|

市场调查报告书

商品编码

1640320

高速测速照相:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)High Speed Cameras - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

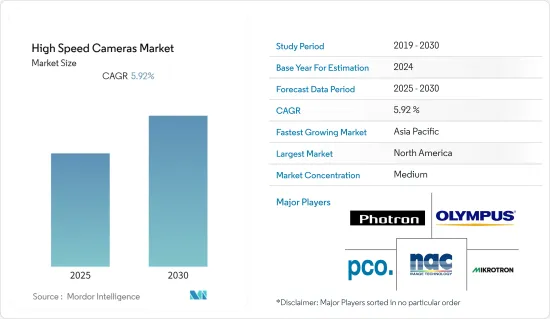

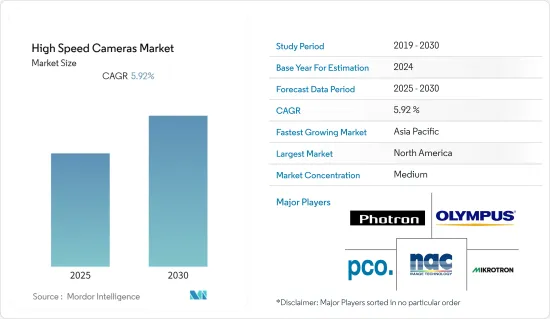

预计预测期内测速照相市场复合年增长率为 5.92%。

主要亮点

- 测速照相由于其比其他摄影机更优越的性能,在各行各业中都很受欢迎。对高度详细分析的需求不断增长,例如航太、烟火、爆炸物和弹道中的燃烧测试和流动可视化,可能会推动工业领域对测速照相的需求。

- 此外,测速照相现在还具有自动光圈操作、宽侦测范围和即时功能等先进功能。这些技术正在被智慧交通系统 (ITS) 采用来预测未来的碰撞、减少交通拥堵、消除交通障碍并提高乘客的安全性和便利性。

- 此外,一些国家的政府加大对智慧城市建设的投入,预计将推动对用于安全和监控的智慧高速摄影机的需求,从而促进市场的成长。例如,2022年10月,Honeywell与加速器在美国市场引进了Honeywell智慧城市加速器计划。该计划将帮助当地社区积极规划未来并建立支持革命倡议的能力。Honeywell将与美国五个地区合作,提供实体支持,加速智慧城市战略计画的发展。

- 由于新冠疫情导致的关闭和贸易限制,测速照相市场短暂停滞。然而,随着使用温度检测来识别 COVID 感染者的红外线摄影机等技术创新的不断增加,预计未来几年市场将蓬勃发展。

- 然而,相机正常运作所需的完整配置包括相机微控制器、镜头、LED 照明以及用于製程监控和管理的软体等设备。测速照相产品更新换代週期长、成本较高是限制测速照相市场发展的因素。

测速照相市场趋势

智慧型运输系统概念推动市场

- 智慧型运输系统(ITS) 旨在透过提高安全性和舒适度以及最大限度地减少交通问题来实现交通效率。它为用户提供先进的交通资讯、当地便利资讯、即时驾驶资讯、空席状况等,帮助减少通勤时间,同时提高安全性和舒适度。

- 摄影机,尤其是高效能机器视觉摄影机,在智慧交通系统中变得越来越重要。高速测速照相具有即时功能、宽感测器范围、自动光圈和昼夜操作等功能,可防止潜在事故,保持交通畅通,并减少交通部门对社会的负面环境影响。

- 利用ITS减少交通事故死亡人数、提高道路安全已成为推动智慧交通系统产业扩张的重要驱动力。交通运输业正在发生的变化凸显了优化交通基础设施以增强道路网路的必要性。因此,对智慧道路安全设备日益增长的需求可能会在未来几年增加对测速照相的需求。

- 此外,智慧交通是智慧城市的重要组成部分。总部位于纽约的联合运输管理中心(JTMC)是北美最大的运输中心。 JTMC 的融合安全和资讯管理 (CSIM) 设施涵盖了该州数百英里的高速公路系统,并配备了数百个摄影机、车辆侦测器、可变讯息标誌和众多高速公路内建建议无线电。其使命重点是全天候协调和通讯,以管理日常交通事故并缓解世界上最繁忙的高速公路上的交通拥堵。这就是推动测速照相市场发展的因素。

- 预计未来几年各国政府将增加对改善交通管理系统的投资,并增加对测速照相的需求。例如,2022 年 4 月,为了改善印度的交通状况,电子和资讯技术部 (MeitY) 在其 InTranSE-II倡议中推出了一系列智慧型运输系统(ITS) 应用程式。据该部称,车载驾驶员辅助和警报系统(ODAWS) 旨在加强高速公路基础设施,因为高速公路上的车辆数量和速度正在增加,加剧了安全问题。

亚太地区创下最高成长率

- 预计整个预测期内亚太地区将保持显着成长。快速的工业化和不断发展的製造地(尤其是中国和印度)预计将成为这一成长的主要动力。全球各地对该地区製造业的投资不断增加,推动对更有效率的生产线监控的需求。

- 此外,「印度製造」计画等倡议已使印度成为世界製造业中心,并赢得了印度经济的全球认可。根据印度品牌股权基金会 (IBEF) 的数据,印度是全球第三大製造地,到 2030 年有潜力出口价值超过 1 兆美元的商品。预计这些努力将推动製造业测速照相市场的发展。

- 高速测速照相越来越多地应用于医疗保健、汽车、食品饮料和消费性电子产品等各个行业,用于维修、机器诊断、分析和预防性保养等任务。预计印度、中国和日本的工业和汽车产业将越来越多地使用机器人和电脑视觉功能,从而促进该地区的发展。

- 测速照相对于正确利用电子和半导体领域、食品加工行业以及领先的研究和学术机构的发展也是必要的。预测期内,这些产业的投资增加将推动对测速照相的需求。例如,到2022年9月,印度预计将从旨在鼓励国内半导体生产的奖励计画中获得至少250亿美元的累积承诺。

高速测速照相产业概况

测速照相市场竞争激烈,有几家国际公司主导全球市场。主要参与者包括 Photron LTD.、Olympus Corporation、NAC Image Technology、Mikrotron GMBH 和 PCO AG。这些关键参与者正在采用产品系列扩展、併购、协议、地理扩展和合作等策略来加强其在高速测速照相市场的市场占有率。

2022 年 9 月,科学与技术设施委员会 (STFC) 技术部门与 Cordin Scientific Imaging 合作生产新一代超快相机感测器。这款新设备由该公司与Cordin Scientific Imaging 公司合作开发,其成像速度比目前市场上的成像速度快四倍,使研究人员能够以之前太快的速度进行成像。新的观点这是以前无法观察到的。

2022 年 8 月,纽约市长承诺扩大测速照相计划,以帮助保护市民。相关人员表示,首都 750 个教育区安装的 2,000 个测速照相将每週 7 天、每天 24 小时运行。

2022年2月,一款新颖的高摄影机开发套件「Aper-Oculus」在Crowdsupply网站上亮相。这款免费软体设计是 Xilinx Kria SOM 的载体系统,旨在为创作者和专业人士提供高速电子格式的小型模组化替代方案。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 测速照相在製造业的应用日益广泛

- 市场限制

- 测速照相高成本

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按组件

- 影像感测器

- 镜片

- 电池

- 记忆系统

- 按影格速率

- 1,000-5,000

- 5,001-20,000

- 20,001-100,000

- 超过10万

- 按应用

- 娱乐与媒体

- 运动的

- 消费性电子产品

- 研究与设计

- 工业製造

- 军事和国防

- 航太

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- Photron LTD.

- Olympus Corporation

- NAC Image Technology

- Mikrotron GMBH

- PCO AG

- Weisscam

- Vision Research Inc.

- Optronis GMBH

- Motion Capture Technologies

- Del Imaging Systems, LLC

- Ix-Cameras Inc.

第七章 市场机会与未来趋势

第八章投资分析

The High Speed Cameras Market is expected to register a CAGR of 5.92% during the forecast period.

Key Highlights

- High-speed cameras are in high demand throughout sectors due to their superior characteristics over other cameras. The growing demand for highly detailed analysis, including combustion testing and flow visualization in aerospace, pyrotechnics, explosives, and ballistics, will likely drive up demand for high-speed cameras in the industrial sector.

- Furthermore, high-speed cameras with sophisticated capabilities such as auto-iris operation, a wide sensing range, and real-time capabilities are available. These technologies are increasingly being employed in intelligent transportation systems (ITS) to anticipate future collisions, decrease congestion, eliminate traffic difficulties, and improve passenger safety and convenience.

- In addition, increasing government expenditure in creating smart cities in several nations is expected to drive demand for smart and high-speed cameras for security and surveillance, contributing to market growth. For instance, in October 2022, Honeywell and Accelerator introduced the Honeywell Smart City Accelerator Project in the US market. This project will help communities actively plan for the future and build the capacity to support revolutionary initiatives. Honeywell is working with five districts in the United States to give in-kind assistance to speed the development of smart city strategy planning.

- Due to the lockdowns and trade restrictions caused by the COVID-19 outbreak, the market for high-speed cameras was hampered for a short period. However, the market is expected to flourish over the coming years due to increasing innovations such as infrared cameras, which use temperature detection to identify COVID-infected people.

- Moroever, the complete configuration necessary for the camera to perform properly includes equipment such as a camera microcontroller, lens, LED illumination, and software for process monitoring and management. Long product replacement cycles coupled with the high cost of the high-speed camera are a few factors restraining the high-speed camera market.

High Speed Cameras Market Trends

Intelligent Transportation Systems Initiative to Drive the Market

- Intelligent Transport System (ITS) aims to achieve traffic efficiency by minimizing traffic problems that enhance safety and comfort. It enriches users with prior information about traffic, local convenience, real-time running information, seat availability, etc., which reduces the travel time of commuters as well as enhances safety and comfort.

- Cameras, particularly high-performance machine vision cameras, are becoming more important in intelligent traffic systems. With features like real-time capability, broad sensor range, auto iris functionality, and day/night functionality, high-speed cameras help prevent potential accidents, keep traffic moving, and decrease the transportation sector's negative environmental impacts on society.

- The use of ITS to decrease traffic fatalities and improve traffic safety is a significant driver fueling the expansion of the intelligent transportation systems industry. The ongoing changes in the transport industry have highlighted the necessity for an optimized transportation infrastructure that might enhance road networks. Thus, the increasing need for road safety smart equipment will increase the demand for high-speed cameras over the coming years.

- Further, intelligent transportation is an essential component of any smart city. The Joint Transportation Management Center (JTMC), based in New York City, is the largest transportation center in North America. JTMC's Converged Security and Information Management (CSIM) installation covers hundreds of miles of the state arterial system and incorporates hundreds of cameras, vehicle detectors, variable message signs, and numerous highway advisory radios. Its mission is focused on around-the-clock coordination and communication to manage daily transportation incidents and reduce congestion on some of the busiest expressways in the world. This drives the market for high-speed cameras.

- Increasing investment by several governments to improve traffic management systems is expected to increase the demand for high-speed cameras over the coming years. For instance, in April 2022, to improve India's traffic situation, the Ministry of Electronics and Information Technology (MeitY) introduced numerous apps under the Intelligent Transportation System (ITS) as a part of the InTranSE- II initiative. According to the administration, onboard driver assistance and warning system (ODAWS) intends to enhance highway infrastructure as the number of cars and speeds on highways have grown, compounding safety problems.

Asia-Pacific to Register the Highest Growth

- Asia-Pacific region is expected to grow at a considerable pace throughout the forecast period. Rapidly increasing industrialization and the evolution of manufacturing hubs, particularly China and India, are expected to be significant drivers behind this growth. Investments from all over the world into the region's manufacturing sector are growing, creating an increased need for more efficient production line monitoring.

- Additionally, initiatives like the 'Make in India' program place India on the world map as a manufacturing hub and give global recognition to the Indian economy. According to India Brand Equity Foundation (IBEF), India is the world's third most demanding manufacturing location, with the potential to export commodities worth over USD 1 trillion by 2030. Such initiatives will drive the market for high-speed cameras in manufacturing sectors.

- High-speed cameras are increasingly being used in a wide range of industries, such as healthcare, automotive, food and beverage, and consumer electronics, and for tasks such as repairing, machinery diagnostics, analysis, and preventative maintenance. Industrial and automotive industries in India, China, and Japan are expected to use robots and computer vision capabilities more often, contributing to regional growth.

- High-speed cameras are also necessary for the proper use of the electronics and semiconductors sector, the food processing industry, and the development of top-tier research institutes and academia. Increasing investment in these industries will drive the demand for high-speed cameras over the forecast period. For instance, in September 2022, India expects a cumulative commitment of at least USD 25 billion due to its bonus program designed to encourage domestic semiconductor production.

High Speed Cameras Industry Overview

The high-speed camera market is highly competitive due to the presence of several international players who dominates the global market. Some of the key players are Photron LTD., Olympus Corporation, NAC Image Technology, Mikrotron GMBH, and PCO AG, among others. These key players have adopted strategies such as product portfolio expansion, mergers and acquisitions, agreements, geographical expansion, and collaborations to enhance their high-speed camera market share.

In September 2022, the Technology Department of the Science and Technology Facilities Council (STFC) collaborated with Cordin Scientific Imaging to produce a next-generation hyperspeed camera sensor. The new device, created in collaboration with Cordin Scientific Imaging, would capture images up to four times faster than those currently available on the market, giving researchers fresh perspectives on physical and and life studies phenomena that were previously too rapid to observe.

In August 2022, the Mayor of New York City declared the expansion of the city's speed camera program, which will help protect citizens. According to the officials, the capital's 2,000 speed cameras in 750 educational zones will be functioning 24 hours a day, seven days a week.

In February 2022, Aper-Oculus, a novel high-camera development kit, was made available on the Crowd Supply website. The free software design is a carrier system for Xilinx's Kria SOM, which was developed to give creators and experts a small and modular alternative for high-speed electronic format.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of High Speed Camera in Manufacturing Sector

- 4.4 Market Restraints

- 4.4.1 High Cost of High Speed Cameras

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Image Sensors

- 5.1.2 Lens

- 5.1.3 Battery

- 5.1.4 Memory Systems

- 5.2 By Frame Rate

- 5.2.1 1,000-5,000

- 5.2.2 5,001-20,000

- 5.2.3 20,001-100,000

- 5.2.4 Greater Than 100,000

- 5.3 By Application

- 5.3.1 Entertainment & Media

- 5.3.2 Sports

- 5.3.3 Consumer Electronics

- 5.3.4 Research & Design

- 5.3.5 Industrial Manufacturing

- 5.3.6 Military & Defense

- 5.3.7 Aerospace

- 5.3.8 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Latin America

- 5.4.4.2 Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Photron LTD.

- 6.1.2 Olympus Corporation

- 6.1.3 NAC Image Technology

- 6.1.4 Mikrotron GMBH

- 6.1.5 PCO AG

- 6.1.6 Weisscam

- 6.1.7 Vision Research Inc.

- 6.1.8 Optronis GMBH

- 6.1.9 Motion Capture Technologies

- 6.1.10 Del Imaging Systems, LLC

- 6.1.11 Ix-Cameras Inc.