|

市场调查报告书

商品编码

1640355

印度塑胶包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030)India Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

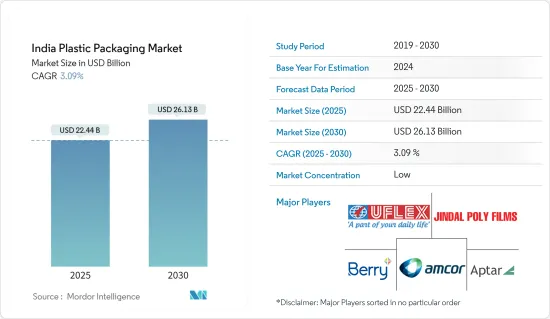

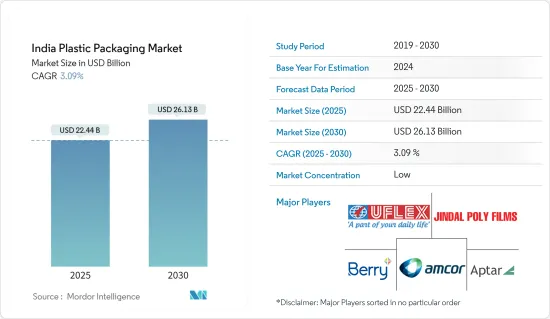

印度塑胶包装市场规模预计到2025年为224.4亿美元,预计到2030年将达到261.3亿美元,预测期内(2025-2030年)复合年增长率为3.09%。

塑胶是最重要的包装材料之一。该材料的轻质和低成本使其在所有最终用户中脱颖而出。

主要亮点

- 塑胶包装是印度包装产业新时代的核心。其用途广泛,使其成为许多行业产品包装的基石。与其他包装类型相比,塑胶包装容器具有高衝击强度、挺度、阻隔性等独特优势,近年来扩大了塑胶包装市场。

- 聚乙烯主要用于塑胶袋、塑胶薄膜、地工止水膜等包装。它是一种轻质、部分结晶质的热塑性树脂,具有高耐久性、低吸湿性和隔音性能。低密度聚乙烯(LDPE)主要用于生产塑胶袋。 LDPE聚乙烯袋柔软有弹性,颜色自然。对这些袋子的需求是由于它们已知的特性,如柔韧性、透明性、高衝击强度和弱阻隔性(不包括水和酒精蒸气) 。虽然其耐热性较弱,但具有优异的电气性能和优异的耐化学性。有环境应力开裂的倾向。

- 袋包装越来越受欢迎,因为它是一种非常方便和便携的解决方案。与传统的硬质包装相比,许多消费者更喜欢灵活的立式袋。过去十年,消费者对立式袋(用于零食、食品和饮料、婴儿食品、工业油和润滑油)的需求急剧增加。特定包装类型的创新进一步促进了市场的永续性。

- 印度的饮料包装市场在过去几年中一直在显着成长。各国饮料包装趋势的快速变化对于市场成长至关重要。饮料包装的新兴趋势集中在结构变化以及可回收材料的开发,例如消费后回收、客户可接受性、安全性和新的填充技术。耐热宝特瓶的开发提高了一些饮料的保质期。

- 然而,由于环境问题日益严重,监管标准发生动态变化,预计印度塑胶包装市场将面临重大挑战。各国政府正在回应公众对塑胶包装废弃物的担忧,并实施法规以尽量减少环境废弃物并改善废弃物管理流程。

印度塑胶包装市场趋势

食品领域占有很大份额

- 食品业对塑胶包装的需求是由对方便、紧凑的解决方案的需求推动的,特别是已调理食品的日益普及。这些餐点通常包装在各种形式的密封托盘中,例如圆形容器或沙拉包,现在正在明显转向使用永续和环保材料。这项策略性措施符合消费者对环保包装解决方案的偏好,并反映了该产业满足市场需求和减少对环境影响的承诺。

- 软包装有多种形式,包括小袋、袋子、薄膜和包装材料,为肉类、家禽和鱼类行业的各种切割、份量和包装形式提供多功能包装解决方案。这使得各种产品的高效包装成为可能,从整块肉到香肠和鱼片等加工产品。

- 消费者越来越多地转向乳酪、牛奶和优格等营养乳製品以获得更高的营养价值也可能推动成长。此外,乳製品长期以来一直与维生素、蛋白质、高吸收性钙等联繫在一起。这些乳製品中存在的多种生物功能成分预计将在预测期内加强乳製品领域。

- 此外,塑胶托盘和容器在许多行业中用作食品容器,例如自助餐厅、餐厅、家庭和办公室。餐厅等食品服务业使用食品包装托盘进行外带和外送服务,以确保食品安全和展示。此外,咖啡馆和麵包店等其他领域也依赖这些托盘进行产品包装和展示,从而增加客户的便利性和吸引力。

- 托盘主要用于食品业的初级和二级包装,以及药品和消费品的二级包装。托盘和容器是一次性市场的一部分,主要用于食品、饮料和酒店业。这些产品广泛使用,价格低廉,占一次性市场的很大一部分。

- 作为「印度製造」计画的一部分,印度政府优先考虑并促进对食品加工领域的投资。政府创建了134个低温运输计划和18个大型食品园区,以改善食品加工供应链。由于最近政府推出了 1000 亿印度卢比(13.5 亿美元)计划来促进该行业,食品加工领域也走上了稳健的发展轨道,这最终将增加国内对软质塑胶包装的需求不断增加。

- 印度电子商务的成长正在创造对各种食品的需求。预计2027年该国线上零售额将达1.73亿美元,较2022年的8,700万美元大幅成长。网上零售的成长显示印度对食品包装的需求正在增加。此外,塑胶瓶和容器由于能够为包装食品提供较长的保质期,因此在食品行业中变得越来越重要。

瓶子在印度经历强劲增长

- 市场上广泛使用瓶子的行业包括食品、饮料、化妆品、工业和医疗。由于瓶装水和非酒精饮料的需求不断增加,饮料领域的塑胶瓶市场预计将成长。

- 百事印度公司宣布,其产品「百事黑」将成为碳酸饮料类别中第一个采用印度製造的 100% 再生 PET宝特瓶的产品。该计划不包括完全回收的瓶子上的百事黑标籤和瓶盖。

- 宝特瓶水市场是由消费者对包装水日益增长的需求推动的,因为与其他包装方法相比,包装水更具成本效益、保质期更长且更易于使用。随着消费者越来越意识到对纯净饮用水的需求,包装水和瓶装水包装产业正经历快速成长。

- 宝特瓶在碳酸饮料、果汁饮料、果汁、运动饮料、能量宝特瓶等各类别中的需求量很大。印度铁路餐饮旅游有限公司推出了「Rail Neer」宝特瓶水品牌,在火车和车站销售。 2021年产量为7,520万瓶,2023年产量将增加至3.577亿瓶,显示该地区宝特瓶水需求呈现有机趋势。

- 宝特瓶很容易成型。装有加压产品(例如软性饮料)的盒子在强大的内部压力下很难保持其形状。然而,技术、製造方法和材料发展的进步使得塑胶在压力下被模製成任何形状成为可能。宝特瓶即使掉落也很安全,重量轻、透明且可重复填充。回收要求也会限制塑胶回收。然而,新技术使得回收更多塑胶成为可能。

竞争格局

印度对塑胶包装的需求大幅增加,导致市场区隔。主导市场的一些主要参与者包括 Aptar Group Inc.、Uflex Limited、Berry Global、Sealed Air Corporation 和 ConstantiaFlexibles。这些公司不断创新并形成战略伙伴关係以保持市场占有率。例如

- 2024 年 4 月,Manjushree Technopack Limited 签订最终协议,以 52 亿印度卢比(629 万美元)的企业价值收购 Oricon Enterprises Ltd. 的塑胶包装业务。被收购的公司包括 Oriental Containers,一家主要用于饮料的塑胶容器和瓶盖製造商; MTL 每年的装置容量接近 150 亿件,此次收购将使 MTL 目前在盖子与封口装置领域的市场占有率增加一倍。

- 2023年12月,美国Aptar公司的完全子公司Aptar Pharma在印度孟买开设了新的生产厂,以提高东南亚市场的产能。产能进一步提升,提升製造能力,为东南亚医药客户提供更多创新产品解决方案。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 更多采用轻质包装

- 增加环保包装和再生塑料

- 电子商务产业的成长可望带动成长

- 市场限制因素

- 原料(塑胶树脂)价格上涨

- 政府法规和环境问题

- 全球塑胶包装市场概况

第六章 市场细分

- 按包装类型

- 软质塑胶包装

- 硬质塑胶包装

- 按最终用户

- 食物

- 饮料

- 医疗保健

- 个人护理和家居产品

- 其他的

- 依产品类型

- 瓶子和罐子

- 托盘/容器

- 小袋

- 包包

- 薄膜包装

- 其他的

第七章 竞争格局

- 公司简介

- Hitech Plast(Hitech Group)

- Mondi Group

- Sealed Air Corporation

- Berry Global Inc.

- Polyplex Corporation Limited

- TCPL Packaging Ltd

- Manjushree Tecnopack Ltd

- Aptar Group Inc.

- Amcor PLC

- Jindal Poly Films Limited

- Cosmo Films Ltd(Cosmo First Limited)

- Constantia Flexibles

第八章投资分析

第9章 市场的未来

The India Plastic Packaging Market size is estimated at USD 22.44 billion in 2025, and is expected to reach USD 26.13 billion by 2030, at a CAGR of 3.09% during the forecast period (2025-2030).

Plastic is one of the most prominent packaging materials. The material's lightweight and low-cost nature instantly distinguished it among all the end-users.

Key Highlights

- Plastic packaging is at the center of a new era in the Indian packaging industry. Its versatile usage is becoming the foundation for many industries for product packaging. Compared to other packaging types, plastic packaging containers provide unique benefits, such as high impact strength, stiffness, and barrier properties, which have expanded the market for plastic packaging in recent years.

- Polyethylene is primarily used for packaging plastic bags, plastic films, geomembranes, etc. It is a lightweight, partially crystalline, thermoplastic resin with high resistance, low moisture absorption, and sound-insulating properties. Low-density polyethylene (LDPE) is mainly used to manufacture plastic bags. LDPE polyethylene bags are soft and flexible and are available in natural colors. The demand for these bags is due to their known features, such as flexibility, transparency, high impact strength, and weak barrier, except for water and alcohol vapor. These bags have weak temperature resistance but outstanding electrical properties and excellent chemical resistance. They show a tendency for environmental stress cracking.

- Pouch packaging is gaining popularity as it is a highly convenient and portable solution. Many shoppers prefer flexible, stand-up pouches over traditional, rigid packaging. Consumers drove the demand for stand-up pouches (for snacks, beverages, baby food, or industrial oils and lubricants) exponentially over the past decade. Specific innovations in the packaging type further drive the market's sustainability.

- The market for beverage packaging has grown significantly over the last few years in India. Rapid changes in beverage packaging trends across the country are critical for the market's growth. The new trends in the packaging of beverages focus on structural changes, as well as the development of recycled materials like post-consumer recycling, customer acceptance, safety, and new filling technologies. The development of heat-resistant PET bottles improved the preservation of several drinks.

- However, the plastic packaging market in India is expected to be significantly challenged due to dynamic changes in regulatory standards, primarily due to increasing environmental concerns. The government is responding to public concerns regarding plastic packaging waste and implementing regulations to minimize environmental waste and improve waste management processes.

India Plastic Packaging Market Trends

Food Segment to Hold a Significant Share

- The food industry's demand for plastic packaging is driven by the need for convenient, compact solutions, particularly with the increasing popularity of ready-to-eat meals. These meals, often packaged in sealed trays of various shapes, including round containers and salad packs, are now seeing a notable shift toward using sustainable and environmentally friendly materials. This strategic move aligns with consumer preferences for eco-conscious packaging solutions, indicating a commitment to meeting market demands and reducing environmental impact within the industry.

- Flexible packaging comes in various forms, such as pouches, bags, films, and wraps, allowing for versatile packaging solutions to accommodate different cuts, portion sizes, and packaging formats within the meat, poultry, and fish industries. This enables efficient packaging of a wide range of products, from whole cuts to processed items like sausages and fillets.

- The increasing shift of consumers toward nutrient-dense dairy products such as cheese, milk, yogurt, and more to achieve high nutrition is likely to aid growth. Besides, dairy products have been long associated with vitamins, proteins, highly absorbable calcium, and more. Numerous biologically functional components in these dairy products are expected to strengthen the dairy products segment over the forecast period.

- Furthermore, plastic trays and containers are used in numerous industries as food containers in cafeterias, restaurants, homes, offices, etc. Food services businesses like restaurants utilize food packaging trays for takeout and delivery services, assuring food remains secure and presentable. Besides, other sectors like cafes and bakeries depend on these trays for packaging and displaying their products, improving customer convenience and appeal.

- Trays are mainly used for primary and secondary packaging in the food industry and secondary packaging in pharmaceutical and consumer goods. Trays and containers are part of the disposables market, mainly in the food, beverage, and hospitality industries. These products are widely available, cost less, and are a large part of the disposables market.

- As part of the "Make in India" initiative, the Indian government prioritized and promoted investments in the food processing sector. The government created 134 cold chain projects and 18 mega food parks to improve the food processing supply chain. The food processing sector is also on a solid development trajectory due to recent government measures, such as the INR 10,000 crore (USD 1.35 billion) program launched to promote the industry, eventually enhancing the demand for flexible plastic packaging in the country.

- The growth of e-commerce in India creates the demand for different food products. The rise of online retail sales in the county grew significantly from USD 87 million in 2022, and it is forecasted to reach USD 173 million by 2027. Growing retail online sales show that the demand for food packaging is increasing in India. Moreover, plastic bottles and containers have gained importance in the food industry due to their ability to provide longer shelf life to packaged food items.

Bottles to Witness Strong Growth in the Country

- The industries where bottles are widely used in the market include food, beverage, cosmetics, industrial, healthcare, and more. The beverage sector's plastic bottle market is anticipated to witness growth owing to the increased demand for bottled water and non-alcoholic beverages.

- PepsiCo India announced that its product Pepsi Black will introduce the first 100% recycled PET plastic bottles in the carbonated beverages category to be manufactured in India. The manufacturer does not include the Pepsi Black label and cap for a completely recycled bottle in this initiative.

- The market for bottled water packaging in plastic bottles is driven by the rising demand for packaged drinking water among consumers because they are more cost-effective than other packaging options, have a longer shelf life, and are easier to use. The packaged and bottled water packaging industries are experiencing rapid growth as public awareness of the need for pure drinking water increases.

- Plastic bottles have a significant demand in India in various categories, such as carbonated soft drinks, juice drinks, fruit juices, and sports and energy drinks, out of which water bottles show a potential share in the country, aiding the growth of the plastic bottle market. Indian Railways Catering and Tourism Corporation Limited launched a pet bottled water brand, "Rail Neer," which is sold on trains and railway stations. It produced 75.20 million bottles in 2021, which increased to 357.70 million bottles in 2023, indicating the organic trend in demand for plastic bottled water in the region.

- A plastic bottle is simple to shape. It can be difficult for a box containing pressurized goods like soft drinks to keep its shape under intense internal pressure. However, with technological advancements, manufacturing methods, and material development, plastic can be molded into any shape, even under pressure. If dropped, a plastic bottle has a high safety factor and is lightweight, transparent, and refillable. The need for collection can constrain plastic recycling. However, new technologies are making it possible for more plastic to be recycled.

Competitive Landscape

As the demand for plastic packaging is increasing significantly in India, the market is fragmented. Large, dominant players in the market include Aptar Group Inc., Uflex Limited, Berry Global, Sealed Air Corporation, and Constantia Flexibles. These companies keep innovating and entering into strategic partnerships to retain their market share. For instance,

- In April 2024, Manjushree Technopack Limited entered into definitive agreements to acquire Oricon Enterprises Ltd's plastic packaging business for an enterprise value of INR 520 crores (USD 6.29 million). The acquired company included Oriental Containers, a manufacturer of plastic containers and closures used primarily in beverages. With an installed capacity of nearly 15 billion pieces per year, this transaction will double MTL's current market share in the cap and closure sector.

- In December 2023, Aptar Pharma, a wholly owned subsidiary of the US-based Aptar Corporation, established its new manufacturing facility in Mumbai, India, to increase production capacity for Southeast Asian markets. Its production capabilities have been further enhanced to improve the manufacturing capacity of pharmaceutical customers in Southeast Asia and to offer more innovative product solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight-packaging Methods

- 5.1.2 Increased Eco-friendly Packaging and Recycled Plastic

- 5.1.3 Growing E-commerc Industry is Expected to Drive Growth

- 5.2 Market Restraints

- 5.2.1 High Price of Raw Material (Plastic Resin)

- 5.2.2 Government Regulations and Environmental Concerns

- 5.3 Global Plastic Packaging Market Overview

6 MARKET SEGMENTATION

- 6.1 By Packaging Type

- 6.1.1 Flexible Plastic Packaging

- 6.1.2 Rigid Plastic Pacakaging

- 6.2 By End User

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care and Household

- 6.2.5 Other End Users

- 6.3 By Product Type

- 6.3.1 Bottles and Jars

- 6.3.2 Trays and Containers

- 6.3.3 Pouches

- 6.3.4 Bags

- 6.3.5 Films and Wraps

- 6.3.6 Other Product Types

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hitech Plast (Hitech Group)

- 7.1.2 Mondi Group

- 7.1.3 Sealed Air Corporation

- 7.1.4 Berry Global Inc.

- 7.1.5 Polyplex Corporation Limited

- 7.1.6 TCPL Packaging Ltd

- 7.1.7 Manjushree Tecnopack Ltd

- 7.1.8 Aptar Group Inc.

- 7.1.9 Amcor PLC

- 7.1.10 Jindal Poly Films Limited

- 7.1.11 Cosmo Films Ltd (Cosmo First Limited)

- 7.1.12 Constantia Flexibles