|

市场调查报告书

商品编码

1640342

亚太地区按钮和讯号设备市场占有率分析、产业趋势和成长预测(2025-2030 年)APAC Push Buttons And Signaling Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

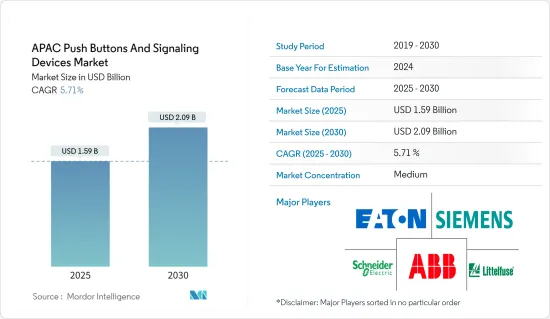

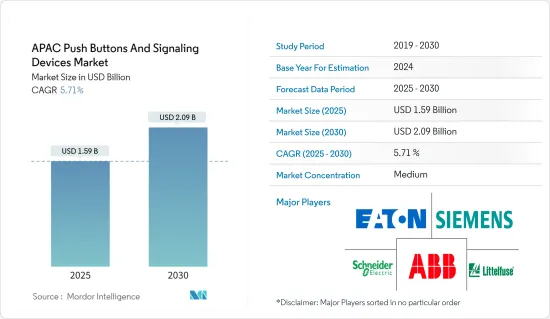

亚太地区按钮和讯号设备市场规模预计在 2025 年为 15.9 亿美元,预计到 2030 年将达到 20.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.71%。

按钮是一种机械开关,可以打开或关闭一个或多个电路来控制机器或製程的某些方面。按钮通常用于启动或停止某个过程,而开关通常用于开启和关闭。在亚洲国家,重置紧急停止装置最常见的方式是拉动释放机制。

主要亮点

- 按钮和信号装置控制安装在工业区的加工设备。按钮设计用于透过人的手指或手臂操作,通常由塑胶或金属等硬质材质製成。大多数信号装置用于指示警告。根据要求、应用或环境,警报也可以是视觉或听觉的。

- 按钮和信号装置等指示装置控制和监控工业设备和机械。这些设备可能包括多个按钮、指示灯以及声音和视觉信号设备。这些设备可用作指示器,发现整个设施的设备故障或材料短缺,提醒操作员设施内的任何危险或死亡事件,并减少製程停机时间。随着食品饮料、化学、製药、石油天然气等行业的工业安全标准日益严格,按钮和讯号设备的市场正在不断扩大。

- 按钮在工业应用中更受青睐,因为它们比其他开关提供更多的功能。与仅提供一项特定功能的标准控制器不同,按钮可以透过连桿连接到其他机械应用。工业应用中的这种灵活性可帮助员工只需按一下按钮即可控制机器的多个方面。在汽车产业,这些设备广泛应用于商用车。

- 号誌装置和系统传达有关机器、生产线或单一工业设备运作的简单讯息。很难想像如果没有适当的低水平光学和声音讯号设备,工业工厂如何正常运作。

亚太地区按钮和讯号设备市场趋势

汽车市场可望占据主要市场占有率

- 为了减少二氧化碳排放,汽车产业正在经历重大变革时期。电动车市场已经见证了大规模的投资,自动启动功能按钮和其他自动化车辆机制的实施也增加了。

- 按钮已被用来提供汽车的无钥匙进入功能。由于按钮点火的便利性和可靠性,许多汽车公司已经广泛采用按钮点火器。

- 由于交通事故和车辆内部损坏的增加,汽车製造商正致力于提高车辆安全性。例如,可以使用按钮来指示车辆是否应该通过交叉路口。这主要提供了易用性,同时提高了乘客安全性。

- 面板灯和喇叭是汽车中最常使用的信号装置。汽车製造商也致力于提供视讯监控和频闪灯等附加功能。此外,现在所有新生产的汽车都配备了紧急照明。预计这也将在预测期内推动市场成长。

- 根据东协汽车联合会预测,2023年,印尼将成为东南亚汽车销量最高的国家,销售量将超过100万辆。

- 在整个全部区域,疫情危机的影响是毁灭性的,许多汽车零售商关闭了一个多月,导致汽车製造商的利润与前两年相比出现了前所未有的下降。可能需要花费数年的时间才能从盈利的下滑中恢復过来。

印度占大部分市场占有率

- 按钮已被用来提供无钥匙进入汽车的功能。按钮点火器由于其舒适性和可靠性已被印度大多数汽车公司广泛采用。据 SIAM India 称,2023 财年印度轻型商用车整体销量将达到约 604,000 辆,高于上年度。

- 面板灯和喇叭是汽车中最常使用的信号装置。汽车製造商也专注于提供视讯监控和频闪灯等附加功能。此外,现在所有新生产的汽车都配备了紧急照明。预计这也将在预测期内推动市场成长。

- 大型工业青睐并选择按钮和讯号装置的自动化主要是为了避免人为错误因素。 SCADA、PLC 和 IT 控制等工业控制系统的出现正在推动市场成长。推动该国需求的关键因素是设备在工业空间中提供的灵活管理和功能以及增强工业现场的安全工作环境。

- 从长远来看,疫情加速了印度各地对可再生能源的需求,预计也将推动市场成长。然而,由于疫情影响了所有终端用户产业,短期影响带来的供应链和需求不确定性预计将阻碍市场成长。

亚太地区按钮与讯号设备产业概况

亚太地区的按钮和讯号设备市场处于半静态状态。越来越多的参与者透过策略併购和与小型企业的合作来增加其市场份额。市场的主要企业包括 ABB 有限公司、施耐德电气公司、西门子股份公司和伊顿公司。

- 2023 年 12 月感测器设备製造商 Pepperl+Fuchs 推出了一款新型按钮盒,可透过 M12 连接器轻鬆连接到 IO-Link 网络,无需复杂的接线。

- 2023年10月,SCHURTER推出了下一代MSM按钮开关。 MSM 数十年的成功基于其优雅的设计和广泛的精密按钮和开关。超小型微动开关现在采用不銹钢机壳,可以安装在安装深度较小的装置中。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 市场驱动因素

- 增加火灾警报管理和安全系统的使用

- 有利于工业安全的政府法规

- 市场限制

- 建设支援基础设施和自动化的前期投资较高

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按产品

- 圆形和方形体型

- 不亮的按钮

- 其他产品

- 按类型

- 听得见的

- 能见度

- 其他类型

- 按最终用户产业

- 车

- 能源和电力

- 製造业

- 饮食

- 运输

- 其他最终用户产业

- 按国家

- 印度

- 中国

- 日本

第六章 竞争格局

- 公司简介

- Siemens AG

- Eaton Corporation

- ABB Ltd

- Schneider Electric

- Littelfuse

- Carling Technologies

- Omron Industrial Automation(Omron Corporation)

- NKK Switches

- Panasonic

- ITW Switches

- Wurth Electronics

- Nihon Kaiheiki

- Marquardt Mechatronik

- Kaihua Electronics

第七章投资分析

第 8 章:市场的未来

The APAC Push Buttons And Signaling Devices Market size is estimated at USD 1.59 billion in 2025, and is expected to reach USD 2.09 billion by 2030, at a CAGR of 5.71% during the forecast period (2025-2030).

A push button is a mechanical switch that opens or closes one or more circuits to control an aspect of a machine or process. The push button is usually used to start or stop a process, with switches ordinarily open or closed. The most common method of resetting an emergency stop in Asian countries is the pull-to-release mechanism.

Key Highlights

- Push buttons and signaling devices control some aspects of the processing equipment installed in industrial areas. Press buttons are shaped to be used by a person's finger or arm, and most of the hard material is plastic or metal. Most signal devices are used for alarm purposes, indicating the warning. An alarm may also be visible or audible depending on the requirement, application, or environment.

- Pilot devices such as push buttons and signaling devices control and monitor industrial equipment and machinery. These devices include several push buttons, indicating lights, and audible-visual signaling devices. These devices can be used as indicators to spot malfunctions and material shortages across facilities and alert operators to any hazard or fatality in the facility, reducing process downtime. The market for push buttons and signaling devices has expanded as industrial safety standards for food and beverages, chemicals, and pharmaceuticals and the oil and gas industries have become more stringent.

- Push buttons are preferred in industrial applications due to the functionality afforded over other switches. Unlike a standard controller that provides one particular function, push buttons can connect to other mechanical applications through linkages. This flexibility in industrial applications helps the employees control multiple aspects of a machine by pushing a button. The automotive industry extensively uses these devices in commercial vehicles.

- Signaling devices and systems convey simple messages concerning machinery, manufacturing lines, or individual industrial equipment operations. Imagining a properly functioning industrial plant without appropriate low-level optical and audible signaling devices is difficult.

APAC Push Buttons And Signaling Devices Market Trends

The Automotive Segment is Expected to Hold a Significant Market Share

- The automotive segment is going through a considerable transformation to curb its carbon footprint. The EV market witnessed significant investments; the implementation of push buttons also increased for auto-start functions and other automated vehicle mechanisms.

- Push buttons have been used to implement keyless access in vehicles. Many automobile companies widely adopt push-button ignition due to its comfort and reliability.

- With the increasing number of road accidents and internal vehicle damage, automotive manufacturers focus on improving vehicular safety. For instance, push buttons can be used to indicate if the vehicle is required to pass through a cross-section. This majorly provides ease of use while improving passenger safety.

- Panel lights and horns are vehicles' most commonly used signaling devices. Automotive manufacturers also focus on providing additional features, such as video surveillance and strobes. Emergency lighting is also included in all the newly manufactured vehicles. This is also anticipated to drive the market's growth during the forecast period.

- According to the ASEAN Automotive Federation, in 2023, Indonesia accounted for the most motor vehicle sales across Southeast Asia, with over one million sales generated.

- Across the region, the repercussions of the pandemic crisis have been immense and unprecedented, as many auto-retail stores remained closed for a month or more, resulting in a decline in profit by the automotive manufacturer compared to the previous two years. It may take years to recover from this plunge in profitability.

India Holds The Majority Market Share

- Push buttons have been used to implement keyless access in vehicles. Many automobile companies widely adopt push-button ignition due to its comfort and reliability in the country. According to SIAM India, the sales volume for light commercial vehicles across India was around 604 thousand units in FY 2023, an increase from the previous year.

- Panel lights and horns are the most commonly used signaling devices by vehicles. Automotive manufacturers also focus on providing additional features, such as video surveillance and strobes. Emergency lighting is also included in all the newly manufactured vehicles. This is also anticipated to drive the market's growth during the forecast period.

- Large-scale industries prefer and opt for automation of push-button and signaling devices, primarily to avoid the human error factor. The emergence of industrial control systems, such as SCADA, PLC, and IT control, aided the market growth. The primary factors that drive demand in the country are the flexibility in management and functionality that devices offer in the industrial space and the enhancement of a safe work environment on industry floors.

- In the long run, the demand for renewable energy across India, accelerated by the pandemic, is also expected to boost the market's growth. However, the uncertainty in the supply chain and demand brought by the short-term repercussions is expected to stall the market's growth as the pandemic impacted all end-user industries.

APAC Push Buttons And Signaling Devices Industry Overview

The Asia-Pacific push button and signaling device market is semi-consolidated. An increasing number of players are increasing their share percentage through strategic mergers and acquisitions and partnerships with several small players. Some of the key players in the market include ABB Ltd, Schneider Electric SE, Siemens AG, and Eaton Corporation.

- December 2023: Pepperl+Fuchs, a sensor device manufacturer, launched a new push button box that can be easily connected to IO-Link networks via an M12 connector without complex wiring.

- October 2023: SCHURTER launched the next generation of MSM push button switches. The foundation of MSM's decades of success is its elegant design and a vast selection of highly accurate push buttons and switches. Subminiature microswitches, which allow installation in units with a small mounting depth, were made available for stainless steel enclosures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Use of Fire Alarm Management Systems and Safety Systems

- 4.2.2 Favorable Government Regulations for Industrial Safety

- 4.3 Market Restraints

- 4.3.1 High Initial Investment in Creating Supporting Infrastructure and Automation

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Round or Square Body Type

- 5.1.2 Non-lighted Push Button

- 5.1.3 Other Products

- 5.2 By Type

- 5.2.1 Audible

- 5.2.2 Visible

- 5.2.3 Other Types

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Energy and Power

- 5.3.3 Manufacturing

- 5.3.4 Food and Beverage

- 5.3.5 Transportation

- 5.3.6 Other End-user Industries

- 5.4 By Country

- 5.4.1 India

- 5.4.2 China

- 5.4.3 Japan

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Eaton Corporation

- 6.1.3 ABB Ltd

- 6.1.4 Schneider Electric

- 6.1.5 Littelfuse

- 6.1.6 Carling Technologies

- 6.1.7 Omron Industrial Automation (Omron Corporation)

- 6.1.8 NKK Switches

- 6.1.9 Panasonic

- 6.1.10 ITW Switches

- 6.1.11 Wurth Electronics

- 6.1.12 Nihon Kaiheiki

- 6.1.13 Marquardt Mechatronik

- 6.1.14 Kaihua Electronics