|

市场调查报告书

商品编码

1640336

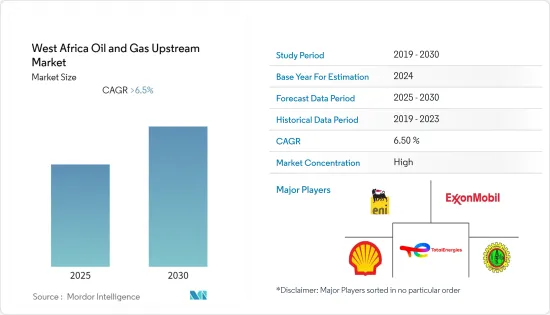

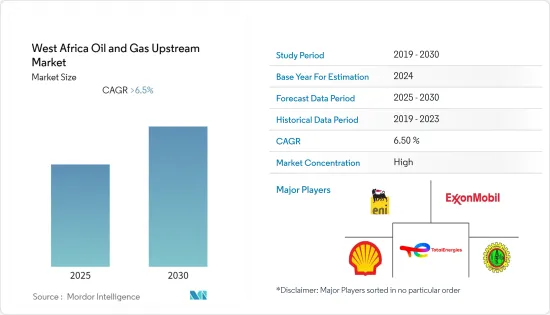

西非石油和天然气上游 -市场占有率分析、产业趋势、成长预测(2025-2030)West Africa Oil and Gas Upstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

西非石油和天然气上游市场预计在预测期内复合年增长率将超过6.5%。

COVID-19 的爆发对市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 由于各种地缘政治原因,该地区石油和天然气产量增加以及原油价格上涨等因素可能会在预测期内推动市场。

- 然而,政治不稳定,加上石油和天然气基础设施遭到破坏以及石油产品被盗,将导致相关人员的商业损失,并降低对石油和天然气计划的投资兴趣,导致西非石油和天然气需求下降。预计期内天然气上游市场将受到压制。

- 近年来,该地区取得了多个海上发现,预计将为上游石油和天然气公司在该地区的投资创造有利可图的机会。

- 随着油价回升、营运商信心增强、产量增加,尼日利亚出现了一批上游计划并主导市场。因此,预计尼日利亚将在预测期内主导市场。

西非油气上游市场趋势

海工行业预计将快速成长

- 与离岸部门相比,西非的陆上部门更容易受到恐怖活动的影响。因此,投资者更加关注离岸市场,儘管离岸计划和发现激增,但陆上行业仍未开发。

- 西非的海上石油和天然气产业持续成长,儘管速度缓慢,创造了新的市场潜力。石油勘探商和生产商继续扩大在西非近海深水和超深水地区的业务,特别是在南部和西部非洲,重大计划正在启动或宣布,资源正在评估和开发。

- 西非海上勘探和生产燃气公司的成长主要得益于政府努力提供重大奖励和支持措施以释放投资机会,以及尼日利亚和加纳等国成熟海上生产区块的替代方案。勘探该地区感兴趣。

- 2022年8月,尼日利亚国营石油公司尼日利亚国家石油公司(NNPC)将与跨国石油公司壳牌、Equinox、雪佛龙、埃克森美孚、中石化、尼日利亚南大西洋石油公司分享五个深水区块的石油产量合约。它计划在未来20年内生产多达100亿桶石油。 OML128、130、132、133和138区块由NNPC共同和单独拥有。

- 此外,安哥拉、加纳和奈及利亚还有多项蕴藏量开发长期竞标。最近在西非近海地区也有成功的发现,例如在象牙海岸共和国海岸和加纳海岸发现了埃尼油田。这些发现需要进一步评估,该地区的开发活动预计将在预测期内吸引投资者并推动市场需求。

- 综上所述,预计西非石油和天然气上游市场在预测期内将以海上细分为主。

尼日利亚主导市场的前景

- 奈及利亚是非洲探明石油和天然气蕴藏量最大的国家之一。截至2021年,奈及利亚天然气蕴藏量为5.53兆立方米,原油储量为3,690万桶。在此期间,探明天然气蕴藏量增加了近10%,但探明石油蕴藏量自2006年以来基本持平。

- 奈及利亚正面临现金流管理、收入下降和兑换问题的困扰。尼日利亚正在采取积极行动应对经济衰退。我们正在探索许多替代收入来源,特别是透过天然气商业化和基础设施扩建。

- 此外,该国计划成为非洲的出口中心,不仅向该地区国家出口,还向印度和中国等亚洲国家出口,预计未来这些国家的天然气需求将增加,上游活动将变得活性化。

- 2022年1月,奈及利亚国家石油公司获得非洲进出口银行50亿美元的企业融资承诺,为尼日利亚上游产业的重大投资提供资金。预计这将推动预测期内的市场成长。

- 因此,由于上述因素,预计奈及利亚在预测期内将主导西非油气上游市场。

西非油气上游产业概况

西非上游油气市场整合。该市场的主要企业包括(排名不分先后)壳牌公司、TotalEnergies SE、埃尼公司、埃克森美孚公司和尼日利亚国家石油公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 石油天然气产业宏观经济经济状况

- 至2028年原油产量及预测(单位:千桶/日)

- 天然气产量及预测(百万吨油当量,2028年)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 部署地点

- 陆上

- 离岸

- 地区

- 奈及利亚

- 迦纳

- 象牙海岸共和国

- 塞内加尔

- 其他西非地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Shell PLC

- TotalEnergies SE

- Eni SpA

- Exxon Mobil Corporation

- Nigerian National Petroleum Corporation

- Ghana National Petroleum Corporation(GNPC)

- BP PLC

- Cairn Energy PLC

- Chevron Corporation

第七章 市场机会及未来趋势

简介目录

Product Code: 51604

The West Africa Oil and Gas Upstream Market is expected to register a CAGR of greater than 6.5% during the forecast period.

The outbreak of COVID-19 negatively impacted the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as the region's increasing oil and gas production and the strengthening of crude oil prices due to various geopolitical reasons are likely to drive the market during the forecast period.

- However, political instability, coupled with vandalism of oil and gas infrastructure and theft of petroleum products, results in business losses for stakeholders, reducing the confidence to invest in oil and gas projects, which is anticipated to restrain the West African oil and gas upstream market during the forecast period.

- Several offshore discoveries have been done in the region in recent years, which is expected to create a lucrative opportunity for oil and gas upstream companies to invest in this region.

- Nigeria dominated the market due to a large number of upstream projects coming up in the country due to operators gaining confidence and increased production, with a rise in crude oil prices after a slump. Therefore, Nigeria is expected to dominate the market during the forecast period.

West Africa Oil & Gas Upstream Market Trends

The Offshore Segment is Expected to be the Fastest-growing Segment

- In contrast to the offshore sector, the onshore sector in West Africa is vulnerable to terrorist operations. As a result, investors are more focused on the offshore market, leading to a proliferation of offshore projects and discoveries while the onshore sector remains unexplored.

- The offshore oil and gas sector in West Africa is still growing, albeit slowly, which is creating new market potential. Oil explorers and producers have continued to extend their operations in West Africa's offshore deep and ultra-deep space, particularly in Southern and Western Africa, where substantial projects have either started or have been announced, awaiting resource appraisal and development.

- The growth of West Africa's offshore exploration and production activities has been mainly driven by the efforts of governments in their region to provide key incentives and supporting policies to unlock the investment opportunity, as well as the growing number of international oil and gas companies interested in exploring alternative fields to replace the maturing offshore producing sites in countries such as Nigeria and Ghana.

- In August 2022, Nigeria's state-owned oil company, Nigerian National Petroleum Company (NNPC) Limited, renewed its oil production sharing contracts for five deep-water blocks with multinational oil companies Shell, Equinox, Chevron, ExxonMobil, Sinopec, and Nigerian company South Atlantic Petroleum. Over the following 20 years, the business plans to generate up to 10 billion barrels of oil. The OML 128, 130, 132, 133, and 138 blocks are jointly and individually owned by NNPC.

- Furthermore, in Angola, Ghana, and Nigeria, several long-term tenders for the development of reserves have been issued. The West African offshore region has also recently witnessed successful discoveries, such as Eni's recent finding in offshore Cote d'Ivoire and Ghana. Such discoveries will require an additional appraisal, and development activities in the region are likely to attract investors, thereby driving the market demand during the forecast period.

- Thus, based on the above-mentioned factors, the offshore segment is expected to dominate the West African oil and gas upstream market during the forecast period.

Nigeria is Expected to Dominate the Market

- In terms of proven oil and gas reserves, Nigeria is one of Africa's largest nations. Nigeria had reserves of 5.53 trillion cubic meters of natural gas and 36.9 million barrels of crude oil as of 2021, respectively. While the nation's proven gas reserves have increased by almost 10% during the same time, proved oil reserves have remained largely stable since 2006.

- Nigeria is having trouble managing its cash flow, low revenue, and convertibility problems. The nation is actively taking action to combat the economic downturn. It is investigating a number of alternative revenue streams, particularly through the commercialization of gas and the expansion of its infrastructure.

- Furthermore, the country plans to become an export hub in Africa by exporting not only to regional countries but also to other Asian countries like India and China, where the gas demand is anticipated to increase in the coming years, resulting in increased upstream activities in the region.

- In January 2022, Nigerian National Petroleum Company Ltd secured a USD 5 billion corporate finance commitment from the African Export-Import Bank to fund major investments in the Nigerian upstream sector. This is likely to aid the market's growth during the forecast period.

- Therefore, based on the above-mentioned factors, Nigeria is expected to dominate the West African oil and gas upstream market during the forecast period.

West Africa Oil & Gas Upstream Industry Overview

The West African oil and gas upstream market is consolidated. Some of the key players in the market (in no particular order) include Shell PLC, TotalEnergies SE, Eni SpA, Exxon Mobil Corporation, and Nigerian National Petroleum Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Macro-economic Condition in the Oil and Gas Industry

- 4.3 Crude Oil Production and Forecast in thousand barrels per day, till 2028

- 4.4 Natural Gas Production and Forecast in million-ton oil equivalent, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 Nigeria

- 5.2.2 Ghana

- 5.2.3 Ivory Coast

- 5.2.4 Senegal

- 5.2.5 Rest of West Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell PLC

- 6.3.2 TotalEnergies SE

- 6.3.3 Eni SpA

- 6.3.4 Exxon Mobil Corporation

- 6.3.5 Nigerian National Petroleum Corporation

- 6.3.6 Ghana National Petroleum Corporation (GNPC)

- 6.3.7 BP PLC

- 6.3.8 Cairn Energy PLC

- 6.3.9 Chevron Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219