|

市场调查报告书

商品编码

1640347

中东和非洲流程自动化:市场占有率分析、产业趋势和成长预测(2025-2030 年)Middle East And Africa Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

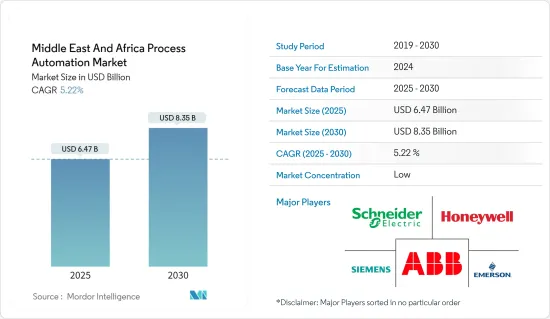

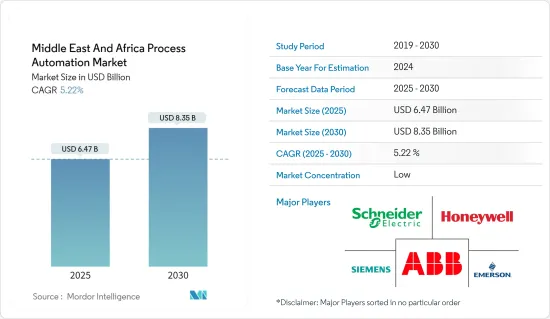

中东和非洲过程自动化市场规模预计在 2025 年为 64.7 亿美元,预计到 2030 年将达到 83.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.22%。

自动化对于现代製造和工业流程来说已成为至关重要的。它可以帮助公司实现他们的优先事项。该地区的公司正在藉助 SCADA、DCS、MES、PLC 等各种技术实现业务自动化。对这些技术的需求正在成长,许多供应商正在提供解决方案来帮助公司提高製造流程的效率。

主要亮点

- 製造流程自动化带来许多好处,包括更容易监控、减少浪费和更快的生产速度。该技术透过标准化来提高质量,并按时、低成本地向客户提供可靠的产品。

- 采用 SCADA、HMI、PLC 系统和提供可视化的软体在连接工业机器和设备并获取即时资料方面发挥关键作用,从而减少产品故障和停机时间。转变为预测和规定性的决策状态。

- 工业物联网 (IIoT) 和工业 4.0 是整个物流链开发、生产和管理的新技术方法的核心,即智慧工厂自动化。这些是工业领域的主导趋势,机器和设备透过网路连接。

- 此外,透过自动化实现内部流程现代化并改善对营运和维护资讯的存取将使该地区的行业能够简化生产和分销并实现更高的产量比率。

- 政府增加对新技术的投入预计将使沙乌地阿拉伯成为中东地区工厂自动化和工业控制系统产业的领先国家之一。这使得工业 4.0 对于该国未来的自动化和製造业至关重要。

- 沙乌地阿拉伯的 2030 愿景展望了工业和自动化的新时代,充分利用了该国的地位、战略伙伴关係、能源资源和物流。该国还计划在2030年实现可再生能源和工业製造部门的自动化,并在国内满足50%的国内需求。

中东和非洲的流程自动化市场趋势

石油和天然气终端用户产业预计将占据主要市场占有率

- 自动化是石油和天然气终端用户产业的主要驱动力和趋势。数位化、自动化和先进技术使操作员和技术人员能够即时存取关键性能、资产状态和技术资讯。该地区的石油和燃气公司越来越多地采用流程自动化工具,以实现更好的决策、故障排除和效能效率。

- 在上游石油和天然气终端用户产业,多项钻井活动必须符合严格的政府法规,并需要精心规划以降低营运成本。最终用户产业通常处理庞大的空间资料集来做出多项决策。为了利用空间资料的力量,人们正在采用多种流程自动化工具和分析引擎。

- 中东的石油和天然气公司在向更多可再生能源转型时经常面临挑战。为了满足多种场景的需求,能源公司需要在经营模式中专注于流程自动化等颠覆性技术,拥抱创新并提高效率。

- 截至 2024 年 2 月,该地区共有 296 个陆上钻井钻机,另有 53 个海上钻井平台位于中东,95 个陆上钻井钻机位于该地区。非洲近海部署了16个钻机。

- 石油和天然气加工过程对安全性和可靠性的需求正在迅速增长。供应链对自动化、行业专业知识和广泛的合作伙伴网路有着巨大的需求。製程自动化帮助石油和天然气生产商整合资讯、控制电力并提供安全解决方案,以满足动态的全球需求。

- 随着原油价格波动,一些石油和天然气公司致力于降低整个分销链的成本并提高效率。为了在竞争日益激烈的环境和不断缩小的零售利润中生存,必须优化多个部门的多个流程。

预计阿联酋将占据较大的市场占有率

- 在工业4.0的推动下,阿拉伯联合大公国(UAE)不断创新并巩固其在工厂自动化和工业控制系统产业的地位。智能技术在市场上的采用正在对国民经济产生正面影响。

- 在阿联酋,建筑业在经济提升和发展中发挥着至关重要的作用。 SCADA 在建设产业的应用越来越广泛。 SCADA(监控和资料收集)允许使用者在本地或远端控制工业操作。 SCADA 在建设产业的优势在于它能够即时监控和收集资料并将其处理用于工业目的。

- 随着全球製造业日益整合,自动化投资的压力也越来越大。

- 阿拉伯联合大公国(UAE)的智慧工厂遭受的网路攻击日益增多,引发了人们对工业控制系统使用的担忧。政府也制定了计划,以遏制此类犯罪的上升。这与为避免网路安全漏洞风险而国内生产智慧工厂的工业控制系统的趋势相吻合。

- 流程发现、流程最佳化、流程智慧和流程协作等技术正在成为机器人流程自动化(RPA)的重要组成部分。展望未来,业务流程管理(BPM)和RPA更加紧密相关的趋势仍将持续。

- 阿联酋政府为使经济摆脱疫情的影响而推出的投资倡议,其中基础设施和电子行业是主要受益者,中小企业也实现了成长。基础设施和电子产业是工业控制系统硬体产品和软体解决方案的重度用户,因此预计将看到直接的正面影响。

中东和非洲流程自动化产业概况

中东和非洲的流程自动化市场高度分散,既有全球参与者,也有中小型企业。市场的主要参与者包括 ABB 有限公司、西门子股份公司、施耐德电气、艾默生电气公司和霍尼韦尔国际公司。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2024年2月,能源管理和自动化数位转型的领导者之一Schneider Electric与科技公司英特尔和红帽公司合作,宣布发布其分散式控制节点(DCN)软体框架。作为Schneider ElectricEcoStruxure 自动化的扩展,新框架使工业企业能够转向软体定义的即插即用解决方案,以增强营运、确保品质、降低复杂性并优化成本。

- 2023 年 10 月:艾默生推出支援其无边界自动化愿景的新技术,这是一个以软体为中心的工业自动化平台,连接来自现场、边缘和云端的资料。它为消费者提供更安全、灵活和可扩展的解决方案,并帮助优化和自动化业务。艾默生的创新包括 DeltaV Edge Environment、乙太网路 APL 和 DeltaV PK Flex Controller。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观趋势对中东和非洲过程自动化市场的影响

第五章 市场动态

- 市场驱动因素

- 更加重视能源效率和降低成本

- 安全自动化系统的需求

- 工业物联网的出现

- 市场挑战

- 成本和实施挑战

第六章 市场细分

- 按通讯协定

- 有线

- 无线的

- 依系统类型

- 按系统硬体

- 监控和资料采集系统 (SCADA)

- 分散式控制系统(DCS)

- 可程式逻辑控制器 (PLC)

- 製造执行系统(MES)

- 阀门和致动器

- 马达

- 人机介面 (HMI)

- 製程安全系统

- 感应器和变送器

- 系统软体

- APC(独立和客製化解决方案)

- 先进的监理控制

- 多元模型

- 推理和顺序

- 基于资料分析和报告的软体

- 其他软体和服务

- 按系统硬体

- 按最终用户产业

- 石油和天然气

- 化工和石化

- 电力和公共产业

- 用水和污水

- 饮食

- 纸和纸浆

- 药品

- 其他最终用户产业

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

第七章 竞争格局

- 公司简介

- ABB Ltd

- Siemens AG

- Schneider Electric

- Emerson Electric Co.

- Honeywell International Inc.

- General Electric

- Mitsubishi Electric

- Fuji Electric

- Eaton Corporation

- Delta Electronics Inc.

第八章投资分析

第九章:市场的未来

The Middle East And Africa Process Automation Market size is estimated at USD 6.47 billion in 2025, and is expected to reach USD 8.35 billion by 2030, at a CAGR of 5.22% during the forecast period (2025-2030).

Automation has become an essential part of modern manufacturing and industrial processes. It helps enterprises to realize priorities. Companies in the region are automating their operations with the help of different technologies like SCADA, DCS, MES, and PLC. The demand for these technologies is escalating, and many vendors are manufacturing solutions to help enterprises achieve higher efficiency in their manufacturing processes.

Key Highlights

- Automation of manufacturing processes offers various benefits, such as effortless monitoring, reduction of waste, and production speed. This technology provides customers with improved quality with standardization and dependable products within time and at a much lower cost.

- Connecting the industrial machinery and equipment and obtaining real-time data have played a vital role in the adoption of SCADA, HMI, PLC systems, and software that offer visualization, thus enabling reducing the faults in the product, reducing downtime, scheduling maintenance, and switching from being in the reactive state to predictive and prescriptive stages for decision-making.

- The Industrial Internet of Things (IIoT) and Industrial 4.0 are at the center of new technological approaches for the development, production, and management of the entire logistics chain, otherwise known as smart factory automation. They dominate industrial sector trends, with machinery and devices being connected via the internet.

- Further, modernizing internal processes with automation and better access to information about operations and maintenance will help the industry streamline production and distribution and allow for a higher yield in the region.

- Increased government spending on new technologies is expected to make Saudi Arabia one of the major countries in the Middle East in the factory automation and industrial control system industry. As a result, Industry 4.0 is important for the future of national automation and manufacturing.

- Saudi Arabia's 2030 vision aims for a new phase of industry and automation by exploiting the country's position, strategic partnerships, energy resources, and logistics. It also seeks to automate the country's renewable energy and industrial manufacturing sectors by 2030 and manufacture 50% of its needs within the country.

Middle East And Africa Process Automation Market Trends

The Oil and Gas End-user Industry is Expected to Hold a Significant Market Share

- Automation is a significant driver and trend in the oil and gas end-user industry. Digitization, automation, and advanced technologies give operators and technicians immediate access to critical performance, asset conditions, and technical information. Oil and Gas companies in the region are increasingly adopting process automation tools to enhance decision-making, troubleshooting, and performance efficiency.

- The upstream sector of the oil and gas end-user industry involves several drilling activities that must meet stringent government regulations and require intense planning to cut operational costs. Often, the end-user industry deals with vast sets of spatial data to make several decisions. Several process automation tools and analytical engines are employed to harness the full power of spatial data.

- Middle Eastern oil and gas companies often face challenges when transitioning to more renewable sources. To meet the demand in diverse situations, energy companies must focus on innovative technologies like process automation within their business models to embrace innovation and increase efficiency.

- As of February 2024, there were 296 land rigs in the region, with a further 53 rigs located offshore in the Middle East and 95 land rigs in that region; 16 rigs were located offshore in Africa.

- There is a surging demand for safety and reliability in the oil and gas industry processes. The supply chain creates a significant need for automation, industry expertise, and an extensive partner network. Process automation helps oil and gas producers integrate information, control power, and provide safety solutions to respond to the dynamic global demand.

- With the fluctuation in crude oil prices, several oil and gas companies focus on minimizing costs and maximizing efficiency throughout the distribution chain. To sustain itself in the rising competitive environment and decrease retail margins, the company needs to optimize several processes in multiple sectors.

The United Arab Emirates is Expected to Account For a Significant Market Share

- Fueled by Industry 4.0, the UAE continues to innovate and consolidate its position in the factory automation and industrial control systems industry. The adoption of smart technologies in the market has positively impacted the national economy.

- In the United Arab Emirates, the construction industry plays an essential role in economic upliftment and development. SCADA is being increasingly used in the construction industry. Supervisory Control and Data Acquisition (SCADA) allows users to control industrial operations on-site and remotely. The advantage of SCADA in the construction industry lies in the ability to monitor and gather data in real-time and then process it for industrial usage.

- Increasing global manufacturing integration is raising the pressure for automation investment, as cost minimization with quality maximization looms ever more significantly as an operating paradigm for Arab manufacturers.

- With cyber-attacks increasing in smart factories in the UAE, there is growing concern about using Industrial Control Systems. The government also has plans to curb the rise of such crimes. This aligns with the growing trend of industrial control systems manufactured in the country for smart factories to avoid the risk of cybersecurity breaches.

- Technologies such as process discovery, process optimization, process intelligence, and process orchestration are becoming a more significant part of Robotic Process Automation (RPA). There is an ongoing trend of increasing a closer relationship between business process management (BPM) and RPA in the future.

- With investment roll-outs by the government to revive the UAE economy from the effects of the pandemic, the infrastructure and electronics industry were marked as the primary beneficiaries, alongside the growth of small and medium-sized enterprises. The infrastructure and electronics industry are heavy users of industrial control systems' hardware products and software solutions and are expected to have a direct positive effect.

Middle East And Africa Process Automation Industry Overview

The Middle East and African process automation market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are ABB Ltd, Siemens AG, Schneider Electric, Emerson Electric Co., and Honeywell International Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024: Schneider Electric, one of the leaders in the digital transformation of energy management and automation, collaborated with the technology companies Intel and Red Hat and announced the release of a Distributed Control Node (DCN) software framework. An extension of Schneider Electric's EcoStruxure Automation, this new framework enables industrial companies to move to a software-defined, plug-and-produce solution to enhance their operations, ensure quality, reduce complexity, and optimize costs.

- October 2023: Emerson introduced new technologies to support its Boundless Automation vision, a software-centric industrial automation platform that connects data from the field, the edge, and the cloud. More secure, flexible and scalable solutions are provided to consumers to help optimize and automate their operations. Emerson's innovations include DeltaV Edge Environment, Ethernet APL and DeltaV PK Flex Controller.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macro Trends on the Middle East and Africa Process Automation Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Energy Efficiency & Cost Reduction

- 5.1.2 Demand for Safety Automation Systems

- 5.1.3 Emergence of IIoT

- 5.2 Market Challenges

- 5.2.1 Cost and Implementation Challenges

6 MARKET SEGMENTATION

- 6.1 By Communication Protocol

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By System Type

- 6.2.1 By System Hardware

- 6.2.1.1 Supervisory Control and Data Acquisition System (SCADA)

- 6.2.1.2 Distributed Control System (DCS)

- 6.2.1.3 Programmable Logic Controller (PLC)

- 6.2.1.4 Manufacturing Execution System (MES)

- 6.2.1.5 Valves and Actuators

- 6.2.1.6 Electric Motors

- 6.2.1.7 Human Machine Interface (HMI)

- 6.2.1.8 Process Safety Systems

- 6.2.1.9 Sensors and Transmitters

- 6.2.2 By System Software

- 6.2.2.1 APC (Standalone and Customized Solutions)

- 6.2.2.1.1 Advanced Regulatory Control

- 6.2.2.1.2 Multivariable Model

- 6.2.2.1.3 Inferential and Sequential

- 6.2.2.2 Data Analytics and Reporting-based Software

- 6.2.2.3 Other Software and Services

- 6.2.1 By System Hardware

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Power and Utilities

- 6.3.4 Water and Wastewater

- 6.3.5 Food and Beverage

- 6.3.6 Paper and Pulp

- 6.3.7 Pharmaceutical

- 6.3.8 Other End-user Industries

- 6.4 By Country

- 6.4.1 United Arab Emirates

- 6.4.2 Saudi Arabia

- 6.4.3 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Siemens AG

- 7.1.3 Schneider Electric

- 7.1.4 Emerson Electric Co.

- 7.1.5 Honeywell International Inc.

- 7.1.6 General Electric

- 7.1.7 Mitsubishi Electric

- 7.1.8 Fuji Electric

- 7.1.9 Eaton Corporation

- 7.1.10 Delta Electronics Inc.