|

市场调查报告书

商品编码

1639544

合成润滑油:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Synthetic Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

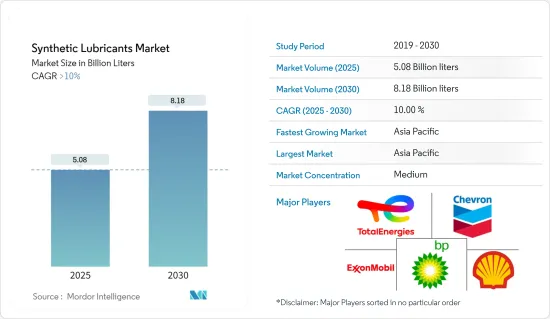

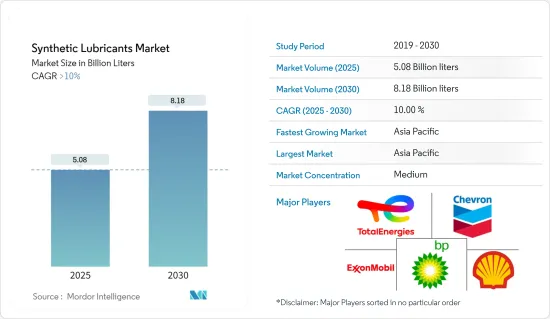

预计2025年合成润滑油市场规模为50.8亿公升,预计2030年将达到81.8亿公升,预测期间(2025-2030年)复合年增长率将超过10%。

COVID-19 的爆发对市场产生了负面影响。 COVID-19 相关法规减少了石油和天然气、汽车和冶金等多个行业的维护需求。主要影响体现在汽车产业。目前市场正从疫情中恢復。预计2022年市场将达到疫情前水准并持续稳定成长。

主要亮点

- 推动市场的关键因素是对具有更好性能的高性能合成润滑油的需求不断增长。这些包括降低可燃性、减少齿轮磨损和延长使用寿命。

- 然而,电动车的激增限制了市场的成长,预计将阻碍所研究市场的成长。

- 此外,工业生产的不断进步预计将在未来几年为市场提供机会。

- 欧洲主导全球市场,德国、法国和英国等国家是最大的消费者。

合成润滑油市场趋势

汽车产业需求增加

- 由于减少碳排放的环境法规日益严格,合成润滑油越来越多地用于汽车产业。合成润滑油是水溶性的,具有高黏度指数,生物分解性,并且对环境友善。

- 有关汽车二氧化碳排放的严格法规增加了对节能润滑油的需求。这些法规正在推动汽车产业的合成润滑油市场。

- 根据OICA(国际汽车构造组织)预测,2022年全球汽车产量将达8,502万辆,较2021年成长6%。这增加了对各种汽车应用中使用的合成润滑油的需求。

- 中国是世界上最大的汽车製造国。由于产品的发展,该国的汽车产业正在不断发展。由于对环境问题的日益关注,该国正在专注于製造在确保燃油效率的同时最大限度地减少排放气体的产品。

- 根据OICA统计,2022年中国汽车产量达2,702.1万辆,汽车销量达2,686.4万辆,与前一年同期比较增长3.4%及2.1%。

- 美国是仅次于中国的全球第二大汽车市场,在全球汽车市场中占有很大份额。 OICA预计,2022年美国汽车产量将达到1,006万辆,比起2021年的915万辆,成长率为9%。

- 所有上述因素预计将增加汽车领域对合成润滑油的需求,从而推动所研究市场的成长。

欧洲主导市场

- 合成润滑油最大的市场是欧洲。在德国、义大利和法国等国家,由于汽车、交通和发电等行业的不断发展,合成润滑油的需求不断增加。

- 德国经济是欧洲第一大经济体,世界第五大经济体。德国是欧洲最大的汽车市场之一。根据VDA(德国工业协会)的数据,2023年8月汽车产量为266,800辆,而2023年7月为290,354辆。

- 欧洲也是飞机工业的主要製造地之一。来自各个领域的製造商云集于此,包括设备製造商、材料和零件供应商、引擎製造商、系统整合商。

- 根据《波音商业展望2022-2041》,预计2041年,欧洲新飞机交付总量将达到8,550架,市场服务价值将达到8,500亿美元。预计未来几年对合成润滑油的需求将会增加。

- 由于OEM对合成润滑油的偏好不断增长,预计在不久的将来对合成变速箱油的需求将进一步增长。

- 发电业进一步拉动市场需求。由于製造技术的进步,各种新工厂正在投入运作。因此,各个最终用户产业的电力需求不断增加。

- 据德国联邦经济事务和气候行动部称,德国处于欧洲网路的中心。它位于欧洲的中心位置,使其成为欧洲电力市场的主要企业和泛欧洲电力流动的枢纽。德国也增加了对邻国的电力出口。德国拥有欧洲最大的发电厂容量,生产和消耗的电力最多。

- 因此,最终用户需求的成长超过产业,预计将推动欧洲的成长。

合成润滑油产业概况

合成润滑油市场因其性质而部分整合。研究市场中的主要企业(排名不分先后)包括埃克森美孚、雪佛龙公司、壳牌公司、TotalEnergies、BP公司等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加高性能合成润滑油的使用

- 由于对环境问题的日益关注,汽车产业的需求增加

- 其他司机

- 抑制因素

- 电动车的普及限制了市场成长

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 依产品类型

- 机油

- 变速箱齿轮油

- 油压

- 金属加工油

- 润滑脂

- 其他产品类型(一般工业用油等)

- 按最终用户

- 发电

- 车

- 重型设备

- 冶金/金属加工

- 其他最终用户产业(石油和天然气等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 印尼

- 泰国

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 北欧国家

- 土耳其

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Valvoline Global Operations(Saudi Arabian Oil Co.)

- Shell plc

- TotalEnergies

- BP plc

- Chevron Corporation

- Exxon Mobil Corporation

- China Petrochemical Corporation

- PETRONAS Lubricants International

- FUCHS

- JX Nippon Oil & Gas Exploration Corporation

- Indian Oil Corporation Ltd

第七章 市场机会及未来趋势

- 工业製造进展

- 其他机会

The Synthetic Lubricants Market size is estimated at 5.08 billion liters in 2025, and is expected to reach 8.18 billion liters by 2030, at a CAGR of greater than 10% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. COVID-19-related restrictions led to declined maintenance requirements from several industries, such as oil and gas, automotive, metallurgy, etc. The major impact was observed in the automotive industry. Currently, the market recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Key Highlights

- The major factor driving the market studied is the increasing demand for high-performance synthetic lubricants owing to their better and improved properties. It includes reduced flammability, reduced gear wear, and increased service life.

- However, the increasing adoption of electric vehicles limits the market growth and is anticipated to hinder the growth of the studied market.

- Moreover, growing advancement in industrial manufacturing is likely to provide opportunities for the market over the coming years.

- The European region dominated the market around the world, with countries like Germany, France, and the United Kingdom being the biggest consumers.

Synthetic Lubricants Market Trends

Rising Demand from Automotive Industry

- Synthetic lubricants are significantly used in the automotive industry owing to rising environmental regulations to reduce carbon emissions. Synthetic lubricants include water solubility, high viscosity index, and biodegradability, which makes them environmentally friendly.

- The stringent regulations on CO2 emissions from vehicles increased the demand for fuel-efficient lubricants. They are driving the market for synthetic lubricants in the automotive sector.

- According to the Organisation Internationale des Constructeurs d'Automobiles(OICA), 85.02 million vehicles were produced across the globe in 2022, witnessing a growth rate of 6% compared to 2021. It is, thereby, enhancing the demand for synthetic lubricants, which are employed for various automotive applications.

- China is the largest manufacturer of automobiles in the world. The country's automotive sector is shaping up for product evolution. The country is focusing on manufacturing products to ensure fuel economy while minimizing emissions, owing to the growing environmental concerns.

- According to OICA, automobile production and sales in China reached 27.021 million and 26.864 million, respectively, in 2022, up 3.4% and 2.1% from the previous year.

- The United States is the second-largest automotive market in the world after China, which occupies a significant share of the global automotive vehicles market. According to OICA, in 2022, the United States automotive vehicle production reached 10.06 million compared to 9.15 million units manufactured in 2021, at a growth rate of 9%.

- All factors above will likely enhance the demand for synthetic lubricants in the automotive segment and thus will propel the growth of the market studied.

European Region to Dominate the Market

- Europe represents the largest market for synthetic lubricants. In countries like Germany, Italy, France, etc., the demand for synthetic lubricants is increasing owing to growing industries like automotive, transportation, power generation, etc.

- The German economy is the largest in Europe and the fifth-largest in the world. Germany is one of the largest automotive markets in Europe. According to the VDA, German Association of Automotive Industry, in August 2023, a total of 266,800 units of automobiles were manufactured compared to 290,354 units in July 2023.

- Europe is also one of the leading manufacturing bases for the aircraft industry. It is home to manufacturers from different segments, such as equipment manufacturers, material and component suppliers, engine producers, and whole system integrators.

- In Europe, according to the Boeing Commercial Outlook 2022-2041, the total deliveries of new airplanes are estimated to be 8,550 units by 2041, with a market service value of USD 850 billion. The demand for synthetic lubricants is likely to rise through the years to come.

- Thus, owing to the increasing preference of OEMs for synthetic lubricants, the demand for synthetic transmission oils is expected to grow further in the near future.

- The power generation sector further boosts the market demand. Advancements in manufacturing technologies are resulting in the commencement of various new plants. It, in turn, is increasing the demand for electricity in various end-user industries.

- According to the Federal Ministry for Economic Affairs and Climate Action, Germany is at the heart of the European network. Its geographical location in the heart of Europe makes it a major player in the European power market and a hub for pan-European power flows. Germany is also increasing electricity exports to neighboring countries. Germany holds the largest power plant capacity in Europe and produces and consumes the most electricity.

- Thus, rising demand from the end-users above industries is expected to drive growth in the European region.

Synthetic Lubricants Industry Overview

The synthetic lubricants market is partially consolidated in nature. The major players in the studied market (not in any particular order) include Exxon Mobil Corporation, Chevron Corporation, Shell plc, TotalEnergies, and BP p.l.c., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of High-performance Synthetic Lubricants

- 4.1.2 Increasing Demand from Automotive Sector Owing to Rising Environmental Concerns

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Adoption of Electric Vehicles Limits the Market Growth

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oils

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Metalworking Fluids

- 5.1.5 Greases

- 5.1.6 Other Product Types (General Industrial Oils, Etc.)

- 5.2 By End User

- 5.2.1 Power Generation

- 5.2.2 Automotive

- 5.2.3 Heavy Equipment

- 5.2.4 Metallurgy and Metalworking

- 5.2.5 Other End-user Industries (Oil and Gas, Etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Indonesia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Valvoline Global Operations (Saudi Arabian Oil Co.)

- 6.4.2 Shell plc

- 6.4.3 TotalEnergies

- 6.4.4 BP p.l.c.

- 6.4.5 Chevron Corporation

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 China Petrochemical Corporation

- 6.4.8 PETRONAS Lubricants International

- 6.4.9 FUCHS

- 6.4.10 JX Nippon Oil & Gas Exploration Corporation

- 6.4.11 Indian Oil Corporation Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Advancement In Industrial Manufacturing

- 7.2 Other Opportunities