|

市场调查报告书

商品编码

1640369

中东和非洲聚氨酯市场占有率分析、产业趋势和成长预测(2025-2030)Middle East And Africa Polyurethane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

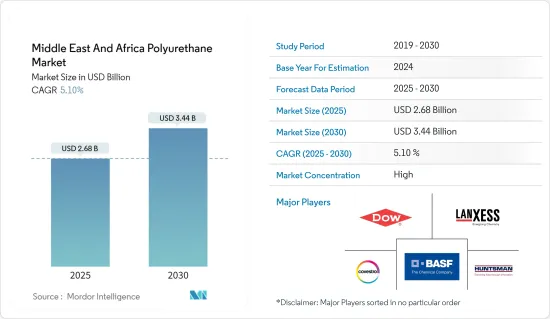

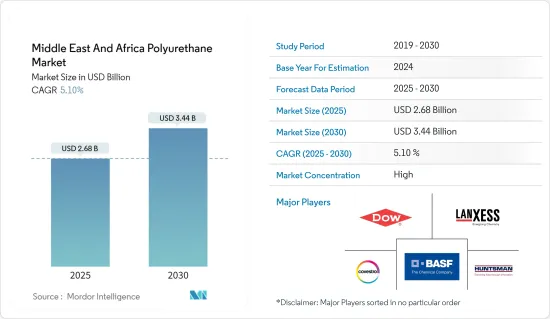

中东和非洲聚氨酯市场规模预计到2025年为26.8亿美元,预计到2030年将达到34.4亿美元,预测期内(2025-2030年)复合年增长率为5.1%。

主要亮点

- COVID-19 的爆发对市场产生了负面影响。为遏制 COVID-19 疫情而导致的计划暂停和放缓、流动限制、生产暂停和劳动力短缺导致聚氨酯市场成长放缓。但由于家具、室内装潢、汽车等多种终端用途的消费增加,较2021年出现显着反弹。

- 短期内,建筑业需求的成长以及电子和家用电子电器产业对隔热材料的需求不断增长是推动所研究市场成长的关键因素。

- 另一方面,原材料价格的波动和聚氨酯涂料的毒性预计将阻碍市场成长。

- 中东地区建筑节能措施意识的不断增强可能为未来市场成长提供机会。

- 沙乌地阿拉伯在市场上占据主导地位,预计在预测期内仍将保持最高的复合年增长率。

中东和非洲聚氨酯市场趋势

建筑业的需求不断成长

- 聚氨酯最广泛的用途是在建筑业。聚氨酯用于製造坚固、轻巧、高性能、耐用且用途广泛的高性能产品。

- 建筑业是硬质聚氨酯泡沫的最大消费者。使用硬质聚氨酯泡沫隔热材料有许多好处,包括能源效率、高性能、多功能性、热/机械性能和环保特性。

- 科威特2035年愿景的「永续生活环境」轴有五个支柱,其中最重要的是到2029年完成价值32.2亿科威特第纳尔(105亿美元)的五个计划。套住宅单位并提供公民住宅照顾。

- 如果实施,这些计划将满足目前91,000套住宅需求的约72%。住宅护理计划的第一个计划以贾比尔艾哈迈德市的科威特2035(新科威特)倡议为中心,该项目的完成率为95%。第二个计划位于Al Mutraa市,完工率为64%,预计于2023年终完工。

- 第三个计划位于郊区城市南阿卜杜拉·穆巴拉克,完工率为72%,预计2025年终完工。第四个计划是South Sabah Al Ahmad,由于仍处于初步阶段,完工率约14%,预计于2029年完工。这个South Saad Al Abdullah目前还处于前期阶段,将于2029年完工,所以完工率为13%。因此,科威特不断增加的住宅将需要硬质泡沫,这将进一步增加科威特聚氨酯市场的需求。

- 因此,上述因素预计将在预测期内提振聚氨酯市场。

沙乌地阿拉伯主导市场

- 沙乌地阿拉伯在中东和非洲聚氨酯市场占有最大份额。由于该国投资、建筑、家具和电子活动的增加,预计聚氨酯的需求在预测期内将会增加。人口和可支配收入的增加增加了开发更高品质住宅的需求。

- 由于「2030 年愿景」、「NTP2020」以及正在进行的几项石油多元化改革,沙乌地阿拉伯的建筑市场预计将出现显着增长并提供丰厚的潜力。 2030 年愿景、NTP2020、私营部门投资促进和正在进行的改革预计将成为预测期内沙乌地阿拉伯建筑业聚氨酯市场的成长动力。沙乌地阿拉伯的 2030 年愿景以及地方政府对全国住宅基础设施开发的大量投资重振了建筑业,并引起了越来越多的国际参与企业的兴趣。

- 此外,根据 2030 年愿景,到 2030 年,沙乌地阿拉伯将开设 80 家新饭店,拥有 11,000 多间豪华客房。因此,建筑和酒店家具的投资将会增加,从而导致对软质泡沫的需求。

- 沙乌地阿拉伯经济目前正进入后石油时代,正在兴建的特大城市可能会带来未来的成长。据业内人士透露,沙乌地阿拉伯目前正在施工的建设计划超过5,200个,总成本达8,190亿美元。这些计划约占波湾合作理事会(GCC) 正在进行的计划总数的 35%。

- 沙乌地阿拉伯的主要城市建设计划包括由麦加市政和农村事务部开发的阿卜杜拉国王安全综合体(五期)和大清真寺(圣地Haram扩建),各耗资213亿美元。

- 沙乌地阿拉伯的顶级建筑计划包括 Neom、红海计划、Qiddiya 娱乐城、Amaala、让·努维尔位于 Al-Ula 的 Sharaan 度假村、麦加大清真寺第三次扩建、吉达塔、住宅部的Sakani Homes、Jabal Omar、Al利雅得维迪安利雅得快速公车系统、法赫德国王医疗城扩建工程、阿卜杜拉·本·阿卜杜勒阿齐兹国王医疗综合体、萨勒曼国王能源园区(Spark)、沙乌地阿美公司的Beli 和Marjan 、Hanazi 太阳能园区、Dumat Al-Jandar 风电场、沙乌地阿美道达尔公司的PIB工厂和泛亚的装瓶厂。

- 沙乌地阿拉伯的「Amid Vision 2030」是一项由旨在发展该国基础设施的大型计划所支持的重大发展计画。 2030 年愿景的重点是解决环境问题、提高公民的生活品质和创造强大的经济,旨在带来改变。 《2030 年愿景》和相应的国家转型计划(NTP)的推出增加了医疗保健、教育和基础设施等多个领域的投资。

- 沙乌地阿拉伯的许多住宅和商业计划已经启动,该国的建设活动预计将活性化。例如,沙乌地阿拉伯政府在全国各地启动了多个大型企划来吸引游客,目前进展顺利。 Qiddiya 是拥有多用户住宅的大型企划之一。到 2025 年将建成 4,000 套住房,到 2030 年将建成 11,000 套住宅,使其成为着名的文化地标。利雅德的 Diriyah Gate计划将于 2027 年建成 2 万套住宅。在新穆拉巴,利雅德市中心计划将建造104,000套住宅。

- 沙乌地阿拉伯是一个发展中国家,获得了大量投资。 2022年3月,沙乌地阿拉伯承诺铺设8,000公里的新轨道,使其铁路网规模增加两倍以上。 2021年7月,运输和物流领域拨款1,470亿美元。 2030年,目标实现时,这些产业占国家GDP的比重将达到10%,比现在增加4%。

- 据海湾理事会公司称,沙乌地阿拉伯计划投资664.9亿美元用于医疗设施,在私营部门的帮助下,参与率预计到2030年将上升65%。

- 考虑到这些因素,沙乌地阿拉伯聚氨酯市场预计在未来几年将稳定成长。

中东和非洲聚氨酯产业概况

中东和非洲聚氨酯市场高度一体化。该市场的主要企业包括(排名不分先后)Covestro AG、 BASF SE、Dow、LANXESS 和 Huntsman International LLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 电子业对隔热材料的需求不断增加

- 建筑业的需求增加

- 其他司机

- 抑制因素

- 原物料价格不稳定

- 聚氨酯涂料的毒性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 目的

- 发泡体

- 硬质泡沫

- 软泡沫

- 被覆剂

- 黏合剂和密封剂

- 合成橡胶

- 其他的

- 发泡体

- 最终用户产业

- 家具/室内装饰

- 建筑/施工

- 电子设备

- 车

- 鞋类

- 包装

- 其他的

- 地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 科威特

- 卡达

- 摩洛哥

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- BCI Holding SA

- Covestro AG

- Dow

- Huntsman International LLC

- Kuwait Polyurethane Industries WLL

- LANXESS

- Mitsui Chemicals, Inc.

- Perfect Rubber

- Wanhua Chemical Group Co.,Ltd

第七章 市场机会及未来趋势

- 提高中东地区建筑节能措施的意识

- 对生物基聚氨酯的需求不断增长

简介目录

Product Code: 52029

The Middle East And Africa Polyurethane Market size is estimated at USD 2.68 billion in 2025, and is expected to reach USD 3.44 billion by 2030, at a CAGR of 5.1% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 outbreak negatively impacted the market. Stoppage or slowdown of projects, movement restrictions, production halts, and labor shortages to contain the COVID-19 outbreak led to a decline in the polyurethane market growth. However, it recovered significantly from 2021, owing to rising consumption from various end-use applications, including furnishing, interiors, and automotive.

- Over the short term, increasing demand from the building and construction industry and growing requirement for thermal insulation from the electronics and appliances industry are some of the major factors driving the growth of the market studied.

- On the flip side, volatile raw material prices and the toxic nature of polyurethane coatings are expected to hinder the growth of the market.

- Growing awareness of the Energy Efficiency Policy related to buildings in the Middle Eastern region is likely to act as an opportunity for market growth in the future.

- Saudi Arabia is expected to dominate the market and will also witness the highest CAGR during the forecast period.

Middle East and Africa Polyurethane Market Trends

Increasing Demand from the Building and Construction Industry

- The most extensive application of polyurethane is in the building and construction industry. Polyurethanes are used to make high-performance products that are strong but lightweight, perform well, and are durable and versatile.

- The building and construction industry is the largest consumer of rigid polyurethane foam. There are many benefits of using rigid polyurethane foam insulation, including its energy efficiency, high performance, versatility, thermal/mechanical performance, and environment-friendly nature.

- The sustainable living environment axis in Kuwait Vision 2035 includes five pillars, the most prominent of which is to provide housing care to citizens through what is planned to ensure the provision of 65.5 thousand housing units through five projects costing about KWD 3.22 billion (USD 10.5 billion), the last of which ends by 2029.

- When these projects are implemented, the state will have met approximately 72% of the current housing requests, which stands at 91,000. The first project of the residential care plan revolves around the vision of Kuwait 2035 (New Kuwait) in the city of Jaber Al-Ahmad, which has a completion rate of 95%. The second project is in the city of Al-Mutla'a, with a completion rate of 64%, to be completed by the end of 2023.

- The third project is in the suburb of South Abdullah Al-Mubarak, which has a completion rate of 72% and will be completed by the end of 2025. The completion rate in the fourth project, which is the South Sabah Al-Ahmad, is about 14%, as it is still in the preparation stage, and it is expected to be completed in 2029. This south of Saad Al-Abdullah has a completion rate of 13% as it is still in its preparatory phase and ends in 2029. Therefore, the growing residential housing construction in Kuwait will demand rigid foams, which will further rise the demand for the polyurethane market in Kuwait.

- Thus, the aforementioned factors are expected to boost the market for polyurethanes during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia holds the largest share in the Middle East and African polyurethane market. The demand for polyurethane is expected to rise throughout the forecast period due to rising investments and construction, furniture, and electronics activities in the country. The rise in the population and disposable income increased the demand for the development of better-quality residential buildings.

- The Saudi Arabian construction market is expected to witness significant growth and offer lucrative potential due to its Vision 2030, NTP 2020, and several ongoing reforms to diversify away from oil. Vision 2030, NTP 2020, the private sector investment boost, and the ongoing reforms are expected to be the growth drivers for the Saudi polyurethane market from the country's construction industry during the forecasted period. Saudi Arabia's Vision 2030, along with a significant investment in housing and infrastructure development promoted across the country by local authorities, is revitalizing the construction industry and generating interest in a growing number of international players.

- Moreover, under Vision 2030, 80 new hotels with more than 11,000 luxurious rooms will be opened across Saudi Arabia by 2030. Therefore, increasing investments in construction and hotel furniture are expected to create demand for flexible foam.

- Currently, the country's economy is entering a post-oil era in which the kingdom's mega-cities, which are under construction, will provide future growth. According to industry sources, more than 5,200 construction projects are currently ongoing in Saudi Arabia at a value of USD 819 billion. These projects account for approximately 35% of the total value of active projects across the Gulf Cooperation Council (GCC).

- Some of the major urban construction projects in Saudi Arabia include the King Abdullah Security Compounds (Phase 5) and the Grand Mosque (Holy Haram Mosque expansion), each valued at USD 21.3 billion and developed by the Ministry of Municipalities and Rural Affairs in Makkah.

- The top construction projects in Saudi Arabia include Neom, the Red Sea Project, Qiddiya entertainment city, Amaala, Jean Nouvel's Sharaan resort in Al-Ula, Makkah Grand Mosque - Third Expansion, Jeddah Tower, Ministry of Housing's Sakani Homes, Jabal Omar, Al Widyan, Riyadh Metro, Riyadh Rapid Bus Transit System, King Fahd Medical City Expansion, King Abdullah Bin Abdulaziz Medical Complexes, King Salman Energy Park (Spark), Saudi Aramco's Berri and Marjan, Hanergy Solar Park, Dumat Al Jandal Wind Power Plant, Saudi Aramco-Total's PIB factory, and Pan-Asia bottling facility.

- Saudi Arabia's Amid Vision 2030 is a significant development plan supported by megaprojects aimed at the growth of the nation's infrastructure. With an emphasis on environmental commitments, enhancing citizen quality of life, and creating a strong economy, Vision 2030 aspires to bring about change. Investments in several fields, including healthcare, education, and infrastructure, have expanded as a result of the introduction of Vision 2030 and the corresponding National Transformation Plan (NTP).

- Many residential and commercial projects are being launched in Saudi Arabia, which is anticipated to increase the country's construction activity. For instance, the Saudi government has started several mega projects, which are well underway around the country to attract tourists. Some of the mega projects that will have residential complexes are Qiddiya: The project will become a prominent cultural landmark with 4,000 residential units by 2025 and 11,000 units by 2030. Diriyah Gate: The project in Riyadh will include 20,000 residential units by 2027. New Murabba: The Riyadh downtown project is likely to house 104,000 residential units.

- Saudi Arabia is developing, and the nation is receiving impressive amounts of investment. The nation declared in March 2022 that it would more than triple the size of its rail network by installing 8,000 kilometers of new track. In July 2021, USD 147 billion was allocated to the transportation and logistics sectors. By 2030, when the targets have been met, these industries will contribute 10% of the nation's GDP, a 4% increase from today.

- According to the Gulf Council Corporation, Saudi Arabia has planned to invest USD 66.49 billion in healthcare facilities, with help from the private sector, whose participation is expected to rise by 65% by 2030.

- With all of these things, the Saudi Arabian polyurethane market is expected to grow steadily over the next few years.

Middle East and Africa Polyurethane Industry Overview

The Middle East and African polyurethane market is highly consolidated in nature. Some of the major players in the market include Covestro AG, BASF SE, Dow, LANXESS, and Huntsman International LLC, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Requirement of Thermal Insulation from the Electronics and Appliances Industry

- 4.1.2 Rising Demand from the Building and Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatile Raw Material Prices

- 4.2.2 Toxic Nature of Polyurethane Coatings

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Foams

- 5.1.1.1 Rigid Foam

- 5.1.1.2 Flexible Foam

- 5.1.2 Coatings

- 5.1.3 Adhesives and Sealants

- 5.1.4 Elastomers

- 5.1.5 Other Applications

- 5.1.1 Foams

- 5.2 End-user Industry

- 5.2.1 Furniture and Interiors

- 5.2.2 Building and Construction

- 5.2.3 Electronics and Appliances

- 5.2.4 Automotive

- 5.2.5 Footwear

- 5.2.6 Packaging

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 South Africa

- 5.3.4 Egypt

- 5.3.5 Kuwait

- 5.3.6 Qatar

- 5.3.7 Morocco

- 5.3.8 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BCI Holding SA

- 6.4.3 Covestro AG

- 6.4.4 Dow

- 6.4.5 Huntsman International LLC

- 6.4.6 Kuwait Polyurethane Industries W.L.L

- 6.4.7 LANXESS

- 6.4.8 Mitsui Chemicals, Inc.

- 6.4.9 Perfect Rubber

- 6.4.10 Wanhua Chemical Group Co.,Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Awareness of Energy Efficiency Policy related to Buildings in the Middle Eastern Region

- 7.2 Increasing Demand for Bio-based Polyurethane

02-2729-4219

+886-2-2729-4219