|

市场调查报告书

商品编码

1640364

模组化资料中心:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Modular Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

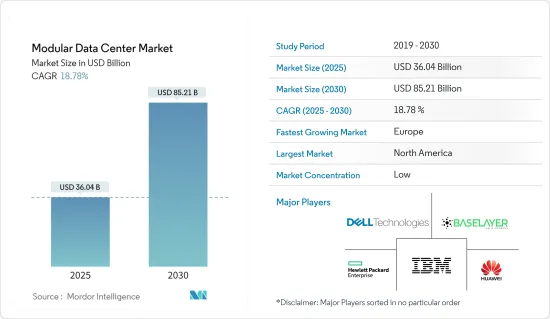

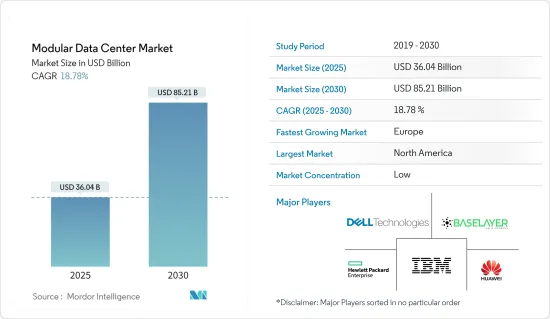

模组化资料中心市场在 2025 年的估值为 360.4 亿美元,预计到 2030 年将达到 852.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 18.78%。

主要亮点

- 我们的分段资料中心解决方案单元让您轻鬆建置IT基础设施。模组化方法可以应用于资料中心级别,也可以应用于更通用的级别。

- 模组化架构可以支援多种工作负载以满足您的业务需求,因为它继续使用云端基础的分散式技术。这些可携式资料中心满足了云端、行动和社交分析日益增长的需求,提供了一种有效且经济的方式来保护电脑效能,而无需增加占地面积。

- 对绿色资料中心的高需求正在推动该市场的成长。绿色资料中心采用节能的管理实务和技术,为企业提供最佳效率,同时减少对环境的影响。由于世界各国政府对能源消费量和环境保护的要求越来越高,模组化资料中心的需求量很大。模组化资料中心最大的优势之一是比传统资料中心耗电量更少、能源效率更高,有助于满足企业降低能源使用的内在需求。

- 在大容量资料中心领域,明显且日益增长的需求是以相对密集的配置快速部署基础设施,并且注重能源和热效率。预计这一领域将出现比传统方法更多的模组化成长。

- 在安装速度和低资本支出方面,模组化资料中心对传统的实体资料中心构成了挑战。然而,传统资料中心在未来一段时间内可能仍会存在,并且模组化资料中心可能非常适合某些应用。

- 全球最大的投资者正将注意力转向数位基础设施市场,该市场对资本的需求强劲,以推动资料经济的发展。即使在新冠疫情期间,投资者的兴趣仍然很高。随着超大规模运算的成长,资料中心的投资也随之增加。随着对现代化、灵活和扩充性的资料中心的需求不断增加,对资料中心的投资预计将为模组化资料中心的采用创造机会。

模组化资料中心市场趋势

IT产业将推动主要市场成长

- 提供云端、主机託管和网路託管服务的公司数量的增加导致 IT 公司对模组化资料中心的需求增加。推动该产业持续成长的关键因素是越来越多的企业持续采用云端运算。

- 主要企业透过提供安全、合规的资料中心以及对世界顶级通讯业者的正确存取权限,帮助IT公司实现混合IT的成功我们正在这样做。资讯和通讯技术产业正在转向模组化和微模组化资料中心来提供许多服务,要求尽可能快的回应时间。

- 全球趋势正在出现:企业出于安全考量纷纷采用模组化资料中心。资讯科技领域的模组化资料中心市场正受到资料储存及其强大且有效率的处理需求不断增长的正面影响。

- 中国IT公司的规模意味着需要私人储存设施和大型资料中心。此外,由于软体服务供应商的数量不断增加,云端储存选项也随着时间的推移而稳定增加,这导致供应商增加容量并产生对资料中心的需求。 SaaS、平台即即服务(PaaS)与基础设施即服务(IaaS)并列为国内三大云端运算之一。这推动了对更多资料中心的需求。

北美占据主要市场占有率

- 行动宽频的成长、巨量资料分析和云端运算水准的提高推动了该地区对新资料中心基础设施的需求。北美拥有众多资料中心,许多公司正在从硬体转向基于软体的服务,这使得该市场成为资料中心安装的潜在目标。

- 为了优化基础设施,组织正在寻找模组化服务,以便他们能够在整合产品组合中选择所需的服务。作为标准化部署的一部分,可透过线上目录取得多种服务选项。这些选择为企业提供了降低初始投资的潜力。 IBM 的整合託管基础架构服务就是这种情况的一个很好的例子。

- 此外,巨量资料和物联网在该地区的渗透将推动下一代模组化资料中心规模和范围的重大变化。考虑到现有的竞争,组织需要开发 IT 可扩充性和容量。模组化资料中心因其灵活性而日益受到青睐,由于资料的迅速增长,再加上混合云端和第三方资料中心外包,它们能够在最短的时间内建立设施。

- 此外,物联网的普及正在推动对边缘资料中心的需求。许多公司将物联网应用于从零售到医疗保健等广泛的领域,产生的资料量非常庞大。

模组化资料中心产业概况

模组化资料中心市场较为分散,竞争容易加剧。目前,只有少数几家主要参与者主导市场,这些占据主导市场份额的参与者正专注于扩大海外基本客群。此外,为了应对激烈的竞争,新的参与者正在透过策略合作计画进入市场。主要参与者包括IBM公司、华为技术有限公司等。

2023 年 2 月,Vertiv 公司推出了承包预製模组化 (PFM)资料中心解决方案 Vertiv MegaMod 和 Vertiv MegaMod Plus。高品质预製模组与 Vertiv 业界领先的电源管理系统、温度控管解决方案、远端监控和 IT 设备机架整合并经过测试,与传统资料中心建置相比,可提供卓越的效能并降低成本。缩短高达40 .该解决方案目前已在欧洲、中东和非洲(EMEA)推出。

2022 年 9 月,Vertiv 在印度推出了 Vertiv 预製资料中心,提供模组化资料中心和基础设施选项。此整合解决方案可根据您的 IT 资产部署进行定制,并提供一种快速安装容量的简单方法。它还提供简单的可扩展性,允许资料中心营运商从满足其即时需求的解决方案开始,然后根据需要进行扩展。 Vertive 在预製模组化资料中心采用领先的电源和热管理、监控和控制技术。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果和先决条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 模组化资料中心的敏捷性和扩充性

- 灾难復原优势

- 市场挑战

- 资料中心面临电力效率和永续性的挑战。

第六章 市场细分

- 按解决方案和服务

- 功能模组解决方案(单独功能模组、一体化功能模组)

- 服务

- 按应用

- 灾难备份

- 高效能/边缘运算

- 资料中心扩展

- 入门资料中心

- 按最终用户

- IT

- 电信

- BFSI

- 政府

- 其他最终用户(医疗保健、零售、国防等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Huawei Technologies Co. Ltd.

- Dell EMC

- HPE Company

- Baselayer Technology LLC

- Vertiv Co.

- Schneider Electric SE

- Cannon Technologies Ltd

- Rittal Gmbh & Co. KG

- Instant Data Centers LLC

- Colt Group SA

- Bladeroom Group Ltd.

第八章投资分析

第九章 市场机会与未来趋势

The Modular Data Center Market size is estimated at USD 36.04 billion in 2025, and is expected to reach USD 85.21 billion by 2030, at a CAGR of 18.78% during the forecast period (2025-2030).

Key Highlights

- Disaggregated data center solution units facilitate the building of the IT infrastructure. A modular approach can be applied at the level of data centers or a more general level.

- Modular architecture can support more than one workload to meet the needs of businesses as organizations continue to use cloud-based dispersed technologies. To meet the growing demand for cloud, mobile, and social analytics, these transportable data centers offer an effective, cost-efficient way of protecting computer performance while leaving no more floor space.

- The high demand for environmentally friendly data centers drives this market's growth. Green data centers use energy-efficient management methods and technology, providing enterprises with little environmental impact and optimum efficiency. Modular data centers are highly requested because of increased energy consumption and environmental protection requirements laid down by governments worldwide. One of the most significant advantages of modular data centers is that, compared to traditional data centers, they consume less power and are more energy-efficient, allowing them to meet companies' intrinsic requirements for lower energy usage.

- In the high-volume data center segment, there is a clear need for rapid infrastructure deployment in comparatively very dense configurations with an emphasis on energy and heat efficiency. We will likely see a much more significant module growth in this segment than conventional approaches.

- Regarding installation speeds and low capex, Modular Data Centres represent a challenge to traditional brick-and-mortar data centers. But, traditional data centers are likely to remain a reality, and some applications may be more suitable for modular data centers.

- The largest global investors are focusing on the market for digital infrastructure, with the extraordinary demand for capital to boost the data economy. The interest of investors remains high even during the COVID-19 situation. The investments in data centers increased after the growth of hyperscale computing. As the demand for modern, flexible, and scalable data centers increases, investments in data centers are expected to create opportunities to adopt modular data centers.

Modular Data Center Market Trends

IT Sector to Hold Significant Market Growth

- Due to the growing number of companies that provide cloud, colocation, and Web hosting services, demand from IT firms for modular data centers is increasing. The significant factor driving the continued growth of this segment is an ever growing number of enterprises adopting cloud computing.

- By providing secure and compliant data centers with adequate access to the world's top telecommunications operators and cloud computing services providers, studied market players help IT companies achieve hybrid IT success. The information and communications technology industry seeks the fastest possible response time and provides services for Modular and micromodular data centers with much to offer.

- A trend is emerging worldwide, such as enterprises adopting modular data centers due to security concerns. The Modular Data Centre Market in the Information Technology sector has been positively influenced by an increasing demand for data storage and its robust and efficient processing.

- Based on the size of Chinese IT companies, private storage facilities and large-scale data centers are required. Furthermore, cloud storage selection has steadily increased over time due to the growing number of Software Service Providers, enabling them to improve their capacity and create demand for data centers. SaaS platform as a service (PaaS) and infrastructure as a service (IaaS) are among China's three major cloud computing categories. This fuels the demand for more data centers.

North America accounts for the Significant Market Share

- The demand for new data center infrastructure in this region is triggered by the growth of Mobile Broadband, increased levels of Big Data Analytics, and cloud computing. Many data centers are present in North America, with many companies switching from hardware to software-based services, and it is estimated that this market will be a potential target for data center installation.

- Organizations are looking for modular services that allow them to select the desired service in an integrated portfolio to optimize infrastructure. Several service options are available from the online catalogs as part of a standardized deployment. These options offer the possibility of lowering an initial investment for companies. An excellent example of this situation is the IBM Integrated Managed Infrastructure Service.

- Moreover, the size and scope of next-generation modular data centers will significantly change due to the penetration of Big Data and the Internet of Things in this region. Given the existing competition, IT scalability and capacity need to be developed by organizations. Modular data centers are gaining momentum, given their flexibility to install a facility in the least time due to an exponential growth of data, coupled with hybrid cloud and outsourcing third-party data centers.

- Additionally, the increasing penetration of IoT is driving the demand for edge data centers. Many companies are taking advantage of IoT for applications ranging from retail to healthcare, and the amount of data generated is enormous.

Modular Data Center Industry Overview

The modular data center market is fragmented, where competition tends to increase and consists of several major players. Few of the major players currently dominate the market, and these major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. Further, new players enter this market through strategic collaborative initiatives catering to intense rivalry. Key players are IBM Corporation, Huawei Technologies Co. Ltd, etc.

In February 2023, Vertiv Co. introduced the Vertiv MegaMod and Vertiv MegaMod Plus, a turnkey prefabricated modular (PFM) data center solution, deployable in expandable units of 0.5 or 1 megawatts for IT loads up to 2 megawatts or more. The high-quality prefabricated modules are integrated and tested with industry-leading Vertiv power management systems, thermal management solutions, remote monitoring, and IT equipment racks to deliver exceptional performance and help companies reduce deployment time by up to 40% compared to a traditional data center build. The solutions are now available across Europe, the Middle East and Africa (EMEA).

In September 2022, Vertiv offered modular data centers and infrastructure options by introducing Vertiv Prefab Data Centres in India. Integrated solutions can be adapted to IT asset deployment and provide a simple way to install capacity quickly. Simple scalability is also offered, enabling the data center operator to start with a solution that meets Immediate needs and then scale up as needed. Vertiv uses its prefabricated modular data centers' key power and temperature management capabilities and monitoring and control technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables & Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Mobility and Scalability of Modular Data Centers

- 5.1.2 Disaster Recovery Advantages

- 5.2 Market Challenges

- 5.2.1 Data Centers Facing Power Efficiency and Sustainability Issues along with Power and cooling

6 MARKET SEGMENTATION

- 6.1 Solution and Services

- 6.1.1 Function Module Solution (Individual Function Module and All-in-One Function Module)

- 6.1.2 Services

- 6.2 Application

- 6.2.1 Disaster Backup

- 6.2.2 High Performance/ Edge Computing

- 6.2.3 Data Center Expansion

- 6.2.4 Starter Data Centers

- 6.3 End User

- 6.3.1 IT

- 6.3.2 Telecom

- 6.3.3 BFSI

- 6.3.4 Government

- 6.3.5 Other End Users (Healthcare, Retail, Defense, etc.)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Huawei Technologies Co. Ltd.

- 7.1.3 Dell EMC

- 7.1.4 HPE Company

- 7.1.5 Baselayer Technology LLC

- 7.1.6 Vertiv Co.

- 7.1.7 Schneider Electric SE

- 7.1.8 Cannon Technologies Ltd

- 7.1.9 Rittal Gmbh & Co. KG

- 7.1.10 Instant Data Centers LLC

- 7.1.11 Colt Group SA

- 7.1.12 Bladeroom Group Ltd.