|

市场调查报告书

商品编码

1640313

粉末涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Powder Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

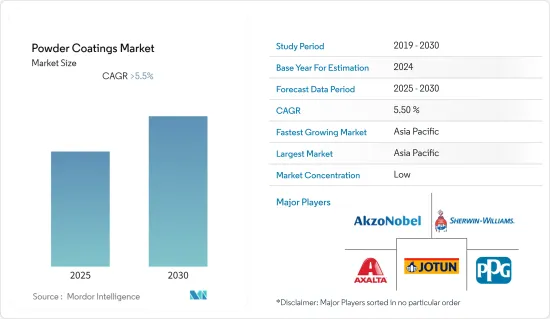

预计粉末涂料市场在预测期内的复合年增长率将超过 5.5%。

COVID-19的爆发导致世界各地的全国范围内停工,扰乱了製造活动,供应链、生产停工和劳动力短缺对2020年的粉末涂料市场产生了负面影响。然而,情况在 2021 年开始改善,市场在预测期内恢復了成长轨迹。

主要亮点

- 从中期来看,对挥发性有机化合物排放的严格监管以及政府促进粉末涂料使用的有利倡议是推动市场的主要因素。

- 相反,获得薄膜涂层的困难预计将阻碍市场成长。

- 亚太新兴经济体正在增加对基础设施和建筑业的投资,这可能为市场创造成长机会。

- 亚太地区主导全球市场,消费量最高的国家是中国、韩国和印度等。

粉末涂料市场趋势

建筑和装饰领域的需求不断增长

- 粉末涂料成长最快的市场之一是建筑和装饰市场,关键原因是粉末涂料的耐用性。

- 此外,聚酯树脂技术的扩展,即稳定的低光泽配方,为建筑市场提供了机会,并促进了粉末涂料的成长。

- 粉末涂料有多种颜色和饰面,这就是为什么许多建设公司依靠粉末涂料为户外场地和公共工程计划提供持久的外部饰面。

- 2021年4月,Jababeka集团子公司PT Jababeka Morotai与OISCA国际学院基金会(OISCA International)合作开发了莫罗泰经济特区(KEK)。根据这项合作,将在印尼北马鲁古省的 KEK 建造一座二战纪念和支援设施。

- 在北美市场,绿建筑的爆发和全球化越来越认识到粉末涂料是建筑铝材涂装的有效选择。

- 根据美国绿建筑委员会 (USGBC) 的数据,2021 年美国前 10 个州将有 1,105 个计划获得 LEED 绿建筑认证,获得认证的土地面积达 2.47 亿 GSF。该地区被认为是粉末涂料的主要商机。

- 根据美国人口普查,新建设约为 1.62 兆美元,较 2020 年的 1.49 兆美元大幅增加 8.46%。预计这种成长趋势将在预测期内提振市场并创造利润丰厚的机会。

- 根据FIEC统计,2021年建筑业总投资大幅成长,成长5.2%,达到1.6兆欧元(约1.7兆美元)。义大利的投资增幅最大(16.4%),其次是爱沙尼亚(10.7%)、希腊(10.6%)和法国(10.5%)。欧盟(EU)投资的激增预计将引发建筑和装饰领域的成长机会,从而促进粉末涂料市场的发展。

- 因此,由于上述因素,建筑和装饰行业对粉末涂料的需求在预测期内可能会增加。

亚太地区主导市场

- 在亚太地区,由于汽车工业、建设活动和工业产品消费的增加,中国和印度在全球市场占有率中占据主导地位。这使得该地区粉末涂料市场的需求不断增加。

- 中国的建筑业正在经历显着成长。根据中国国家统计局数据,2021年中国建筑业产值约29.31兆元人民币(约4,215.7亿美元)。

- 在印度2022-23年联邦预算中,基础设施资本支出将从5.54兆印度卢比(约669.8亿美元)大幅增加至7.5兆印度卢比(约905.9亿美元),成长35.4%,其中包括铁路住宅总量。

- 2021年9月,艾仕得宣布在中国北部吉林省吉林市破土动工兴建最先进的油漆厂。新工厂占地 46,000平方公尺,将生产轻型汽车、商用车和汽车塑胶零件的移动涂料。

- 2021年5月,PPG宣布已完成对中国嘉定油漆涂料工厂的1,300万美元投资。此次扩建将使该厂的产能每年增加8,000多吨。

- 此外,2021年中国电动车销量将激增154%,从2020年的130万辆增加到330万辆。中国财政部宣布,自2021年1月1日至2022年12月31日,新增电动车免征汽车购置税并给予财政辅助。

- 因此,由于上述趋势和终端用户行业的成长,预计在预测期内该地区对粉末涂料的需求将显着增长。

粉末涂料产业概况

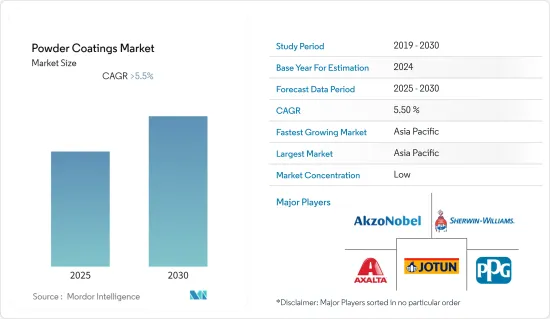

粉末涂料市场是细分的,只有少数几家国际参与企业占据了相当大的份额,而每个国家都有几家本土企业。这些主要企业包括 Akzo Nobel NV、Axalta Coating Systems LLC、The Sherwin-Williams Company、PPG Industries Inc. 和 Jotun。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对VOC排放的严格监管以及政府为推广粉末涂料的积极努力

- 其他司机

- 抑制因素

- 粉末涂料难以变薄

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(以金额为准的市场规模)

- 树脂型

- 丙烯酸纤维

- 环氧树脂

- 聚酯纤维

- 聚氨酯

- 环氧聚酯

- 其他树脂种类(聚氯乙烯、聚烯)

- 最终用户产业

- 建筑与装饰

- 车

- 工业的

- 其他最终用户产业(家具、家用电子电器产品)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 南非

- 沙乌地阿拉伯

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Asian Paints PPG Pvt. Limited

- Axalta Coating Systems LLC

- BASF SE

- Berger Paints India Limited

- Cardinal

- IFS Coatings

- IGP Pulvertechnik AG

- Jotun

- Kansai Paint Co. Ltd

- National Paints Factories Co. Ltd

- Nippon Paint Holdings Co. Ltd

- Nivera Paints (India) Pvt. Ltd

- PPG Industries Inc.

- RPM International Inc.(TCI Powder Coatings)

- SAK Coat

- SHAWCOR

- The Sherwin-Williams Company

第七章 市场机会及未来趋势

- 扩大亚太新兴经济体基础建设投资

The Powder Coatings Market is expected to register a CAGR of greater than 5.5% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns around the globe disrupted manufacturing activities, and supply chains, production halts, and labor unavailability negatively impacted the powder coating market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- Over the medium term, the significant factors driving the market studied are strict regulation against VOC emissions and favorable government initiatives promoting powder coatings usage.

- Conversely, the difficulties in obtaining thin film coatings are expected to hinder the market's growth.

- Nevertheless, growing investments in the infrastructure and construction industry in the emerging economies of the Asia-Pacific region is likely to create growth opportunities for the market studied.

- Asia-Pacific dominated the market globally, with the most significant consumption from countries such as China, South Korea, and India.

Powder Coatings Market Trends

Growing Demand from Architectural and Decorative Segment

- One of the fastest-growing markets for powder coatings is the architectural and building market, primarily due to powder coating durability.

- Moreover, polyester resin technology expansion, namely stable, low-gloss formulas, provided architectural market opportunities that promoted powder coating growth.

- Due to the variety of colours and finishes available in powder coatings, many construction companies are turning to powder coatings to provide long-term exterior finishes for outdoor venues and public work projects.

- In April 2021, PT Jababeka Morotai, a subsidiary of Jababeka Group, collaborated with the OISCA International College Foundation (OISCA International) to develop the Morotai Special Economic Zone (KEK). Under this collaboration, a World War II monument and supporting facilities will get constructed in KEK, North Maluku Province, Indonesia.

- In the North American market, green construction practices explosion and globalization have further increased the awareness regarding powder coatings as a viable option to coat architectural aluminum.

- In 2021, according to the U.S. Green Building Council (USGBC), 1,105 projects had been certified with LEED certification for green buildings in the top 10 states of the US with 247 million GSF land. It will likely provide a massive opportunity for powder coatings in the region.

- As per US Census, the new construction value was around USD 1.62 trillion, with a notable growth of 8.46% from USD 1.49 trillion in 2020. The upward growth trend is expected to boost the market and create lucrative opportunities in the forecast period.

- According to FIEC, the construction industry witnessed a notable growth in total investment, with 5.2% in 2021, and amounted to EUR 1.6 trillion (~USD 1.70 trillion). The most significant rise in investment was observed in Italy (16.4%), followed by Estonia (10.7%), Greece (10.6%), and France (10.5%). A rapid increase in investment in European Union is anticipated to trigger growth opportunities for the Architectural and Decorative segment, which in turn would help the development of the Powder Coating market.

- Therefore, with the abovementioned factors, the demand for powder coatings in the architectural and decorative industries will likely increase over the forecast period.

Asia-Pacific to Dominate the Market

- In the Asia-Pacific region, China and India dominated the global market share due to the rising consumption from the automotive industry, construction activities, and industrial goods. It is augmenting the demand for the powder coatings market in the region.

- China is in experiencing massive growth in its construction sector. According to the National Bureau of Statistics of China, in 2021, the construction output in China was valued at approximately CNY 29.31 trillion (~USD 421.57 billion).

- In the Indian Union Budget 2022-23, capital expenditure on infrastructure increased sharply by 35.4%, from INR 5.54 lakh crore (~USD 66.98 billion) to INR 7.50 lakh crore (~USD 90.59 billion) in 2022-23, which includes a total of 2,000 km of the rail network and 60,000 houses under PM Aawas Yojna, among others.

- In September 2021, Axalta announced that it broke ground to construct a state-of-the-art coatings facility in Jilin City, Jilin Province, North China. The 46,000 sq m new plant will produce mobility coatings for light vehicles, commercial vehicles, and automotive plastic components.

- In May 2021, PPG announced a USD 13 million investment completion in its Jiading, China, paint and coatings facility, including eight new powder coating production lines and an expanded Powder Coatings Technology Center. The expansion will increase the plant's capacity by more than 8,000 metric tons annually.

- Furthermore, in 2021, electric vehicle sales in China skyrocketed by 154%, with total electric vehicle sales of 3.3 million units, up from 1.3 million in 2020. It is the Ministry of Finance of China's statement to provide financial subsidies for new electric vehicles, as they will be exempted from vehicle purchase tax between January 1, 2021, to December 31, 2022.

- Hence, with such trends mentioned above and the end-user mentioned above industries' growth, the demand for powder coatings is estimated to grow substantially in the region during the forecast period.

Powder Coatings Industry Overview

The powder coatings market is fragmented, with only a few international players holding a considerable share and several local players in individual countries. These major players include Akzo Nobel NV, Axalta Coating Systems LLC, The Sherwin-Williams Company, PPG Industries Inc., and Jotun.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strict Regulations against VOC Emissions and Favorable Government Initiatives Promoting the Use of Powder Coatings

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Difficulty in Obtaining Thin Film of Powder Coating

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Polyester

- 5.1.4 Polyurethane

- 5.1.5 Epoxy-Polyester

- 5.1.6 Other Resin Types (Polyvinyl Chloride, Polyolefins)

- 5.2 End-user Industry

- 5.2.1 Architecture and Decorative

- 5.2.2 Automotive

- 5.2.3 Industrial

- 5.2.4 Other End-user Industries (Furniture, Appliances)

- 5.3 Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Asian Paints PPG Pvt. Limited

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 BASF SE

- 6.4.5 Berger Paints India Limited

- 6.4.6 Cardinal

- 6.4.7 IFS Coatings

- 6.4.8 IGP Pulvertechnik AG

- 6.4.9 Jotun

- 6.4.10 Kansai Paint Co. Ltd

- 6.4.11 National Paints Factories Co. Ltd

- 6.4.12 Nippon Paint Holdings Co. Ltd

- 6.4.13 Nivera Paints (India) Pvt. Ltd

- 6.4.14 PPG Industries Inc.

- 6.4.15 RPM International Inc. (TCI Powder Coatings)

- 6.4.16 SAK Coat

- 6.4.17 SHAWCOR

- 6.4.18 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Investments in the Infrastructure in the Emerging Economies of the Asia Pacific Region