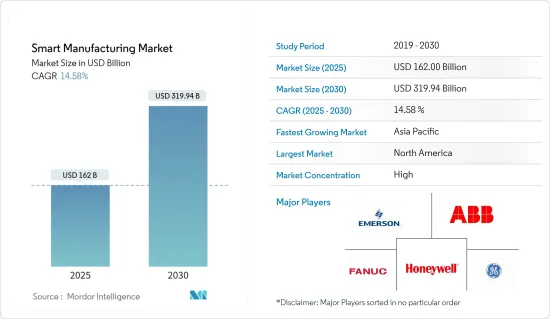

预计2025年智慧製造市场规模为1,620亿美元,2030年将达3,199.4亿美元,预测期间(2025-2030年)的复合年增长率为14.58%。

预计采用智慧製造的力道不断加大将推动市场成长。智慧製造领导联盟(SMLC)是美国的产业协会、技术供应商、研究机构和大学的联盟,致力于下一代智慧製造平台和智慧工厂连接。同样,另一个由产业主导的倡议——工业互联网联盟(IIC)成立,旨在汇集加速工业自动化发展所需的先进技术和组织。

使用 SCADA、ERP、HMI、PLC、DCS、PLM、MES 等服务和软体,业界现在能够收集即时资料并做出决策。该软体对行业有益,因为它可以减少产品错误、减少停机时间、执行计划维护、从反应阶段转移到预测和製定阶段并支援决策。

对製程控制和系统的依赖,加上 IT 和营运技术系统的整合,使製造业日益面临网路攻击的风险。製造商的控制系统长期以来被认为是坚不可摧的,因为它们是独特的、客製化的网路。物联网为专有资讯被窃取提供了新的可能性。随着这些最初没有采取适当安全措施的设备日益自动化数位化,资料安全问题也将增加,从而阻碍市场成长。

此外,全球对工业4.0的投资正在增加。由于工业 4.0 的智慧解决方案对业务产生积极影响(例如提高生产力),企业已开始采用这些解决方案。例如,根据凯捷和印度国家软体和服务公司协会(NASSCOM)的报告,预计到 2025 年,超过三分之二的印度製造业将采用工业 4.0。

此外,为了在市场竞争中保持领先,公司正致力于创新和推出新产品。例如,2023 年 2 月,我们宣布推出可程式逻辑控制器 OTAC,以解决工业IoT、智慧工厂和操作技术(OT) 中的关键突出挑战。这是专为 PLC 设备而最佳化的解决方案,利用该公司的动态「一次性身份验证码」(OTAC) 技术来解决典型的 ICS/OT 安全挑战。

新冠肺炎疫情促使製造业重新评估传统生产流程,并专注于推动整个生产线的数位转型和智慧製造。製造商也被迫实施和设计多种灵活的新方法来监控他们的产品和品管。

智慧製造市场趋势

汽车产业可望推动市场成长

汽车製造业预计将从智慧技术、工业4.0、物联网等获得强劲推动力。离散製造是指生产或製造可以单独计数或触摸的单独零件。这部分主要和组装相关。离散製造还包括日益互联的产品,例如汽车和汽车零件。

智慧製造有望帮助平衡供需、增强产品设计、优化製造效率并大幅减少浪费。机器人和感测器等现场设备和工业控制系统为汽车产业提供了更快回应市场需求、减少製造停工时间、提高供应链效率和扩大生产力的机会。

智慧製造解决了汽车产业最关注的计划工期问题。快速回报计划与低成本自动化和成本创新相结合,正在帮助製造商透过提高生产力来提高竞争力。

此外,瑞银预测,到2025年欧洲电动车销量将达到633万辆,其次是中国,销量为484万辆。由于欧洲和亚太地区引领电动车需求,该地区智慧汽车工厂的采用预计将增加。

为了跟上汽车製造业不断变化的格局,业内许多公司都在采用智慧製造解决方案。例如,2022年1月,华域汽车系统股份有限公司(以HASCO的名义开展业务)与ABB集团宣布,双方已基于现有合作关係成立合资企业,以「推进下一代智慧製造」。两家公司声称,合资公司将使他们能够进一步巩固华域汽车在自动化解决方案领域的主导地位,使中国客户受益。

在过去的 50 年里,汽车产业一直在组装上使用机器人完成各种製造工序。目前,汽车製造商正在探索在更多工序中使用机器人。对于此类生产线来说,机器人更有效率、灵活、精确和可靠。这项技术使汽车产业继续成为机器人最重要的用户之一,并持有全球最自动化的供应链之一。

例如,2022年4月,Stellantis NV的子公司汽车製造商菲亚特宣布将在其Mirafiori工厂投资7亿欧元,使用协作机器人等最尖端科技生产500辆电动车。该公司部署了 11 台 Universal Robots A/S 协作机器人,以自动化复杂的组装任务和品管。协作机器人对于智慧工厂至关重要,因为它们结构紧凑、重量轻,并且可以与人类一起安全地工作。

亚太地区占较大市场占有率

中国生产了市场需求的很大一部分产品,并拥有世界上最大的製造业。据工业和资讯化部称,儘管新冠疫情限制措施导致生产和供应链受挫,但 2022 年工业产出与前一年同期比较增 3.6%。工信部预测,2022年製造业产出将成长3.1%,占中国GDP的28%。

中国传统上被视为世界製造工厂,透过数位化和工业化,中国已经经历了从(廉价)密集型製造业向高端製造业的重大转型。根据GSMA预测,到2025年,中国可能占全球IIoT市场的三分之一。

製造业也已成为印度高成长产业之一。 「印度製造」计画使印度成为世界製造业中心,并获得了全球认可。

政府在本地实施 IIoT使用案例发挥关键作用。 「数位印度」和「印度製造」等政府倡议正在促进印度製造业的发展。物联网将透过提供创新方式支持製造业的永续发展,使「印度製造」宣传活动受益匪浅。

此外,印度製药业在自动化方面相对领先,Zydus Cedilla、Torrent Pharma 和 Cipla 等主要国内製药公司已经创新了其製药製造流程,特别是在需要完全整合机械和设备的领域。

此外,印度政府的目标是到2025年将经济成长5兆美元,其中製造业价值可能达到1兆美元。 「印度製造」、「技能印度」和「数位印度」等旗舰项目的整合可能是实现这一目标并推动该国市场成长的关键。

此外,一些领先的行业参与者正在印度投资智慧製造设备,以提高效率并增强市场竞争力。例如,三星电子2023年3月宣布,将在位于诺伊达的第二大行动电话工厂投资智慧製造能力,以增强生产竞争力。

智慧製造业概况

智慧製造市场竞争激烈,由多家主要企业组成。该市场占有领先份额的主要公司正致力于扩大海外基本客群。两家公司正在利用策略性联合措施来增加市场占有率和盈利。此外,在这个市场运营的公司正在收购致力于自动送货机器人技术的新兴企业,以增强其产品供应。

2023年5月,三菱电机宣布将对Clearpath Robotics进行策略性投资,以支持製造业自动化的发展。 Clearpath Robotics 专门从事自主移动机器人 (AMR) 的开发和销售。透过此项投资,该公司将加强对使用AMR系统实现工厂全面优化和自动化的支援。

2023年3月,Honeywell国际公司宣布推出Honeywell通用机器人控制器(HURC),用于控制不同的机器人和自动化系统,促进资料和通讯的无缝交换。该公司将在芝加哥的 ProMat 2023 上展示其机器人和自动化解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对智慧製造市场的影响

第五章 市场动态

- 市场驱动因素

- 为实现效率和质量,对自动化的需求不断增加

- 数位化规性和政府支持

- 物联网的兴起

- 市场限制

- 资料安全问题

- 高昂的初始实施成本和熟练劳动力的短缺阻碍了企业全面实施该技术。

第六章 市场细分

- 依技术分类

- 可程式逻辑控制器 (PLC)

- 监控和资料采集 (SCADA)

- 企业资源规划 (ERP)

- 分散式控制系统(DCS)

- 人机介面 (HMI)

- 产品生命週期管理 (PLM)

- 製造执行系统(MES)

- 其他技术

- 按组件

- 机器视觉系统

- 控制设备

- 机器人

- 通讯部分

- 感应器

- 其他组件

- 按最终用户产业

- 车

- 半导体

- 石油和天然气

- 化工和石化

- 药品

- 航太和国防

- 饮食

- 金属与矿业

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲国家

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- ABB Ltd

- Emerson Electric Company

- Fanuc Corporation

- General Electric Company

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Texas Instruments Incorporated

- Yokogawa Electric Corporation

第八章投资分析

第九章:市场的未来

The Smart Manufacturing Market size is estimated at USD 162.00 billion in 2025, and is expected to reach USD 319.94 billion by 2030, at a CAGR of 14.58% during the forecast period (2025-2030).

The increasing initiatives to adopt smart manufacturing will drive market growth. Smart Manufacturing Leadership Coalition (SMLC), a combination of US-based industrial organizations, technology suppliers, laboratories, and universities, is working on a next-generation Smart Manufacturing Platform and Smart Factory connectivity. Similarly, another industry-led initiative, the Industrial Internet Consortium (IIC), was formed to bring together the advanced technologies and organizations needed to accelerate the growth of industrial automation.

Using services and software, such as SCADA, ERP, HMI, PLC, DCS, PLM, and MES, has enabled industries to collect real-time data and make decisions. The software has been beneficial to the industry as it reduces product errors, reduces downtime, conducts planned maintenance, moves from the reactive phase to the predictive and prescribing phases, and enables decision-making.

The dependence on process control and systems combined with the convergence of IT and operating technologies systems has increasingly exposed manufacturing firms to cyber attacks. Manufacturers' control systems have long been deemed impenetrable due to their proprietary and customized networks. IoT has opened the scope for the theft of proprietary information. With more automation and digitization of these devices, which were originally built without the proper security measures, the data security concern will also grow, hindering the market growth.

Furthermore, investments in Industry 4.0 are rising globally. Organizations have started adopting Industry 4.0 smart solutions owing to their positive impact on their businesses, including increased productivity. For instance, as per a report by Capgemini and the National Association of Software and Services Companies (NASSCOM), it is expected that more than two-thirds of the Indian manufacturing sector intention embrace Industry 4.0. by 2025

Moreover, the companies operating in the market focus on innovations and launch new products to stay ahead of the competition. For instance, in February 2023, which announced the launch of Programmable Logic Controller OTAC to combat key unresolved challenges related to industrial IoT, smart factories, and operational technology (OT). This provides a highly optimized and highly secure authentication solution specifically for PLC devices by utilizing their dynamic 'one-time authentication code' (OTAC) technology to resolve typical ICS/OT security challenges.

The outbreak of COVID-19 triggered the manufacturing sector to re-evaluate its traditional production processes, primarily driving digital transformation and smart manufacturing practices across the production lines. The manufacturers also forced to implement and devise multiple agile and new approaches to monitor product and quality control.

Smart Manufacturing Market Trends

Automotive Industry is Expected to Drive the Market Growth

Automotive manufacturing is expected to gain strong impetus from smart technologies, Industry 4.0, IoT, etc. Discrete manufacturing is producing or manufacturing distinct parts that can be individually counted and touched. The pieces are mainly related to assembly lines. Discrete manufacturing includes products, such as cars, automotive parts, etc., that are increasingly connected.

Smart manufacturing is expected to help balance supply and demand, enhance product design, optimize manufacturing efficiency, and significantly reduce waste. Field devices, like robotics, sensors, etc., and ICS offer opportunities to the automotive sector to react faster to market requirements, reduce manufacturing downtimes, enhance supply chain efficiency, and expand productivity.

Smart manufacturing addresses the prime concern of the automotive industry, i.e., the length of a project. Quick return-on-investment projects combined with low-cost automation and cost innovation are helping manufacturers improve competitiveness through productivity improvement.

Further, according to UBS, Europe's projected electric vehicle sales are expected to reach 6.33 million units by 2025, followed by China, with 4.84 million units. As Europe and Asia-Pacific are leading the electric vehicles demand, the regions are anticipated to see an increase in smart automotive factories' implementation.

To cater to the changing landscape of automotive manufacturing, many players in the industry are adopting smart manufacturing solutions. For instance, in January 2022, Huayu Automotive Systems Co., which does business as HASCO, and ABB Group announced that they have created a joint venture building on their existing relationship "to drive the next generation of smart manufacturing." The companies claimed that the joint venture would enable them to further develop HASCO's leading position with automated solutions that benefit customers in China.

For the past 50 years, the automotive industry has used robots in its assembly lines for various manufacturing processes. Currently, automakers are exploring the use of robotics in more procedures. Robots are more efficient, flexible, accurate, and dependable for such production lines. This technology enables the automotive industry to remain one of the most significant robot users and possess one of the most automated supply chains globally.

For instance, in April 2022, an automotive manufacturing company, Fiat, a subsidiary of Stellantis NV, invested EUR 700 million at its Mirafiori factory, intending to produce 500 electric vehicles using state-of-the-art technology, such as collaborative robots. The company aims to automate its complex assembly line operations and quality controls, installing 11 cobots from Universal Robots A/S. Cobots are an essential part of the smart factory since they are compact, light, and built to work alongside humans safely.

Asia Pacific Region to Occupy a Major Market Share

China produces a sizeable portion of the market's demand and has the largest manufacturing sector in the entire world. In addition, despite production and supply chain setbacks brought on by COVID-19 curbs, the nation's industrial output increased by 3.6% in 2022 compared to the previous year, according to the Ministry of Industry and Information Technology (MIIT). The MIIT predicted that the manufacturing sector's output would have increased by 3.1% in 2022, making up 28% of China's GDP.

Traditionally seen as the world's manufacturing factory, China has significantly transformed from (cheap) labor-intensive manufacturing to high-end manufacturing through digitalization and industrialization. According to GSMA, China may account for one-third of the global IIoT market by 2025.

Manufacturing has also emerged as one of the high-growth sectors in India. The 'Make in India' program places India on the world map as a manufacturing hub and globally recognizes the Indian economy.

Government plays an important role in implementing the use of cases of IIoT in the region. Government initiatives, like Digital India and Make in India, are adding impetus to the Indian manufacturing industry. IoT immensely benefits the Make in India campaign by providing innovative ways to sustain manufacturing organizations' sustainable development.

Moreover, India's pharmaceutical sector is comparatively ahead in automation, with the major pharmaceutical companies in the country, such as Zydus Cedilla, Torrent Pharma, and Cipla, focusing on automating their manufacturing processes of drugs, especially in areas where the complete integration of machines and equipment is required.

Additionally, India's government aims for a USD 5 trillion economy by 2025, of which manufacturing may be worth USD 1 trillion. The convergence of flagship programs, such as Make in India with Skill India and Digital India, may be key to achieving this goal, thereby driving the country's market growth.

Furthermore, several leading industry players are investing in smart manufacturing units in India to improve efficiency and gain a competitive edge in the market. For instance, in March 2023, Samsung Electronics announced investing in smart manufacturing capabilities at its second-largest mobile phone plant in Noida to make production more competitive.

Smart Manufacturing Industry Overview

The smart manufacturing market is highly competitive and consists of several major players. The major players with star shares in the market focus on expanding their customer base across foreign countries. The companies leverage strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market are also acquiring start-ups working on autonomous delivery robot technologies to strengthen their product capabilities.

In May 2023, Mitsubishi Electric Corporation announced to make a strategic investment in Clearpath Robotics to support the development of manufacturing automation. Clearpath Robotics specializes in developing and selling autonomous mobile robots (AMR). Through this investment, the company will strengthen its support for complete factory optimization and automation by utilizing AMR systems.

In March 2023, Honeywell International, Inc. announced introducing Honeywell Universal Robotics Controller (HURC) to control disparate robotics and automation systems and facilitate the seamless exchange of data and communications. The company will demo robotic and automation solutions at ProMat 2023 in Chicago.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Smart Manufacturing Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation to Achieve Efficiency and Quality

- 5.1.2 Need for Compliance and Government Support for Digitization

- 5.1.3 Proliferation of Internet of Things

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Data Security

- 5.2.2 High Initial Installation Costs and Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Programmable Logic Controller (PLC)

- 6.1.2 Supervisory Controller and Data Acquisition (SCADA)

- 6.1.3 Enterprise Resource and Planning (ERP)

- 6.1.4 Distributed Control System (DCS)

- 6.1.5 Human Machine Interface (HMI)

- 6.1.6 Product Lifecycle Management (PLM)

- 6.1.7 Manufacturing Execution System (MES)

- 6.1.8 Other Technologies

- 6.2 By Component

- 6.2.1 Machine Vision Systems

- 6.2.2 Control Device

- 6.2.3 Robotics

- 6.2.4 Communication Segment

- 6.2.5 Sensor

- 6.2.6 Other Components

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Semiconductors

- 6.3.3 Oil and Gas

- 6.3.4 Chemical and Petrochemical

- 6.3.5 Pharmaceutical

- 6.3.6 Aerospace and Defense

- 6.3.7 Food and Beverage

- 6.3.8 Metals and Mining

- 6.3.9 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Emerson Electric Company

- 7.1.3 Fanuc Corporation

- 7.1.4 General Electric Company

- 7.1.5 Honeywell International Inc.

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Robert Bosch GmbH

- 7.1.8 Rockwell Automation Inc.

- 7.1.9 Schneider Electric SE

- 7.1.10 Siemens AG

- 7.1.11 Texas Instruments Incorporated

- 7.1.12 Yokogawa Electric Corporation