|

市场调查报告书

商品编码

1640315

环保水泥:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Green Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

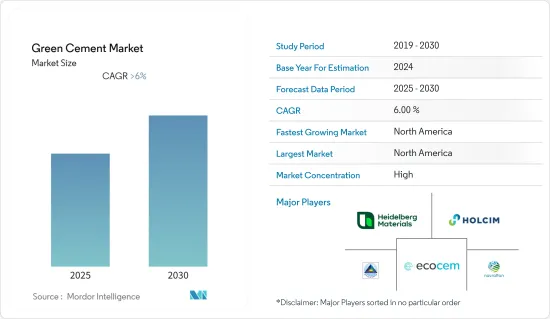

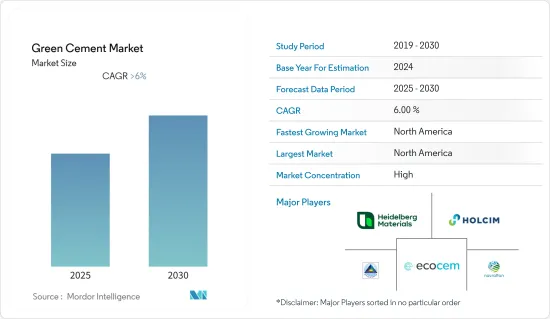

预计预测期内环保水泥市场的复合年增长率将超过 6%。

主要亮点

- 2020 年,新冠疫情对市场产生了负面影响。为了遏制病毒传播,建筑工程和其他活动被迫停止,这对市场造成了不利影响。然而,到 2021 年,由于建设活动的增加,市场实现了强劲成长。预计预测期内市场将遵循类似的路径。

- 推动市场发展的关键因素包括政府对绿建筑的优惠政策以及对水泥生产产生的温室气体 (GHG)排放日益增长的担忧。预计飞灰等原料的充足供应也将推动市场向前发展。

- 相反,建筑市场的象征性预计会严重阻碍市场成长。高贝利特水泥(HBC)在中国的良好表现可能会在未来几年提供成长机会。

- 由于该地区建设活动的快速增长,预计预测期内北美将主导全球市场。

环保水泥市场趋势

住宅建设产业需求增加

- 住宅领域是全球白水泥需求的主要市场之一。由于中产阶级可支配收入的增加,新住宅的增加预计将推动所研究市场的发展。

- 随着建筑规范和政策对节能建筑的要求不断提高,住宅领域的环保水泥也随之增加。在加拿大,经济适用住房倡议(AHI)、新建筑加拿大计划(NBCP)和加拿大製造等各种政府计划正在为住宅行业的扩张提供重要支持。

- 曼彻斯特市议会 (MCC) 已核准一项为期九年、将于 2022 年 2 月建造四座高层建筑的计划。多用户住宅高从 39 层到 60 层不等,计划分布在艾尔威尔河(被称为三一岛)沿岸的两个街区。这 1,950 套公寓将建在摄政路 (Regent Road)、利物浦路 (Liverpool Road) 和水街 (Water Street) 之间的土地上,目前该地块用作停车场。

- 越南建设部也宣布,广宁省下龙市人民委员会将于2022年11月初在下龙市红海区和高清区开始兴建约1,000套社会住宅计划。

- 此外,德国也核准在2022年10月建造25,399套住宅。根据联邦统计局(德语:Statistisches Bundesamt,缩写Destatis)的数据,与 2021 年 10 月相比,这一数字减少了 4,198 例(14.2%)。此外,2022 年 1 月至 10 月期间,总合颁发了 297,453 张住宅建筑许可证。

- 此外,在北美,美国环保署(EPA)对温室气体(GHG)排放的严格监管刺激了消费者对清洁能源来源的需求,从而推动了对环保水泥的需求。

- 此外,随着消费者(尤其是已开发国家的消费者)对绿色住宅能源效益的认识不断提高,预计将在预测期内推动住宅领域的环保水泥市场的发展。

美国在北美需求中占主导地位

- 近年来,由于人口成长和消费者收入提高,美国对新住宅的需求稳步增长。由于多户住宅趋势日益增长以及人口向都市区迁移的增加,美国人口普查局正在发放更多的新建住宅建筑许可证。

- 2022年前11个月的建筑支出达到1.6576兆美元,较2021年同期的1.4998兆美元成长10.5%。 2022年11月住宅建筑经季节性已调整的后的年率为8,680亿美元,比10月修订后的8724亿美元低0.5%。 11月住宅建筑经季节性调整后年率为5,583亿美元,较10月修订后的5,492亿美元高出1.7%。

- 根据美国人口普查局的数据,2023 年 1 月发放的私人住宅建筑许可证经季节性已调整的年率上升至 133.9 万张,较 12 月修订后的 133.7 万张仅增长 0.1%。

- 根据美国人口普查局的统计数据,2023 年 1 月,经季节性已调整的私人住宅竣工数量年化为140.6 万套,较12 月修订后的139.2 万套和2022 年1 月的124.7 万套增长1.0 %。

- 除了新住宅开发外,美国还在住宅维修方面投入大量资金。随着移民人口的不断增长,对復原的需求也日益增加。此外,人们越来越意识到永续性和高效建设的重要性,这也推动了修復趋势。充足的政府贷款也有助于鼓励该国的住宅维修。

- 此外,上述因素以及对绿色建筑的日益关注为预测期内建筑业健康使用环保水泥提供了机会。

环保水泥产业概况

环保水泥市场部分整合。所研究的市场中的主要企业包括海德堡水泥股份公司 (HeidelbergCement AG)、Kiran Global Chem Limited、Ecocem、Navrattan Group 和 Holcim。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 政府绿建筑的优惠政策

- 人们对水泥生产产生的温室气体排放日益担忧

- 丰富的原料

- 限制因素

- 建筑市场的异端

- 其他阻碍因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 飞灰基

- 蛞蝓基座

- 石灰石基

- 硅灰基

- 其他产品类型

- 按建筑业

- 住宅

- 非住宅

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- Ecocem

- Ecoplus Industries Pvt. Ltd.

- Hallett Group

- HEIDELBERGCEMENT AG

- Holcim

- JSW Cement

- Kiran Global Chems Limited

- NavrattanGroup

- Taiheiyo Cement Corporation

- UltraTech Cement Ltd

- Votorantim Cimentos

第七章 市场机会与未来趋势

- HBC(海贝莱特水泥)在中国市场表现亮眼

- 主要水泥公司正在进行的研究和开发

简介目录

Product Code: 51288

The Green Cement Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. Construction work and other activities were put on hold to curb the virus's spread, negatively affecting the market. However, in 2021, the market grew steadily, owing to increased building and construction activities. The market is expected to follow a similar projection during the forecast period.

- The major factors driving the market include favorable government policies for green buildings and increasing concern about greenhouse gas (GHG) emissions from cement production. The abundance availability of raw materials, such as fly ash, is also expected to drive the market forward.

- On the contrary, the iconoclastic nature of the construction market is expected to hinder the market's growth significantly. Over the next few years, the encouraging performance of high belite cement (HBC) in China will likely act as an opportunity for growth.

- North America is expected to dominate the global market during the forecast period due to the exponentially increasing construction activities in the region.

Green Cement Market Trends

Rising Demand from the Residential Construction Industry

- The residential sector is one of the significant demanding markets for white cement across the globe. Increasing construction of new residential buildings owing to the rise in disposable income of the middle class is expected to drive the market studied.

- The rising number of building codes and policies mandating energy-efficient structures have led to the growth of green cement in the residential sector. In Canada, various government projects, including the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada, are set to support the expansion of the sector hugely, thereby driving the use of green cement in the residential sector.

- Manchester City Council (MCC) approved a nine-year scheme to build four skyscrapers in February 2022. The apartment blocks, ranging from 39 to 60 storeys in height, are planned for two parcels of land on the banks of the River Irwell, known as Trinity Islands. The buildings, featuring 1,950 flats, would be located on land between Regent Road, Liverpool Road, and Water Street, which is currently a car park.

- In its recent publication, the Ministry of Construction of Vietnam also stated that the People's Committee of Ha Long City in Quang Ninh Province commenced construction of a social housing project of nearly 1,000 apartments in Ha Long City's Hong Hai Ward and Cao Thang Ward in the early November of 2022.

- Furthermore, Germany also approved the construction of 25,399 homes for October 2022. According to the Federal Statistical Office (German: Statistisches Bundesamt, shortened Destatis), this represented a drop of 4,198 building permits, or 14.2%, from October 2021. Further, between January and October 2022, a total of 297,453 residential building permits were issued.

- Additionally, in North America, stringent regulations of the US Environmental Protection Agency (EPA) regarding greenhouse gas (GHG) emissions are accelerating consumer demand for a clean energy source, which in turn would lead to an increase in the demand for green cement.

- Furthermore, growing awareness among consumers, especially in developed nations, regarding the energy benefits associated with green homes is expected to drive the green cement market in the residential sector over the forecast period.

United States to Dominate the Demand in North American Region

- The demand for new homes in the United States has been steadily increasing in recent years, owing to the country's growing population and rising consumer incomes. With the expanding trend of multi-family construction and the increase in migration to cities, the US Census Bureau has issued more permits for the construction of new residential buildings.

- During the first eleven months of 2022, construction spending amounted to USD 1,657.6 billion, 10.5% above the USD 1,499.8 billion for the same period in 2021. In 2022, residential construction was at a seasonally adjusted annual rate of USD 868.0 billion in November, 0.5% below the revised October estimate of USD 872.4 billion. Non-residential construction was at a seasonally adjusted annual rate of USD 558.3 billion in November, 1.7% above the revised October estimate of USD 549.2 billion.

- According to the US Census Bureau, in January 2023, the seasonally adjusted annual rate of privately owned dwelling units authorized by building permits was 1,339,000, which is a mere 0.1% higher than the revised December rate of 1,337,000.

- The statistics by the US Census Bureau also stated that the privately owned housing completions were at a seasonally adjusted annual rate of 1,406,000 in January 2023, which is 1.0% more than the revised December estimate of 1,392,000 and 12.8% higher than the January 2022 rate of 1,247,000.

- Aside from new home development, the United States is investing heavily in home improvements. The necessity for rehabilitation has become increasingly critical as the country's migrant population has grown. In addition, the increased awareness of the importance of sustainability and high-efficiency constructions has fueled the restoration trend. The availability of many government loans also encourages home upgrading in the country.

- Moreover, the aforementioned factors, along with a growing focus on green buildings, are providing opportunities for green cement to be used in the construction sector at a healthy rate during the forecast period.

Green Cement Industry Overview

The green cement market is partially consolidated in nature. Some of the major players in the market studied include Heidelberg cement AG, Kiran Global Chem Limited, Ecocem, NavrattanGroup, and Holcim, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Favorable Government Policies for Green Buildings

- 4.1.2 Increasing Concern of GHG Emissions from Cement Production

- 4.1.3 Abundance Availability of Raw Materials

- 4.2 Restraints

- 4.2.1 Iconoclastic Nature of Construction Market

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Fly Ash-based

- 5.1.2 Slag-based

- 5.1.3 Limestone-based

- 5.1.4 Silica fume-based

- 5.1.5 Other Product Types

- 5.2 Construction Sector

- 5.2.1 Residential

- 5.2.2 Non-residential

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ecocem

- 6.4.2 Ecoplus Industries Pvt. Ltd.

- 6.4.3 Hallett Group

- 6.4.4 HEIDELBERGCEMENT AG

- 6.4.5 Holcim

- 6.4.6 JSW Cement

- 6.4.7 Kiran Global Chems Limited

- 6.4.8 NavrattanGroup

- 6.4.9 Taiheiyo Cement Corporation

- 6.4.10 UltraTech Cement Ltd

- 6.4.11 Votorantim Cimentos

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Encouraging Performance of HBC (High Belite Cement) in China

- 7.2 Continuous R&D by Major Cement Companies

02-2729-4219

+886-2-2729-4219