|

市场调查报告书

商品编码

1639549

印度太阳能 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)India Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

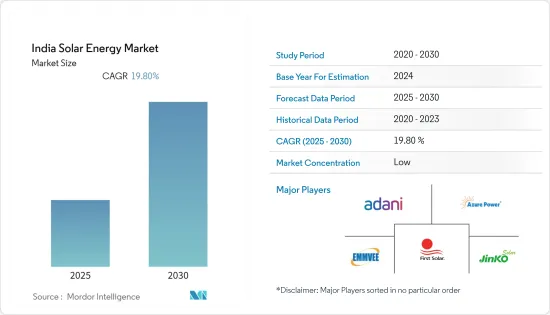

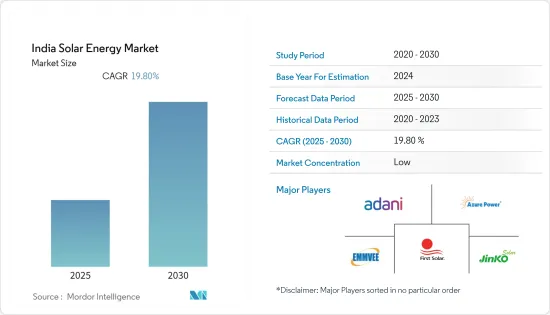

印度太阳能市场预计在预测期内将以 19.8% 的复合年增长率成长。

印度太阳能发电市场预计年终将达到7,907万千瓦,五年后将达到1,951万千瓦。

主要亮点

- 从中期来看,由于太阳能技术成本下降、太阳能发电系统灵活性增强以及太阳能作为一种环保的发电方式,印度太阳能市场正在成长。新能源和可再生能源部 (MNRE) 鼓励可再生能源发电的计划等政府措施也正在提振市场。

- 另一方面,太阳能市场受到应用和配电损耗以及供电连续性不可预测等问题的限制。

- 印度光照充足,全年都能获得太阳能。这意味着拉贾斯坦邦、古吉拉突邦和安得拉邦等阳光最充足的邦有很多地方可以利用太阳能。除此之外,由于外国投资和许多改进技术的研发计划,印度太阳能市场还有许多成长机会。

印度太阳能市场趋势

太阳能发电领域预计主导市场

- 预计太阳能发电领域在预测期内将占据最大的市场占有率。这是因为太阳能组件的成本正在下降,并且这些系统可用于多种用途,例如发电和热水。

- 据IRENA称,印度太阳能装置容量从2021年的49.3GW增加到2022年的约62.8GW。与前一年同期比较,这一数字增加了约31%。印度部署了大量太阳能发电能力,特别是公共产业,这导致了成长。印度政府计划增加太阳能发电装置容量。

- 国家热电公司 (NTPC) 于 2022 年 8 月在苏拉特哈齐拉附近运作了一个太阳能发电工程。 Kawas太阳能发电工程发电量为56兆瓦,透过该计划,NTPC将把其太阳能发电组装置容量和商业容量增加到68,454兆瓦。随着这些计划的完成,太阳能发电领域在印度太阳能市场的份额预计将在预测期内增加。

- 2022年1月,信实工业公司(RIL)与古吉拉突邦政府签署协议,将在10-15年内在古吉拉突邦投资806.1亿美元,建造100吉瓦的可再生能源发电发电厂和绿色氢生态系统。在公用事业规模上,可再生能源发电发电厂包括太阳能发电厂。 RIL计划投资81.2亿美元为即将推出的可再生计划建立光伏组件、电解槽、电池和燃料电池的製造设施。

- 鑑于这些变化,预计太阳能发电领域将在未来几年占据印度最大的市场占有率。

政府扶持措施带动市场

- 近年来,印度政府计划采取各种倡议,以增加太阳能在未来可再生能源发电组合中的份额。根据新可再生统计,截至2023年2月,2022年太阳能发电装置容量为6,670千万瓦。

- 根据新能源和可再生能源部(MNRE)的《国家风光互补政策》,该措施是促进大规模併网风光互补系统的框架。这些系统减少了可再生能源发电的不可预测性,提高了电网稳定性,同时最大限度地利用了土地和传输基础设施。

- 新能源和可再生能源部(MNRE)在过去三年实施的其他计划包括太阳能园区计划、300MW防御计划和500MW VGF(可行性缺口资助)计划。

- 德里政府于 2022 年 12 月核准了《2022 年太阳能措施计画》。该计画要求两年内将装置容量从2,000MW增加到6,000MW。德里新的太阳能计画旨在两年内安装 6,000 兆瓦的太阳能装置容量。由此,太阳能发电在德里年度电力需求中的份额预计将在三年内从9%增加到25%。

- 因此,随着即将到来的政府计划和支持措施,太阳能的发展预计将在未来几年推动印度太阳能市场的发展。

印度太阳能产业概况

印度太阳能市场较分散。市场上营运的主要企业包括(排名不分先后)Adani Enterprises Ltd.、Emmvee Photovoltaic Power Private Limited、Azure Power Global Limited、JinkoSolar Holdings 和 First Solar Inc。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年太阳能装置容量及预测(单位:GW)

- 政府法规和措施

- 最新趋势和发展

- 市场动态

- 促进因素

- 政府对太阳能发展的支持措施

- 太阳能技术成本下降

- 抑制因素

- 供电连续性的不可预测性

- 促进因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 技术部分

- 光伏(PV)

- 聚光型太阳光电(CSP)

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- 参与企业国内市场

- Adani Solar

- Emmvee Solar

- Mahindra Susten Pvt. Ltd.

- Sterling and Wilson Pvt. Ltd.

- Tata Power Solar Systems Ltd.

- Vikram Solar Limited

- ReNew Power Pvt. Ltd.

- NTPC Ltd.

- Azure Power Global Ltd.

- Foreign Players

- JinkoSolar Holdings Co. Ltd.

- First Solar Inc.

- Hanwha Q Cells Co. Ltd.

- SMA Solar Technology AG

- Trina Solar Limited

- 参与企业国内市场

第七章 市场机会及未来趋势

- 增加研发计划以改善太阳能技术

The India Solar Energy Market is expected to register a CAGR of 19.8% during the forecast period.

India's solar market is estimated to be at 79.07 GW by the end of this year and is projected to reach 195.11 GW after five years.

Key Highlights

- Over the medium term, the Indian solar energy market is growing owing to the cost of solar power technology declining, solar systems becoming more flexible, and solar power is a greener way to make electricity. The market is also propelled by supportive government policies, particularly the Ministry of New and Renewable Energy (MNRE) plans to encourage renewable-based power generation.

- On the other hand, the solar energy market is restrained by issues like transmission and distribution losses and unpredictability in the continuity of power supply.

- Nevertheless, India has a lot of solar irradiance and gets solar energy all year. This means there are many places in the sunniest parts of the country, like Rajasthan, Gujarat, and Andhra Pradesh, where solar energy can be used. This, along with foreign investment and a lot of research and development projects to improve the technology, gives the Indian solar energy market a lot of chances to grow.

Solar in India Market Trends

Solar PV Segment is Expected to Dominate the Market

- The solar PV segment is expected to have the biggest market share during the forecast period. This is because the cost of solar modules is decreasing, and these systems can be used for many different things, like making electricity and heating water.

- As per IRENA, India's installed solar PV capacity was around 62.8 GW in 2022, up from 49.3 GW in 2021. This was an increase of approximately 31% over the year. India put in a lot of solar PV installations, especially for utility projects, which led to growth. The Government of India plans to increase the solar PV installed capacity.

- The National Thermal Power Corporation Limited (NTPC) turned on a solar PV project near Hazira in Surat in August 2022. The Kawas solar PV project has a capacity of 56 MW; with this project, NTPC will increase its solar footprint to 68,454 MW of group-installed and commercial capacity. With the completion of these types of projects, the share of the solar PV segment in the Indian solar energy market is expected to increase in the forecast period.

- In January 2022, Reliance Industries (RIL) signed a pact with the Gujarat government to invest USD 80.61 billion in Gujarat over ten to fifteen years to set up 100 GW of renewable energy power plants and a green hydrogen ecosystem. At the utility scale, renewable energy power plants include solar power plants. RIL is expected to invest USD 8.12 billion in setting up manufacturing facilities for solar PV modules, electrolyzers, batteries, and fuel cells for upcoming renewable projects.

- Because of these changes, the solar PV segment is expected to have the biggest market share in India over the next few years.

Supportive Government Policies to Drive the Market

- In Recent years, the country planned various government initiatives to increase the solar energy share of India's future renewable power generation mix. According to Ministry of New and Renewable Energy, as of February 2023, the solar energy constitutes 66.70 GW installed capacity in 2022.

- According to the Ministry of New and Renewable Energy's (MNRE) national wind-solar hybrid policy, this policy is a framework for promoting large grid-connected wind-solar PV hybrid systems. These systems will reduce the unpredictability of renewable energy generation and improve grid stability while using land and transmission infrastructure best.

- Some other schemes implemented by the Ministry of New and Renewable Energy (MNRE) over the last three years are the Solar Park Scheme, the 300 MW Defense Scheme, and the 500 MW VGF (Viability Gap Funding) Scheme.

- The Delhi government approved its Solar Policy 2022 plan in December 2022. The plan calls for the installed capacity to go from 2,000 MW to 6,000 MW in the two years.Delhi's new solar policy aims to install 6,000 MW of solar capacity in the two years. This will likely bring the share of solar energy in Delhi's annual electricity demand from 9% to 25% in three years.

- Thus, with the upcoming government projects and supportive policies, solar energy developments are expected to boost the Indian solar energy market in the coming years.

Solar in India Industry Overview

The Indian solar energy market is fragmented. Some of the major companies operating in the market (not in particular order) include Adani Enterprises Ltd., Emmvee Photovoltaic Power Private Limited, Azure Power Global Limited, JinkoSolar Holdings Co. Ltd., and First Solar Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar Energy Installed Capacity and Forecast, in GW, till 2028

- 4.3 Government Policies and Regulations

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies for Developing Solar Energy

- 4.5.1.2 Declining Cost of Solar Power Technology

- 4.5.2 Restraints

- 4.5.2.1 Unpredictability in the Continuity of Power Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Domestic Players

- 6.3.1.1 Adani Solar

- 6.3.1.2 Emmvee Solar

- 6.3.1.3 Mahindra Susten Pvt. Ltd.

- 6.3.1.4 Sterling and Wilson Pvt. Ltd.

- 6.3.1.5 Tata Power Solar Systems Ltd.

- 6.3.1.6 Vikram Solar Limited

- 6.3.1.7 ReNew Power Pvt. Ltd.

- 6.3.1.8 NTPC Ltd.

- 6.3.1.9 Azure Power Global Ltd.

- 6.3.2 Foreign Players

- 6.3.2.1 JinkoSolar Holdings Co. Ltd.

- 6.3.2.2 First Solar Inc.

- 6.3.2.3 Hanwha Q Cells Co. Ltd.

- 6.3.2.4 SMA Solar Technology AG

- 6.3.2.5 Trina Solar Limited

- 6.3.1 Domestic Players

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Research and Development Projects to Improve the Solar Technology