|

市场调查报告书

商品编码

1640318

南美聚氯乙烯(PVC) -市场占有率分析、产业趋势、成长预测(2025-2030 年)South America Polyvinyl Chloride (PVC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

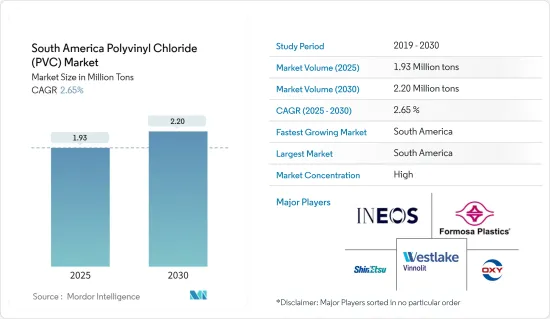

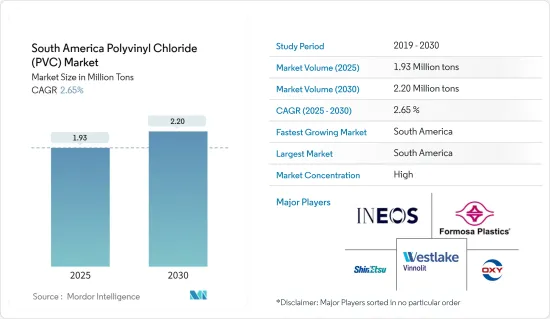

南美聚氯乙烯市场规模预计2025年为193万吨,预计到2030年将达到220万吨,预测期内(2025-2030年)复合年增长率为2.65%。

PVC 强度高、重量轻、耐候、耐腐蚀、耐化学腐蚀、耐磨、用途广泛且易于使用,因为它可以以任何方式切割、成型、焊接和连接。

主要亮点

- 市场研究的主要驱动力是越来越多地使用塑胶来使汽车更轻、更省油、建筑行业需求的增加以及医疗行业应用的增加。

- 然而,对人类健康和环境的有害影响预计将成为市场成长的主要障碍。

- 加速电动车的使用和回收PVC可能是未来的机会。

南美洲聚氯乙烯(PVC)市场趋势

建筑业的需求不断增加

- PVC 管道已在建筑领域使用了 60 多年,因为它们在生产过程中提供了宝贵的节能效果、低成本的配送以及安全、免维护的使用寿命。这些管道广泛用于水、废弃物和废水管道系统,因为它们不会堆积、结垢、腐蚀和点蚀,并且其光滑的表面减少了泵送所需的能量。

- 2022 年第二季度,该地区的酒店建设项目数量为 555 个计划和 90,496 间客房。经过近两年因疫情带来的不确定性后,拉丁美洲酒店业终于出现復苏迹象。随着全部区域边境监管和检疫要求的放鬆,消费者信心增强。

- 在南美洲,2022 年上半年动工了 40 个计划,总合8,481 间客房。 2022年第二季新计画共36个计划、6,208间客房,较去年同期成长57%。

- 2022年12月,巴西聚氯乙烯(PVC)市场等待政府宣布基础设施和建筑领域的新措施,将改善供应链和商业环境。

- 2021 年,巴西基础建设投资达 1,480 亿巴西币(274.5 亿美元)。

- 所有上述因素预计将在预测期内推动市场成长。

巴西主导市场

- 在南美洲,巴西在市场上占据主导地位,并且在预测期内可能会继续保持这一地位。该国的建筑、汽车和电子产业正在崛起。

- 巴西政府推出“基础设施特许经营计划”,投资该国道路、机场、港口、能源等基础设施。根据该计划,政府宣布对交通、能源和卫生计划投资 144 亿美元。

- 此外,政府计划平衡经济适用住宅的供需(由人口增长和快速都市化创造),并利用官民合作关係(PPP)模式来取代老化的交通基础设施。

- 根据新闻部落格「南美洲门户」报道,2022年1月至5月,巴西建筑业景气指数(ICEI)有所改善,从4月的55.5和3月的55.3上升至5月的56.2。

- 巴西对汽车的需求量大,被认为是世界十大乘用车製造国之一。根据国际汽车製造工业(OICA) 的数据,2022 年巴西乘用车销量为 1,824,833 辆。

- 家用电子电器产品的销售似乎已经饱和状态。消费者在购买昂贵产品时会持谨慎态度,并且这种行为预计将持续下去。

- 所有这些因素预计将在预测期内推动巴西 PVC 市场的成长。

南美洲聚氯乙烯(PVC)产业概况

南美聚氯乙烯市场具有一体化特征。顶尖公司专注于为各个最终用户产业提供更好的材料。南美洲聚氯乙烯的主要生产商包括台塑公司、英力士公司、信越化学公司、西方石油公司和Westlake Vinnolit GmbH &Co.KG。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加塑胶的使用使汽车更轻并提高燃油效率

- 扩大在医疗产业的应用

- 建筑业的成长

- 抑制因素

- 对人类和环境的有害影响

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 产品类型

- 硬质聚氯乙烯

- 透明硬质PVC

- 不透明硬质PVC

- 软聚氯乙烯

- 透明软质PVC

- 不透明软PVC

- 低烟PVC

- 氯化聚氯乙烯

- 硬质聚氯乙烯

- 稳定剂类型

- 钙稳定剂(钙锌稳定剂)

- 铅基稳定剂(Pb稳定剂)

- 锡和有机锡稳定剂(Sn稳定剂)

- 钡基及其他(液态混合金属)

- 目的

- 管道和配件

- 薄膜片材

- 电线电缆

- 瓶子

- 型材、软管、管材

- 其他的

- 最终用户产业

- 建筑/施工

- 车

- 电力/电子

- 包装

- 鞋类

- 医疗保健

- 其他的

- 地区

- 巴西

- 阿根廷

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)分析**/市场排名分析

- 主要企业策略

- 公司简介

- Braskem

- Formosa Plastics Corporation

- INEOS

- Occidental Petroleum Corporation

- Orbia

- Shin-Etsu Chemical Co., Ltd.

- Westlake Vinnolit GmbH & Co. KG

- Xinjiang Zhongtai Chemical Co., Ltd.

第七章 市场机会及未来趋势

- 转向 PVC 回收

- 加速电动车 (EV) 的普及

The South America Polyvinyl Chloride Market size is estimated at 1.93 million tons in 2025, and is expected to reach 2.20 million tons by 2030, at a CAGR of 2.65% during the forecast period (2025-2030).

PVC is strong and lightweight, durable to weathering, rotting, chemical corrosion and abrasion, versatile, and easy to use, as it can be cut, shaped, welded, and joined in any style.

Key Highlights

- Major factors driving the market studied are the increasing use of plastics to reduce vehicle weight and enhance fuel economy, growing demand from the construction industry, and increasing applications in the healthcare industry

- However, hazardous impacts on humans and the environment are expected to majorly hinder the growth of the market studied.

- The accelerating usage of electric vehicles and PVC recycling are likely to act as an opportunity in the future.

South America Polyvinyl Chloride (PVC) Market Trends

Growing Demand from the Construction Industry

- PVC pipes have been used in building and construction for over 60 years, as they offer valuable energy savings during production, low-cost distribution, and a safe, maintenance-free lifetime of service. These pipes are widely used for pipeline systems for water, waste, and drainage as they suffer no build-up, scaling, corrosion, or pitting, and they provide smooth surfaces reducing energy requirements for pumping.

- In Q2 2022, the region's total hospitality construction pipeline includes 555 projects and 90,496 rooms. Following nearly two years of uncertainty caused by the pandemic, the Latin American hotel industry is finally showing signs of recovery. Consumer confidence has risen as border restrictions and quarantine requirements across the region have been relaxed.

- In South America, 40 projects totaling 8,481 rooms began construction in the first half of 2022. In Q2 2022, new project announcements increased 57% year-on-year to 36 projects or 6,208 rooms.

- In December 2022, Brazil's polyvinyl chloride (PVC) market was awaiting new policies to be announced by the government in the infrastructure and construction sectors, which will improve the supply chain and business conditions.

- Brazil's infrastructure investment amounted to 148 billion Brazilian reals (USD 27.45 billion) in 2021.

- All the above-mentioned factors are likely to drive the market growth during the forecast period.

Brazil to Dominate the Market

- Brazil dominated the market in South America and is likely to continue its dominance during the forecast period. The country is attributed to the rise in construction, automotive, and electronics industries.

- The government of Brazil launched the 'Infrastructure Concessions Program' to invest in infrastructure for roads, airports, ports, and energy, in the country. In this program, the government announced an investment of USD 14.4 billion in transport, energy, and sanitation projects.

- Additionally, the government plans to balance the demand for and supply of affordable housing (created by the increasing population and rapid urbanization) and its efforts to improve the country's aging transport infrastructure using the public-private partnership (PPP) model.

- According to a News Blog, Gateway to South America, Brazil's business confidence indicator (ICEI) in the construction industry improved in the first five months of 2022, rising to 56.2 in May 2022 from 55.5 in April and 55.3 in March 2022.

- Brazil has a high demand for vehicles and is considered among the ten leading passenger vehicle manufacturers across the world. According to the International Organization of Motor Vehicle Manufacturers (French: Organisation Internationale des Constructeurs d'Automobiles (OICA)), Brazil's passenger cars sale was 18,24,833 in 2022.

- Sales of consumer electronics appear to have reached a point of saturation in the country. Consumers are careful while buying expensive products, and this behavior is expected to continue in the upcoming years.

- All such factors are likely to drive the PVC market growth in Brazil over the forecast period.

South America Polyvinyl Chloride (PVC) Industry Overview

South America's polyvinyl chloride market is consolidated in nature. The top companies have been focusing on providing better materials for various end-user industries. Major manufacturers of South American PVCs are Formosa Plastics Corporation, INEOS, Shin-Etsu Chemical Co., Ltd., Occidental Petroleum Corporation, and Westlake Vinnolit GmbH & Co. KG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Plastics to Reduce Vehicle Weight and Enhance Fuel Economy

- 4.1.2 Increasing Application in the Healthcare Industry

- 4.1.3 Growth from the Construction Industry

- 4.2 Restraints

- 4.2.1 Hazardous Impact on Humans and the Environment

- 4.2.2 Other Restrainta

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Rigid PVC

- 5.1.1.1 Clear Rigid PVC

- 5.1.1.2 Non-Clear Rigid PVC

- 5.1.2 Flexible PVC

- 5.1.2.1 Clear Flexible PVC

- 5.1.2.2 Non-Clear Flexible PVC

- 5.1.3 Low-smoke PVC

- 5.1.4 Chlorinated PVC

- 5.1.1 Rigid PVC

- 5.2 Stabilizer Type

- 5.2.1 Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 5.2.2 Lead-based Stabilizers (Pb Stabilizers)

- 5.2.3 Tin- and Organotin-based Stabilizers (Sn Stabilizers)

- 5.2.4 Barium-based and Others (Liquid Mixed Metals)

- 5.3 Application

- 5.3.1 Pipes and Fittings

- 5.3.2 Films and Sheets

- 5.3.3 Wires and Cables

- 5.3.4 Bottles

- 5.3.5 Profiles, Hoses and Tubings

- 5.3.6 Other Applications

- 5.4 End-User Industry

- 5.4.1 Building and Construction

- 5.4.2 Automotive

- 5.4.3 Electrical and Electronics

- 5.4.4 Packaging

- 5.4.5 Footwear

- 5.4.6 Healthcare

- 5.4.7 Other End-User Industries

- 5.5 Geography

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Braskem

- 6.4.2 Formosa Plastics Corporation

- 6.4.3 INEOS

- 6.4.4 Occidental Petroleum Corporation

- 6.4.5 Orbia

- 6.4.6 Shin-Etsu Chemical Co., Ltd.

- 6.4.7 Westlake Vinnolit GmbH & Co. KG

- 6.4.8 Xinjiang Zhongtai Chemical Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Towards PVC Recycling

- 7.2 Accelerating Usage of Electric Vehicles (EVs)