|

市场调查报告书

商品编码

1640380

紫外线固化涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)UV-Cured Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

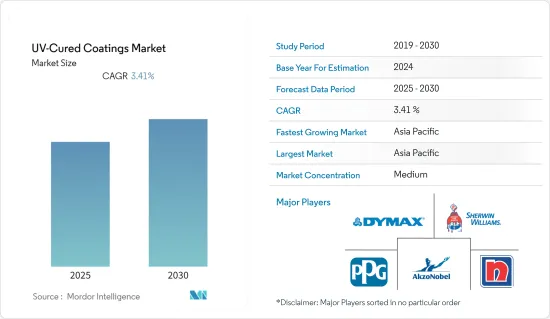

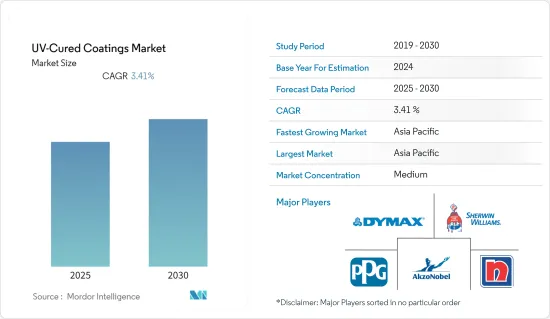

预计预测期内紫外线固化涂料市场复合年增长率为 3.41%。

COVID-19对市场产生了负面影响。为了遏制新冠病毒的传播,全球多个国家已进入封锁状态。许多企业和工厂关闭,扰乱了全球供应链并影响了全球的生产、交货时间和产品销售。目前,市场正在从新冠疫情中復苏并经历显着的成长。

主要亮点

- 对木材加工的需求不断增加,推动了市场的成长。

- 然而,高昂的初始资本成本和完成复杂 3D 物体的困难阻碍了市场的成长。

- 在预测期内,采用紫外线粉末涂料的转变可能会为所研究的市场带来成长机会。

- 预计亚太地区将占据市场主导地位,这主要是由于中国和日本对紫外线固化涂料的需求很高。

紫外线固化涂料市场的趋势

汽车产业可望主导市场

- 由于其优异的物理耐久性,对紫外光固化被覆剂的需求显着增加,主要来自汽车产业。紫外线固化涂料用于汽车零件的生产,赋予其表面各种特性。这些包括耐磨性、抗刮性、防眩光性、耐化学性、抗微生物性和防雾性。

- 这些涂层用于各种汽车零件,包括头灯、外部塑胶零件和片状模塑胶(SMC) 车身板。此外,紫外线固化透明涂层也用于汽车工业。它也适用于车窗,以减少穿过的紫外线量。

- 根据国际汽车製造商组织(OICA)的数据,2022 年汽车产量与前一年同期比较增长 6%。此外,由于私人出行需求增加等诸多因素,预测期内汽车产业预计将实现成长。

- 2022年中国汽车总产量为2,702万辆,较去年与前一年同期比较成长3%。此外,2022年加拿大汽车总产量将达122万辆,与前一年同期比较增加10%。

- 因此,上述因素可能在预测期内增加对紫外线固化被覆剂的需求。

亚太地区主导市场成长

- 亚太地区占有主要的市场占有率,这主要归因于汽车和航太工业的需求不断增加。

- 中国和日本是紫外光固化涂料的主要消费国。目前,印度市场对紫外线固化涂料的需求较低。不过,预计消费量很快将大幅增加。

- 预计当局为推广环保产品而製定的严格法规将促进该区域市场的进一步创新和发展。

- 中国已成为世界最大汽车生产国。 2022年,汽车产量增加3%左右。中国汽车产业迄今表现良好,预计未来仍将持续成长。

- 然而,中国政府专注于增加电动车的生产和销售。因此,中国政府计划在 2020 年将电动车 (EV) 产量提高到每年 200 万辆,到 2025 年提高到每年 700 万辆。预计这些趋势将在预测期内推动中国汽车产业的成长。

- 此外,中国是世界上航空业成长最快的国家之一,客运量每年持续以6.6%左右的速度成长。因此,该国计划在未来五年内建造一批机场。预计这将推动商用喷射机的需求。因此,喷射机上使用的紫外线固化被覆剂的需求也预计将增加。

- 同样,印度政府计划在 2032 年之前在该国建造约 100 个机场。预计这将进一步增加对商用喷射机的需求。

- 日本是最大的飞机製造商之一。日本主要生产下一代战斗机F-35A和其他军用飞机。我们也致力于加强航太工业的基础。近年来,由于货运需求的增加,民航机的产量增加。

- 因此,预计预测期内所有上述因素都将推动该地区对紫外线固化被覆剂的需求。

紫外光固化涂料产业概况

紫外线固化涂料市场较为分散,众多参与者所占的市场占有率很小。主要市场参与者包括阿克苏诺贝尔、PPG工业公司、日本涂料公司、 晶粒公司和剪切机-威廉斯公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 木材装饰材料需求不断成长

- 其他驱动因素

- 限制因素

- 设备初始成本高

- 难以完成复杂的 3D 对象

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 监理政策分析

第五章 市场区隔(以金额为准的市场规模)

- 依树脂类型

- 环氧树脂

- 聚酯纤维

- 胺甲酸乙酯

- 其他树脂类型

- 按应用

- 车

- 印刷油墨

- 金属

- 木头

- 航太

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析**/排名分析

- 主要企业策略

- 公司简介

- AkzoNobel NV

- Ashland Coatings

- Cardinal Paint

- Dymax Corp.

- Jainco Industry Chemicals

- Keyland Polymer

- Master Bond Inc.

- Nippon Paint

- PPG Industries Inc.

- Protech Powder Coatings Inc.

- Red Spot Paint & Varnish Company

- Seagrave Coatings Corp.

- Sherwin-Williams Co.

- Watson Coatings

第七章 市场机会与未来趋势

- 向 UV 粉末涂料的转变

The UV-Cured Coatings Market is expected to register a CAGR of 3.41% during the forecast period.

The market was negatively impacted due to COVID-19. Several countries worldwide went into lockdown to curb the virus spread due to the pandemic. The shutdown of numerous companies and factories disrupted worldwide supply networks and harmed global production, delivery schedules, and product sales. Currently, the market recovered from the COVID-19 pandemic and is increasing significantly.

Key Highlights

- The increasing demand for wood finishing is driving the market's growth.

- However, the high initial equipment costs and difficulty in finishing complex 3D objects are some of the factors restraining the market's growth.

- The shifting focus toward adopting UV powder coatings will likely provide growth opportunities for the market studied during the forecast period.

- The Asia-Pacific region is expected to dominate the market, mainly due to the high demand for UV-curable coatings in China and Japan.

UV-Cured Coatings Market Trends

The Automotive Industry is Expected to Dominate the Market

- Due to their superior physical durability, the demand for UV-cured coatings is increasing significantly, primarily from the automotive industry. UV-curable coatings are used in manufacturing automotive components to impart various properties to surfaces. It includes wear or scratch resistance, glare reduction, chemical resistance, microbial resistance, and anti-fogging.

- These coatings are used in various parts of vehicles, such as forward lightings, exterior plastic parts, and sheet molding compound (SMC) body panels. Furthermore, UV-cured clearcoats are used in the automotive industry. Also, it is applied to vehicle windows to reduce the UV radiation amount that passes through.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), automotive production increased in 2022 by 6% compared to the previous year. Also, the automotive industry is expected to increase during the forecast period due to many factors, such as increased demand for private mobility.

- In China, the total vehicle production was 27.02 million units with an increase of 3% in 2022 compared to the previous year. Also, in Canada, the total vehicle production was 1.22 million units in 2022, with an increase of 10% in the production of vehicles in the country compared to the previous year.

- Therefore, the above factors will likely augment the demand for UV-cured coatings over the forecast period.

Asia-Pacific to Dominate the Market Growth

- The Asia-Pacific region accounted for the major market share primarily due to the increasing demand from the automotive and aerospace industries.

- China and Japan are the primary consumers of UV-cured coatings. Currently, UV-cured coatings are witnessing low demand from the Indian market. However, their consumption is expected to increase significantly shortly.

- Stringent regulations formulated by authorities to promote eco-friendly products are expected to lead to further innovation and developments in the regional market.

- China emerged as the world's largest automotive producer. In 2022, the country witnessed about a 3% increase in the production of vehicles. The performance of the Chinese automotive industry increased so far and is also expected to grow in the future.

- However, the Chinese government is focusing on increasing the country's production and sale of electric vehicles. Thus, the country is planning to increase the production of electric vehicles (EVs) to 2 million a year by 2020 and 7 million a year by 2025. Such trends are expected to drive the Chinese automotive industry's growth during the forecast period.

- Furthermore, China includes one of the fastest-growing aviation industries in the world, with a consistent increase in passenger traffic at about 6.6% per year. Thus, the country is planning to construct numerous airports in the next five years. It is expected to drive the demand for commercial jets. It, in turn, is expected to drive the demand for UV-cured coatings for application in jets.

- Similarly, the Indian government is planning to construct about 100 airports in the country by 2032. It is further likely to drive the demand for commercial jets.

- Japan is one of the largest producers of aircraft. Japan is mainly manufacturing the F-35A next-generation fighter jet and other military aircraft. Furthermore, it is focusing on strengthening the foundation of the aerospace industry. Commercial aircraft production increased in the past few years due to the increasing cargo demand.

- Hence, all the factors above are expected to drive the demand for UV-cured coatings in the region during the forecast period.

UV-Cured Coatings Industry Overview

The UV-cured coatings market is fragmented, where numerous players account for an insignificant market share. Some major market players include AkzoNobel, PPG Industries, Nippon Paints, Dymax Corp., and The Sherwin-Williams Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Wood Finishings

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Initial Costs of Equipment

- 4.2.2 Difficulty in Finishing Complex 3D Objects

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policies Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Urethane

- 5.1.4 Other Resin Types

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Printing Ink

- 5.2.3 Metal

- 5.2.4 Wood

- 5.2.5 Aerospace

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel NV

- 6.4.2 Ashland Coatings

- 6.4.3 Cardinal Paint

- 6.4.4 Dymax Corp.

- 6.4.5 Jainco Industry Chemicals

- 6.4.6 Keyland Polymer

- 6.4.7 Master Bond Inc.

- 6.4.8 Nippon Paint

- 6.4.9 PPG Industries Inc.

- 6.4.10 Protech Powder Coatings Inc.

- 6.4.11 Red Spot Paint & Varnish Company

- 6.4.12 Seagrave Coatings Corp.

- 6.4.13 Sherwin-Williams Co.

- 6.4.14 Watson Coatings

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward the Adoption of UV Powder Coatings