|

市场调查报告书

商品编码

1640349

防水透气纺织品:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Waterproof Breathable Textiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

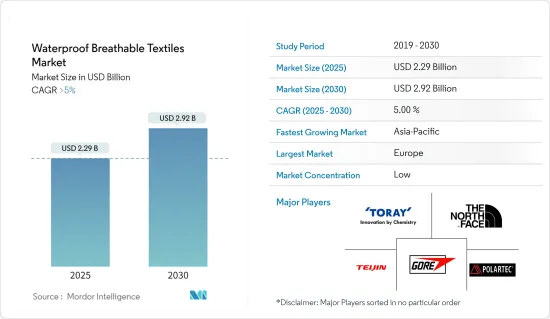

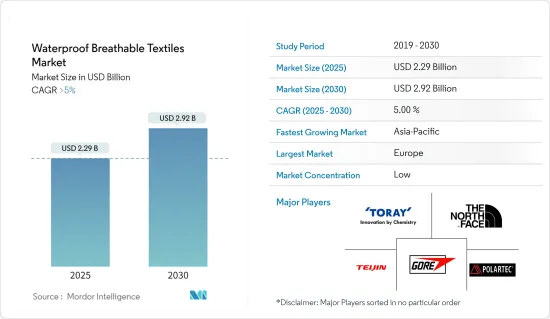

防水透气纺织品市场规模预计到2025年为22.9亿美元,预计到2030年将达到29.2亿美元,在预测期内(2025-2030年)复合年增长率将超过5%。

主要亮点

- 短期内,运动服和运动服行业需求的增加预计将推动防水透气布料市场的成长。

- 另一方面,PFAS 对健康和环境的有害影响正在阻碍市场成长。

- 由于全球供应链中断,COVID-19 大流行对市场产生了负面影响。疫情期间,许多主要负责供应纺织品、纺织品等原料的工厂纷纷停工。然而,随着主要终端用户产业恢復运营,市场在 2021 年显着復苏。

- 对永续性和新技术的日益关注预计将在未来几年创造更多机会。

- 预计欧洲将在预测期内主导市场。

防水透气纤维市场趋势

运动服和运动服领域预计将出现高成长

- 以聚四氟乙烯为基底的防水透气纤维用于各种运动服和运动服应用,例如健行靴、跑鞋、运动夹克、工作鞋、帽子、手套、背包以及其他运动服和工作服。

- 以聚氨酯和聚酯为基底的防水透气聚酯布料用于生产各种夹克、外套、户外服和工作服。

- 防水和透气的纤维用于慢跑者和徒步旅行者的运动服和运动服的设计,以帮助干燥衣服和控制汗水。

- 全球休閒市场预计将从2021年的2,770亿美元成长到2026年的3,810亿美元,成长率为7%,带动防水透气纺织品的需求。

- 在印度,根据青年事务和体育部的数据,印度政府透过 Khelo India 计画在 2021-22 年的体育支出达 83.9 亿印度卢比(约 1.12 亿美元)。此类支出和体育计划被认为可以支持所研究市场的成长。

- 人们对防水透气纺织品在运动产业中的好处的认识不断提高,预计将在预测期内进一步提振市场。

亚太地区成长最快

- 亚太地区防水透气纺织品市场预计将以最快的速度成长。防水透气纺织品越来越多地应用于运动服和运动服、防护衣、普通服饰和家用纺织品等行业。

- 中国对于运动服装、配件和鞋类来说是一个极具吸引力的市场。由于人事费用上升,跨国公司正在将业务转移到中国境外。该国对运动服和运动服的需求很高。根据国际贸易管理局预测,2024年,中国运动服饰市场规模预计将达到828亿美元,年增率为11%。

- 中国于2023年主办了2022年亚运。比赛于2023年9月23日至10月8日在杭州举行。亚运会通常有全部区域超过 10,000 名运动员参加。参与度的增加有助于国内运动服和运动服的需求。

- 印度越来越倾向全球健身趋势。由于生活方式的改变,人们的健康意识越来越强。人们正在采用新的健康习惯来维持健康的生活方式。印度运动服装市场以男士运动服装和装备为主,其次是份额较小的女性用和婴儿市场。

- 由于消费能力的增强和生活水准的提高,该国的普通服饰和家用纺织品正在增长。此外,该国的建设和重建活动正在增加,预计将进一步提振家用纺织品的需求。

- 因此,在预测期内,对运动服和运动服、防护衣、普通服饰、家用纺织品和医用纺织品的需求不断增长可能会推动亚太地区防水透气纺织品市场的成长。

防水透气纺织业概况

全球防水透气纺织品市场细分为:研究市场的主要企业包括(排名不分先后)WL Gore & Associates Inc.、Toray Industries Inc.、Polartec、THE NORTH FACE-A VF COMPANY 和 Teijin Ltd.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 作为防护衣的防水透气纺织产品的需求不断增加

- 运动服和运动服行业的需求增加

- 市场限制因素

- PFAS 对健康和环境的不利影响

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章 市场区隔(以金额为准的市场规模)

- 按原料分

- 聚四氟乙烯 (PTFE)

- 聚酯纤维

- 聚氨酯

- 其他的

- 依纤维分类

- 高密度布料

- 膜

- 涂层

- 按用途

- 运动服和运动服

- 防护衣/军用

- 一般服饰及家用纺织品

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Formosa Taffeta Co. Ltd

- HeiQ Materials AG

- Helly Hansen

- Henderson Textiles

- Jack Wolfskin-Ausrustung For Draussen Gmbh & Co. Kgaa

- Marmot Mountain LLC

- Pertex

- Polartec

- Schoeller Switzerland

- Stotz & Co. AG

- Sympatex

- Teijin Limited

- The North Face, A VF Company

- Toray Industries Inc.

- WL Gore & Associates Inc.

第七章市场机会与未来趋势

- 越来越关注永续性和新技术

简介目录

Product Code: 51758

The Waterproof Breathable Textiles Market size is estimated at USD 2.29 billion in 2025, and is expected to reach USD 2.92 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

Key Highlights

- Over the short term, growing demand from the sportswear and activewear industry is expected to boost the growth of the waterproof breathable fabric market.

- On the flip side, the harmful effect of PFAS on health and the environment is hindering the market's growth.

- The COVID-19 pandemic impacted the market negatively due to global supply chain disruptions. During the pandemic, many factories responsible for raw material supply, mainly textiles and fabrics, were shut down. However, with the resumption of operations in major end-user industries, the market recovered significantly in 2021.

- The growing focus on sustainability and new technologies is expected to create more opportunities in the coming years.

- Europe is expected to dominate the market during the forecast period.

Waterproof Breathable Textiles Market Trends

Sportswear and Activewear Segment Expected to Witness High Growth

- Polytetrafluoroethylene-based waterproof breathable textiles are used in various sportswear and activewear applications, including trekking boots, running shoes, sports jackets, work shoes, caps, gloves, backpacks, other sports clothing, and workwear.

- Polyurethane and polyester-based waterproof breathable polyester fabrics are used in manufacturing various jackets, outerwear, outdoor clothing, and workwear.

- Waterproof breathable textiles are used to design sportswear and activewear like joggers and hikers as they help dry clothes and manage sweat.

- The global athleisure market is expected to grow from USD 277 billion in 2021 to USD 381 billion in 2026, with a growth rate of 7%, which is anticipated to enhance the demand for waterproof-breathable fabrics.

- In India, according to the Ministry of Youth Affairs and Sports, the expenditure on sports by the Indian government in FY 2021-22 accounted for INR 8.39 billion (~USD 0.112 billion) through the Khelo India scheme. Such expenditures and sports schemes are likely to support the growth of the market studied.

- The increasing awareness about the benefits of waterproof breathable textiles in the sports industry is expected to boost the market further over the forecast period.

Asia-Pacific to Register the Highest Growth

- The Asia-Pacific waterproof breathable fabric market is expected to grow at the fastest rate. The waterproof, breathable textile is increasingly used in industries such as sportswear and activewear, protective clothing, general clothing, and home textiles.

- China has been an attractive market for athletic apparel, accessories, and footwear. Multinational companies are shifting their operations outside China due to rising labor costs. The country has a high demand for sportswear and activewear. According to the International Trade Administration, the Chinese sportswear market is expected to reach USD 82.8 billion by 2024, growing at an annual rate of 11%.

- China hosted the 2022 Asian Games in 2023. The games took place in Hangzhou from September 23 to October 8, 2023. The Asian Games generally attract more than 10,000 athletes across the region. Increased participation benefitted the demand for sports and activewear in the country.

- India is increasingly inclining toward the global fitness trend. The changing lifestyle has promoted health consciousness among people. The population is now adding new health regimes to maintain a healthy lifestyle. The sportswear market in India is dominated by sportswear and gear for men, followed by a market for women and a smaller share for kids.

- The country's general clothing and home textile is witnessing growth owing to rising spending power coupled with improved standards of living. In addition, the country's increasing construction and redevelopment activities are further anticipated to fuel the demand for home textiles.

- Therefore, the expanding demand for sportswear and activewear, protective clothing, general clothing, home textile, and medical textiles are likely to promote the growth of the waterproof breathable textile market over the forecast period in the Asia-Pacific region.

Waterproof Breathable Textiles Industry Overview

The global waterproof breathable textile market is partly fragmented. The major players in the market studied include W. L. Gore & Associates Inc., Toray Industries Inc., Polartec, THE NORTH FACE - A VF COMPANY, and Teijin Limited (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Waterproof Breathable Textiles as Protective Wear

- 4.1.2 Growing Demand from Sportswear and Activewear Industry

- 4.2 Market Restraints

- 4.2.1 Harmful Effect of PFAS on Health and Environment

- 4.3 Industry Value-chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Raw Material

- 5.1.1 Poly Tetra Fluoro Ethylene (PTFE)

- 5.1.2 Polyester

- 5.1.3 Polyurethane

- 5.1.4 Other Raw Materials

- 5.2 By Textile

- 5.2.1 Densely Woven

- 5.2.2 Membrane

- 5.2.3 Coated

- 5.3 By Application

- 5.3.1 Sportswear and Activewear

- 5.3.2 Protective and Military

- 5.3.3 General Clothing and Home Textile

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Formosa Taffeta Co. Ltd

- 6.4.2 HeiQ Materials AG

- 6.4.3 Helly Hansen

- 6.4.4 Henderson Textiles

- 6.4.5 Jack Wolfskin - Ausrustung For Draussen Gmbh & Co. Kgaa

- 6.4.6 Marmot Mountain LLC

- 6.4.7 Pertex

- 6.4.8 Polartec

- 6.4.9 Schoeller Switzerland

- 6.4.10 Stotz & Co. AG

- 6.4.11 Sympatex

- 6.4.12 Teijin Limited

- 6.4.13 The North Face, A VF Company

- 6.4.14 Toray Industries Inc.

- 6.4.15 W.L. Gore & Associates Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Focus on Sustainability and New Technologies

02-2729-4219

+886-2-2729-4219