|

市场调查报告书

商品编码

1640330

东非石油和天然气上游 -市场占有率分析、产业趋势、成长预测(2025-2030)East Africa Oil and Gas Upstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

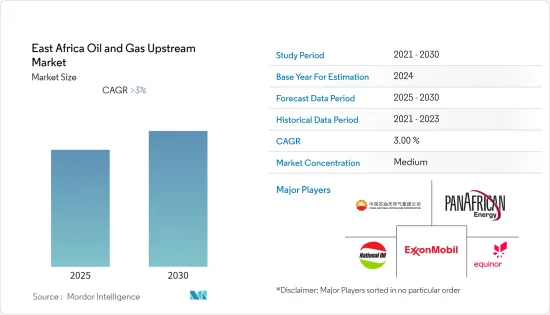

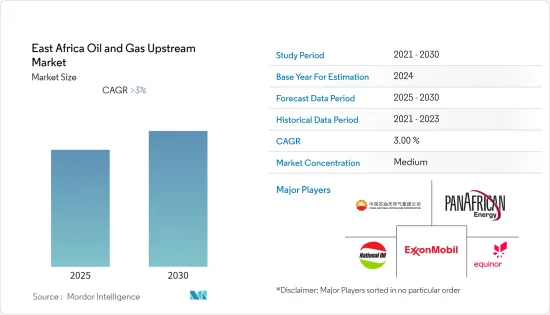

预计东非油气上游市场在预测期内复合年增长率将超过3%。

2020 年市场受到 COVID-19 的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,该地区石油和天然气产量和消费的成长预计将在预测期内提振东非石油和天然气上游市场。

- 同时,南苏丹和索马利亚等东非国家的不稳定可能会阻碍该地区石油和天然气产业的成长。

- 然而,该全部区域越来越多的探勘计划预计将为市场参与企业提供机会。

- 由于对石油业的投资增加,预计肯亚将在预测期内主导市场。

东非油气上游市场趋势

陆上部门主导市场

- 截至2021年,陆上油气天然气田非油气总产量的较大比例。例如,南苏丹的石油产量将仅来自陆上油田,从2010年的每天31,000桶增加到2021年的每天153,000桶。

- 对石油产品的需求不断增长,以及东非国家透过现有和新发现扩大石油和天然气产量的努力预计将在预测期内推动陆上领域的上游活动。

- 2022 年 7 月,刚果民主共和国 (DRC) 政府宣布计划在未来几轮许可中提供 27 个石油区块和 3 个天然气区块。 27个油田中,3个位于刚果中部省沿海盆地,11个位于坦噶尼喀湖周边,9个位于库韦特中部,4个位于艾伯特湖周边。这三个气田位于基伍湖沿岸。

- 2022 年 10 月,印度国家石油公司子公司 ONGC Videsh Ltd (OVL) 和 Indian Oil Corp. Ltd (IOCL) 宣布收购 Tullow Oil PLC 正在推进的 34 亿美元石油计划约 50% 的参与权益。 PLC 谈判共同收购

- 因此,预计陆上产业将在预测期内主导市场。

肯亚正在经历显着的成长

- 在东非地区,肯亚很可能成为预测期内原油产量大幅增加的主要国家之一,目前石油消费量量约2%。

- 产量的增加预计将归因于 ONGC Videsh、IOCL 和 TotalEnergies 等公司的投资决定。

- 从2014年开始,该国钻机数量从2011年的1座增加到11座,许多国际石油公司的勘探和生产活动大幅增加。然而,到2021年,该国祇有四座钻机在运作中。

- 2022 年 2 月,TotalEnergies 和艾伯特湖开发案的合作伙伴宣布了乌干达和坦尚尼亚的最终投资决定和计划启动。

- 2014年和2020年的油价暴跌对市场造成了严重影响。然而,此后已经恢復,这可以从该国石油和天然气行业最终投资决策数量的增加看出。

- 石油和天然气上游计划投资的增加预计将在预测期内推动肯亚石油和天然气上游市场的成长。

东非油气上游产业概况

东非上游油气市场适度整合。主要企业包括(排名不分先后)肯亚国家石油公司、Equinor ASA、埃克森美孚、泛非能源坦尚尼亚有限公司和中国石油天然气集团公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年石油产量预测(单位:千桶/日)

- 2027年天然气产量预测(单位:十亿立方英尺/天)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 位置

- 陆上

- 离岸

- 地区

- 坦尚尼亚

- 莫三比克

- 肯亚

- 其他东非地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- National Oil Corporation of Kenya

- Equinor ASA

- Exxon Mobil Corporation

- PanAfrican Energy Tanzania Ltd

- China National Petroleum Corporation

- TotalEnergies SE

第七章 市场机会及未来趋势

简介目录

Product Code: 51486

The East Africa Oil and Gas Upstream Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing production and consumption of oil and gas in the region are expected to boost East Africa's oil and gas upstream market during the forecast period.

- On the other hand, instability in East African countries like South Sudan and Somalia may impede growth in the oil and gas sector in the region.

- However, an increasing number of exploration projects across the region are expected to act as an opportunity for the market players.

- Kenya is expected to dominate the market during the forecast period due to the rising investment in the oil industry.

East Africa Oil and Gas Upstream Market Trends

Onshore Sector to Dominate the Market

- As of 2021, onshore oil and gas fields accounted for a significant share of the total oil and gas production in East Africa. For example, South Sudan's oil production, which solely comes from onshore oilfields, increased from 31 thousand barrels per day in 2010 to 153 thousand barrels per day in 2021.

- The increasing demand for petroleum products and the East African countries' efforts to boost oil and gas production through existing and new discoveries are expected to drive the upstream activities in the onshore segment during the forecast period.

- In July 2022, the government of the Democratic Republic of Congo (DRC ) announced its plans to put on offer 27 oil blocks and three gas blocks in its upcoming licensing round. Of the 27 oil blocks, three are in the coastal basin of the Kongo Central province, 11 are near Lake Tanganyika, nine are in the Cuvette Centrale, and four are near Lake Albert. The three gas blocks are located on Lake Kivu.

- In October 2022, a consortium of India's national oil company's subsidiary ONGC Videsh Ltd (OVL) and Indian Oil Corp. Ltd (IOCL) announced that they are in talks with Tullow Oil PLC to jointly acquire around 50% participating interest in the latter's USD 3.4 billion oil project in Kenya.

- Therefore, due to such factors, the onshore sector is expected to dominate the market during the forecast period.

Kenya to Witness Significant Growth

- In the East African region, Kenya is likely to be one of the significant countries witnessing a significant ramp-up of crude oil production during the forecast period, up from approximately 2% of the country's current oil consumption.

- The production growth is expected due to the investment decision made by companies like ONGC Videsh, IOCL, and TotalEnergies.

- The country witnessed a significant rise in exploration and production activities from a number of international oil companies, starting in 2014 when the rig count in the country increased to 11 from a mere 1 in 2011. However, in 2021, the country only had four operational rigs.

- In February 2022, TotalEnergies and the Lake Albert Development Project partners announced the final investment decision and the launch of the project in Uganda and Tanzania, representing a total investment of approximately USD 10 billion.

- The crude oil prices crash of 2014 and 2020 severely impacted the market. However, it has recovered since then, which can be observed through the increasing number of final investment decisions in the country's oil and gas sector.

- The increased investment in upstream oil and gas projects is likely to drive the growth of Kenya's oil and gas upstream market during the forecast period.

East Africa Oil and Gas Upstream Industry Overview

The East African oil and gas upstream market is moderately consolidated. Some of the major companies include (in no particular order) the National Oil Corporation of Kenya, Equinor ASA, ExxonMobil Corporation, PanAfrican Energy Tanzania Ltd, and China National Petroleum Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Oil Production Forecast in thousand barrels per day, till 2027

- 4.3 Natural Gas Production Forecast in billion cubic feet per day, till 2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 PESTLE ANALYSIS

5 MARKET SEGMENTATION

- 5.1 Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 Tanzania

- 5.2.2 Mozambique

- 5.2.3 Kenya

- 5.2.4 Rest of East Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 National Oil Corporation of Kenya

- 6.3.2 Equinor ASA

- 6.3.3 Exxon Mobil Corporation

- 6.3.4 PanAfrican Energy Tanzania Ltd

- 6.3.5 China National Petroleum Corporation

- 6.3.6 TotalEnergies SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219